Upstox Originals

From street snacks to the billion-dollar empire, the journey of Haldiram's

.png)

5 min read | Updated on August 31, 2024, 10:46 IST

SUMMARY

This is one of the largest companies in the Indian snack industry - with revenues higher than even Pepsico. Can you guess? Here is one more hint - What do you sprinkle on a plate of warm poha to add that perfect crunch? For many across India, the answer is simple: Haldiram's bhujia. In this article, we chronicle Haldiram’s journey, and its product innovations that transformed it into one of India’s largest players in the sweets, and snacks segment.

From street snacks to the billion-dollar empire, the journey of Haldiram's

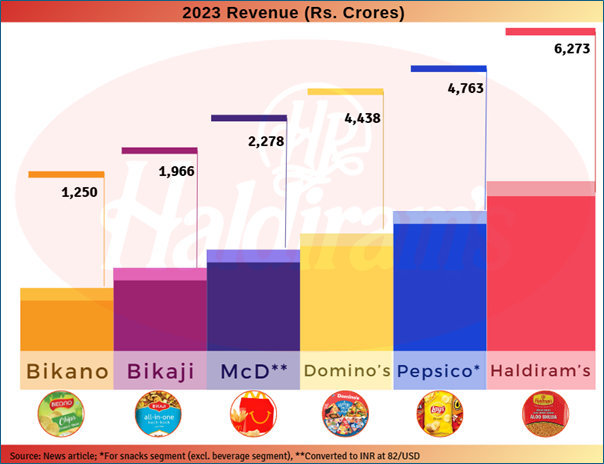

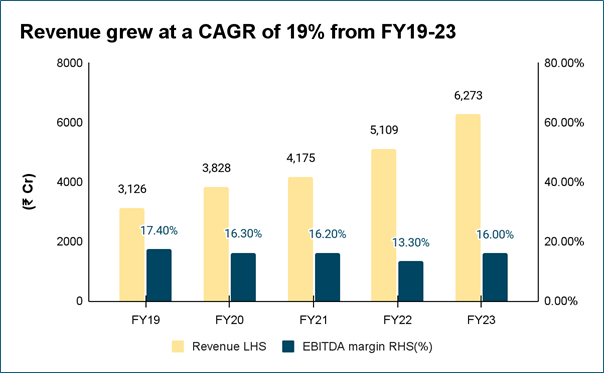

In the bustling world of Indian snacks, one name stands out: Haldiram's. With sales surging 19% to ₹6,273 crore, it commands a ~21% market share in the snack food industry.

What will come as a surprise to many, Haldiram's has surpassed most of its competition in terms of revenues. This not only includes players like Bikaji (with whom it shares familial ties and both businesses originated in Rajasthan) but also global giants like Pepsico.

Source: News articles, Ace Equity

Let's dive into the flavorful journey of this homegrown giant.

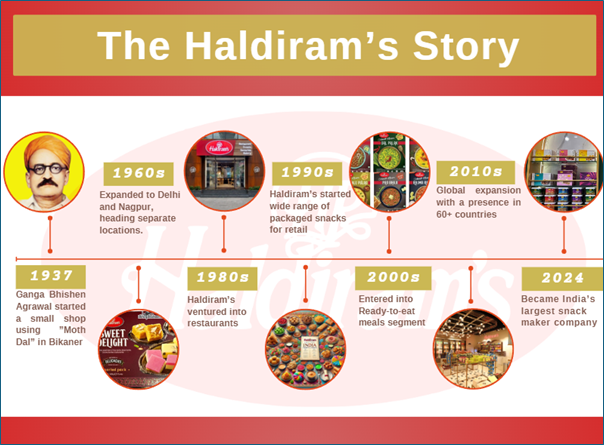

Source: News articles

How Haldiram’s crafted a global food empire

To understand the rise of Haldiram’s, we need to understand its strategic moves.

