Upstox Originals

India’s sports economy: The next $130 billion growth frontier

.png)

7 min read | Updated on March 25, 2025, 18:08 IST

SUMMARY

India’s sports sector, once considered a small industry, is now racing ahead to become one of the country’s most dynamic industries. The industry is growing at 2x pace of India’s GDP growth, driven by a young population, digital disruption, rising disposable incomes, and policy support. This article explores the growth of India’s sports economy, why brands and businesses are jumping on board, what is fuelling the viewership boom, and the trends shaping the next decade.

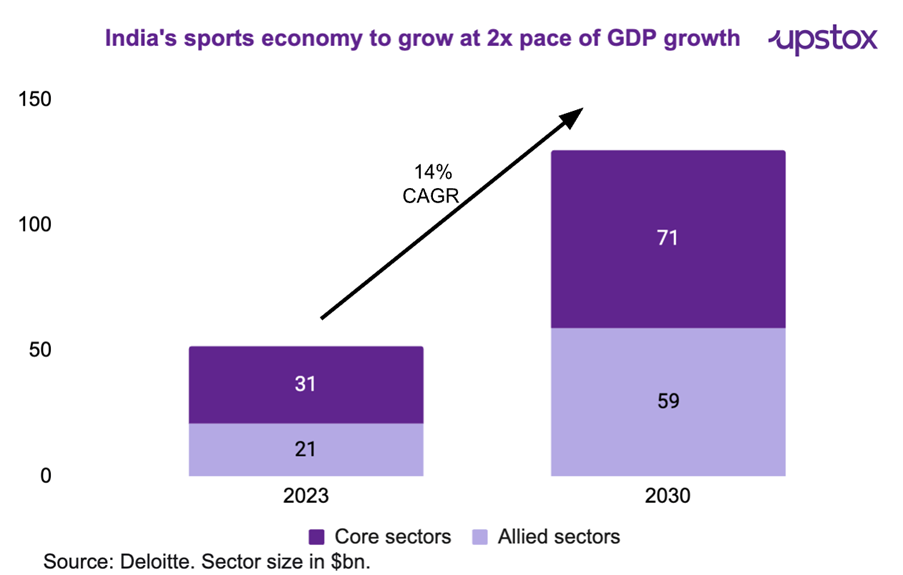

India’s sports economy is projected to grow at a 14% CAGR, reaching $130 billion by 2030

Digital content is bringing in new fans, with 1 in 2 people starting to follow a sport after seeing it online as per Deloitte. Technology makes fan engagement easier in ways that traditional media can't, making sports more social, fun, and personalised.

How big is India’s sports industry?

India’s sports economy is currently valued at $52 billion and is projected to grow at a 14% CAGR, reaching $130 billion by 2030 as per Deloitte estimates. That’s almost double the speed of India’s GDP growth.

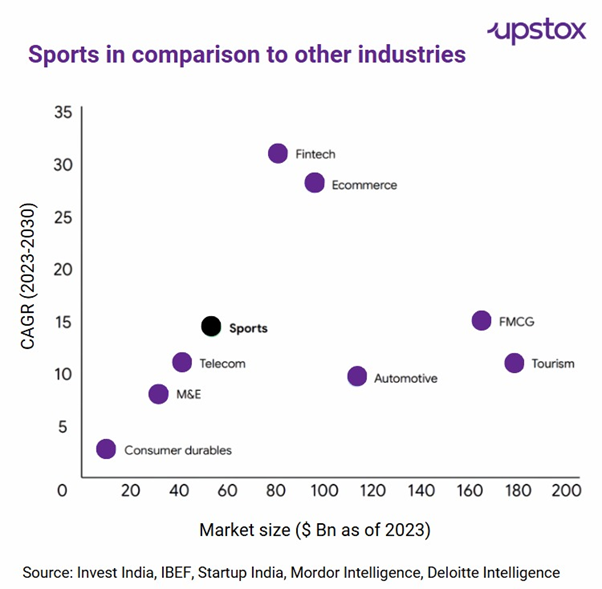

Sports in comparison to other industries

Sports now outpaces established industries like telecom in size and is fast approaching the scale of sectors like automotive and tourism. The sector is set to grow faster than industries like automotive and tourism. The turning point came nearly 15 years ago when the Indian Premier League (IPL) made sports a part of everyday entertainment.

