Upstox Originals

Near-term election impact: What does the next week hold?

.png)

4 min read | Updated on May 31, 2024, 19:57 IST

SUMMARY

The Nifty50 index saw an almost 2% correction in the last 5 days. The 2024 Lok Sabha election results are just around the corner, and this caused some volatility. Are you curious to find out what happened in the past 5 elections? Should investors take immediate action?

Analysing market movement near elections

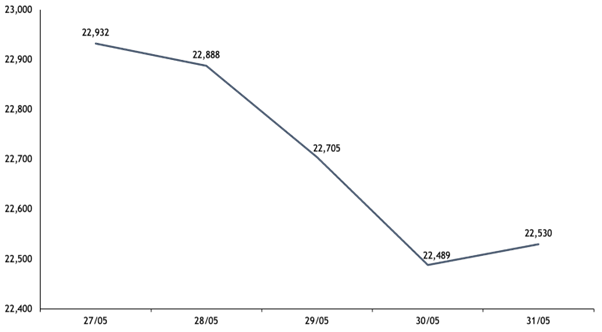

The 2024 Lok Sabha Election results will be announced on June 4. The past week has seen an increase in volatility, partly due to the same, as seen in the chart below.

Source: Investing.com

Staying away from politics, the aim is to help you understand what happened in the past and how an investor should think about the upcoming week.

Let’s dive in.

What does the past indicate?

As seen in the table below, the short-term election impact is no different from other news/events in the markets.

What does that mean?

Markets only react sharply, when results are different from expectations. In the table below, we have shown the reaction in the table is for the result day or on the next trading day (if the result day is a non-trading day)

| Year | Market anticipation | Election result | Nifty reaction |

|---|---|---|---|

| 2019 | A return of NDA alliance | NDA alliance won | -0.7% |

| 2014 | NDA alliance expected to win | NDA alliance won | 1.1% |

| 2009 | A return of UPA alliance | UPA alliance won; stronger than expected Congress performance | 17.7% |

| 2004 | A return of NDA alliance | UPA alliance won | -7.9% |

Source: Hindustan Times, Investing.com

Let’s take a more detailed look at each of these election periods. In the following section, we look at market performance 5 days before and 5 days after the results.

The period of 5 days prior period - should also cover volatility caused by exit polls (if any). It is difficult to pinpoint the exact date of the exit polls since there are multiple agencies, but 5 days prior should cover most of them

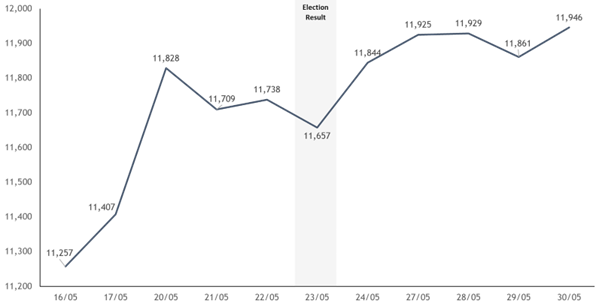

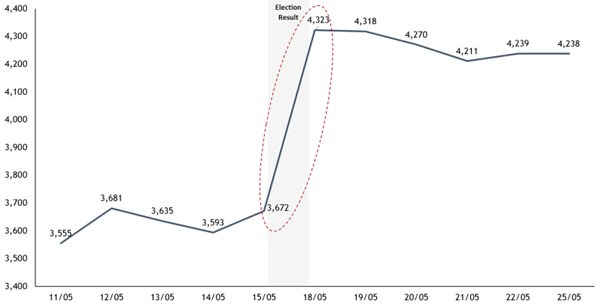

Let’s look at the most recent 2019 elections.

What happened on election day: Markets corrected almost 1% (at closing) on the day of the result, before rallying 2% the next day.

What happened in the 10 days: Markets rallied almost 6%.

Source: Investing.com

Moving to 2014 Lok Sabha Elections

What happened on election day: Markets rallied just over 1%.

What happened in the 10 days: Markets rallied almost 7%.

Source: Investing.com

2009 elections saw higher volatility.

On election day, markets rallied about 18% as the UPA government won a better-than-expected majority.

Over 10 days: Total market return was about 19%.

Source: Investing.com

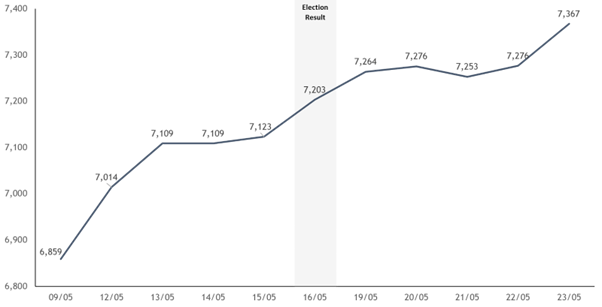

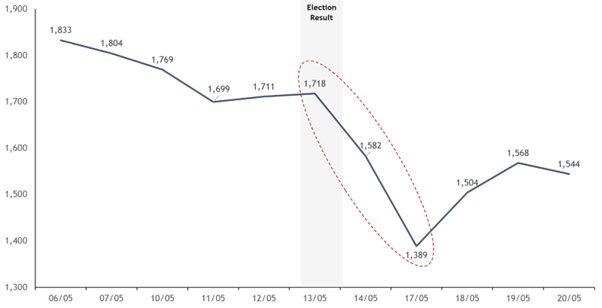

Finally 2004: where results were not in line with market expectations

On election day, markets corrected almost 8% and almost 19% over three days as the incumbent NDA government unexpectedly lost the elections.

Over 10 days: Markets corrected about 16% overall. As can be seen from the chart below, markets did show some bounce back.

Source: Investing.com

What’s in it for traders?

Traders can benefit by implementing various techniques to capitalise on market volatility and potential trends. Pre-Market preparation by analysing the exit polls and early trends which can provide a sense of market direction. That said, remember - exit polls are indicative, not definitive.

What’s in it for investors?

If you continue to believe in India’s potential, then not much will change. Certain knee-jerk reactions are possible and may present opportunities to increase positions or book profits. In either case, it is vital to remember that over the long term, Indian equity markets have made huge strides and been robust wealth creators.

Investors are better off sticking to their investment thesis rather than making decisions based on short-term events.

Also, the past won’t necessarily repeat. Investors and traders should evaluate current market conditions independently.

About The Author

Next Story