Upstox Originals

How have markets responded to past corrections

.png)

5 min read | Updated on August 16, 2024, 12:20 IST

SUMMARY

For a long-term investor, an intermittent market correction offers a buying opportunity. While most people know this in theory, in practice it is difficult to buy when everyone around you is in panic. With this blog, we want to provide some insight - we analyse some of the biggest single-day falls over the past two decades and also the subsequent short and long-term recovery.

Market corrections can offer potential investment opportunities

If one were to plot the market movements of 2024, two days particularly stand out - the day of the general election results when the market corrected more than 5% (compared to the previous close) and the recent volatility caused by Japanese interest rate changes, that jolted the market close to 3%.

Each of these dips has largely been bought into.

This prompted us to look at some of the past falls and market performance 1 and 3 years post the fall.

Past falls and performance post

The table below showcases the most significant (more than 5%) one-day drops in the Nifty50, along with the subsequent returns one and three years later. For example, on March 23, 2020, the index plummeted by 13%, only to rebound by 95% within a year.

Top 10 market falls over the past 24 years

| # | Event | Day | Nifty50 level | % Change* | Returns post 1-year | Returns post 3-years |

|---|---|---|---|---|---|---|

| 1 | Covid pandemic | 23rd Mar 2020 | 7,610 | -13% | 95% | 124% |

| 2 | Election results in India | 17th May 2004 | 1,389 | -12% | 43% | 204% |

| 3 | Global financial crisis | 24th Oct 2008 | 2,584 | -12% | 93% | 97% |

| 4 | Global financial crisis | 21st Jan 2008 | 5,209 | -9% | -46% | 10% |

| 5 | Covid pandemic | 12th Mar 2020 | 9,590 | -8% | 57% | 79% |

| 6 | Election results in India | 14th May 2004 | 1,582 | -8% | 26% | 161% |

| 7 | Covid pandemic | 16th Mar 2020 | 9,197 | -8% | 62% | 85% |

| 8 | Dotcom bubble | 4th Apr 2000 | 1,428 | -7% | -20% | -29% |

| 9 | FII sell-off | 18th May 2006 | 3,389 | -7% | 24% | 28% |

| 10 | Global financial crisis | 11th Nov 2008 | 2,939 | -7% | 70% | 76% |

Source: NSE. Data is being considered for the period January 2000 to July 2024. *% change is calculated by comparing from the previous day closing.

