Upstox Originals

India’s economic pulse: Three wins and three worries in 2024

.png)

6 min read | Updated on December 14, 2024, 23:31 IST

SUMMARY

2024 is coming to a close - what would you list as the top 3 economic strengths and weaknesses of India? How has the Indian economy evolved in these past 12 months? Take this journey with us, as we we evaluate the three major factors that give us confidence and three factors that worry us (ever so slightly) about what the future holds.

Exploring the major economic developments of 2024

Some consider this a blessing and some a curse!

2024 started on a very shaky note. For those who don't remember, most pundits had predicted a US slowdown in 2024. This was supposed to have a sharp spill-over impact across the world.

Besides that, the US was going for elections and so was India, all of which created their own uncertainty. As the year comes to a draw - 2024 has certainly been an interesting year. The US economy remains robust, and Indian markets overcame the results of a surprising election outcome.

That said, all is not necessarily well. As the year ends, we note 3 macroeconomic factors that give us hope and confidence in this country's growing strength and 3 points that will still need more attention.

With that, let's dive in and assess some of the more positive developments of 2024.

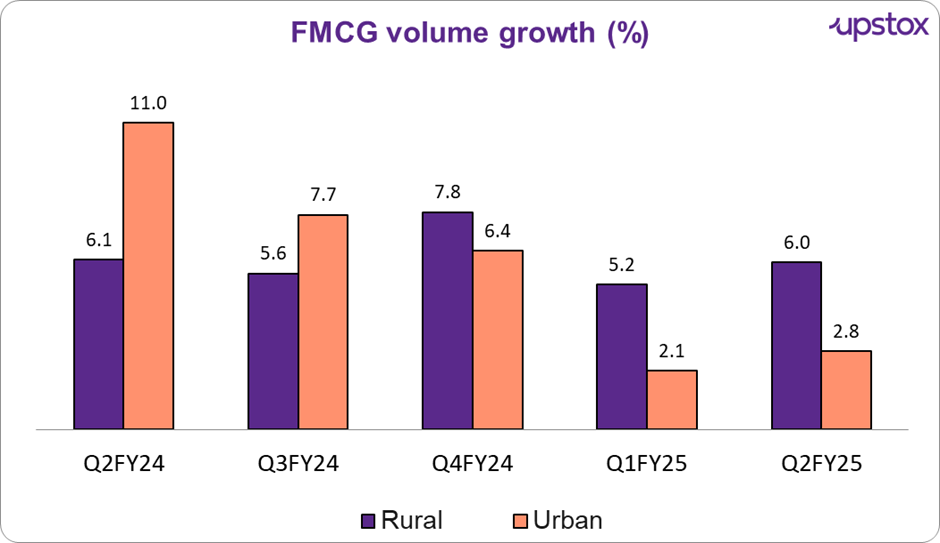

Resilient rural economy

Source: Nielsen; news articles

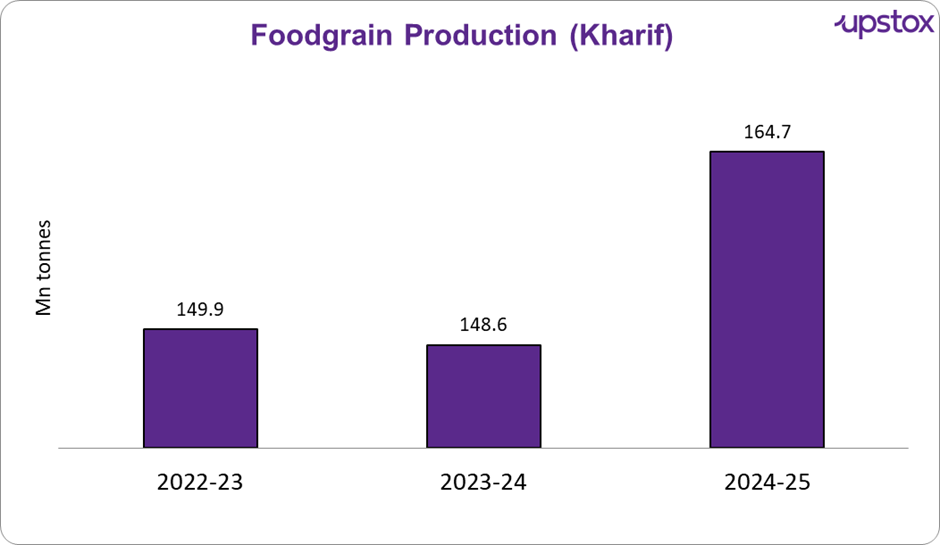

Moderating inflation, good rainfall, and strong crop production have been some of the key drivers of this trend. For instance, 2024 saw a record Kharif food grain production at ~164.7 million tonnes, a 10.9% increase year-on-year, fuelled by favourable monsoon conditions and MSP hikes.

Source: dea.gov.in, Note: 1st AE means First Advance Estimate

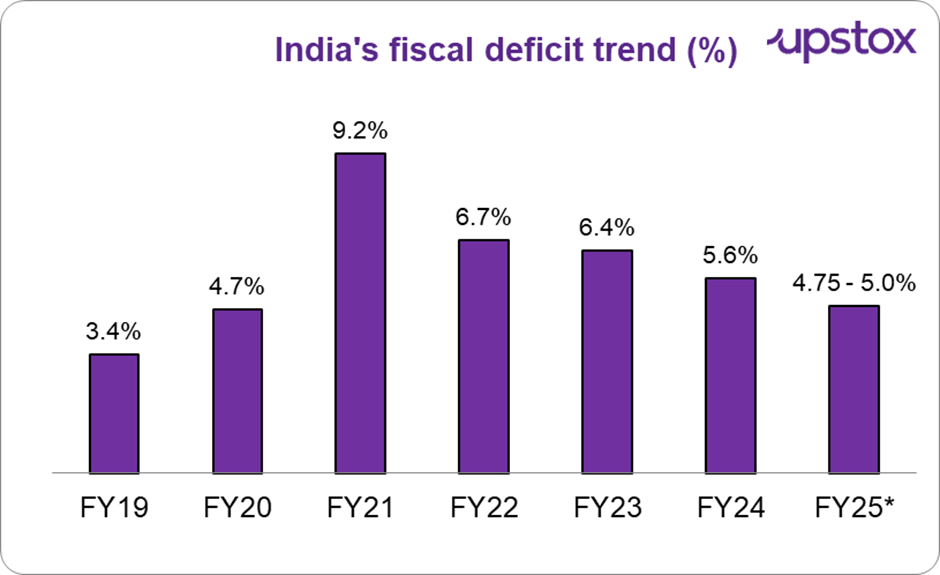

Reducing fiscal deficit

As can be seen from the chart below, India’s fiscal deficit has continued to narrow. Despite an election year, India has managed to keep spending under check-in 2024. The CII has set a target of 4.5-4.9% for this current fiscal year, and basis the latest estimates, the government could come close to achieving this target.

