Upstox Originals

Is India’s emerging market weight shrinking? A deeper look

.png)

7 min read | Updated on March 07, 2025, 11:55 IST

SUMMARY

India's declining weight in the emerging markets index has sparked discussions among investors. However, does this signal a negative outlook from global funds, or is it merely a temporary correction? In this article, we analyse India's standing relative to its emerging market peers and examine fund allocations to the country. Additionally, we explore commentary from major funds to determine whether their long-term view on India has shifted.

Many global emerging market funds continue to remain overweight on India

Have you heard about India’s declining weight in the emerging markets index & funds but aren’t quite sure what that actually means? Or maybe you’re wondering what the emerging markets index is and why it even matters.

Don’t worry, we’ve got you covered! This article dives into everything about the emerging markets, how it influences market sentiment, and whether investors should pay attention to it or not.

What are emerging markets?

An emerging market economy is a country that's growing and starting to do more business with the world. These countries show signs of becoming more developed, like having strong economic growth. As they grow, they trade more and attract more investments. Examples include India, China, and Taiwan.

What are emerging market funds?

These investment funds put money into businesses in fast-growing countries. They can be mutual funds or ETFs, letting you invest in many companies at once instead of just one. Some focus on stocks, others on bonds, and they can be managed by experts or follow a market index. They’re popular because they mix high growth with a bit of safety by spreading the risk. These funds can be active or passive in nature.

Each of these funds have a benchmark index, for example the MSCI Emerging Market Index. Active funds attempt to outperform their respective benchmarks by allocating appropriate funds to the countries depending on their view. if they are bullish on a country, their allocation to that country will typically be higher than the benchmark. Also, called as being overweight. And if they are bearish - then vice versa. Also, called being underweight.

Lets look at what’s the buzz around India’s EM index weightage and where India stands when compared to other major emerging economies.

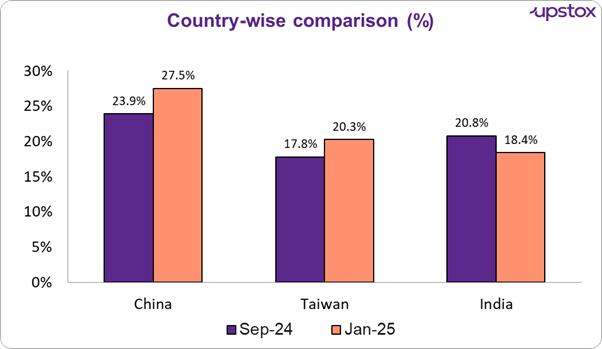

Source: Moneycontrol

Take a look at the chart—India’s weight has dropped, while China and Taiwan have gained ground since September 2024. But why? We’ll get to that in a moment. But first, let’s check out India’s weight trend in the EM Index and see what’s been happening for the past 2 years.

Declining India’s weight in the emerging markets index

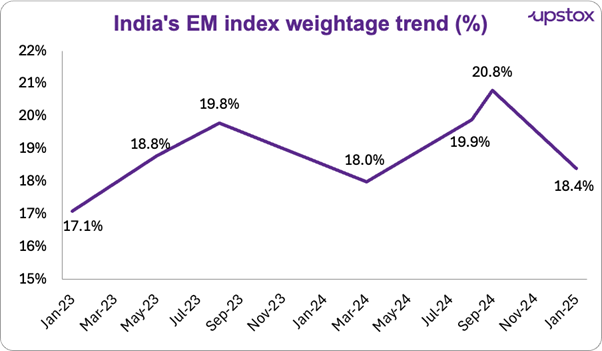

Source: Various News Portals

Back in September 2024, India made history by crossing the 20% mark in the EM Index for the first time ever! Not just that—it even knocked China off the top spot. But since then, India’s weight has been slipping and recently it slipped to third place, behind Taiwan as well. Let’s look at some of the major reasons for this change:

-

Market correction - India’s stock market recently saw a big drop, wiping out nearly $1 trillion in value. This lowered the overall size of Indian stocks in the index, reducing India’s weight.

