Upstox Originals

From fields to fortune, rural spending spikes

.png)

4 min read | Updated on November 20, 2024, 13:48 IST

SUMMARY

As Q2Y25 results come to a close, a striking commentary across sectors has been the rise in rural spending. While most companies have been talking about slowing consumption and demand, the rural demographic remains a silver lining. In this article, we look at some comments by management and some key trends in rural demand.

Rural demand has been steadily outpacing urban demand

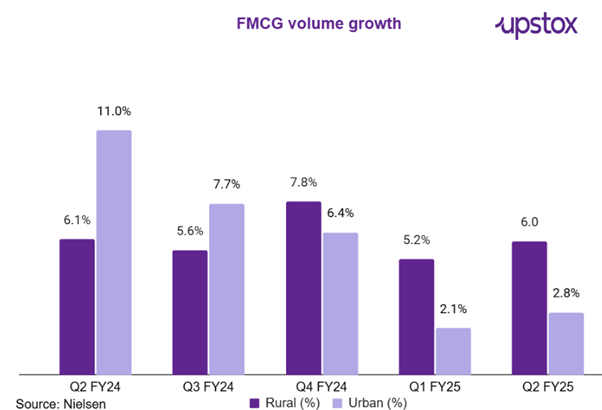

Data from NielsenIQ reveals a clear pattern: rural India's consumption growth is outpacing urban areas. In Q2FY25, both urban and rural markets showed a sequential recovery in consumer demand. Urban consumption growth in Q2FY25 is 2.8%, while rural growth increased to 6.0%, 2x faster than urban growth.

This trend isn't new; it marks the third consecutive quarter where rural areas have led in volume growth across most of India.

Various sectoral companies have reiterated the trend in their recent Q2FY25 earnings commentary, which has also caused some of them to rethink their strategies.

-

FMCG impacted most: Companies like Tata Consumer Products, Nestle, and Hindustan Unilever are experiencing a demand softening in urban markets. However, they are seeing stable and even expanding demand in rural areas, with rural consumers buying larger packs and showing more interest in personal care and snack products.

-

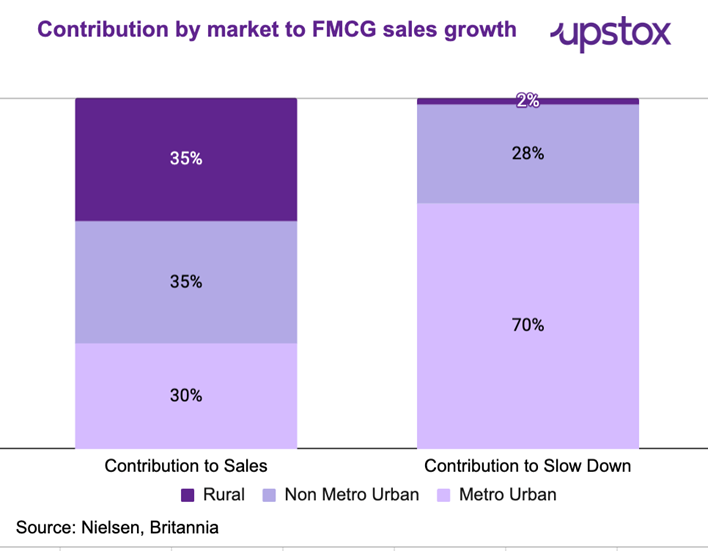

Britannia recently confirmed the same trend but brought more granular details i.e. metro which contributed 30% of the FMCG sales has contributed almost 70% to the FMCG slowdown.

-

Maruti Suzuki noted a rising demand for SUVs in rural areas is a significant opportunity. Rural buyers now account for 54% of Maruti’s SUV sales mix. From Maruti’s perspective, this has helped them stem the fall in overall demand with a slowdown in sales of entry-level cars. From an overall standpoint, this once again talks of increasing premium demand in rural markets

-

Consumer finance major Bajaj Finance saw its rural sales finance AUM grow by 32% against urban’s 18% YoY growth during Q2FY25, while Choldmandlam said they will focus on rural areas more for penetrating growth.