Source: Statista; *FY25 is a projection

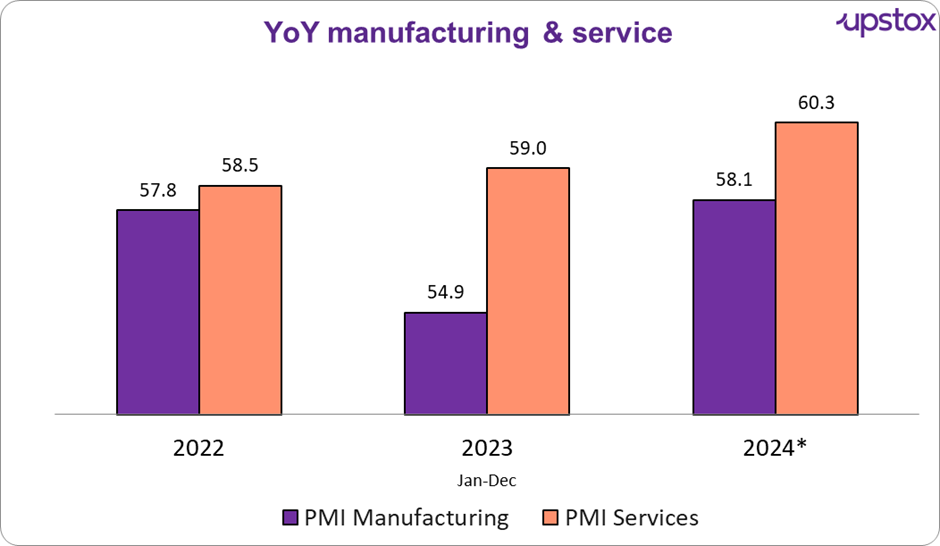

Strength in manufacturing and services

Manufacturing PMI has seen a strong bounce back thanks to an increased domestic and international order book. Service PMI also reached new highs, driven by strong consumer demand, underpinned by rising incomes and a growing middle class.

Source: dea.gov.in, Moneycontrol, Note: 2024* data is till August (latest available)

However, dear reader, you might have gauged from the introduction, this is not just about all that went well in 2024. The year has also seen some critical challenges that India must confront in the upcoming year. Let’s look at some of those.

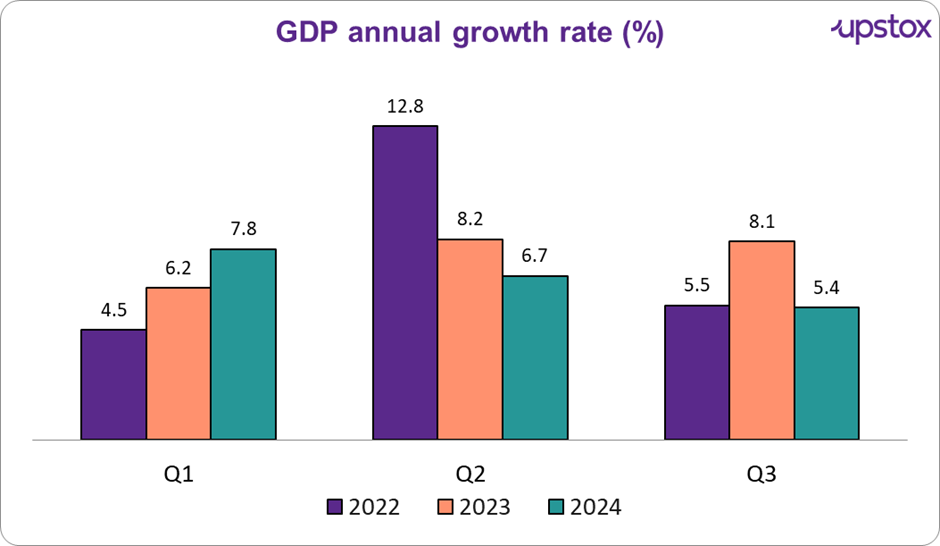

Slowing GDP growth rate

India's GDP growth has been steadily slowing in this calendar year.

Source: tradingeconomics.com

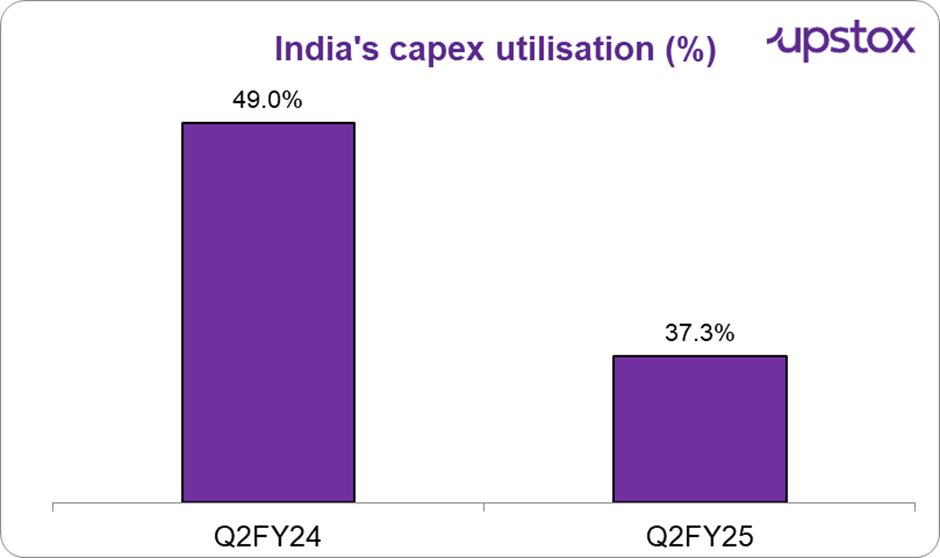

2024 being an election year, saw limited government capital expenditure, which has weighed on most industries across the country, impacting overall economic growth.

