Upstox Originals

How the Indian government has saved ₹26,000 crore

.png)

5 min read | Updated on March 07, 2025, 17:35 IST

SUMMARY

The Indian government revolutionised its fund management system by replacing a fragmented, inefficient approach with the Treasury Single Account (TSA) and Single Nodal Agency (SNA) models. These reforms have improved transparency, reduced borrowing costs, and saved ₹26,000 crore in interest costs by ensuring funds are allocated just-in-time, preventing idle balances and misuse.

Reforms by the government have reduced borrowing costs and saved ₹26,000 crore in interest costs

Imagine if your salary got deposited in hundreds of different bank accounts, and you had no clue how much was where. Sounds like a nightmare, right? Well, for years, that’s exactly how government funds were managed—scattered across 18 lakh+ accounts, making tracking and spending a logistical mess.

To tackle these challenges, the government introduced the Treasury Single Account (TSA) and the Single Nodal Agency (SNA) Model. These systems have transformed fund management, ensuring better transparency, efficiency, and accountability.

Treasury Single Account (TSA)

Introduced in 2017-18, the Treasury Single Account (TSA) consolidates all government receipts and payments into a single account or linked accounts at the RBI, eliminating the need for multiple bank accounts.

Single Nodal Agency (SNA) Model

Introduced in 2021-22, the Single Nodal Agency (SNA) Model aimed at streamlining fund flow. Instead of funds getting stuck at multiple levels, a Single Nodal Agency in each state manages them through a dedicated bank account, ensuring real-time tracking, transparency, and efficiency.

Let’s understand the way government funds were managed, the challenges it caused before the new systems were introduced, and why the old system was in dire need of a revamp.

-

Fragmented government funds: Before TSA and SNA, public money was spread across 18 lakh+ accounts, making it a nightmare to track, leading to delays, inefficiencies, and potential misuse.

-

Idle funds sitting around: Large sums were released in bulk but sat unused for months, while the government kept borrowing at high interest rates instead of reallocating resources efficiently.

-

Lack of transparency and accountability: With no real-time tracking, funds passed through multiple layers, increasing the risk of mismanagement, diversion, and delays in reaching those who needed them.

-

Inefficient cash management: Ministries and states handled their finances separately, often overestimating needs and borrowing unnecessarily, leading to poor fiscal planning.

-

Complex fund flow mechanisms: Money moved through too many layers, causing delays in payments to vendors and beneficiaries, making the entire process frustratingly slow. These new systems have already saved the government a whopping ₹26,000 crores since 2017-18.

We understand what TSA and SNA are, but how do they actually work? Here’s how.

How does the TSA and SNA Model work?

The Treasury Single Account (TSA) and Single Nodal Agency (SNA) Model work together to ensure efficient, transparent, and real-time fund management at both central and state levels.

- TSA handles centralised funds for ministries to allocate funds for the state.

- Funds released in Just-in-Time (only when needed) model directly from RBI to avoid idle balances.

- Central Nodal Agencies (CNAs) and Sub-Agencies withdraw funds within pre-set limits.

- SNA manages state-level funds, with money in an SNA account bank.

- Agencies use Zero Balance Subsidiary Accounts (ZBSAs) to access funds only when needed.

- The entire system is integrated with the Public Financial Management System (PFMS) for real-time tracking and better oversight.

Sounds complicated? No worries, let's understand this with a simple analogy.

Think of TSA like a family’s central bank account—instead of keeping money scattered in multiple accounts, all funds stay in one place. When needed, just the right amount is transferred just-in-time, avoiding waste and unnecessary borrowing. Now, imagine you have relatives in different cities.

Rather than sending them lump sums that might sit idle, you assign one trusted person in each city (SNA) to manage funds efficiently. They get money only when required, ensuring better control, transparency, and zero wastage—exactly how TSA and

SNA streamline government finances.

Now that we know what TSA and SNA are and how they work, let’s get to the big question— what are the benefits of these new initiatives?

-

Centralised fund management – TSA consolidates all government cash into a single RBI account, eliminating fund fragmentation and improving oversight.

-

Just-in-Time fund release – Funds are disbursed only when needed, reducing idle balances and ensuring efficient utilisation.

-

Real-time transparency & tracking – The government integrated TSA and SNA models with the Public Financial Management System (PFMS) to enable live monitoring of fund flow, preventing misuse and delays. Think of PFMS as an accounting system for the government to track how public funds are flowing.

-

Lower borrowing costs – By minimising idle funds, the government borrows less, saving on interest payments. Simplified and accountable fund flow – SNA reduces CSS-related accounts from 15 lakh+ to 4,500, ensures zero-balance withdrawals, and requires states to use 75% of funds before receiving more.

Since its launch, TSA and SNA models have saved ₹15,000 crore and ₹11,000 crore, respectively in interest costs. That’s ₹1,875 crore saved every year from TSA since 2017-18 and ₹3,667 crore annually from SNA in just three years—just in interest payments.

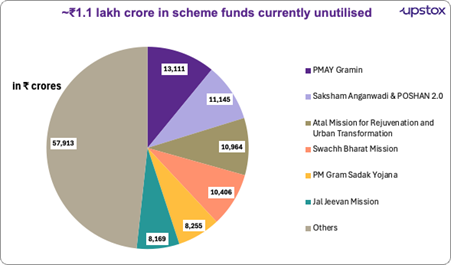

To put it in perspective, ₹26,000 crore in savings is 24% of the ₹1.1 lakh crore still sitting idle in SNA accounts and 4.8% of the annual budget for centrally sponsored schemes(2025-26). For reference, there is ₹1.1 lakh crore currently unutilised in

SNAs across various schemes.

Source: Union Budget 2025-26, ThePrint

These funds are currently in SNA which makes disbursement to the states more efficient, utilising the Just-in-Time model to ensure the states get funds as per their needs. Additionally, the SNA system makes it easier for the government to share interest earned on this amount between centre and states.

In summary

Now that we understand this initiative clearly, it makes sense why Finance Minister Nirmala Sitharaman called it the "UPI of governance," as it brings seamless and accountable fund management, much like UPI in digital payments. By reducing delays and improving oversight, these systems ensure that our funds are utilised effectively.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story