Upstox Originals

From mines to markets: What drove commodities in 2024

.png)

9 min read | Updated on December 30, 2024, 17:03 IST

SUMMARY

In 2024 commodities did not just keep up with equities, but some of them even stole the show! Gold and silver have delivered more than 25% annual returns. Green tech demand, supply hiccups, and a few global shake-ups, these markets had plenty of ups and downs. Here’s the scoop on what made waves and what lies ahead.

Exploring the factors that impacted the prices of key commodities and their outlook for 2025

Besides the stock markets, 2024 has been a stellar year for many commodities. In this article, we take stock of how 6 major commodities - gold, silver, steel, copper, aluminium, and natural gas have performed in this past year.

Why these commodities?

-

Gold and silver are two of the largest consumed metals in India. From religious purposes, and industrial uses to financial security, Indians have a deep affinity with them

-

Natural gas is crucial for India’s energy needs, although India currently depends on imports due to limited domestic production.

-

Industrial metals like steel, copper, and aluminium play a vital role in India’s growth. Not only are they critical for conventional manufacturing and trading industries, but they (copper and aluminium especially) also are critical to new-age technologies like electric vehicles and AI.

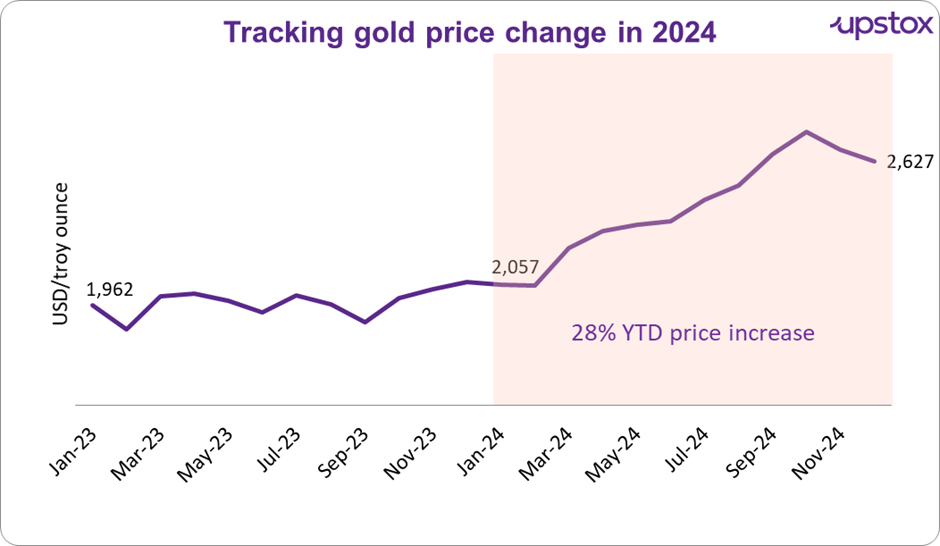

Gold

Gold prices have surged in 2024 by 29% due to several key factors, like

-

Geopolitical tensions boosted safe-haven demand. Globally, central banks purchased a record 483 tonnes in the first half of 2024. The RBI purchased about 77 tonnes of gold from January to October 2024.

-

Global economic issues related to growth and inflation also supported prices. Global rate cut expectations (which did come through as well) made gold an appealing investment alternative.

-

Strong demand from Asian markets, particularly India and China, to support electronics manufacturing (smartphones and other hi-tech devices) also bolstered prices.

-

Lastly, an effort to reduce reliance on the US dollar, supported prices.

Source: Investing.com, Note: Data as of 30-12-24, Note: 1 troy ounce is ~31 gms

What's in store for the future?

Gold’s long-term outlook remains positive with ongoing monetary policy easing (lowering interest rates), strong central bank purchases, and robust consumer demand.

