Upstox Originals

Comparing the performance of promoter-driven and professionally managed companies

.png)

4 min read | Updated on May 29, 2024, 17:54 IST

SUMMARY

Research suggests that family-owned businesses (FOBs) outperform professionally managed ones. Not only do they have a long track record of delivering better profitability and cash flows, they are also better wealth creators.

In India, FOBs contribute 79% to the national GDP

According to a McKinsey Report, family-owned businesses (FOBs) contribute over 70% to global GDP, with an annual turnover of $60-$70 trillion and employing about 60% of the global workforce. In India, FOBs contribute 79% to the national GDP.

FOBs in India have become integral to our daily lives, from Bajaj’s two-wheelers to Reliance’s Jio. In this article, we look at some of the largest FOBs operating in India, and their wealth creation journey and compare them with professionally managed ones.

But what exactly are FOBs? These are companies where the family/promoter stake is more than 25%.

Let’s now dive in and look at their performance versus professionally managed companies over FY14-23. We cite data from a survey that examined the top 500 listed companies (350 - FOBs, 150 - non-FOBs) and performed a comparative analysis between both types of companies.

Cash flow generation and wealth creation

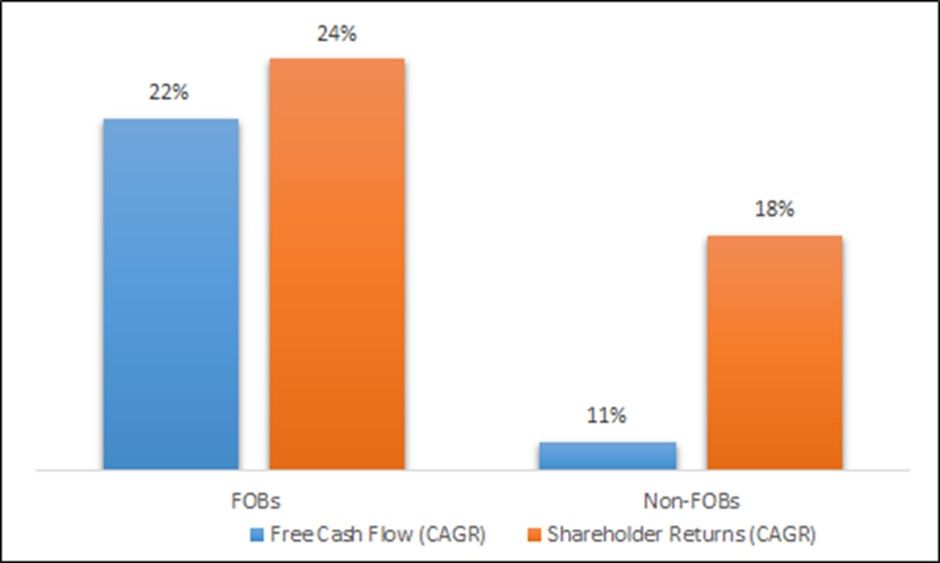

FOBs have demonstrated the ability to deliver much higher growth (almost 2x) in free cash flow generation (one of the most important metrics of fundamental performance) during the period FY14-23. We also note, better cash flow generation is typically associated with higher operating profitability as well.

Given their performance. FOBs outperformed non-FOBs, delivering higher total shareholder returns (TSR) of 24% versus 18% by non-FOBs.