On a more positive note, with elections now firmly in hindsight, there are already signs of increasing capital expenditure. For instance, the government has announced a ₹9,000 crore push for battery makers and ₹4,000 crore electronic component manufacturing companies.

As such, while growth has disappointed last few quarters, all hope is not lost.

Source: Business Standard

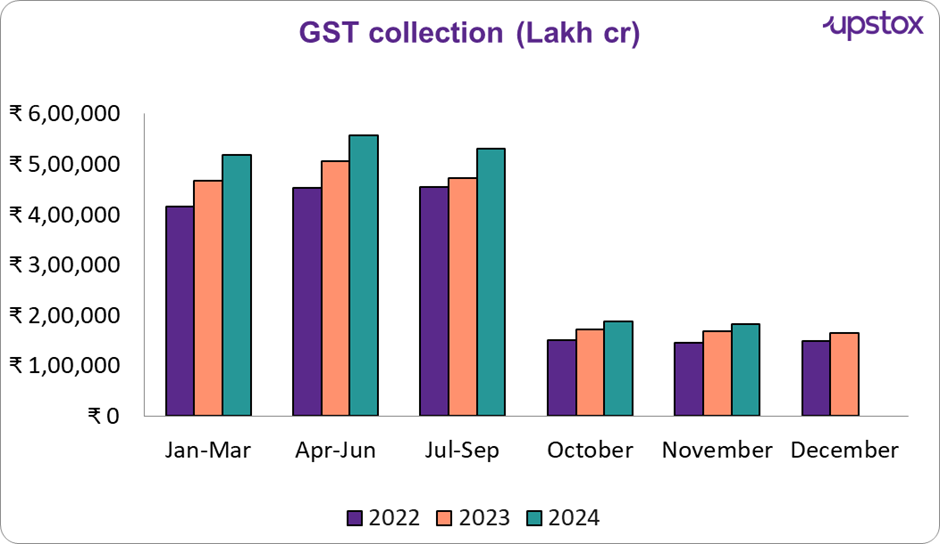

GST collections

Yes, on an absolute number basis, GST collections have been growing, and that is encouraging. But here are some things that worry us:

-

Growth in collections has been slowing down. In September 2024, the growth rate dipped to 6.5%, the slowest in 40 months It has since picked up, but we would like to see a sustained improvement

-

Since reaching an all-time high in April-May of this year, GST collections, even in absolute numbers have not managed to break that barrier. While India’s economy remains robust overall, this trend points to some signs of slowdown, which should be monitored.

