Upstox Originals

Investors are making riskier bets on stocks through thematic/sectoral mutual funds

(1) (3).jpg)

6 min read | Updated on July 12, 2024, 14:07 IST

SUMMARY

Nearly half of 2024's mutual fund inflows have flowed into thematic and sectoral funds, highlighting a trend towards concentrated investment strategies among mutual fund investors.

Thematic/sectoral funds are seeing a rise in inflows

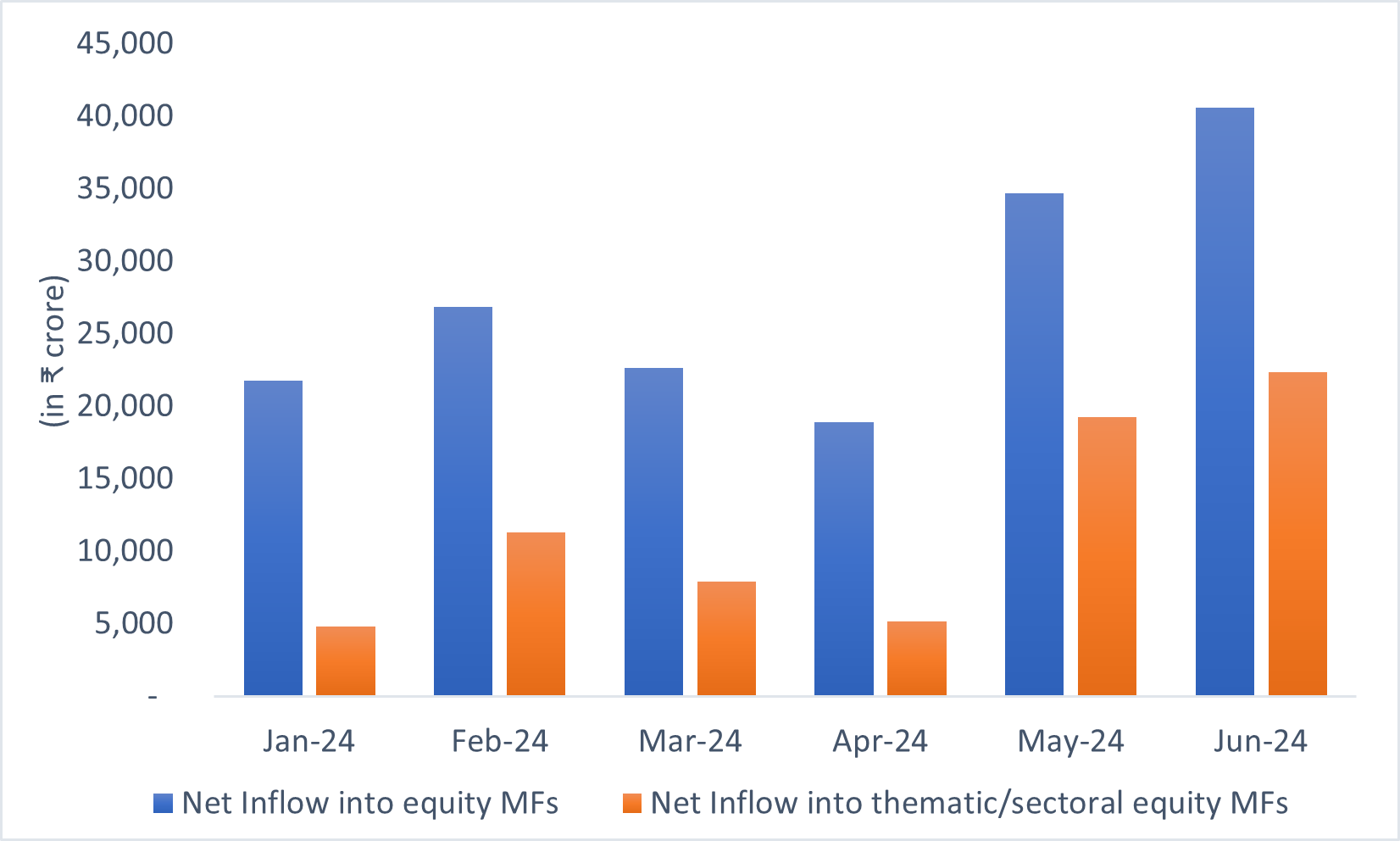

Equity mutual funds (MFs) schemes saw net inflows of ₹40,608 crore in June 2024. The Centre for Monitoring Indian Economy database has data going as far back as October 1999, and this is the highest-ever net inflow that equity MF schemes have seen during the course of a month. Equity MF schemes are schemes that largely invest in stocks listed on Indian exchanges. Further, MF investors can invest in a scheme or they can redeem the investment they have already made. When the difference between what is invested and what is redeemed is positive, then there is said to be a net inflow into the scheme.

