Upstox Originals

How Indian budgets are setting the stage for growth

6 min read | Updated on January 22, 2025, 07:11 IST

SUMMARY

A detailed analysis of the past Indian budgets points towards - 1) Rising developmental capital expenditure; 2) Focus on lowering fiscal deficit; 3) Reducing subsidy burden; and 4) A push toward research and development. In this article, we lay out the trend in key areas of government spending that will help India chart out the next decade of its growth.

Indian budgets have started to focus on capital expenditure and R&D, which should help the economy

Let’s be honest, when we think of the budget, we only think one thing: will they cut our taxes or not? It's the thing people wait for with bated breath.

But, the budget is a lot more than that. It is a document that lays out the vision for India and the roadmap for the future. It talks about critical aspects like growth, fiscal deficit, infrastructure development, and many more such things - which directly or indirectly have a direct impact on our lives.

When it comes to building a stronger economy, every rupee counts. There are multiple key announcements that investors focus on in a budget speech. Announcements regarding capital expenditure, fiscal deficit, tax collections, R&D investments are not mere discussions of fund outlay but are vital for economic growth.

India’s budgetary journey over the years reflects how deliberate changes in spending and priorities can reshape a nation’s economic landscape. In this article, we break down some critical aspects that any investor must consider.

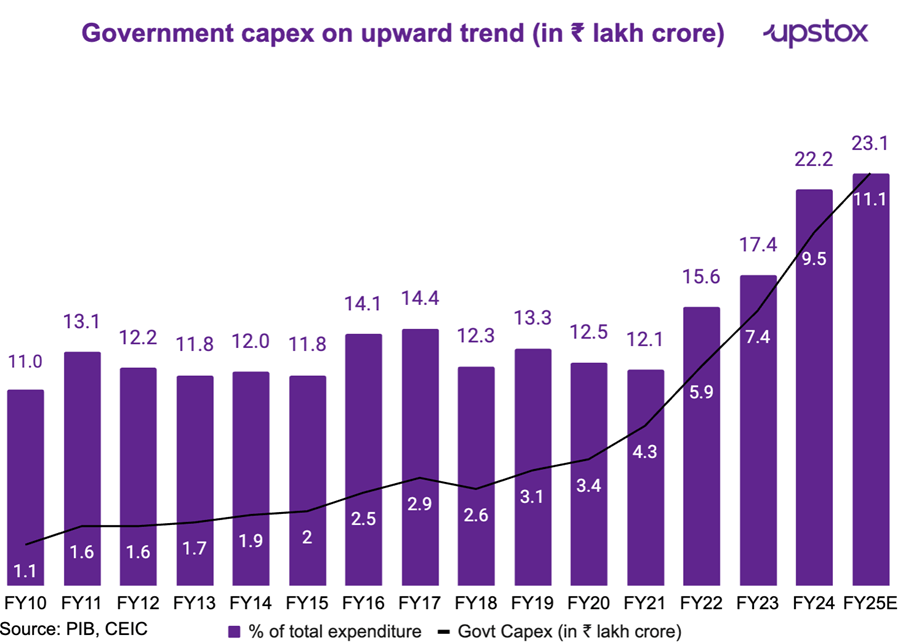

Investing for growth: Rising capex

The share of capital expenditure (Capex) in total spending has soared from 12% in the last decade to an impressive 22% by 2024. The major thrust areas of capex are into sectors like renewables, infrastructure, railways, roads, EVs, digital infrastructure, and electronics which are further supported by the private sector also through PLI Schemes and Make in India initiatives.

What does this mean?

Instead of focusing on immediate consumption, the government is channelling resources into long-term infrastructure and development projects. This not only strengthens the economy today but lays the groundwork for a more sustainable tomorrow.