-

Mahindra & Mahindra (M&M), a key player in India's SUV market and a leader in farm equipment, expressed optimism regarding the growth of its tractor segment during the latter part of the financial year. Banking on this demand, M&M is expecting double-digit growth in tractor sales in H2FY25.

-

Other companies that acknowledged the trend for their respective sectors are - Ultratech Cement (Building products) - Zydus Wellness (Healthcare products) - Voltas (Consumer durables) - V-Mart Retail and Spencers Retail (Modern trade) - Huhtamaki India (Packaging) - Asian Paints and Kansai Nerolac (Construction and building products)

Why is rural demand outpacing urban demand?

Several interconnected factors are driving this rural consumption boom:

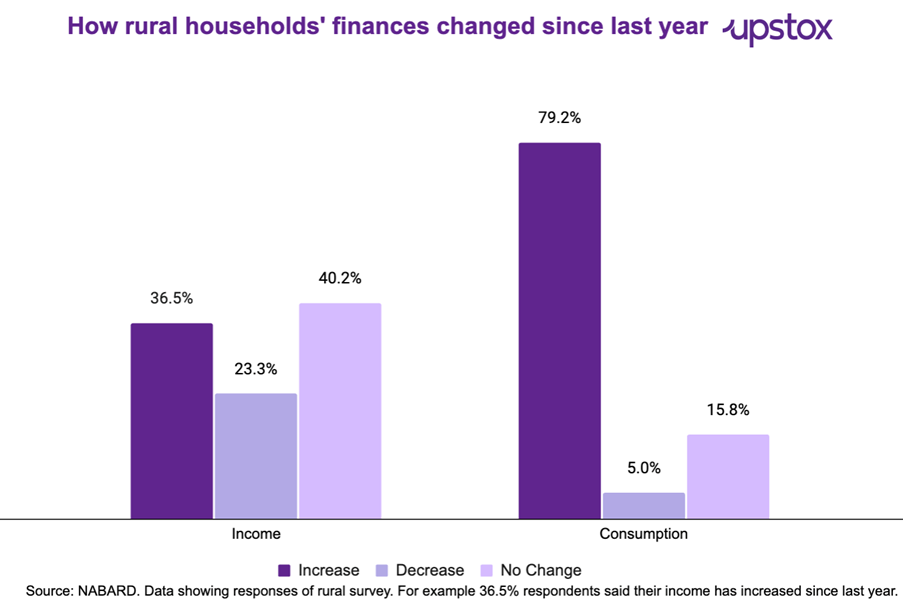

- Rural incomes on the rise: A good monsoon season has translated into higher agricultural output, boosting farmers' incomes, who form a large part of the rural population. This has directly increased purchasing power in these areas which is evident from NABARD’s recent rural survey which said ~36.5% of respondents saw an increase in income while ~79.2% of respondents saw increased consumption.

-

Government support for rural development: Rural infrastructure investments, including roads and agricultural facilities improvements, have played a crucial role in supporting rural incomes. These improvements not only aid agricultural productivity but also create jobs and enhance overall economic activity in rural areas.

-

Changing consumer preferences: Rural consumers are no longer limiting themselves to basic necessities. There's a growing demand for products previously associated with urban markets.