In fact, equity MF schemes saw net inflows of ₹34,697 crore in May 2024. This was the second-highest net inflow figure ever. Further, from January to June, as the stock prices have gone from strength to strength, equity MF schemes have seen a total inflow of around ₹1.66 lakh crore. Multiple points arise here, as listed below:

-

A good chunk of investments into equity MFs are made by retail investors. And as has been seen in the past, retail investors are attracted to stocks, only once prices have rallied considerably. When it comes to investing in stocks, the basic law of demand—that is, higher demand at lower prices—works in reverse. In 2024-25, the current financial year, the Price to Book ratio of stocks that make up the BSE 500 index has been at its highest level ever since 2007-08. The Price to Book ratio is a measure of valuation. A high Price to Book ratio of an index like BSE 500, essentially tells us that stock prices on an aggregate are at a very high level with respect to their current earnings and the future business prospects of companies.

-

There are different kinds of equity MF schemes. Thematic/sectoral equity MF schemes are one kind. These schemes invest either in a specific sector, let’s say something like banking or infrastructure or defence, or they invest in a so-called theme like consumption or a business cycle or something termed as special-opportunities, or even innovation for that matter. Now, in 2024, as mentioned earlier, net inflows into equity MFs have been at ₹1.66 lakh crore. Of this, around ₹70,716 crore, or close to 43% has been invested in thematic/sectoral funds. The story gets even more interesting when we look at the data for just May and June. Of the ₹75,305 crore invested in equity MF schemes during the period, ₹41,565 crore or more than 55% has been invested in sectoral/thematic schemes (see chart below). And therein lies the problem.

Net inflows into equity MFs

Source: Centre for Monitoring Indian Economy

-

In June 2024, there were nine new fund offers (NFOs) launched in the sectoral/thematic equity MF space. These NFOs saw total inflows of ₹12,974 crore. What does that tell us? The MFs are launching newer schemes when the valuations of so many stocks are totally out of whack with their earnings. When this money gets invested, the prices and thus the valuations will go up further. Of course, the easiest time for MFs to get retail investors to invest money in equity MFs is when prices have already gone up quite a bit. This is not something that has happened for the first time. It’s just another example of history repeating itself. Or as Neil Parikh, the CEO of PPFAS Mutual Fund tweeted: “Wow, the sheer number of NFOs launched, especially thematic funds is a bit scary.. be careful guys.”

-

What does all this really mean? Close to 43% of inflows into equity MFs have been invested into thematic/sectoral schemes in 2024. Even over the last year, more than 35% of the net inflows into equity MF schemes have come into sectoral/thematic schemes. So, retail investors are making concentrated bets on sectoral/thematic equity MF schemes. Now, the entire idea of investing in equity MF schemes is to build in some diversification into the overall portfolio, by not putting all eggs into one basket. But the moment one bets big on a particular sector, especially when valuations are totally out of whack, one is doing exactly the opposite. If the sector in which the MF is investing goes out of favour, the fall in stock prices can be quick. And that won’t be good for the overall portfolio. But when the going is good, the assumption that most retail investors make is that it will continue to be good.

-

Also, some thematic funds with themes like consumption, business cycle, etc., are nothing but normal diversified equity MFs. They have been launched simply because it’s easier for MFs to get investors to invest big-money into new schemes. It’s an exercise in driving up the assets under management (AUM) of the MFs. The more AUM MFs have, the more money they make. It’s as simple as that.

-

In fact, let’s dig a little deeper. In the last year, equity MF schemes have seen net inflows of ₹2.6 lakh crore. Of this, large-cap funds have seen net inflows of only ₹4,737 crore or less than 2%—1.8% to be exact—of the net inflows into equity MF schemes during the period. Large-cap MFs invest in large-cap stocks or stocks that are ranked in the top 100 as measured by market capitalization. Currently, many such stocks are not as expensively priced as mid-cap or small-cap stocks or stocks in sectors that are currently favoured. Clearly, investors are chasing recent performance and in the process, making concentrated and riskier bets, thereby beating the entire idea of investing in stocks through MFs.

So, that’s the story. Every generation of retail investors feels that a new era has dawned upon us. Or that this time it’s different. Or that they have already figured out everything that needs to be figured out to invest in stocks, directly or indirectly. But then as history clearly shows us that rarely turns out to be the case. This is why diversification remains the only game in investment town.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story