Upstox Originals

From pixels to powerhouse: The Nvidia journey

.png)

5 min read | Updated on July 08, 2024, 20:24 IST

SUMMARY

This stock has delivered a CAGR of 77% over the past decade. Its market cap is around $3 tn, making it one of the most valuable companies globally. Nvidia is a leader in the technology industry and currently commands about 80% market share in the AI processing space. Let's take a look at its journey from a GPU maker to the leader in AI solutions.

Nvidia is the largest manufacturer of AI chips

Since June 2019, Nvidia stock has generated more than 3,200% returns, while AMD and Intel have returned 418% and -34%, respectively. Its product innovations have propelled it to market leader status, which is reflected in its financial and market performance.

Source: S&P Cap IQ

What has led to this performance?

As a pioneer of the Graphics Processing Unit (GPU) in 1999, the company has long been known for its innovations.

The GPU’s modern-day avatars remain some of the most relevant products in the world of tech, critical in areas such as gaming, data centres and cloud computing. This demand was further bolstered during the lockdown as the shift to remote work and consequent demand for data centres that could enable cloud-based computing along with even more interest in video games while everyone was locked indoors.

While the company was already a market leader in these industries, the rise of AI and Nvidia’s role in advancing this technology has caught the eyes of investors globally.

With the rise of AI, Nvidia's GPUs have become indispensable in AI research and applications, cementing the company's position as a technological leader. Nvidia's unveiling of cutting-edge devices such as the A100 Tensor Core GPU highlighted the company's important role in advancing AI. These advancements helped Nvidia gain a mammoth 80% market share in AI processing (March 2024).

Nvidia’s key innovations over the years

The table below lists some of the key innovations that have helped Nvidia retain its technological edge.

| Year | Product / Technology | Key use |

|---|---|---|

| 2026 | Expected launch of Rubin chips | Include new GPU and CPU as well as networking chips. |

| 2024 | 'Blackwell' range of chips | Allows organizations to build and run real-time generative AI with 25% less cost and energy consumption savings |

| 2022 | Omniverse platform | Metaverse |

| 2018 | NVIDIA RTX | First GPU capable of real-time ray tracing (reinvented computer graphics) |

| 2016 | Pascal architecture | GeForce 10 series (GPU series used in sectors such as gaming, data centres and cryptocurrency mining) |

| 2012 | AlexNet neural network | Critical to the development of modern AI |

| 2006 | Compute Unified Device Architecture (API) | Accelerated general-purpose processing |

| 1999 | GPU | Gaming |

Source: Nvidia Website, Business Standard, Reuters

Acquisitions

The company paired its own organic growth with about 17 strategic acquisitions. Some of its key acquisitions are listed below:

| Year | Target name | Value? | Rationale |

|---|---|---|---|

| 2023 | OmniML | NA | Technology to miniaturise machine learning applications, such as large language models - critical to AI |

| 2019 | Mellanox solution | $6.9 bn | Expanding data centre capabilities and offering networking solutions required for high-performance computing |

| 2006 | Hybrid Graphics | NA | Boost Nvidia's mobile and embedded graphics ambitions. |

| 2003 | MediaQ | $70 mn | Allowing for expansion into mobile graphics and wireless devices |

| 2002 | 3dfx Interactive | $70 mn and 1 mn shares | Stronger position in the game business by providing important IP and inventory |

Source: Media articles, company disclosures

Jensen Huang's role in transforming Nvidia

Jensen Huang, Nvidia's co-founder and CEO, has played a key role in the company's climb to prominence in the technology industry. He co-founded Nvidia in 1993 with Curtis Priem and Chris Malachowsky, with the initial focus on GPUs for the gaming sector.

He is credited with the ability to foresee industry trends and capitalise on emerging technologies. He has been a cornerstone of Nvidia’s continued success and was instrumental in expanding Nvidia’s product offering beyond gaming to include professional visualisation, data centres, and artificial intelligence (AI). He also sought acquisitions that added to Nvidia’s inventory of capabilities.

Financial performance

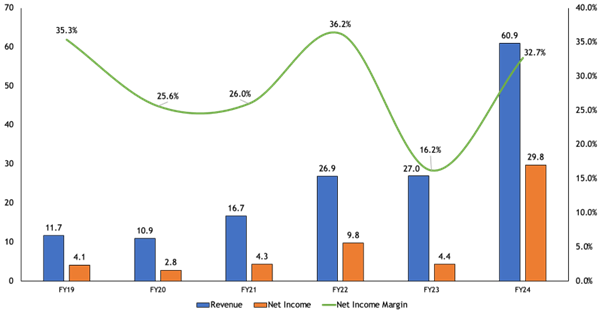

Nvidia's revenue has increased from $11.7 bn in FY19 to $60.9 bn in FY24 (39% CAGR). Their profitability increased from $4.2 bn in FY19 to $29.8 bn (48% CAGR).

Source: Company reports

What does this mean for investors?

Indian investors might do well to read into the business they invest more deeply to identify companies that continually invest in innovation and focus on maintaining market leadership in the industries they cater to. What are some key business learnings from Nvidia for investors?

- Continuously looking for opportunities beyond existing business verticals

- Commitment to innovation is a key moat, helping it stay ahead of competition

- The management’s ability to foresee industry trends has helped it adapt to the changing business landscape

Finally, for all investors out there, Nvidia is another success story of long-term investing. Remaining invested in a company that demonstrates the qualities mentioned above can help create significant wealth over the long term!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story