Today, sports play a vital role in the Indian economy as it contributes:

- $9 billion in indirect taxes (~3.7% of total indirect taxes), projected to rise to $21 billion by 2030

- 4.7 million jobs, which could cross 10.5 million by 2030

- $4.2 billion in investments since 2020 across gaming, broadcasting, and sports tech

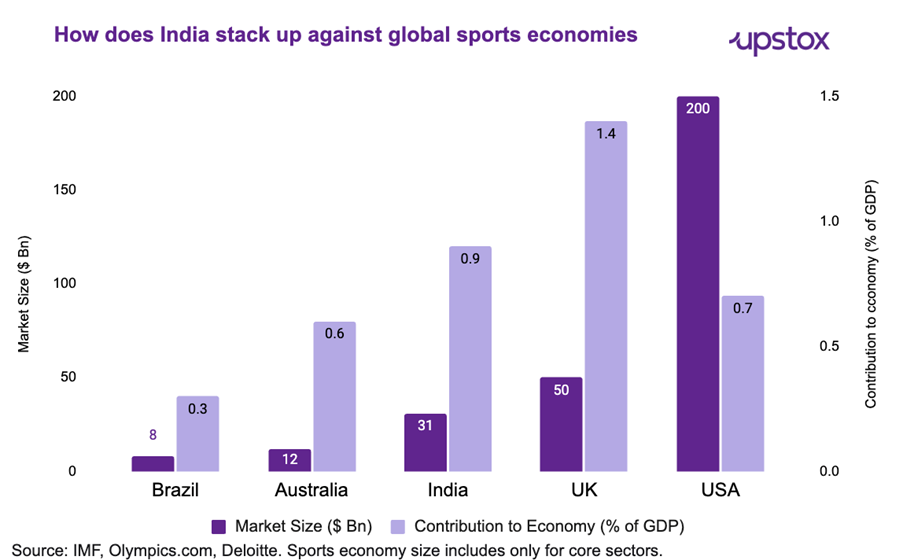

How has India stacked up against the global sports economy?

India’s sports economy is already making waves globally, with a market size of $31 billion—larger than Australia ($10–12 billion) and Brazil ($6–8 billion), and not far behind the UK ($45–50 billion). In terms of contribution to GDP, sports adds 0.9% to India’s economy, ahead of countries like the US (0.7%) and Australia (0.6%), though still behind the UK (1.4%).

How do businesses do business with sports?

Businesses tap into the sports economy through three main strategies:

-

Sports-based strategies

- Franchising (e.g. owning IPL or ISL teams)

- Developing sports-focused products/services (e.g. nutrition, wearables)

- Investing in grassroots and league ecosystems

-

Alignment strategies

- Brand sponsorships of teams and events

- Venue naming rights and in-stadium activations

- Organising experiential marketing campaigns around sports

-

Thematic strategies

- Sports-themed sales promotions

- Real-time “moment marketing” (e.g. celebrating wins, match-day discounts)

- Integrating sports elements into brand storytelling and digital engagement

Why sports viewership is booming in India

-

Technology driven engagement

-

Non-live content like match analysis, reels, memes, and highlights now drive 20% more consumption than live matches, as Google estimates.

-

Digital audiences spend 3x more time engaging with sports content compared to non-digital audiences.

-

-

Government push & policy support

-

India’s sports budget grew by 1.6x over the last five years, swelling from $260 million in 2019 to $405 million in 2024

-

Initiatives like Khelo India, TOPS (Target Olympic Podium Scheme), and Fit India have advanced India’s sports landscape and awareness.

-

Initiatives like the National Sports Repository System and the National Sports Governance Bill 2024 have encouraged the development of sports infrastructure.

-

-

Digital access & smartphone penetration

-

With 695 million smartphone users, 820 million active internet users, and highly affordable data (7th cheapest globally), Indian sports is gaining traction, with 90% of fans accessing sports content via digital channels.

-

OTT platforms like JioCinema and Disney+ Hotstar (now merged as JioHotstar) have bolstered streaming access. 31% of fans spend more time engaging with sports content now than they did two years ago, as per Google Kantar report.

-

-

Cultural shifts

- Sports are now a part of aspirational lifestyles, fitness culture, and even social identities, as we have highlighted these trends here.