The bigger picture

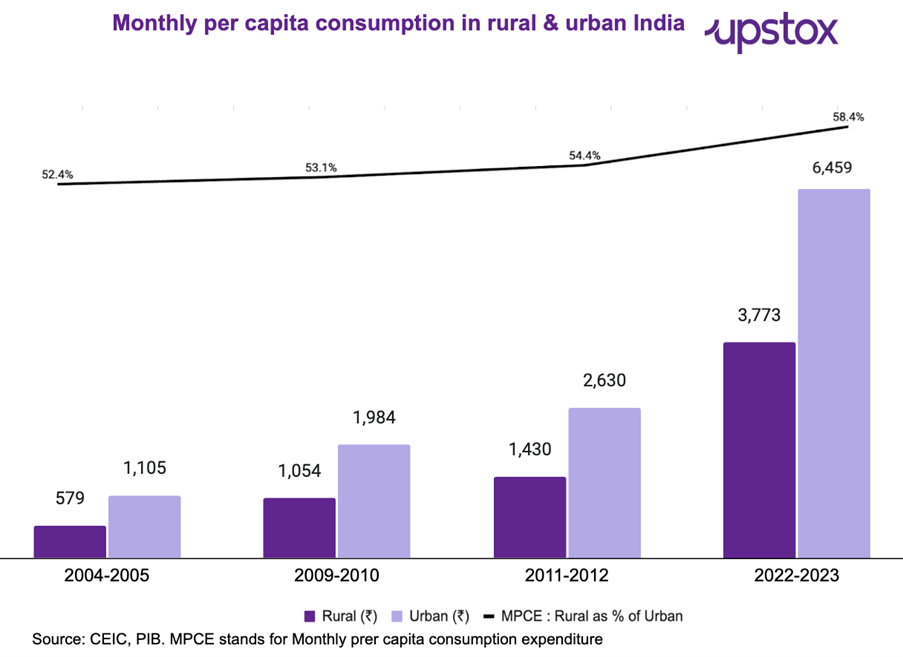

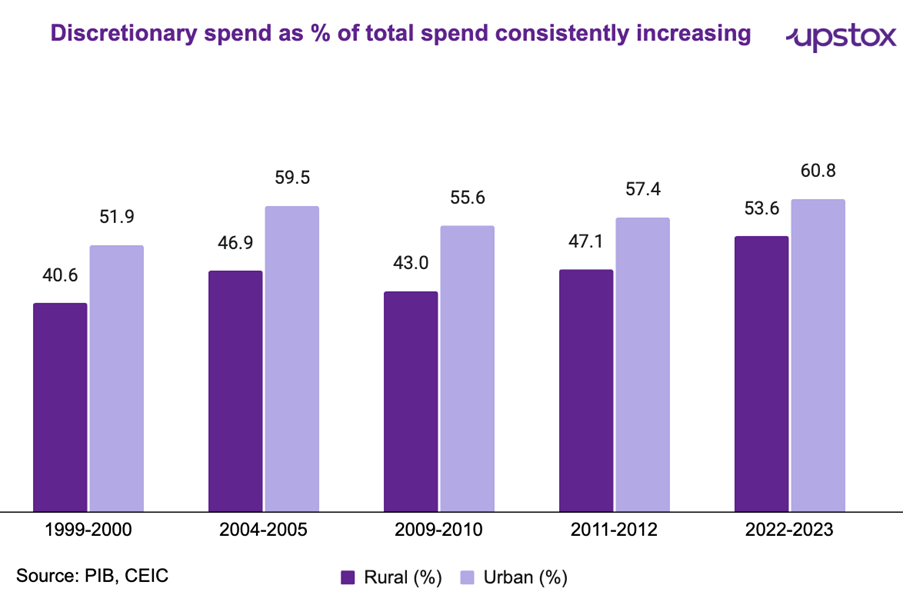

Rural demand outpacing urban demand has been a developing trend for over a decade now. As we show in the chart below, rural consumption expenditure has been steadily rising.

Faster premiumisation trend in rural - The share of discretionary spend in monthly consumption expenditure has been consistently increasing, with rural India seeing a robust growth

Key risks

While India has made definite progress, a key challenge is that rural demand is dependent upon factors that are beyond the hands of the consumers, namely:

- Rainfall and crop performance and

- Sustained government support

Any shift in either factor can have a meaningful impact on overall rural demand.

Conclusion

The Indian consumer market is transforming, with rural consumption playing an increasingly vital role in driving growth. While factors like favourable monsoons and government support have contributed to this shift, the story is bigger than that. Rural consumers are demonstrating evolving preferences, moving beyond traditional consumption patterns.

This presents both challenges and opportunities for companies operating in India. Those who can effectively adapt their strategies to cater to the unique needs of both urban and rural consumers are likely to benefit most from this dynamic market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story