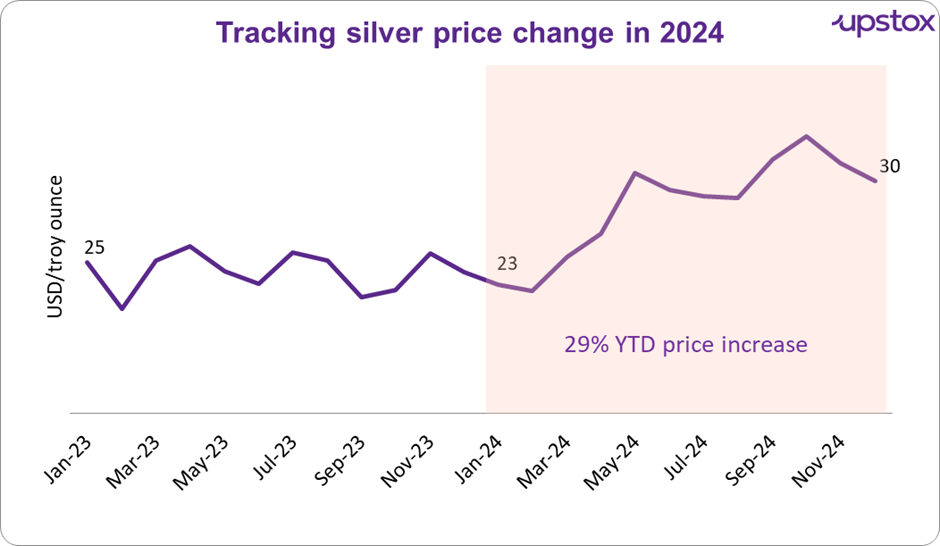

Silver

Silver prices surged by 30% in 2024, reaching a decadal high of $33 before easing later in the year.

-

The global push towards green technologies significantly increased demand for the metal due to its essential role in these products. Mines are struggling to keep pace with the demand. For instance, silver supply is projected to reach 1.03 bn ounces in 2024, well below the estimated demand of 1.20 bn ounces.

-

Similar to gold, investors also see silver as a ‘safe-haven’ during bouts of economic uncertainty in major economies. For e.g. silver prices rose by ~50% during Covid.

Source: Investing.com, Note: Data as of 30-12-24

What's in store for the future?

The future outlook for silver in 2025 and beyond is promising, with analysts expecting substantial price appreciation due to some of the factors discussed above. However, geopolitical uncertainties, economic slowdowns, and US policy shifts could impact silver’s price trajectory.

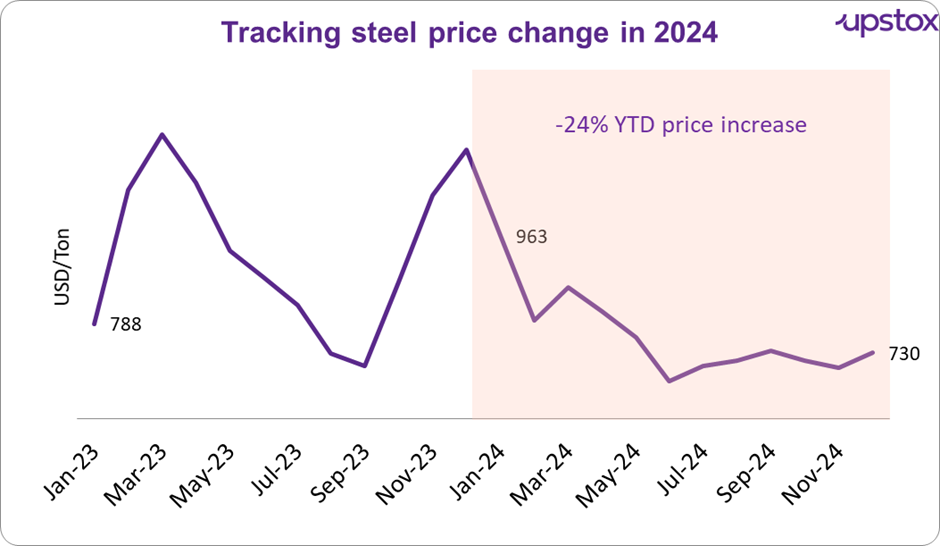

Steel

Steel prices continued their downward trend in 2024 due to the following factors:

-

As with most industrial metals, China plays a vital role in global steel pricing, being its largest producer and consumer. As per China Iron and Steel Association (CISA), China's consumption and output in the first three quarters of 2024 fell 6.2% and 3.6% YoY. Goes without saying a slowdown in the Chinese property and infrastructure sectors has kept prices subdued.

-

Weakness in China has led to a flooding of cheap steel across other major economies, further impacting prices.

-

Prices however found some support due to relatively stronger demand from India and other economies in the MENA and ASEAN regions.

Source: Investing.com, Note: Data as of 30-12-24; prices are for Hot Rolled Coils

What's in store for the future?

Unfortunately, the 2025 outlook for steel is relatively weak. While a demand pick-up in India and other economies helps, only a sustained improvement in China is expected to provide a major boost to steel prices. For perspective, China accounts for nearly half of the global steel demand in the world. Besides this, any tariffs from the upcoming government in USA could further lead to price volatility