-

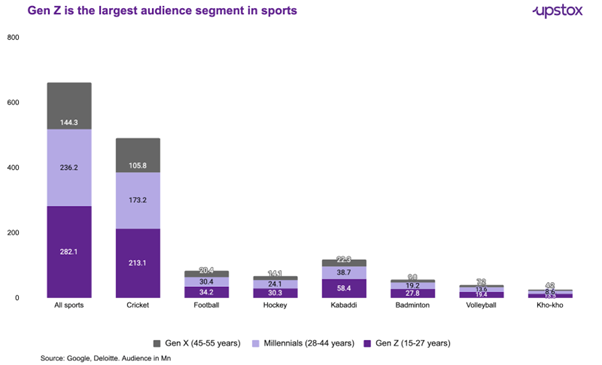

Gen Z is redefining India’s sports consumption

- Gen Z, now the largest audience segment in India, is transforming how sports are consumed and monetised. According to a Bain & Company report, by 2035, ₹1 out of every ₹2 spent on consumption in India will come from Gen Z—a trend that signals growth potential for sports leagues, content platforms, and brand partnerships targeting this digital-native cohort.

- Rise of Regional Sports Leagues

-

What began with the IPL 18 years ago in cricket has now become a trend across major sports in India. The country is now home to over 10 regional sports leagues, including Pro Kabaddi, the Indian Super League, and the Hockey India League.

-

This surge has significantly boosted sports broadcasting and media investments, which grew from $1.2 billion in 2021 to $3.3 billion in 2023. According to a report from Group M and Google, this figure is expected to double, reaching $6.7 billion by 2033.

-

Key trends shaping Indian sports by 2030

-

Team sports continue to dominate: Cricket (492M fans), Kabaddi (120M), and Football (85M) lead the charts.

-

Indigenous sports go mainstream: Pro Kabaddi League (200M+ viewership) and Ultimate Kho Kho (64M) show growing fanbases. Gen Z is the biggest backer of these formats.

-

Women’s sports rise: Leagues like the Women’s Premier League and Pro Panja are gaining traction. Female spectatorship and athlete participation are rising rapidly.

-

Fan-centric digital models: Fantasy gaming, sports tech, and micro-content are deepening fan engagement. Monetisation is expanding from tickets and TV to merchandise, NFTs, and digital experiences.

Opportunity ahead in the sports sector: Which business will see the highest growth?

Here is why these top 5 core sub-sectors are growing at the fastest pace

-

Sports goods & apparel: rising discretionary income along with growing interest for sports-deriving demand. 59% of households earning more than $600 a month are willing to spend for sports-related products. Geographical expansion of fitness-related stores like Decathlon, and Curefit across India also fuels demand

-

Sports technology: From performance tracking tools to widespread digital adoption and community platforms, demand is surging across categories. Notably, India now ranks third globally in the number of sports tech startups. With BCCI—the world’s richest cricket board generating over ₹18,700 crore annually in profits—there is ample financial muscle to integrate cutting-edge technologies that enhance both player performance and fan experience.

-

Broadcasting: Today, 90% of consumers – 93% of Gen Z – engage with sports content digitally . In India, search interest for terms related to sports has grown 4x in 2023 (vs. 2019). The 2022 IPL auction marked a turning point, with digital rights matching TV for the first time. Rising fandoms, ad spend, and franchise value are driving double-digit growth across media rights, sponsorships, and endorsements.

Apart from core sub-sectors, nutraceuticals and wearables are other sectors which are expected to see strong growth.

| Core sub-sectors | 2023 Value ($ bn) | 2030 Value ($ bn) | CAGR(2023-30) (%) |

|---|---|---|---|

| Sports technology | 0.3 | 1.0 | 19 |

| Facilitator services | 1.0 | 2.5 | 14 |

| Sporting goods and apparel | 24.9 | 58.0 | 13 |

| Broadcasting and promotions | 3.3 | 6.7 | 11 |

| Fantasy sports and esports | 1.0 | 1.8 | 9 |

| Sports infrastructure | 0.3 | 0.5 | 8 |

| Allied sub-sectors | |||

| Nutraceuticals | 11.8 | 40.2 | 19 |

| Wearables | 1.4 | 3.9 | 16 |

| Gym and fitness centres | 1.0 | 1.9 | 10 |

| Sports tourism | 7.1 | 13 | 9 |

Source: Deloitte, Google

The decade of Indian Sports has begun

India’s sports economy is transitioning from passion to powerhouse. With supportive policies, surging youth interest, digital enablement, and rising corporate participation, the sector is set to redefine how India entertains, earns, and aspires. For businesses, investors, and policymakers, the message is clear: the sports opportunity is not just emerging—it is exploding.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story