-

Diversification and premiumisation: The story began in Bikaner with a small shop owned by Mr. Ganga Bhishen, fondly called as Haldiram. To differentiate his product, he reinvented bhujias, and named it after the popular Maharaja of Bikaner, Dunger Singh. This “Dunger Sev” branding enabled him to sell it at a premium price of 5 paise per kg when competitors charged only 2 paise. The strategy proved to be a major hit.

-

Product innovation: By the 1960s, Haldiram’s had stores in Bikaner, Nagpur, Kolkata and Delhi. The Chandni Chowk shop in Delhi was particularly successful. In Nagpur, where bhujias were not widely popular, Haldiram’s introduced the new iconic Kaju Katli. Recognizing the demand for innovative bhujias, Haldiram's expanded its product portfolio encompassing over 410 items, including sweets, snacks, ready-to-eat meals, frozen foods, and beverages.

-

Global expansion: Never content with domestic success, Haldiram’s ventured into international markets. Today, the brand has a presence in over 60 countries, including major markets like the UK, Thailand, Australia, UAE, and Japan, Haldiram’s has established itself as a global food brand.

-

Packaging innovation: The story doesn't end here, anticipating future competition, Haldiram’s modernized its packaging. So, the introduction of Zip-pouch bags, nitrogen packaging, and small packs with ₹5, ₹10, and ₹20 helped the brand penetrate markets across India. Today, Haldiram’s products are available in more than 7 million outlets, supported by a strong retail network with over 250 outlets across the country.

-

Ready-to-eat products: To further expand its reach, Haldiram’s ventured into several sub-brands such as Minute Khanna, Cup Shup, and Cookie Heaven, capturing various segments of the snack food business. Brands like Minute Khaana specifically target the frozen food market. Haldiram’s commitment to quality and understanding of market dynamics transformed it from a local shop to a global sensation.

Now, let’s look at Haldiram’s financial performance

Source: Ace Equity

The billion-dollar question: Acquisition or IPO?

Potential buyers reportedly eyeing Haldiram’s include Tata, Blackstone and Bain Capital

But, why does everyone want to acquire Haldiram’s?

The potential answer is the large valuation and strong presence of Haldiram in the roots of India in India’s snacking market.

| Potential buyers | Bid | Latest update |

|---|---|---|

| Blackstone | $8.0 - 8.5 bn | In negotiations |

| Bain & Co. and Temasek | $8.0 - 8.5 bn | Submitted non-binding offer |

| Tata | $10.0 bn | In negotiations |

Source: News articles; Note: Haldiram’s is seeking a valuation of $10 bn

The company has raised its financial projections from $10 to $12 billion, reflecting a positive growth forecast. However, negotiations have hit a snag. As a result, Haldiram’s is now exploring multiple strategic options, including a potential IPO and a merger.

One significant consideration is the internal merger between Haldiram’s Snacks and Haldiram’s Foods, which could streamline operations and present a unified brand to the market. This internal consolidation could enhance their appeal to both potential buyers and public investors.

In parallel, the company is in the early stages of considering an IPO, weighing the benefits of going public against the offers from potential buyers. While no formal steps have been taken, Haldiram’s has engaged with financial advisors to evaluate the IPO process.

This indicates that while acquisition offers are still on the table, the company is seriously considering other strategies like an IPO or a merger, including the internal consolidation of its business units, to meet its valuation expectations.

Conclusion

Haldiram's journey of becoming a global food giant is a testament to its customer-centric approach, unwavering commitment to quality, and strategic innovation.

-

Innovation is Key: Haldiram's success lies in its ability to continually adapt and innovate its products to meet evolving consumer preferences.

-

Resilience in Family Business: Haldiram's journey underscores that family businesses can thrive through resilience and collective effort, adapting to challenges while maintaining core values.

-

Embrace Change: Even as an established brand, Haldiram's has demonstrated a willingness to embrace change and adapt to market trends.

-

Strategic Pricing: The company's pricing strategy has been instrumental in its success. By positioning itself as a premium brand while also offering affordable options, Haldiram's has appealed to a wide range of consumers.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story