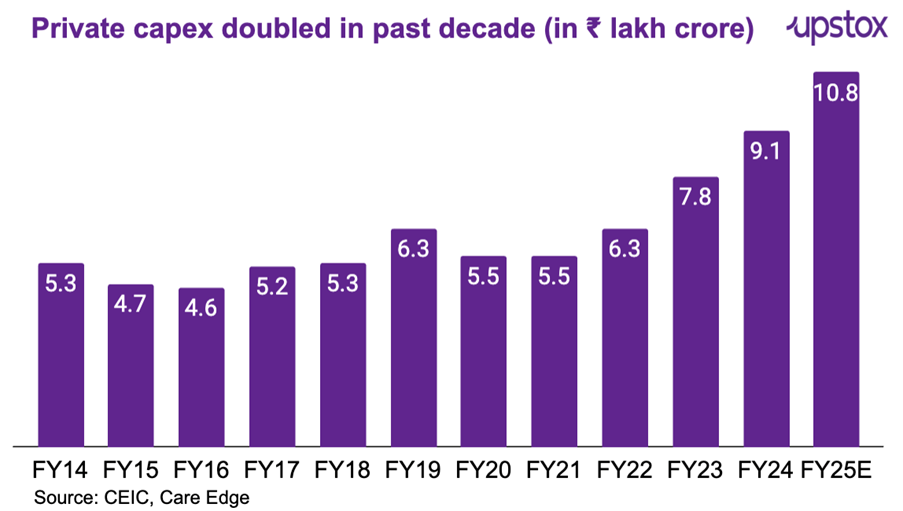

Government capex is also a critical driver for the capex plans of private companies since it helps build critical infrastructure like roads, dams, power lines, bridges, etc. This lowers bottlenecks for private companies and also creates a platform for their plans. As seen in the chart below, private capex has doubled from FY14 to FY24.

