Upstox Originals

India's instant noodle market is on the boil

.png)

5 min read | Updated on October 12, 2024, 12:24 IST

SUMMARY

For ages, saying ‘instant noodles’ in India meant ‘Maggi’. However, times are changing as competitors like YiPPee!, Wai Wai, and popular Korean ramen are gaining ground. Even in rural areas, local brands are challenging Maggi's dominance. This article explores how these emerging players are reshaping the instant noodle market and the shifting dynamics within the industry.

India's instant noodle market is seeing a rise in competition

Known for its ‘2-minute’ promise, Maggi has been the go-to quick meal for busy moms, working adults, and hungry students, dominating the instant noodle market for over 30 years. India is now its largest market, with over 6 billion servings in FY24!

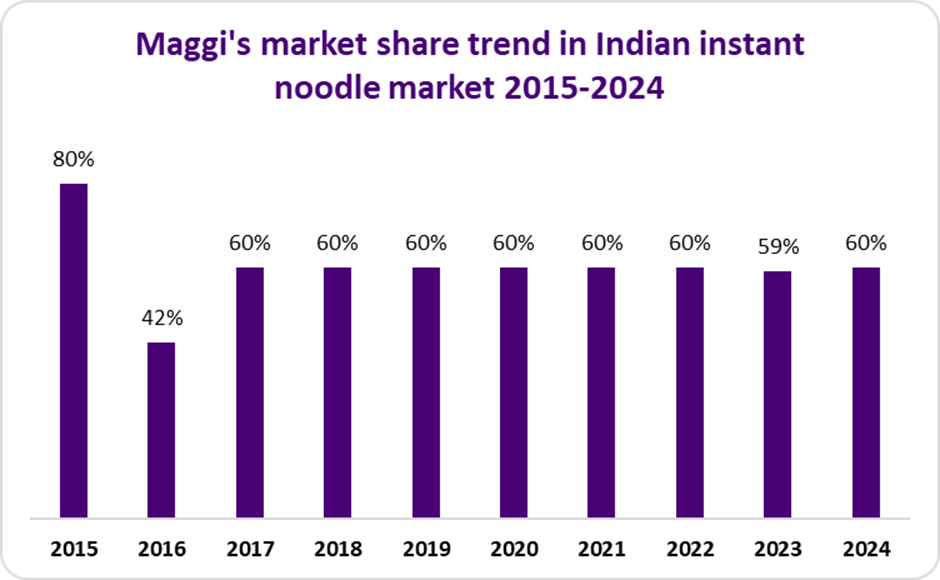

But Maggi’s journey hasn’t been without challenges. In 2015, a ban over lead concerns wiped out its 80% market share to zero overnight. Despite the setback, Maggi bounced back and now holds a solid ~60% share as of FY24. However, curiously, Maggi has not been able to regain its former glory… Hmm…makes you wonder? What could be the reason?

Source: News articles

Indian instant noodle market overview

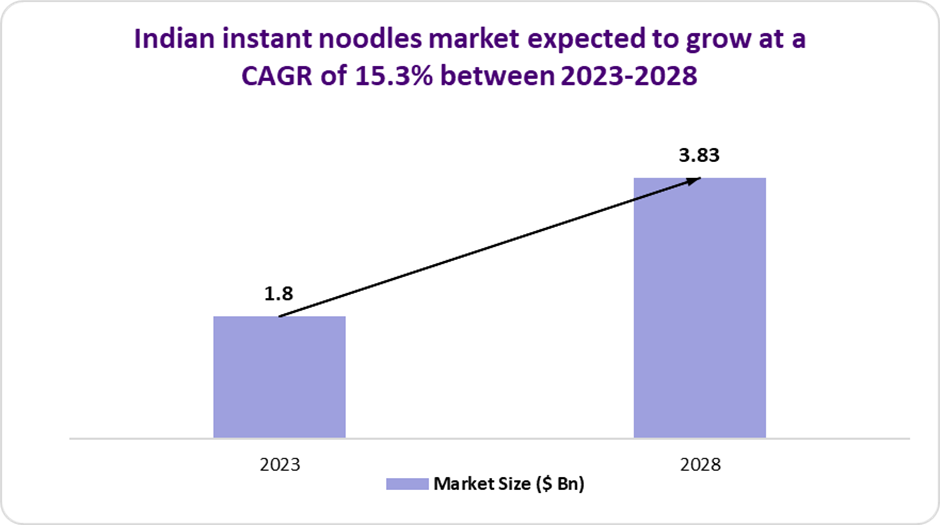

The instant noodles market is growing faster than a viral reel—set to jump from $1.8 billion in 2023 to $3.8 billion by 2028, with an annual growth rate of 15.3%.

