Upstox Originals

India’s expanding share in global GDP: A closer look at PPP

6 min read | Updated on December 17, 2024, 22:53 IST

SUMMARY

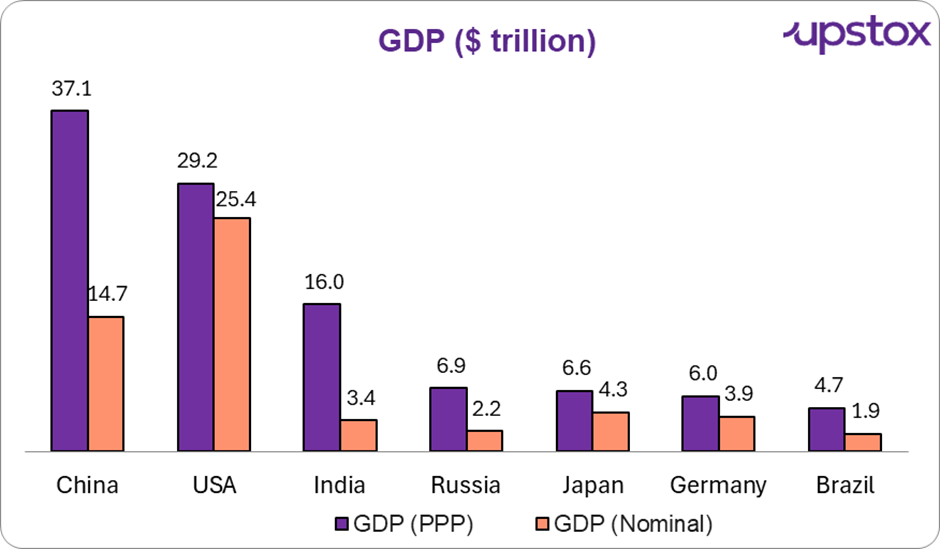

Did you know India is the third-largest economy by GDP in PPP terms? India’s contribution to global GDP (in PPP terms) is now almost 2.5x that of Germany. What exactly is PPP and how does it differ from conventional GDP? In this article, we delve into these concepts and explore the key factors behind India's impressive economic growth.

India is the third-largest economy from a PPP point of view

As per the International Monetary Fund (IMF), India is the third-largest economy globally when looked at from a PPP point of view. While GDP (PPP) isn't a new concept, it remains relatively unfamiliar to many. Conventionally GDP data that gets published or spoken about is nominal or real GDP.

So what do we mean by GDP (PPP)?

PPP stands for Purchasing Power Parity. It compares the cost of living in different regions by accounting for exchange rate differences.

For example - if a burger costs ₹100 in India and $20 in the USA, the PPP ratio works out at 5 (100/20). For every dollar in the USA, you need to spend ₹5 in India.

How is this calculated?

India’s nominal GDP in ₹ terms is about ~₹280 to ₹300 lakh crore.

-

Divided by the exchange rate of $1 = ₹85, you will get a nominal GDP of ~$3.4 trillion.

-

Divided by the PPP ratio of ~₹20 = you will get the PPP GDP of $14-16 trillion

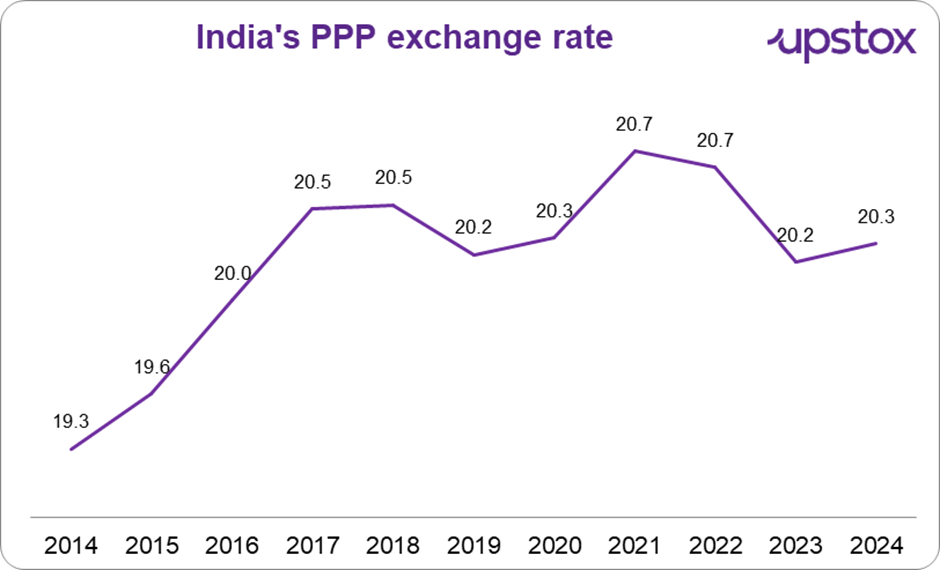

Since the dollar is the world’s reserve currency, PPP for all countries is typically calculated relative to the dollar. The chart below depicts the PPP ratio for India over the past decade.

Source: IMF

What this means is - that for every dollar, Inda needs to spend ~₹20.

Wait, then why do we have an exchange rate?

What is the exchange rate of ~₹85 (as of December 17, 2024), and why should you care about it?

So, here is the thing - in many ways PPP is a theoretical concept, working on the law of one price. It suggests that the same good or service should have the same price, regardless of the region it's sold in. This however excludes facets like:

- Difference in taxations;

- Transport and labour cost;

- Government interference (think: trade barriers, quotas, etc);

- Excessive consumer spending (can have a short-term impact on demand-supply); and

- Overall market sentiment.

