Upstox Originals

Gamify your investments: Evaluating opportunities in India's gaming sector

.png)

3 min read | Updated on June 23, 2024, 13:46 IST

SUMMARY

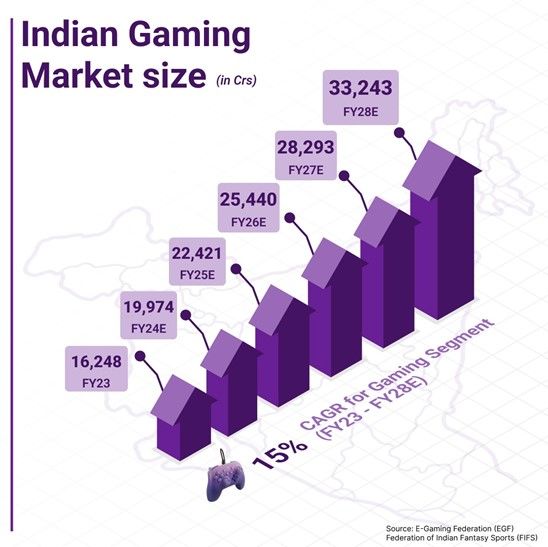

The Indian gaming industry is projected to grow at 15% CAGR during FY23-FY28. As one of the most underpenetrated gaming markets, India offers a massive opportunity, but it will have to overcome regulatory hurdles.

Stock list

The Indian gaming industry is projected to grow at 15% CAGR during FY23-FY28.

India's online gaming market grew 28% annually from 2020 to 2023. It was worth 16,428 crore rupees in 2023 and is predicted to reach ₹33,243 crore by 2028, growing 15% per year.

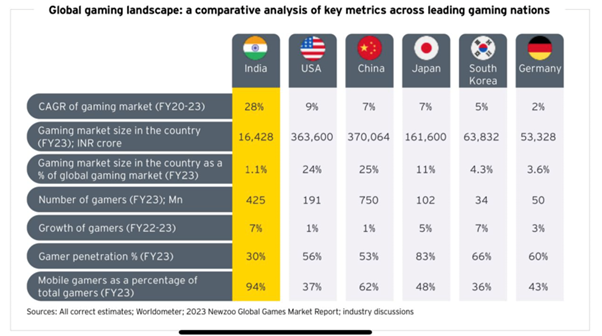

Indian gaming industry is still under-penetrated

As seen in the image below, the Indian gaming industry remains widely under-penetrated compared to global peers. This comparison is made even stark when we consider the following points:

- Almost 65% of India’s population is aged under 35 years.

- Smartphone and internet penetration remains below 40% and around 55% respectively.

- As 5G penetration increases, gaming will receive a further boost.

Growth drivers

-

Increased user engagement: By FY23, India had 42.5 crore online gamers, the second highest globally. This was due to more people turning to online gaming for entertainment during the pandemic.

-

Introduction of new gaming genres: The introduction of new gaming genres and interactive gaming experiences attracted a larger number of users.

-

Increasing investment: The gaming industry attracted ₹22,931 crore of investments from both domestic and foreign investors further fueling growth

-

Rise in e-sports: E-sports, a gaming category that organises online gaming tournaments grew by 25.7% CAGR growth between 2018 to 2023 to reach $1.2 bn market size. This growth is driven by the increasing number of tournaments and the rise in sponsorships.

-

Rise in new technology: New technologies like augmented reality and virtual reality are expected to transform the gaming experience by offering more immersive and interactive gameplay.

-

Government Push: The government launched the Digital Gaming Research Initiative with focus on R&D and development of the gaming industry, including programmes to upskill and empower youth towards gaming.

Challenges

-

Implementation of GST: In July 2023, the Indian government increased GST to 28% from 18% on online gaming, negatively affecting margins for most gaming companies since additional GST has to be borne by gaming companies.

-

Implementation of TDS: Gaming companies must deduct 30% TDS from the users' net winnings, which further slowed down the gaming industry's growth.

Key players and their financial and performance metrics

The key listed players in the gaming industry include Nazara Technologies, Delta Corp, and OnMobile.

The operating margins of these companies were adversely affected in FY24 due to the implementation of GST and TDS. Regulatory pressures have caused fluctuations and declines in the revenues of these gaming companies, and their share returns have similarly decreased year over year.

| Revenue | Stock price return | Operating margins | |||

|---|---|---|---|---|---|

| Key players | 3-year CAGR | 3-year CAGR | FY22 | FY23 | FY24 |

| Nazara | 35.8% | -6.3% | 14.0% | 9.0% | 9.0% |

| Delta Corp | 30.2% | -14.7% | 23.0% | 36.0% | 32.0% |

| OnMobile | -2.4% | -16.9% | 9.0% | 3.0% | 4.0% |

Source: Screener

Insight for investors

The gaming industry presents a unique opportunity for investors to bet on a fast growing industry in India which is still emerging. The shift of passion to the profession of gaming is a big trend that will see its benefits in the coming years.

The lack of clarity on regulatory aspects, high GST and high valuations of listed companies are key risks. Investors should consider the potential risks and growth triggers while investing in the gaming industry.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story