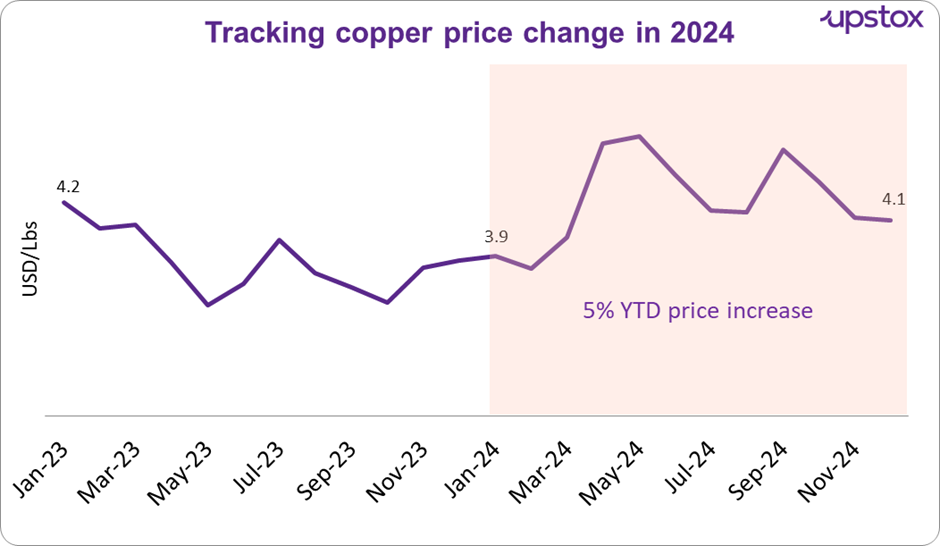

Copper

What are the reasons that impacted copper prices? Let’s check them.

-

The initial surge in copper price was driven by expectations of strong demand from multiple industries ranging from EVs, AI, data centres, etc. This is beyond copper’s usual industrial applications.

-

That said, since early 2024, the price has broadly cooled off and this can be attributed to:

- Weaker-than-expected manufacturing growth, especially in China

- A shift to the usage of scrap copper (more readily available) due to high copper prices, led to a cool-off in primary copper prices.

Source: Investing.com, Note: Data as of 30-12-24

What's in store for the future?

While the long-term story of copper’s role in green energy and AI is intact, near-term prices continue to be dominated by China. Overall China is responsible for ~56% of global consumption. If the Chinese governments attempt to stimulate the economy fructify, copper prices could see a surge.

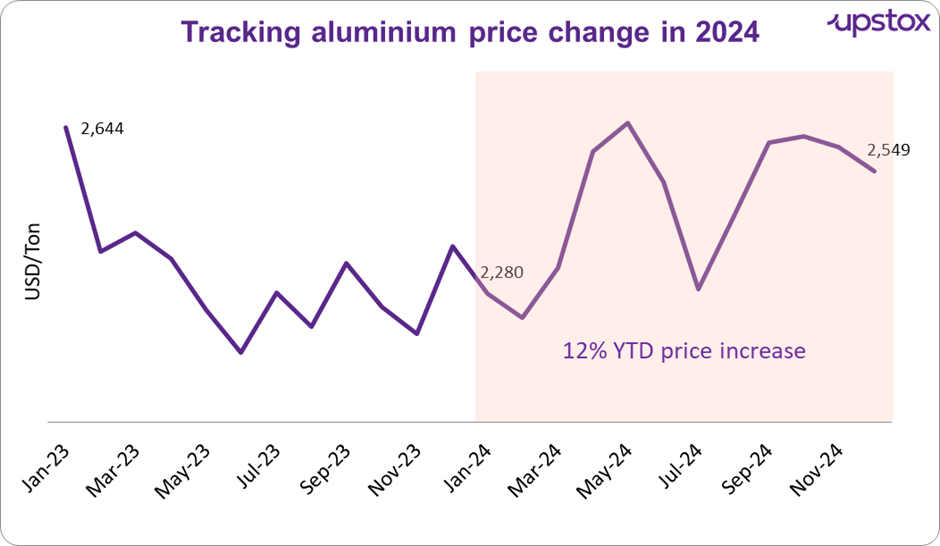

Aluminium

-

Aluminium prices have surged due to supply constraints and rising alumina (raw material) costs. Alumina prices surged 40% in 2024 due to supply chain disruptions and high demand from China.

-

Besides that, production cuts by major producers like Rusal and limited restarts of European smelters have further tightened supply.

-

The anticipated demand growth from renewable energy projects and monetary easing have also supported prices.

Source: Investing.com, Note: Data as of 30-12-24

What's in store for the future?

The future outlook for aluminium is cautiously optimistic, with potential price gains if supply issues persist and global economic conditions stabilise. A report by AL Circle predicts significant growth in the global aluminium industry by 2025, driven by demand from key sectors, high alumina costs and China's green energy investments. However, trade tensions, China's economic slowdown, and policy changes could pose challenges.

