Upstox Originals

Is consumption the new shelter from the storm?

4 min read | Updated on February 01, 2025, 18:14 IST

SUMMARY

The Finance Minister has raised the limit for tax exemption in the Union Budget 2025. With more money now expected in the people's hands, consumption could receive a big boost. However, as broader economic growth remains challenged, this raises a crucial question—do FMCG and consumption indices now become the new shelter from the storm?

THe Union Budget 2025 has raised the tax exemption limit

The Union Budget 2025 has provided a much-needed boost to consumption by increasing the tax exemption limit from ₹7 lakh to ₹12 lakh under the new tax regime. For those eligible for the standard deduction, the limit is ₹12.75 lakh. The Finance Minister has also promised a revised Direct Tax law that is expected to streamline the law and make it simpler and clearer.

This relief is also expected to have a multiplier impact on the economy as people are expected to spend this money across different avenues (two-wheelers, cars, jewellery, entertainment, travel, etc) and thus help growth.

While all of this is largely true, these measures do not address the immediate challenge of growth in the economy. This is evidenced by the fact that the larger stock market, NIFTY50, has given a mixed reaction to the budget.

However, from an investor’s point of view, this raises a crucial question - Do FMCG and consumption become the shelter for the investors, in case the storm continues (NIFTY50 has corrected ~13% from its high in 2024)?

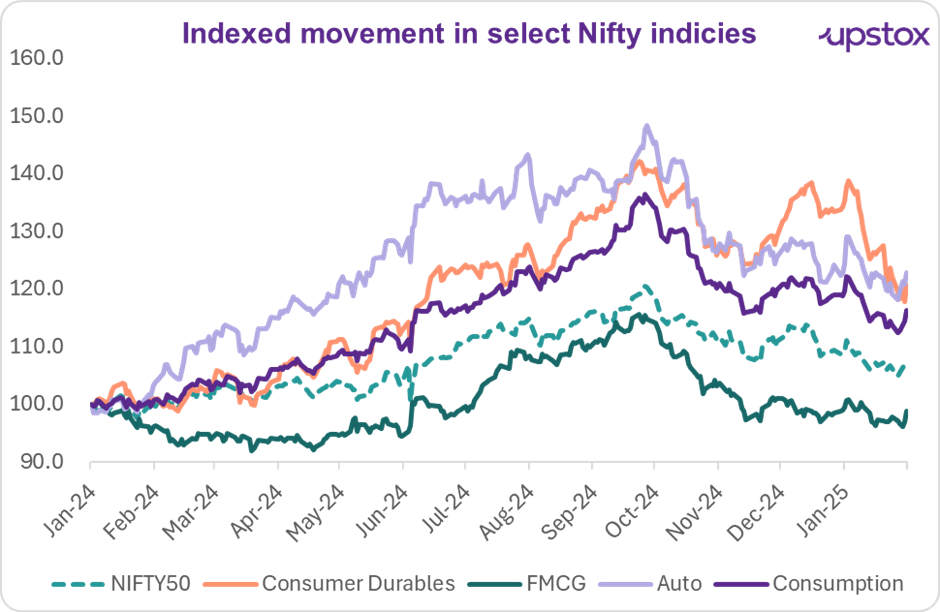

As we see in the chart below, all the consumption indices have been corrected, with the NIFTY FMCG index underperforming its consumption peers as well as the market.

Source: NSE

Fundamentally, the pace of profit growth across each of these indices has either been consistently slowing down versus the broader market or has seen a sharp slowdown in the past few quarters. So far earnings for Q3FY25 (quarter ending December 2024) have also been a mixed bag, with no definitive signs of revival.

| in ₹ crore | Dec-23 | Mar-24 | Jun-24 | Sep-24 |

|---|---|---|---|---|

| NIFTY50 | 160,206.7 | 175,000.1 | 159,378.8 | 169,349.8 |

| YoY Growth (%) | 15.3% | 29.5% | 2.8% | 12.8% |

| Nifty Consumer Durable | 2,121.1 | 2,359.9 | 2,672.9 | 2,061.7 |

| YoY Growth (%) | 6.3% | 10.9% | 22.4% | 4.0% |

| Nifty FMCG | 11,998.9 | 10,569.0 | 12,184.8 | 12,310.1 |

| YoY Growth (%) | 9.1% | -7.3% | 4.6% | 1.5% |

| Nifty Auto | 17,725.3 | 16,067.6 | 16,168.7 | 15,844.9 |

| YoY Growth (%) | 85.8% | 24.3% | 35.1% | -3.6% |

| Nifty Consumption | 33,859.0 | 31,901.8 | 35,348.7 | 32,035.3 |

| YoY Growth (%) | 60.1% | 5.0% | -5.4% | -7.3% |

Source: Ace Equity

As such, now that the Finance Minister has left more money in the hands of individuals, it should give consumption a boost. Urban consumption, which has been slowing down for the past few quarters, could now see some support.

Besides this, with the government now supporting consumption, these sectors should also see investor sentiment turn positive.

A combination of improving fundamentals as well as supportive sentiment could make the FMCG and consumption sectors ideal for investors who are looking for shelter in the current economic environment.

Why are we not completely out of the woods?

Larger economic growth is still challenged. The government’s capex estimates for the upcoming year don’t show any major spike, banks / NBFCs report a rise in NPAs (retail and MFI), and unemployment is still higher than comfort levels. And all this, while the global economy itself is facing multiple challenges (threat of tariffs and trade wars, inflation, among others).

A word of caution

The caveat here is that people only spend money when they have some clarity on the future. If they have an optimistic view of the economy, expect growth to pick up, unemployment to go down, and so forth, they will spend. Otherwise, people typically tend to save for a rainy day. As such, sustained improvement in the economy is vital to seeing the impact of these tax cuts.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story