Fiscal discipline

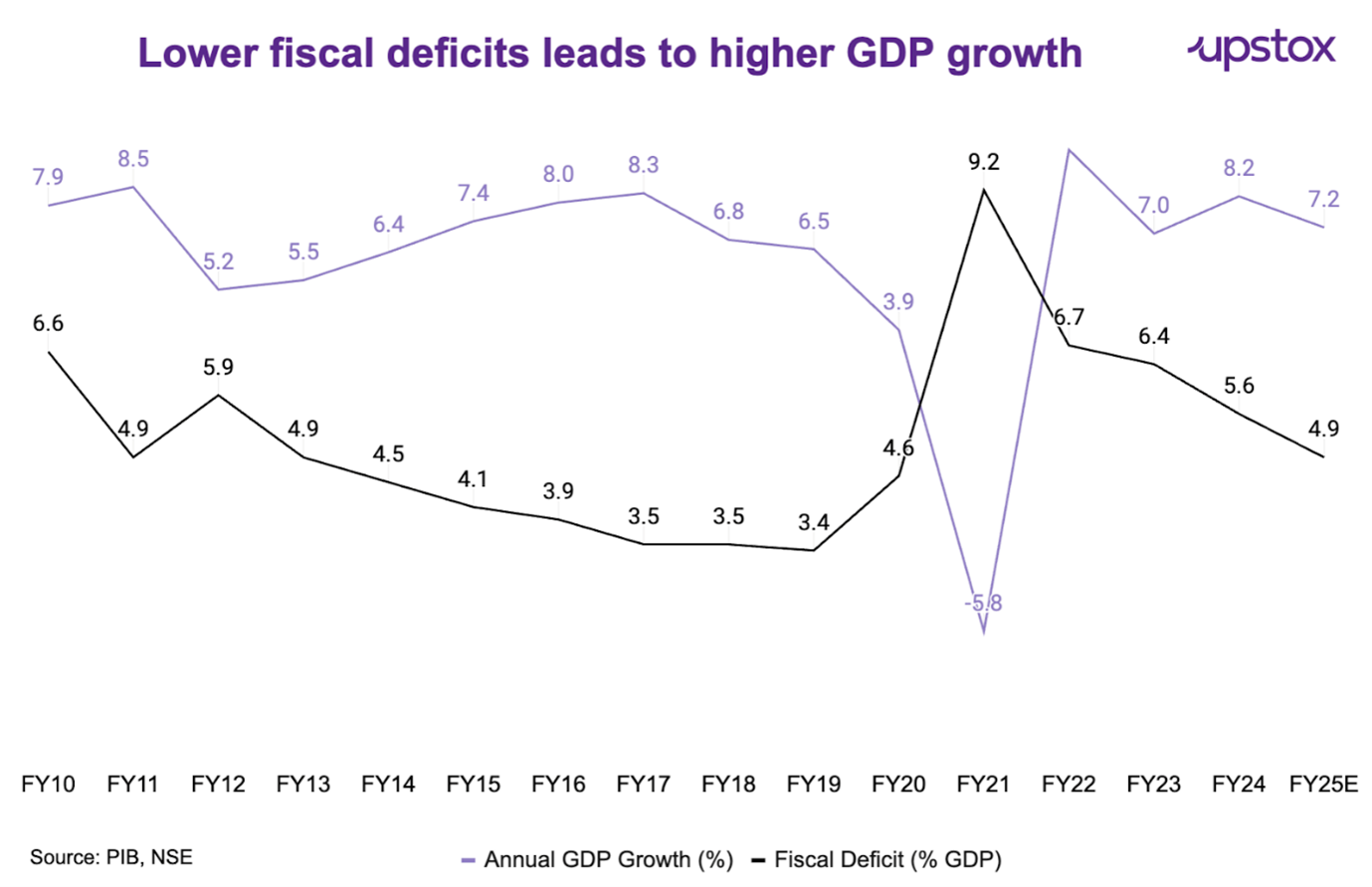

A fiscal deficit is a government’s loss, i.e., its total expenditures exceed its total revenue. So, a declining fiscal deficit strengthens the government’s financial position and, hence, the overall economy.

Remember the pandemic? Governments worldwide struggled to balance their books, and India was no exception. Yet, despite the unprecedented challenges, the fiscal deficit has been declining. This reflects prudent financial management and a commitment to restoring economic stability post-pandemic.

Interestingly, the budget, which sets out the government's revenue and expenditures, plays the primary role in deciding the fiscal deficit, which is inversely proportional to GDP growth. A lower fiscal deficit leads to higher GDP growth. A lower fiscal deficit also leads to lower interest rates.

Since the government can fund its expenses from its own revenue, it does not need to borrow money. Which lowers pressure on the debt markets and helps interest rates come down.

