Upstox Originals

Global economy in 2024: Back on track and gearing up for 2025

.png)

7 min read | Updated on December 17, 2024, 21:17 IST

SUMMARY

In 2024, the global economy showcased its resilience with emerging markets leading the charge. Global trade rebounded, inflation started to ease and central banks have started to shrink their balance sheets. 2024 has made all the right noises and set the stage for a strong 2025. In this article, we encapsulate all of these economic developments and also look at some of fastest fastest-growing global industries.

The global economy showed resilience in 2024, setting stage for a strong 2025

“Time moves slowly but passes quickly.” – Alice Walker

Can you believe it? 2024 is already wrapping up, and we are already staring down the exciting unknown of 2025! Time’s flying, but before leaping into 2025, let’s rewind the clock and dive into the major global economic highlights that made 2024 a year to remember!

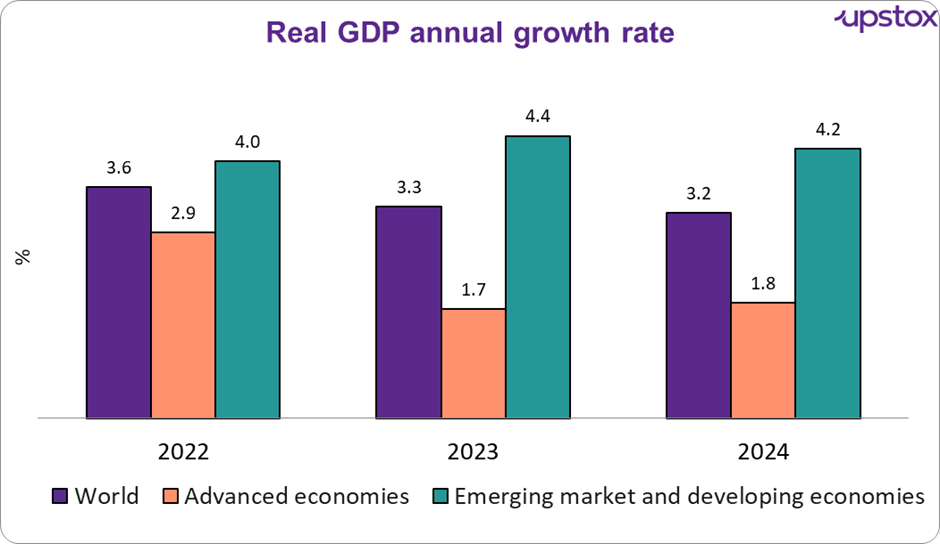

Real GDP growth

2024 continued to be the year where emerging markets have led the charge for global growth. After the unusually high growth rates in 2021, due to the low base and COVID-19 rebound, the growth rates across advanced and emerging economies have settled back around their pre-COVID levels, which were 1.9% and 3.7% respectively.

To a certain extent growth in advanced economies was impacted by tight monetary policies. Another key monitorable for investors will be the fact that real GDP growth has been shrinking in advanced economies despite falling inflation levels.

Source: imf.org, Note: Advanced economies mean Euro area (all major European countries), Major advanced economies (G7) (USA, Canada, Japan), and other advanced economies (Australia, Sweden, Norway).

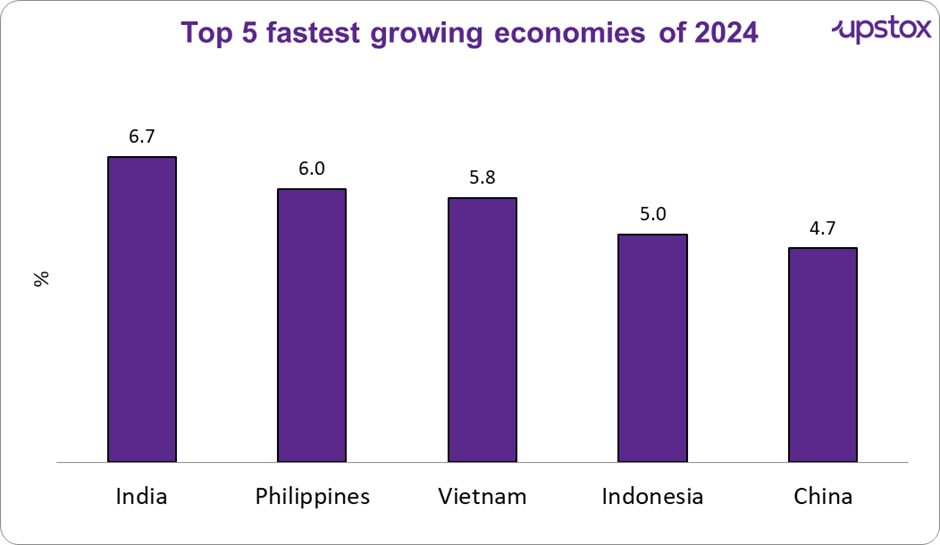

Emerging economies have fared a bit better than their pre-COVID levels especially, India which is leading the pack with a GDP growth of ~7% in 2024, the fastest among emerging economies.