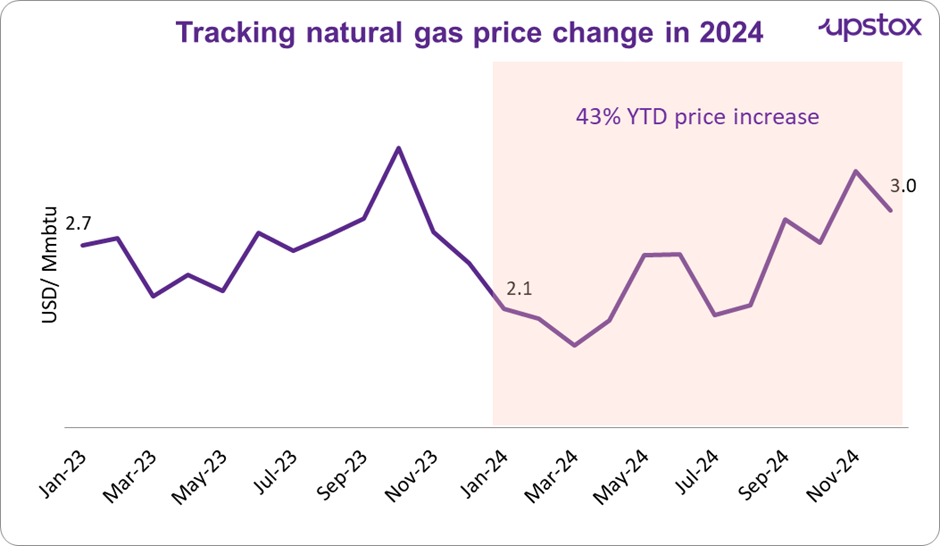

Natural Gas

-

Natural gas prices have been highly volatile over the past two years, largely due to the Ukraine conflict and its impact on Russian gas supplies to Europe.

-

This year, prices surged 67% due to cold weather in key regions like Europe, China, and Japan. Tight supply conditions in the US and disruptions from Hurricane Rafael further fuelled the rise.

Source: Investing.com, Note: Data as of 30-12-24 | Mmbtu: Million British Thermal Units

What's in store for the future?

The future of natural gas prices looks mixed. In 2025, as per Reuters, prices are expected to rise due to ongoing supply challenges and high demand, especially in Europe and the US. However, beyond 2026 prices are expected to stabilise, as increased production will be more or less offset by increased demand from industries and enterprises looking to transition away to cleaner fuels.

Commodity trends at a glimpse

| Commodity | Positive price drivers | Key risks | Overall 2025 outlook |

|---|---|---|---|

| Gold | Central bank buying Safe-haven demand Further rate cuts or expectations thereof | Policy changes Market corrections | Favourable |

| Silver | Green tech demand Safe-haven appeal | Supply deficit, Economic slowdown | Favourable |

| Steel | Improvement in Chinese demand Sustained support from other major global players | Further weakening of China’s economy Tariffs from the incoming US government | Weak |

| Copper | Green energy EV demand Supply constraints | China slowdown | Mixed |

| Aluminium | Green energy Supply constraints | Trade tensions High input costs | Mixed |

| Natural gas | Energy transition Favourable weather | Geopolitical tensions Supply volatility | Mixed |

What does this mean for investors?

In years such as 2024, investors - especially the novice ones - would be tempted to try and invest in asset classes that have had a strong year. There is also a case to be made that commodities can provide an element of portfolio diversification.

That said, investors often fail to recognise that versus equities, which are more domestic, almost all commodities are global in nature. Their prices are impacted by global events, which are not only well beyond their control but also much more difficult to forecast. As such, one must have a firm grasp of the risk with commodity investing, before venturing into that asset class.

A limited, but much simpler way to introduce commodities to your portfolio is via ETFs. Exchange-traded funds (ETFs) provide a low-cost, liquid, and diversified way to invest, enabling exposure to commodity price movements without the complexities of direct ownership or trading in physical assets. However, please note that in India, for now, we only have access to gold and silver ETFs.

Select commodity ETFs (by AUM size)

| Name | AUM (₹Cr.) | Expense ratio (%) | 1-year return (%) | 3-year return (%) | 5-year return (%) |

|---|---|---|---|---|---|

| Nippon Gold ETF (GOLDBEES) | 15,064 | 0.81 | 19.8 | 54.5 | 88.2 |

| ICICI Pru Gold ETF | 10,984 | 0.50 | 20.0 | 22.4 | 22.4 |

| HDFC Gold ETF | 5,782 | 0.18 | 19.9 | 27.8 | 27.8 |

| ICICI Pru Silver ETF | 7,748 | 0.40 | 17.3 | 18.1 | 18.1 |

| Nippon Silver ETF (SILVERBEES) | 5,087 | 0.56 | 17.3 | 38.8 | 38.8 |

| Kotak Silver ETF | 737 | 0.45 | 3.8 | 3.8 | 3.8 |

Source: nseindia, valueresearch; Note: Data as of 27-12-24

About The Author

Next Story