From subsidies to self-reliance

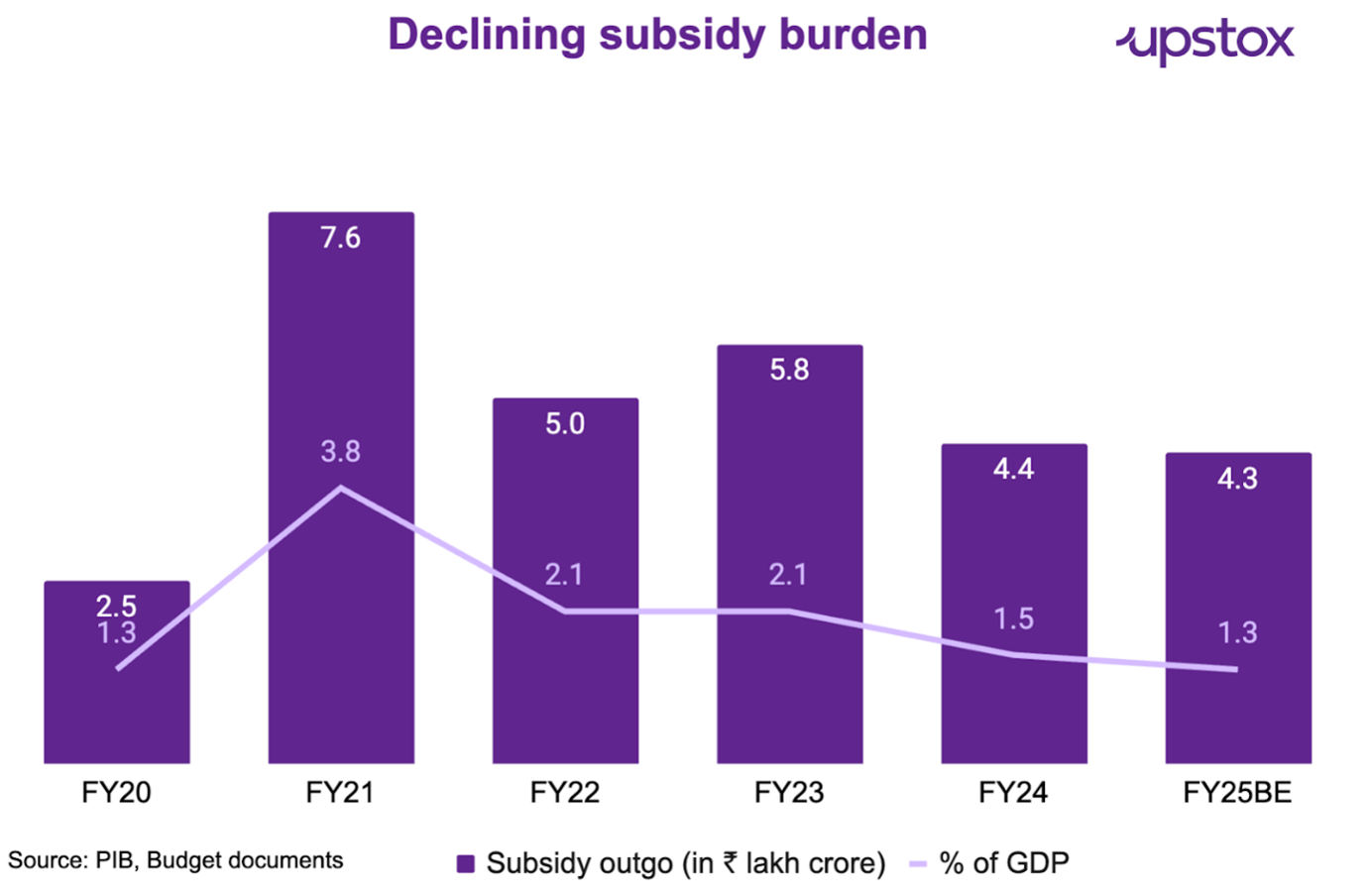

Another significant transformation is the decline in subsidies, which is at a five-year low. Interestingly, while subsidies play a critical role in supporting vulnerable populations, reducing their share of expenditure highlights a shift towards policies that encourage self-reliance and long-term growth, such as investments in education, healthcare, and infrastructure.

Through the lens of sustainable development, declining subsidies reduce economic burden on the government. It also means increased ability to spend towards future development schemes.