Source: Euromonitor International macro model

Let's take a look at why these economies are growing so fast.

-

India: Growth is driven by the expanding middle class and technological advancements. Besides this, a pick-up in public and private spending is further expected to augment economic momentum. However, challenges such as job creation, food security, and climate risks remain.

-

Philippines: Growth is fuelled by public investments, improved exports, growing tourism, and an overall strong demand environment. Key challenges that remain are - high interest rates and any major global headwinds.

-

Vietnam: Growth is driven by booming foreign direct investment, especially in manufacturing. Its expanding tech sector makes it a favoured investment destination, although its export reliance makes it vulnerable to external shocks.

-

Indonesia: Growth is supported by domestic consumption and infrastructure investments. Rising global electronics demand and improving travel flows further bolster its exports, while governance reforms are anticipated under new leadership.

-

China: Despite challenges like property market issues and subdued consumption, China continues to be a major growth driver with improved industrial output, exports, and government spending. Long-term risks include demographic shifts, government interference, and economic decoupling.

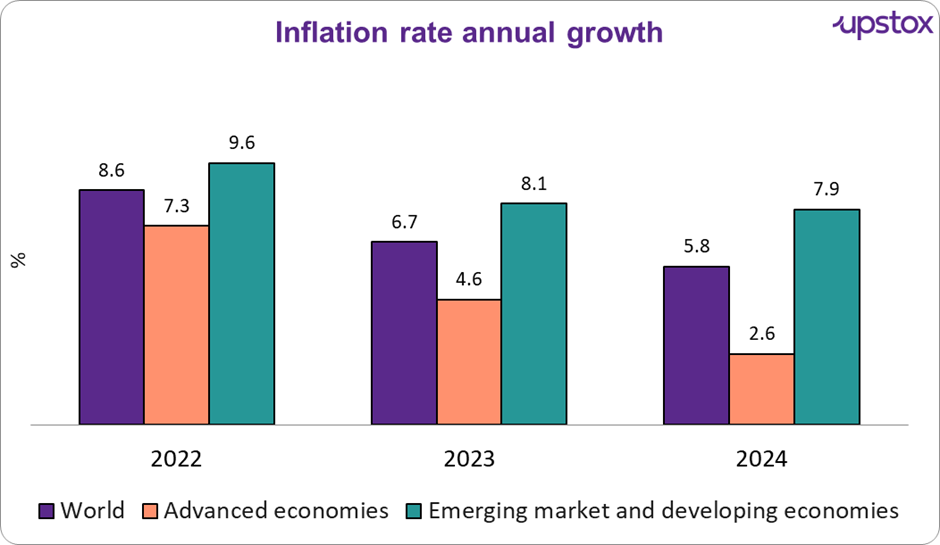

Inflation trends

As highlighted above, inflation has been reducing across the world. The inflation rate has improved compared to 2022, which experienced a surge in inflation driven by oil prices, global demand, supply chain disruptions, and interest rate shocks. According to the IMF as these conditions normalise inflation is expected to further ease in 2025. Ideally, this should translate into further rate cuts across the world and bolster growth.

Source: imf.org

The 5 global fastest-growing industries

| Industry | Revenue growth | Commentary |

|---|---|---|

| Military shipbuilding & submarines | 12.2% | Increased military spending: Rising geopolitical tensions, have boosted spending reaching $84.9 billion. Technological advancements: Consistent global technological advancements have made countries such as China and USA key players in this sector |

| Tourism | 11.6% | Emerging trends: The rise of "bleisure" (business + leisure) trips and increasing internet accessibility have created new demand. Regional growth: Strong growth in Asia Pacific, the Middle East, Africa, and Latin America drives the industry's recovery due to pent-up demand, better air connectivity, and relaxed visa rules. |

