Upstox Originals

Market corrections: A stepping stone to long-term growth?

.png)

4 min read | Updated on November 13, 2024, 17:40 IST

SUMMARY

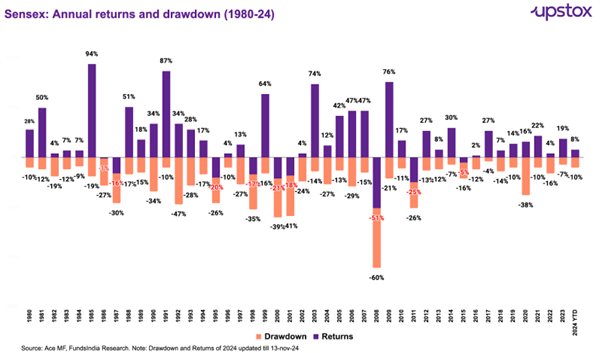

Indian markets have corrected ~11% from their all-time highs, with pundits already announcing the markets have entered a correction zone. That said, as we show in this article, corrections are a normal part of the market journey and can offer opportunities for the discerning investor. In this article, we go back almost 40 years, analysing drawdown and returns in each year. We also look at some of the key reasons for the current downturn and factors that investors should watch out for.

Markets have corrected ~11% from their highs

The Indian stock market, like many others around the world, often experiences periods of volatility and correction. These temporary setbacks can cause anxiety among investors, but history shows a reassuring trend: despite intra-year declines, the market has delivered positive annual returns over the long term.

In this post, we'll dive into how drawdowns can be a normal part of the market cycle and why staying invested is key.

What does data say?

Looking at the Sensex data from 1980 to 2024, we see a pattern where intra-year declines of more than 10% are common. Over 44 years, 35 years ended in positive territory, showcasing the resilience of the market. Here are a few key insights:

-

Drawdown average: The average decline within a year has been around -20%.

-

Returns average: Despite these declines, the average annual return stands at 19%.

Here’s a more detailed breakdown of market resilience in the face of intra-year declines:

| Intra-year declines | Total tears | No of years with positive returns |

|---|---|---|

| 0 to -10% | 4 | 4 |

| -10% to - 20% | 23 | 22 |

| More than -20% | 17 | 9 |

Source: FundsIndia Research, ACE MF

-

Small declines (0% to -10%): Across 4 years with minor declines, the market ended positively in all 4 years. This suggests that small dips are generally not a barrier to finishing the year with gains.

-

Moderate declines (-10% to -20%): Out of 23 years with moderate drops, 22 of those years still closed positively. This high recovery rate (96%) indicates that even when the market faces noticeable declines, it has a strong tendency to rebound and end on a positive note.

-

Large declines (more than -20%): In 17 years of significant drops, only 9 years (about 53%) managed to end with gains. This shows that severe downturns are more challenging to recover from within the same year, though recovery is still possible in over half of the cases.

This data highlights that, historically, the market has shown strong resilience, particularly with smaller to moderate declines.

Finally, let’s look at some of the key factors driving this current correction.

Causes for the current market correction:

-

Earnings miss: Over 44% of companies reported Q2FY25 earnings missed analyst expected earnings, which has caused concern about future expectations and an overall economic slowdown

-

High FII sell-off: As we highlighted in Why a falling rupee is not bad news, October-November has seen a strong FII sell-off, which has weighed down the market.

-

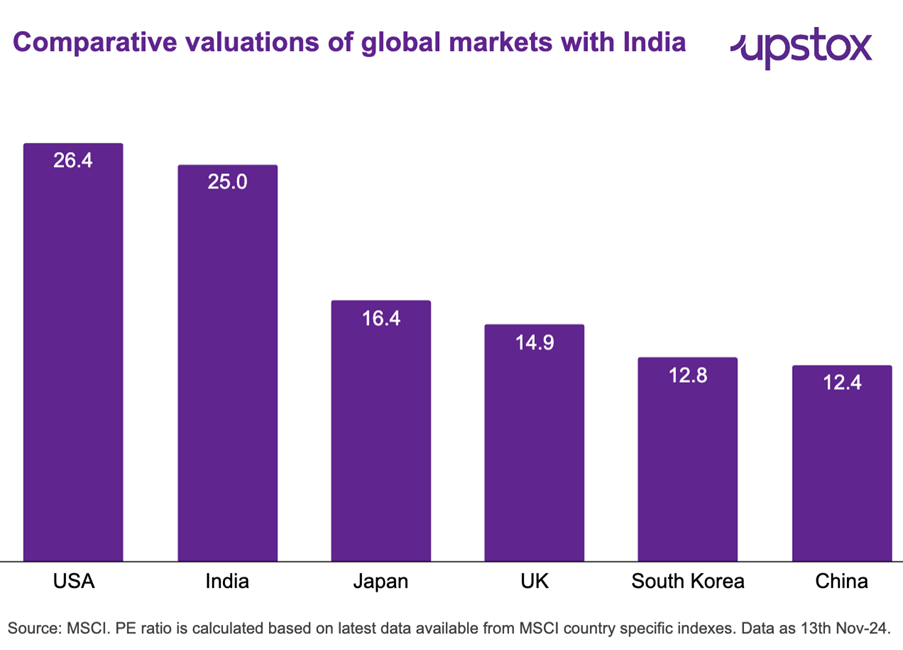

High valuations: Indian markets are trading at comparatively high valuations as compared to other global peers.

What could reverse this correction?

Well, goes without saying, that any reversal in the above factors could help trigger the next rally. With the recent Chinese stimulus disappointing the markets, global investors might once again be forced to reconsider their fund flows. Besides that, even though the broader market has corrected ~10-11%, many high-quality companies have corrected more, opening up investing opportunities for discerning investors.

Finally, one factor that is expected to help keep the markets buoyant is DII and SIP inflows. Indian mutual fund industry recorded monthly SIP contributions exceeding ₹25,000 crore for the first time in October 2024.

Lessons for investors: Patience pays off

-

Don’t fear corrections: Market declines are temporary. Historical data shows that corrections don't derail long-term growth.

-

Stay disciplined: Emotional decisions can lead to losses. Focus on your long-term goals rather than reacting to short-term volatility.

-

Consider systematic investments: SIPs (Systematic Investment Plans) help average out the cost of investing, reducing the impact of market fluctuations.

Conclusion

The key takeaway from decades of data is clear: market corrections are a natural part of investing. Staying invested through these phases has consistently proven beneficial for long-term growth. For investors in the Indian stock market, these drawdowns should be viewed not as setbacks but as opportunities to strengthen their portfolios for the future.

About The Author

Next Story