FOBs have delivered better performance and returns

Source: Bloomberg, ASK Capital

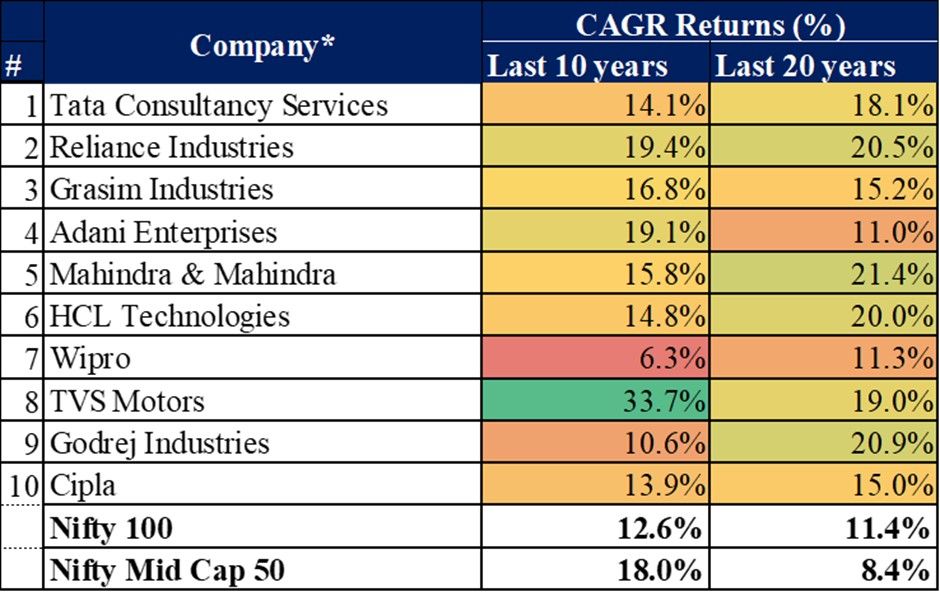

In this next part, we look at some domestic Family Owned Business (FOBs). The list in India is fairly exhaustive, but below we have tried to collate a list of some of the largest businesses that have been around for a few generations.

| Family | Business brand | Started in year | First line of business | Current range of operations | Approx revenue (₹ cr)* |

|---|---|---|---|---|---|

| Tata | Tata Group | 1868 | Trading | Hotels, Automobile, Power, Steel, FMCG, Technology, Communications | 12,00,000 |

| Ambani | Reliance Industries | 1957 | Oil & Gas | Oil & Gas, Retail, Digital Services, Media & Entertainment | 9,14,472 |

| Birla | Aditya Birla Group | 1857 | Trading | Cement, Chemicals, Metal, Retail, Textiles, Financial Services, Renewables, Telecom, Real Estates, Entertainment | 6,21,676 |

| Adani | Adani | 1993 | Integrate Resource Management | Airport operations, edible oils, road, rail and water infrastructure, data centres, and solar manufacturing, among others | 2,62,500 |

| Mahindra | Mahindra & Mahindra | 1945 | Automotive | Farm Equipment, Automotive, Hotels | 1,21,269 |

| Nadar | HCL Technologies | 1976 | IT | IT and Business Services, Engineering and R&D services, Products & Platforms | 1,11,408 |

| Premji | Wipro | 1945 | Edible Oil | IT Services, Consumer Care and Lighting | 89,760 |

| TVS | TVS Group` | 1962 | Aluminium die castings | Automobile and Financial Services | 72,250 |

| Godrej | Godrej Industries | 1897 | Consumer Products | Real Estate, Consumer Products, Industrial Engineering, Appliances, Furniture, Security and Agricultural Products | 43,578 |

| Hamied | Cipla | 1935 | Pharma | Pharma | 25,774 |

Source: Public sources; * Latest available data

Source: investing.com; *Where holding companies are not listed, we have taken the result of a major group company as a representation

Why are FOBs outperformers?

According to the McKinsey study:

- FOBs demonstrate the ability to focus beyond profits. They are purpose-driven, giving them long-term focus

- They typically have a conservative and cautious stance on finances

- Consequently, this leads to efficient decision-making, which bolsters their performance

Investor insight

Before investing in a business, it's crucial to thoroughly examine the promoter or the management, their financial and operational capabilities, and their qualifications. Past performance is no guarantee of the future. Investors should evaluate a company’s operational performance, management’s capital allocation and other fundamental factors before deciding.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story