Upstox Originals

Perception versus reality: Impact of US elections on Indian IT

.png)

5 min read | Updated on July 26, 2024, 21:01 IST

SUMMARY

Indian IT has a very high reliance on USA (more than 50% revenue contribution). Therefore, do the USA elections present any opportunity for Indian IT investors? In our quest to find this information - we have come across a very interesting case study - on the role of perception in the markets. Read on to find out more.

Are Indian IT stocks impacted by USA elections

“It all depends on how we look at things, and not how they are in themselves.” - Carl Jung, the Swiss psychiatrist and psychotherapist, which goes

As in day-to-day life, perception plays an important role in financial markets as well. Investors tend to anticipate the future and decide whether they should invest or divest their investments.

Oftentimes, this might not be based on underlying fundamentals. We believe we have found one such example in Indian markets.

Let’s take a look at Indian IT stocks.

Indian IT’s high reliance on the USA

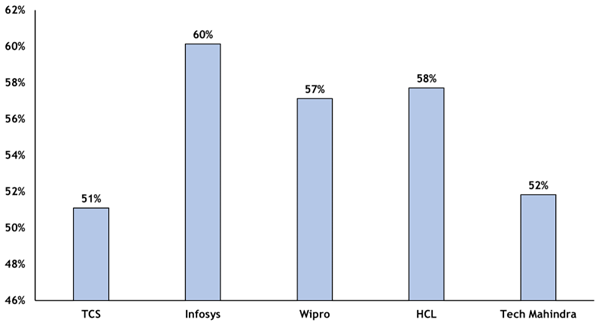

The USA elections are just around the corner. Indian IT has a very high reliance on the USA / North America in terms of revenue contribution (chart below).

US revenue contribution for top IT companies in FY 2024

Source: Company financials & Capital IQ

Source: Company financials & Capital IQThis prompted us to analyse the impact these elections have, if any, on the sector.

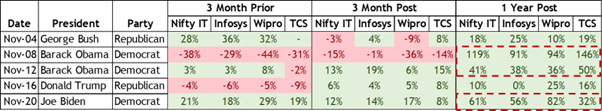

We found something very interesting. Take a look at the table below

IT stocks’ returns over varied periods and across USA presidents*

Source: Investing.com; *the new president is decided in November

Source: Investing.com; *the new president is decided in November-

If you look closely, here is what you note - one year after every US election, Indian IT stocks have returned positive performance.

-

If you look even more closely, you will note, the one-year returns are stronger during a democratic president than with a republican president.

Interesting, right?

In our quest to understand potential reasons, we started with the most obvious one. Is the business of IT companies impacted during this period? Let's take a look at the short and long-term revenue trends.

Short-term trend in revenue

In the table below, we analyze the revenue performance a year after the president is elected and compare it to the year before. For our analysis, we have only considered the revenue from USA / North America. For example

- President Obama was first elected in 2008 (or FY09 by Indian accounting standards). So,

- Year after - Revenue growth of FY10 over FY09

- Year before - Revenue growth of FY09 over FY08. We have presented this data, so it is easier to compare performance.

What did we find?

No clear trend!

During the time of the republican President Bush, revenue growth remained robust, while a year after President Obama - a Democrat - took office, revenue growth dipped from 30% to 8% - partly due to the global financial crisis of 2008.

One could argue that when President Trump took office, revenue growth was severely impacted the year after that. But then, growth in the year before was also weak, suggesting that there were company-specific or cyclical factors that impacted revenue growth and not necessarily or entirely the President.

Short-term trend in USA revenue growth of IT companies (Infosys, Wipro, and TCS)

| Date | President | Party | Revenue growth one year after elections | Revenue growth in the year before the elections |

|---|---|---|---|---|

| Nov-04* | Bush | Republican | 30% | 35% |

| Nov-08 | Obama | Democratic | 8% | 30% |

| Nov-12 | Obama | Democratic | 23% | 22% |

| Nov-16 | Trump | Republican | 0% | 10% |

| Nov-20# | Biden | Democratic | 21% | 3% |

Source: Company annual reports, Cap IQ; *Only Infosys and Wipro revenue growth, as TCS numbers were unavailable; ##Revenue growth impacted by COVID-19

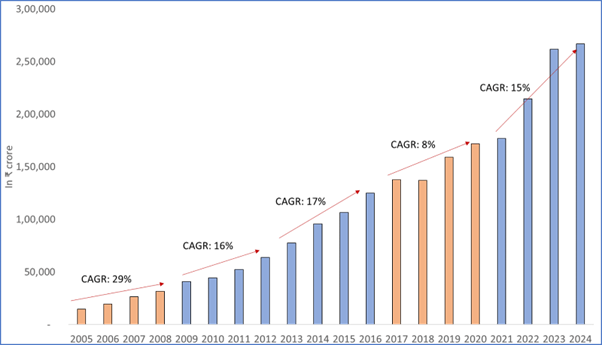

Let’s look at the long-term trend

Even here, we find that revenue growth is not as impacted by the President or the political party. During the time of President Bush, revenues soared higher than while President Obama was in power for all eight years.

Long-term trend in USA revenue growth of IT companies (Infosys, Wipro, and TCS)*

Source: Company financials, Cap IQ; *Orange/Blue highlighted columns are Republican/Democrat presidents

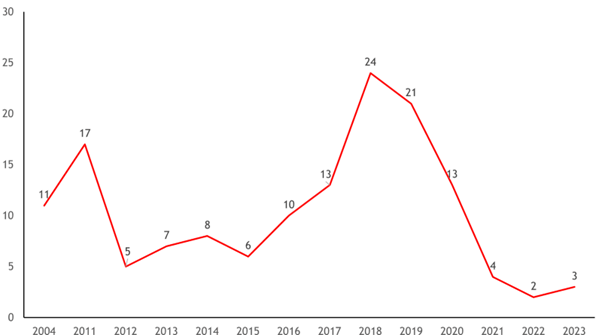

H1-B visa denial rate

Finally, we also look at the H1-B visa denial rate to see if there are any operational impacts. We note that the denial rate was increasing during the time of President Trump. That said, even during President Obama’s time, denial rates were as high as 17%. Infact, US lawmakers questioned him about such high denial rates.

H1-B Visa Denial Rates (FY2012-FY2022) (in %)*

Source: redbus2us.com; * Data has been consistently available since 2011.

Source: redbus2us.com; * Data has been consistently available since 2011.Even more interestingly, Indian IT companies have been reducing their reliance on H1-B visas - over the past 8 years this reliance has come down by 56%. Besides the ever-changing regulatory hurdles, this can also be attributed to:

- Companies have domestic workforce capabilities in the USA itself

- Improving technological prowess (cloud computing, bots)

What then could be the reason?

We believe that it is perception more than actual on-ground action that is driving this trend.

Our regular readers are aware that we do not indulge in any sort of political bias or speculation. That said, in the USA, democrats are perceived as more liberal, and open to immigration. As such, the election of a democratic president, could fuel more optimism and bolster share prices.

What does this mean for investors?

As always we implore investors to analyse the fundamentals of a company or industry before making investing decisions. For those, who do the hard work, such market perceptions could bring interesting entry or exit opportunities, which they can take advantage of.

About The Author

Next Story