Source: mordorintelligence

Nestlé Maggi and Sunfeast YiPPee! dominate the scene, holding over 80% of the market share. Wai Wai of CG Foods (a subsidiary of Nepal's Chaudhary Group) has the third largest market share followed by other notable players like Hindustan Unilever’s Knorr, Nissin’s Top Ramen, Capital Foods’ Ching’s Secret, and Patanjali’s Noodles.

Competitors on the rise

Maggi may still be the undisputed leader when it comes to taste and product loyalty, but the competition in India’s instant noodle market is heating up. Maggi’s price hikes from ₹10 to ₹14 have opened the door for local players to thrive, especially since it moved away from the popular ₹5 price point. At the same time, the arrival of trendy Korean noodles has dealt a double blow.

The battle for noodle supremacy is fierce, with brands like YiPPee!, Wai Wai, Top Ramen, Patanjali, and even Unilever’s Knorr entering the fray. YiPPee! is attracting younger consumers with playful flavors and its unique round noodle block, while Wai Wai appeals to urban college students with its ready-to-eat convenience. Then there’s the Korean invasion, with brands like Samyang and Nongshim spicing things up with their bold, fiery flavors. These brands have become the "new cool," riding the K-pop wave and drawing in millennials and Gen Z looking for an adventurous, spicy twist.

Also, it’s not just the big names in the game anymore. Local players like 123Noodles in Karnataka, TRDP Mario in Delhi, Anil in Chennai, Mr. Noodles in West Bengal, and Gippi noodles (by Balaji) in Gujarat and Maharashtra are emerging as strong regional contenders. These brands are gaining traction by catering to local tastes and price points, challenging national and international players.

Brand strategies to combat competition

| Maggi | Launched Oats noodles with millet magic for healthier options Launched Maggi teekha masala and Maggi chatpata masala noodles, priced affordably at ₹10, targeting rural markets Introduced Korean Noodles in Veg and Chicken Barbeque flavors Focus on strict quality controls and healthier ingredients to regain consumer trust |

|---|---|

| YiPPee! | Expanding market share, especially in North India where there is untapped potential Launched the Wow Masala noodles at ₹10, a spicier variant for flavor-seeking consumers Launched Korean noodles in 2 flavors Introduced millet-based noodles for healthier food options Differentiates itself with long, non-sticky noodles and added vegetables |

| Wai Wai | Launched region-specific flavors to cater to local preferences and expand its market presence- Fish-flavored for West Bengal, Jain noodles for Northern India, Akbare chicken noodles for East and North East India Reducing the salt content in its noodles by 10-25% to cater to health-conscious consumers The tentative IPO for its Indian arm is scheduled for Q1FY26. Planning a pre-listing fundraise in early 2025 to support the expansion of operations in India. |

Growing popularity of Korean noodles in India

Korean noodles are an exciting new trend in the country. According to NeilsenIQ, its sales in India skyrocketed from a mere ₹2 crore in 2021 to over ₹65 crore in 2023! Reflecting a 400% YoY growth. A lot of this buzz began during the COVID-19 lockdown when folks were stuck at home, binge-watching K-dramas and jamming to K-pop.

This surge in interest helped Korean food manufacturers tap into a new market which led to the import of Korean noodles increasing by 162%! The biggest hurdle for Korean noodles? The price! While your favorite masala noodles cost just ₹10 to ₹15 a pack, imported Korean options are priced between ₹100 and ₹150.

Despite that, Korean food makers have a golden opportunity to cater to adventurous eaters eager to explore new flavors. Imagine being the kid in class who brings a unique dish for lunch that everyone wants to try. Korean noodles are quickly becoming that dish in India!

Conclusion

Maggi is still the go-to name for instant noodles in India, but the competition is intensifying. Local players are also capitalizing on regional preferences and pricing strategies, further challenging Maggi’s dominance. While Maggi enjoys strong brand loyalty, staying ahead will require continuous innovation, particularly in flavors and affordability. The question now is whether Maggi can adapt fast enough or if the new wave of competitors will take a bigger bite of the market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story