Source: Gstcouncil; *Data for December has not been published yet

Last, but not least - we look at

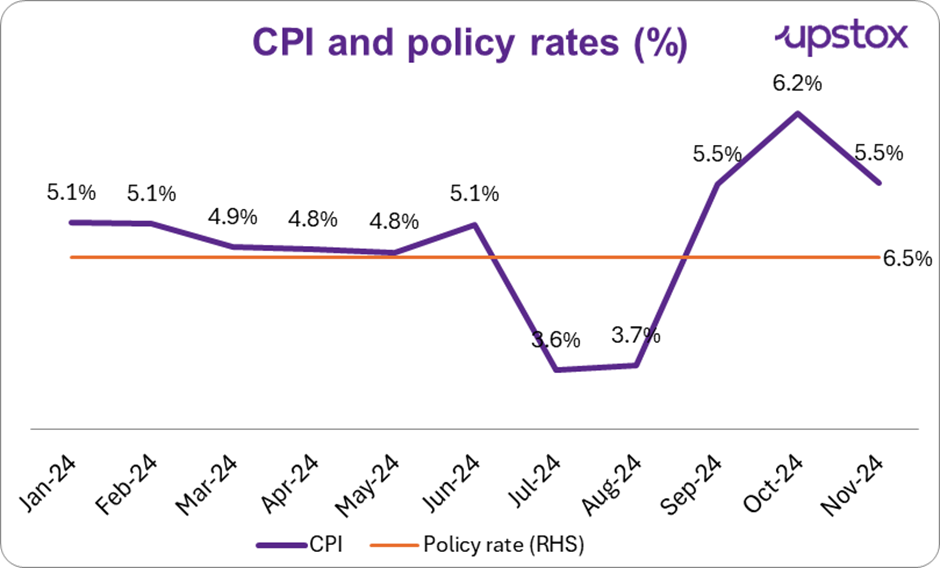

Rising inflation

2024 has been an eventful year on the inflation front as well. For most of the year, inflation has steadily been reducing - prompting most market experts to posit when the RBI finally cut rates to give growth a boost. However, rising inflation, led by food prices, and volatile oil prices have time and again given the RBI a pause in lowering rates. For the entire 2024, rates have been stable at 6.5%. As inflation once again rises beyond the RBI’s comfort zone, it remains to be seen when the RBI finally pulls the trigger on rates.

Source: MOPSI

Finally, we look at how the financial markets have performed

Financial markets

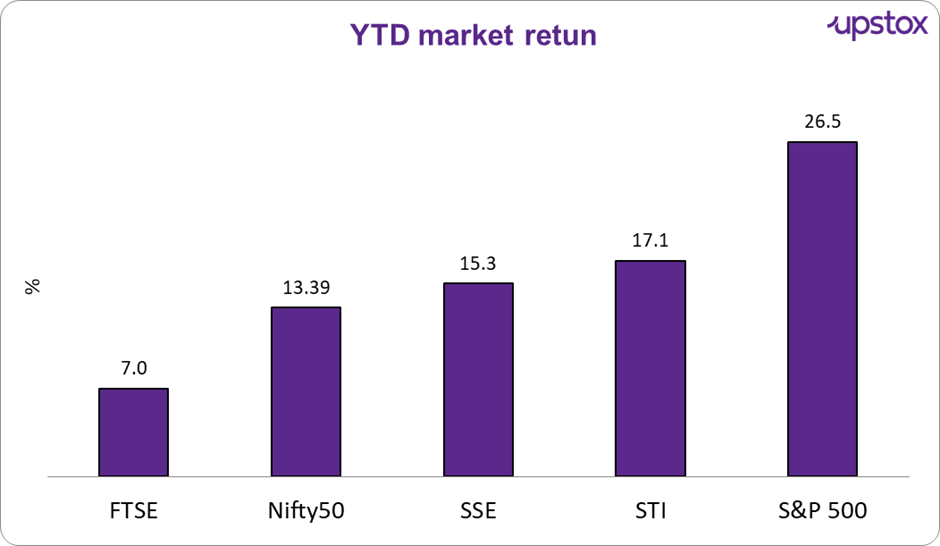

In our assessment, domestic financial markets have been adversely impacted by overtly high investor expectations. Despite the fluctuations, caused by the elections and budget, Nifty delivered decent performance, especially when compared to other global markets.

Macroeconomic factors have impacted the market performance as well. Earnings in Q2FY25 (quarter ending September 2024) were below expectations, which has caused concerns about future growth in the economy.

Besides this, the valuations of Indian companies are still frothy, which has seen strong FII outflows (among other reasons), which have further impacted the markets.

In contrast, economies like the USA and China, where most investors had expected 2024 to be a weak year, have outperformed.

Source: finance.yahoo.com, Note FTSE- European Index, SSE- China index, STI- Singapore Index Data as on 10-12-24

What does this mean for investors?

Just like any year, 2024 has seen its share of growth as well as some areas of concern. Our goal here is to present a picture of our economy as things stand today and let you, the investor decide what your next move should be.

After many years of robust growth, some consolidation is inevitable. Whether it happens in 2025 or some other time, is the key question an investor needs to currently answer. Over the long term, India’s growth story is still sound and should hopefully translate into meaningful returns for the markets. Short-term bumps however are also critical and investors should take note, before their next investment decision.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story