| Cardboard box & container manufacturing | 8.2% | E-commerce: The rise in e-commerce has led to increased consumer spending. Sustainability trends: The demand for sustainable packaging solutions gives cardboard an edge over plastic and foam. |

| Airport operation | 8.1% | Post-pandemic recovery: The resumption of air travel continues to drive revenue growth. Market dynamics: With low internal competition and airlines being the primary customers, the industry benefits from stable revenue streams. |

| Global military aircraft & aerospace Manufacturing | 7.4% | The industry is booming thanks to its growing use beyond defence—think climate monitoring, disaster response, and scientific research. Advanced technologies like drones, AI, and satellite systems are driving demand even further. Lightweight materials, 3D printing, and hybrid engines are revolutionising production. |

Source: ibisworld

Global trade outlook

Global merchandise trade rebounded in the first half of 2024, with a 2.3% YoY increase. This upward trend is expected to continue for the rest of the year and into 2025. The WTO now forecasts world merchandise trade volume to increase by 2.7% in 2024 and 3.2% in 2025. This rebound comes after a slump in 2023, which was caused by high inflation and rising interest rates.

Source: WTO, Note: Figures for 2024* and 2025* are projections

Easing inflationary pressure has allowed central banks in advanced economies to start cutting interest rates. This should stimulate consumption, boost investment and support a gradual recovery of global trade. However, there are still some significant downside risks to the forecast, including regional conflicts, geopolitical tensions, and policy uncertainty.