Patterns and Insights

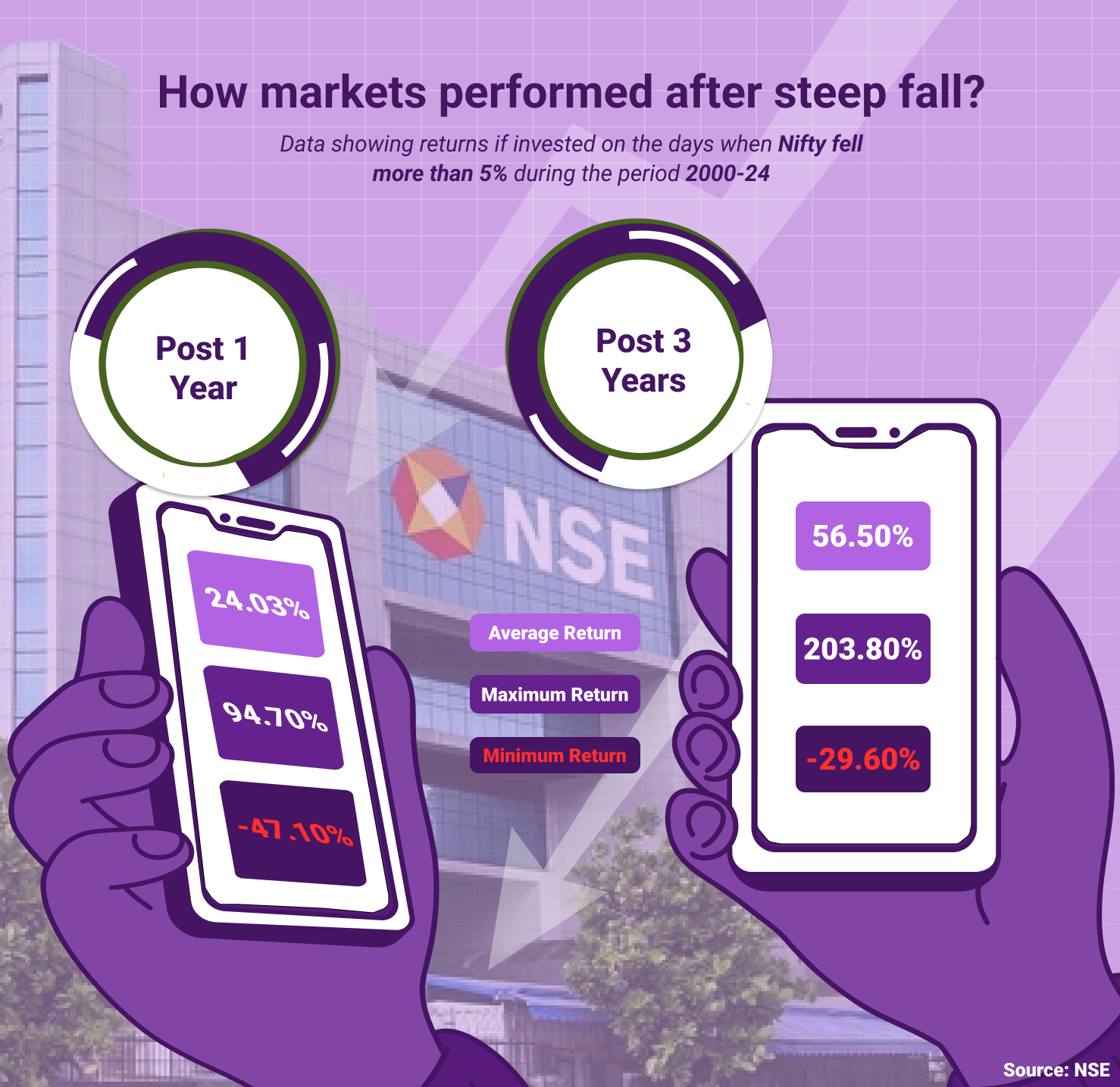

We have analysed the Nifty’s historical data and steep falls (of more than 5%), there are 31 such instances over the 24-year period of Jan 2000 - July 2024 (the table above lists only the top 10). How to read the table below? Only in 29% of instances returns were negative if invested for 1 year while the same probability goes down to just 9.7% during the 3-year time frame.

Return distribution post corrections

| Post 1 Year | Post 3 Year | |||

|---|---|---|---|---|

| Return Distribution % | No of Instances | % of time | No of Instances | % of time |

| Less Than 0 | 9 | 29.0 | 3 | 9.7 |

| 0-20 | 4 | 12.9 | 5 | 16.1 |

| 20-40 | 5 | 16.1 | 5 | 16.1 |

| 40-60 | 5 | 16.1 | 3 | 9.7 |

| 60-80 | 5 | 16.1 | 6 | 19.4 |

| 80-100 | 3 | 9.7 | 5 | 16.1 |

| More than 100 | 0 | 0.0 | 4 | 12.9 |

| Total | 31 | 100 | 31 | 100 |

Source: NSE, Investing.com

Key investor insights

Source: NSE

Source: NSE-

One year post a steep fall, the chances the market will rebound more than 20% is more than 70%.

-

Over a 3-year time period, the chance to earn more than 60% absolute returns is greater than 50%.

-

The average return one year after these drops is ~24% while it's ~56% in the case of a 3-year time frame. This trend suggests that while short-term losses can be daunting, the medium-term outlook offers comfort.

-

If an investor were to remain invested for 3 years, there is a less than 10% chance of realising a negative return after such a steep fall.

What does this mean for investors?

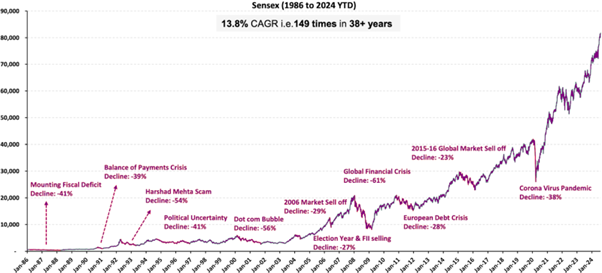

We once again reiterate the importance of long-term investing. Short-term hurdles could be a potential entry point for investors. A look at the chart below show indicates the number of obstacles markets have overcome in the past to reach these levels and the consequent returns that have been generated

Long-term Sensex trajectory

Source: NSE, FundsIndia. Data as of 31st July-24.

Source: NSE, FundsIndia. Data as of 31st July-24.Besides this, a few other takeaways:

-

Patience Pays Off: Historical data shows that markets tend to recover, often dramatically, within a year of significant drops.

-

Stay Informed: Keeping a historical perspective can help maintain calm during market downturns.

-

Diversification: Spreading investments can help mitigate risks during volatile periods.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story