As you might have guessed already, all of these have a bearing on an economy’s growth and therefore its overall exchange rate as well.

So, what is the PPP data saying?

As you can see from the chart below, India’s GDP (PPP) is far ahead of its GDP when calculated in nominal terms. Nominally, India is placed at the fifth rank, behind Germany and Japan.

But when looked at from the PPP point of view, India has a decisive third rank, far outpacing its next competitor.

Source: IMF

What is even more interesting, although not widely known is this - India has been the third largest economy from a PPP point of view for over a decade (even beyond this), as you can see from the table below.

What is however interesting and noteworthy is that except for India and China, none of the major economies have managed to expand their share for more than a decade now. For example, the USA’s share of the world was 17.2% in 2010 and has now fallen to ~15%.

Alternatively, India and China have increased their share from ~6.0% and 15.0% in 2014 and 8.2% and 19.1% respectively as of 2024. India now contributes nearly 2x of Russia (its next competitor)

GDP (PPP) of select countries - % share in the world

| 2014 | 2019 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| China | 15.0 | 17.5 | 18.4 | 18.7 | 19.1 |

| USA | 16.3 | 15.4 | 15.1 | 15.0 | 15.0 |

| India | 6.0 | 7.1 | 7.6 | 7.9 | 8.2 |

| Russia | 3.4 | 3.3 | 3.5 | 3.5 | 3.6 |

| Germany | 3.7 | 3.5 | 3.3 | 3.2 | 3.1 |

| Japan | 4.5 | 3.9 | 3.5 | 3.5 | 3.4 |

Source: IMF

Okay, so why have only 2 countries expanded their share in the PPP?

There are several factors behind this, and in this section, we’ll explore some of the key ones. For simplicity, we’ve chosen the United States as a benchmark and will compare India against it.

Increase in per capita income: When we look at the per capita income of the two countries, India’s per capita income has grown faster than that of the United States. As such, the purchasing power of Indians has also grown faster.

Per capita income - India versus USA

| 2014 | 2018 | 2023 | CAGR (%) | |

|---|---|---|---|---|

| India (in ₹) | 79,118 | 112,835 | 169,496 | 9% |

| USA (in $) | 55,304 | 63,201 | 81,695 | 4% |

Source: IMF, India’s NSO, Macrotrends, press releases

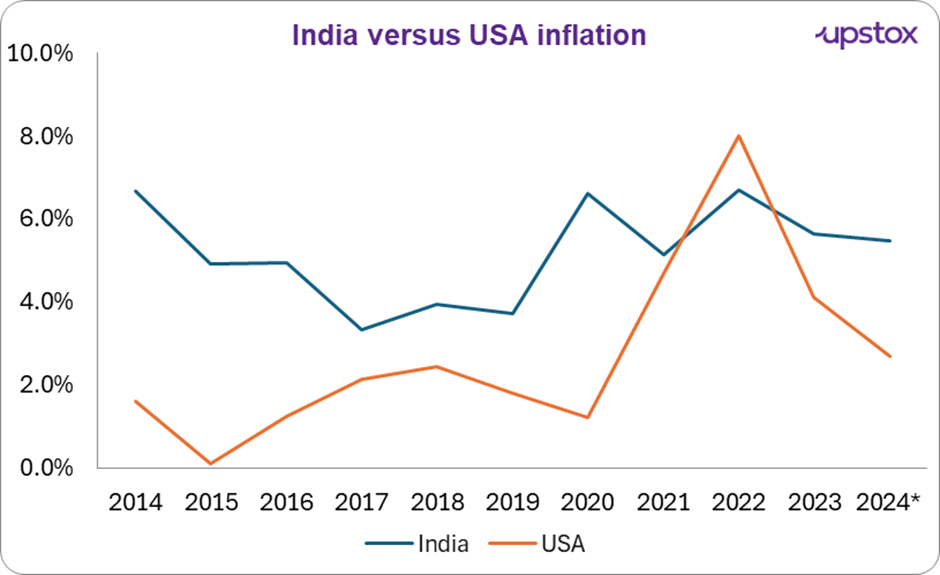

- Inflation: Inflation in India has largely been stable or reducing. Even during COVID-19, India was able to keep inflation growth under check, while it exploded in the United States. Favourable inflation coupled with stronger growth has once again given India an edge compared to its global peers.

Source: Macrotrends; *2024 - latest available data

-

Population edge: With a population of over 1.4 billion, India's vast consumer base contributes significantly to its economic output. Despite a lower per capita income compared to many countries, the volume and size of consumption can bolster the GDP (PPP).

-

Other measures: Focus on digitisation, increased financial inclusion and participation, technological advancements, growing manufacturing, and increased share in exports have all played a vital role in strengthening the Indian economy

These are just some key measures that have supported India’s growth.

This now leads us to the final question? What can dampen this trajectory?

The obvious answer is that any adverse change in the above factors can hurt India. Besides that, any major depreciation in the local currency (since PPP is calculated in USD terms) relative to its peers, could impact India’s global standing.

So, what does all this mean?

India has demonstrated impressive growth and this highlights India's potential as a key player on the global stage. Bolstered by strong fundamentals, India’s global economic influence has been rising and is expected to continue doing so in the near future.

That said, PPP is largely a theoretical concept - if you want to buy something in the USA for example- you still need to pay the nominal exchange rate of ~₹85. India also has multiple challenges - from equitable economic distribution to ensuring the demographic dividend is efficiently utilised. For now, India’s remarkable growth in PPP terms underscores its emerging role as a global economic powerhouse.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story