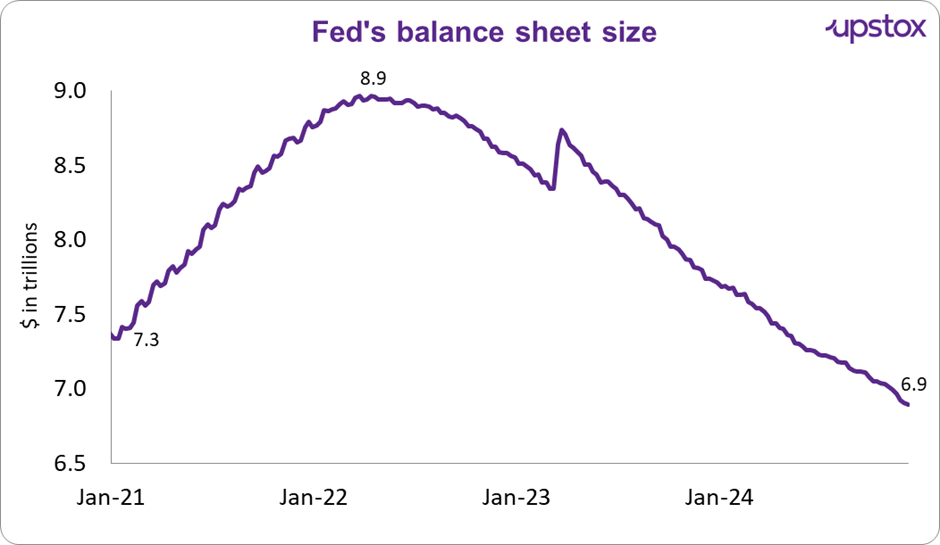

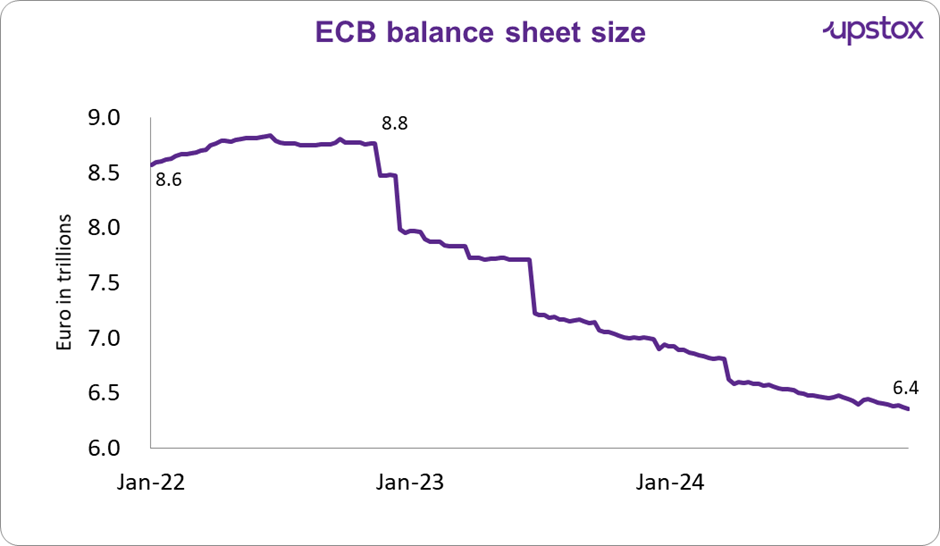

US and Europe balance sheet

As we show in the two charts below, the US Fed and European Central Bank (ECB) have both continued to tighten their belts. The balance sheets of most global central banks had widened post-COVID, as central banks attempted to support government spending and as well as economic growth. n The Fed has shrunk its balance sheet from $8.9 trillion to $6.9 trillion (2022 to 2024), by halting reinvestments of maturing securities.

-

Market impact: Long-term bond yields rose, making borrowing costlier, and impacting growth as highlighted above.

-

Economic constraints: Elevated rates cooled housing demand and consumer spending.

Source: federalreserve.gov, Note data as of 10-12-24

The ECB, under the Asset Purchase Programme (APP) has contracted its balance sheet by more than €2 trillion.

Source: fred.stlouisfed.org, Note: data as on 06-12-24

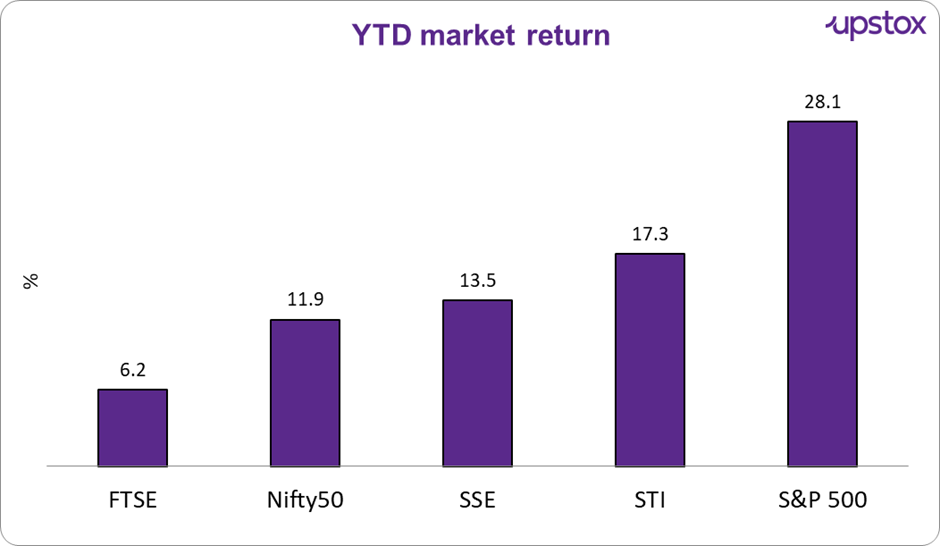

How have global markets performed?

Finally, we look at how these global measures have impacted some major countries across the world.

Source: finance.yahoo.com, Note FTSE- United Kingdom's Index, SSE- China index, STI- Singapore Index Data as on 17-12-24

-

US: Most readers might not remember, but 2024 was supposed to be a dire year for US. Most economists and market experts expected a recession this year. Not only did the US not go into a recession, but it has seen a year of sold economic growth which has translated into robust market performance.

-

Singapore: Singapore's solid economic fundamentals and rising dividends in its financial and industrial sectors make it a safe haven in global volatility, expected to drive equity market growth amidst ongoing uncertainty.

-

China: Chinese government stimulus and regulatory reforms aimed at boosting growth, foreign investment, and by extension even their financial markets.

-

India: Just like this article, in India’s economic pulse, we highlighted some major economic achievements for the Indian economy. These include a resilient rural economy, reduced fiscal deficit, and growth in manufacturing and services PMI. On the other hand, the recent weakness in GDP growth, compared with volatile inflation are cause of concern.

-

UK: The market has lagged behind other global markets for several reasons. The Bank of England made two rate cuts in 2024, which fell short of market expectations. Additionally, the UK market has a lower weighting in the technology sector, which has seen huge gains worldwide.

So, what are we trying to say?

The global economy proved its adaptability, with emerging markets blazing trails and advanced economies navigating challenges. Industries capitalised on post-pandemic shifts, inflation showed signs of cooling, and global trade gained momentum—signalling a cautiously optimistic future.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story