Upstox Originals

Market volatility 101: What every investor needs to know

5 min read | Updated on January 14, 2025, 18:44 IST

SUMMARY

Since October 2024, markets have corrected more than 10%. Wondering about your next move? In this article, we explore how investor sentiment, more than on-ground realities, can sometimes lead the markets from a state of excess to fear. In this article, we delve into understanding these market cycles and how this volatility presents an opportunity for savvy investors.

Understanding market cycles is crucial to investing success

Popular investor Howard Marks, Co-chairman of Oaktree Capital Management, once asked, “Why don't things just grow at their long-term growth rates?”

Let me simplify this. Long-term returns from the NIFTY50 typically average 12-13% per annum. So, going by Mr Marks' question, why doesn't the NIFTY50 deliver 12-13% returns every year?

If one were to analyse the history of stock markets, there would be very few years when the markets delivered their average annual returns. It's typically higher or lesser than the average and sometimes by a huge margin!

Any guesses why this is so? Simply put, humans are not rational. While we would tremendously like to believe so, we all know that it is not true. From the fear of losing money to the fear of missing out on large (sometimes imagined) gains, human emotions tend to move from fear to greed, and back to fear.

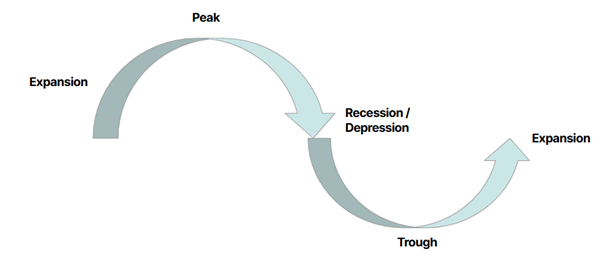

And this is reflected in the financial markets in the form of market cycles. This is what a typical market cycle looks like:

Before anyone jumps the gun, I am in no way insinuating that we are headed towards a recession. There are still multiple levers that can be pulled (by the government or the central bank) to contain this current market fall to a correction (10-15% fall in markets). So far, the market has corrected ~11% (at the time of writing this on January 14, 2025).

Why is it important to understand market cycles?

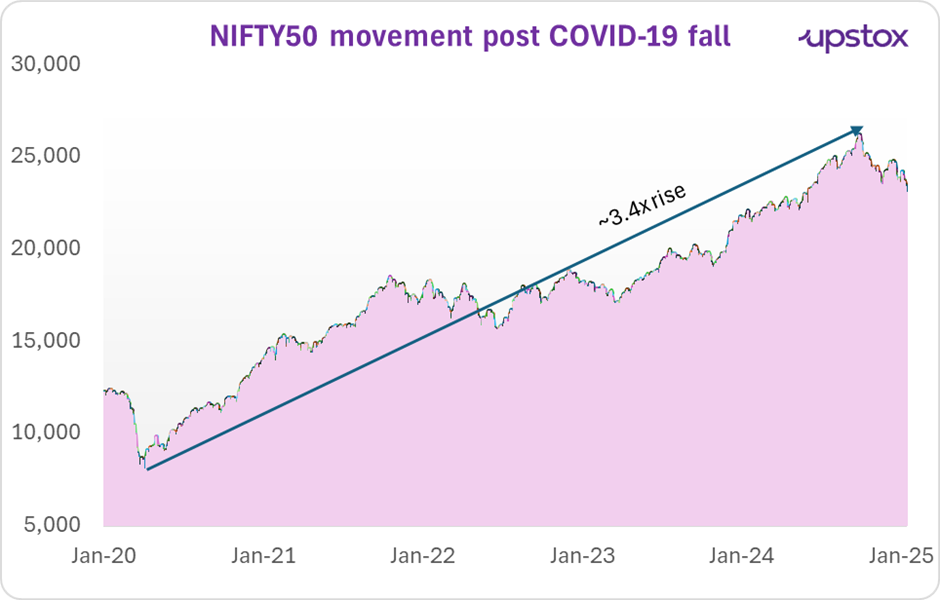

Most importantly, it helps put things in perspective. Looking at the chart of the NIFTY50 since 2020, we note that the market has been rising consistently for 4-5 years. Think about all the things this market has overcome (or maybe even ignored)

-

Two different regional wars

-

Massive global inflation

-

Varied political surprises (and even shocks)

-

Worries about markets being overvalued!

Source: NSE; data as of January 14, 2025

It can be argued that even one of these factors could be enough to give the markets a pause. But they didn’t. And most importantly, no one complained when the markets were going up!

Flip the equation to today.

-

Last Friday (January 10, 2025), India’s Index of Industrial Production (IIP) was published. The IIP clocked a healthy pace of 5.2% (for November 2024), which was a 6-month high. Just for the record, IIP for November 2023, when the markets were still rising, was just 2.5%.

-

Yesterday, (January 13, 2024), India’s inflation data was released for the month of December 2024. Surprisingly, retail inflation came in at 5.22%, lower than the expectation of 5.3%. This was the second straight month of declining inflation. Annual growth in food prices eased to 8.39% in December from 9.04% in November 2024. This further makes a case for rate cuts in India

This is not to say that all is well with the economy. Of course, there are challenges (discussed later), but at a time when exuberance has started to move towards dismay, it is highly likely that even optimistic signals will be ignored by investors. Just the same as the potentially worrying signals that were ignored during times of exuberance in the markets.

Investor psychology is a key, albeit an underappreciated driver of market movements. Still not convinced? Take the example of HCL Tech today. India’s third-largest IT company in its results managed to deliver

-

Strong QoQ revenue growth

-

Expanded EBIT margins to 19.5%. It has guided for EBIT margins of 18-19% (its usual band) for the full year of FY25.

Despite that, the stock has corrected more than 8% (at the time of writing). Why? It did not meet investor expectations. Yes, the company has guided for some growth-related challenges ahead, but IT companies have been cautioning about growth for more than two quarters now!

It is simply a game of investor expectations. This is not a suggestion that one must go and buy HCL Tech, but rather an example of how investor perception is sometimes more critical than on-ground realities.

Does this mean all is well?

No. The economy is facing many challenges:

-

GDP growth for FY25 is expected at 6.4%, the slowest in the last 4 years

-

Oil prices and exchange rates are playing truant

-

Consumption (mostly urban) remains slow

So, yes the economy does have challenges to overcome. But once again - at any point in time - an economy typically has challenges to overcome. Simply because of a turn in sentiment - it is possible that challenges are being amplified and positives overlooked.

“Buy low, sell high” or “Buy when everyone is fearful, and sell when everyone is greedy” are age-old investing lessons. Almost everyone is aware of these!

But here is the thing - most people don't have the will to actually execute them. The point is that understanding human psychology and developing the ability to differentiate noise from the news are key ‘skill sets’ required to follow through on this advice.

Cycles are inevitable and are typically exacerbated by the failure to remember past cycles. But most importantly, they are self-correcting!

Final thoughts

As US investor Peter Lynch once said:

So, if your long-term view of India remains unchanged, don't let short-term ups and downs shake your confidence.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story