-

China and Taiwan’s relative outperformance - While India’s market struggled, China and Taiwan’s stock markets performed relatively better. As a result, their weight in the index increased, pushing India down to third place.

-

Index rebalancing - Updates its index regularly based on market changes. As stocks rise and fall, country weightages shift to reflect new market conditions.

-

Selling pressure - Investors have been selling Indian stocks, especially big companies, due to global uncertainties and local market trends. This has further impacted India’s position in the index.

So, with all these shifts in the EM Index, how are emerging market funds reacting? Are they doubling down on India, or are they tilting more towards China? Time to see how these funds have placed India when compared to China in their portfolios.

Select actively managed emerging markets funds

| Fund | AUM ($ Mn) | India’s Weight (%) | India Benchmark (%) | China’s Weight (%) | China Benchmark (%) |

|---|---|---|---|---|---|

| GQC Partners Emerging Markets Equity | $2,404 | 31.3 | 19.2 | 9.5 | 24.6 |

| JP Morgan Emerging Markets IT | $1,360 | 21.6 | 18.4 | 17.0 | 24.7 |

| Invesco Global Emerging Markets | $833 | 8.4 | 18.4 | 23.7 | 27.6 |

| M&G Global Emerging Markets | $671 | 4.9 | 18.4 | 30.8 | 27.5 |

| PGIM Jennison Emerging Markets Equity Opportunities Fund | $641 | 28.8 | 18.4 | 22.5 | 27.5 |

| Aubrey Global Emerging Markets Opportunities Fund | $258 | 37.1 | 18.4 | 27.5 | 27.5 |

| VanEck Emerging Markets Fund | $396 | 16.8 | 19.7 | 25.3 | 25.0 |

| BNY Mellon Global Emerging Markets Fund | $395 | 25.4 | 19.4 | 23.8 | 26.6 |

| Franklin Templeton Emerging Markets Fund | $213 | 13.3 | 18.4 | 24.3 | 27.5 |

| Invesco Emerging Markets ex China | $219 | 13.7 | 27.0 | NA | NA |

Source: Fund factsheets

As can be seen above, half of the 10 emerging market funds shown above are overweight on India versus their respective benchmarks. In comparison, only two funds are overweight in China.

There are two ways to interpret this data.

The optimistic interpretation is that investors remain overweight on India as our structural story is intact. As such, their confidence in India’s long-term growth story remains unimpacted.

On a more pessimistic note, Indian markets could still see some more pain. If investors’ negative view of India persists, they could continue to sell Indian stocks and go overweight on other emerging market economies.

Which is the right answer? Unfortunately, it is difficult to say. However, the tax break announced in the budget, the recent repo rate cut, and signs of improvement in earnings all bode well for India. If this trend persists, India could once again see additional inflows.

Finally, we look at some opinions on the Indian market from some of the funds mentioned above. And understand if there is something fundamentally wrong or if it's just another correction phase and these funds are waiting for the storm to settle down.

Management commentary: Global funds’ view on India

-

Aubrey notes India’s market dip stabilising as oil prices and the strong US dollar reverse, with tax cuts for 35 million middle-income workers boosting consumption.

-

Despite short-term challenges, VanEck sees India’s long-term growth intact, driven by urban spending, ‘Make in India,’ green energy, and infrastructure expansion.

-

PGIM Jennison expects India to remain well positioned to capitalize on its growing middle class.

-

Franklin Templeton expects India to remain the fastest-growing major economy, with strong consumer sentiment and increased government spending driving growth.

Most global funds have a positive view of the Indian markets while acknowledging recent corrections. This suggests that despite current conditions, it might not be all gloom and despair.

In summary

While the overweight allocation to India is definitely positive at the moment, India will need to justify that positioning, especially in such challenging markets. Earnings improvement, strong growth, a streamlined inflation, signs of government spending, pick up in private capex are just some of the factors that these funds are likely to monitor as they decide on their next steps.

Beyond these, we are also competing with global peers to gain not just a mind share but also attract additional flows from these investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story