Encouraging innovation: Rising R&D

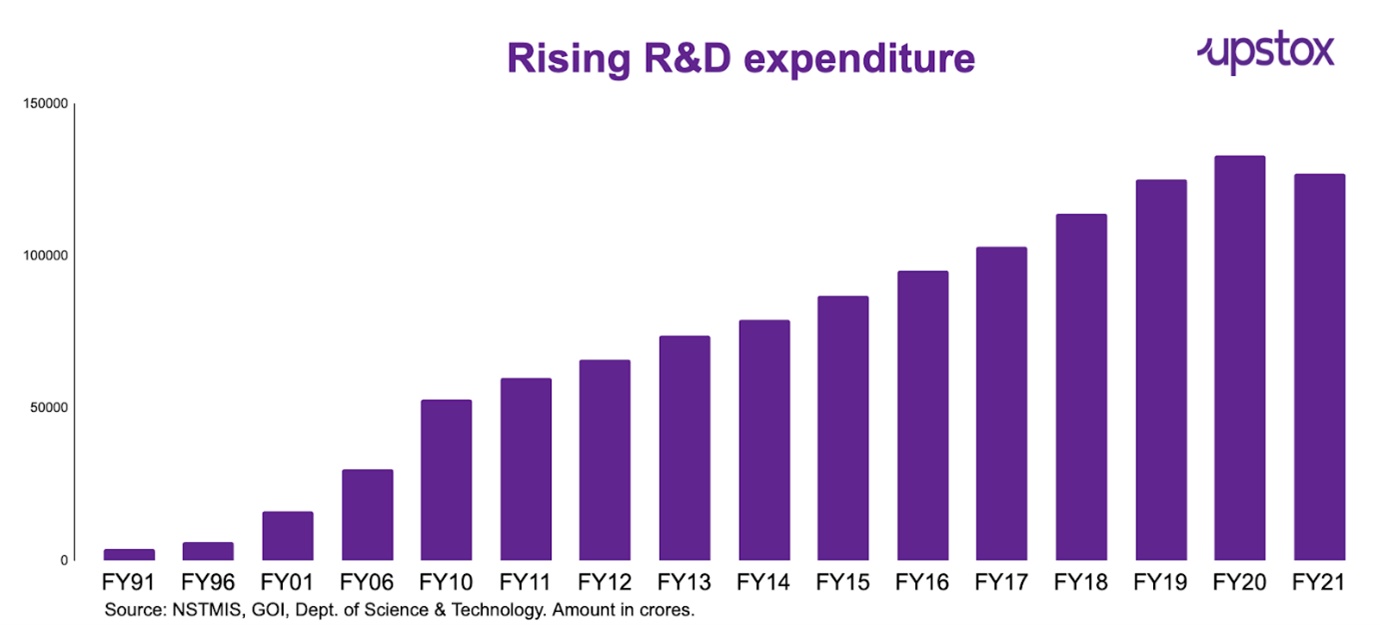

Innovation drives progress, and rising R&D expenses show that India is gearing up to be a global leader in technology and innovation. From AI to green energy solutions, these investments promise to propel the nation into a future of cutting-edge advancements.

Gross expenditure on R&D in India has consistently increased over the years and has more than doubled from the last decade (2011 to 2021) as per the latest information available.

The Union Budget 2024-25 strongly emphasised innovation, research, and development as key drivers of India's progress towards becoming a developed nation. These include the setting up of the Anusandhan National Research Foundation, substantial investments of ₹50,000 crore in private sector-driven research, expansion of the space economy, and advancements in agricultural and nuclear energy research.

In nearly a decade, India has made tremendous strides in the Global Innovation Index rankings, rising from the 81st position in 2015 to 39th in 2024. This steady climb reflects the country’s focused approach towards nurturing innovation across various sectors, driven by strong governmental support and a robust intellectual property framework.

Higher taxes lead to high revenue.

Another data strengthening India’s resilience is tax collection. India’s direct tax to GDP ratio at a decadal high along with absolute tax collection data also reveals all-time high tax collection (both direct and indirect)

| Fiscal Year | Tax-GDP Ratio (%) | Collection (₹ Cr) |

|---|---|---|

| 2014-15 | 5.5 | 6,95,792 |

| 2015-16 | 5.4 | 7,41,945 |

| 2016-17 | 5.5 | 8,49,713 |

| 2017-18 | 5.8 | 10,02,738 |

| 2018-19 | 6.0 | 11,37,718 |

| 2019-20 | 5.2 | 10,50,681 |

| 2020-21 | 4.7 | 9,47,176 |

| 2021-22 | 5.9 | 14,12,422 |

| 2022-23 | 6.1 | 16,63,686 |

| 2023-24 | 6.6 | 19,60,166 |

Source: PIB

Rising tax collection gives two positive signals - it strengthens the government's financial position giving them leeway to spend more for development.

Insights for Investors

As we explained in India’s Outlook 2025, rising capex along with declining fiscal deficit helps the government to build more sustainable development solutions. The early fruits of the government's sustainable strategy are evident from increasing tax collection (depicting higher income, and business volumes), while R&D spending on an uptrend helps India in innovating further.

About The Author

Next Story