Upstox Originals

Journey across India’s travel industry, discovering interesting opportunities

.png)

4 min read | Updated on July 15, 2024, 22:21 IST

SUMMARY

Tourism industry revenue is projected to grow at over 9% in the next 4 years. But what's driving this sector's growth? How do the various opportunities stack up?

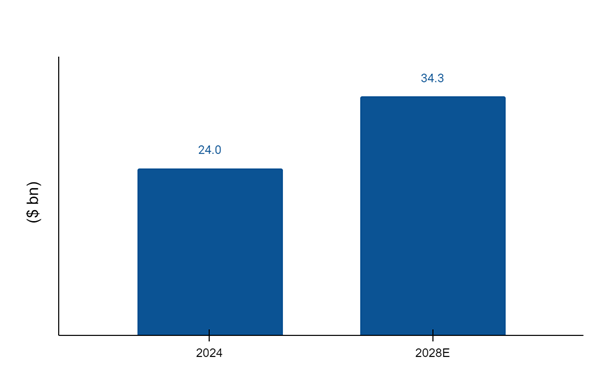

Travel sector is expected to grow at over 9% over the next 4 years

According to the World Economic Forum's 2024 Travel & Tourism Development Index, India secured 39th place globally, a huge leap from 54th in 2021. This improvement is expected to persist.

The travel industry’s revenue is projected to reach $34.3 bn by 2028, fuelled by affordability, better transportation, and improving infrastructure over and above a wealth of natural, cultural, and business travel options.

India’s tourism industry is projected to grow at a CAGR of ~9.3%

Source: IBEF

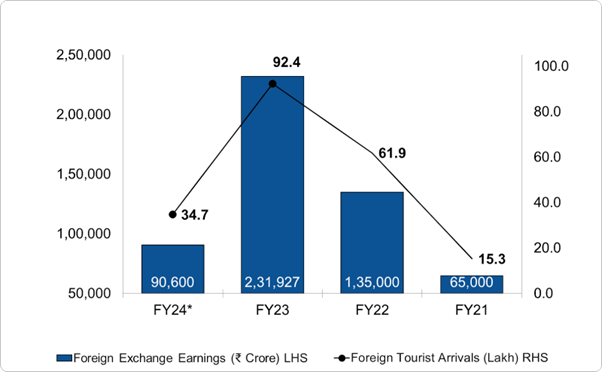

A surge in tourist influx is translating into a significant boost for the country's foreign exchange earnings (FEE). The FEE has grown at a CAGR of ~89% during 2021-23.

FTA grew at a CAGR of 145.9% from FY21 to FY23

Source: GOI ; *Data from Jan to Apr 2024

Source: GOI ; *Data from Jan to Apr 2024What are the factors contributing to the trend?

| Factors | Impact |

|---|---|

| Enhanced connectivity | New highways, superfast trains, and regional airports are making travel smoother and opening up access to inland destinations. |

| Rising travel budgets | A report by ACKO and yourGov Travel found that nearly half (48%) of Indians plan to allocate more towards travel in 2024. |

| State tourism push | Many states like Kerala and Madhya Pradesh are investing in tourism projects to attract more private investments. |

| Reduced GST | GST reductions on rooms to 12% and 18% are improving affordability and adding to cost-effectiveness. |

The Indian tourism and hospitality industry has diverse segments like accommodation, food & beverage, attractions & recreation, and travel & tourism, each playing a vital role in crafting unforgettable experiences for visitors.

Which segment is poised for future booms in India's tourism industry?

| Segment | Expected growth | Reason | Key Industries to benefit |

|---|---|---|---|

| Eco-tourism | 15.7% CAGR till 2027 | Global shift towards sustainable travel | Hotels |

| Cruise Tourism | 9.5% CAGR till 2027 | Increasing passenger traffic | No direct listed player |

| Travel Spending | 9% CAGR till till 2030 | Domestic air passenger traffic | Airlines, Railways |

| Package holidays | 7.4% CAGR till 2028 | Surge in user numbers | Travel agencies |

Source: McKinsey, Invest India, Statista, Set my trip

Tata Asset Management launches thematic index fund

Capitalizing on India's booming tourism industry, Tata Asset Management, a leading mutual fund house, has launched the nation's first tourism-focused index fund. This open-ended scheme invests in companies across travel, tourism, and hospitality sectors, offering investors exposure to this high-growth market, with an AUM of ₹ 59,965 crore as of 30 June 2024.

Let’s look at the key metrics of a few select companies associated with travel and tourism.

| Business Segment | Company | Market Cap ( ₹ crore)* | ROE % | D/E | EV/EBITDA* | Stock Price CAGR (2021-24)% |

|---|---|---|---|---|---|---|

| Airlines | Indigo | 1,69,310 | NA | NA | 10.8 | 34 |

| Hotel and Resorts | Indian Hotels | 84,224 | 14.3 | 0.3 | 38.7 | 66 |

| EIH | 26,306 | 17.6 | 0.1 | 24.0 | 54 | |

| Lemon Tree Hotels | 11,615 | 16.3 | 2.4 | 26.3 | 52 | |

| Tour travel-related services | IRCTC | 83,076 | 40.4 | 0.0 | 47.7 | 34 |

| Ease My Trip | 7,260 | 31.2 | 0.0 | 31.5 | 19 | |

| Restaurants | Jubilant FoodWorks | 38,274 | 12.4 | 1.9 | 35.2 | 19 |

| Travel agencies | Thomas Cook | 11,919 | 13.7 | 0.2 | 18.4 | 55 |

| Yatra Online** | 1,961 | -1.0 | 0.1 | 40.0 | - |

Source: Screener; *Data as of 15th July 2024l **Yatra online got listed on 29th Sep 2023 on stock exchanges;

Conclusion

India's travel and tourism industry is rising significantly and can be a lucrative sector for investors to consider, but it's crucial to understand the inherent risks and rewards.

- Untapped markets present exciting prospects for investors, it can be a valuable addition to an investor's portfolio, offering diversification beyond traditional sectors.

- The industry is susceptible to external factors like geopolitical tensions, climate change, and pandemics, which can significantly impact performance.

- Thorough research is essential before investing to clearly understand the opportunities and threats specific to this dynamic market.

About The Author

Next Story