Upstox Originals

FII versus DII: The tug of war continues

4 min read | Updated on November 21, 2024, 20:06 IST

SUMMARY

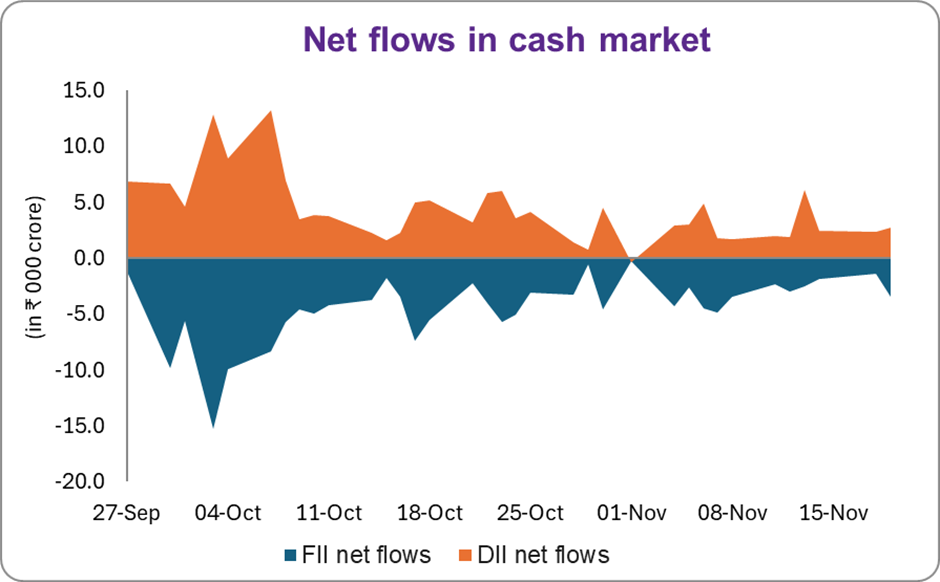

Would it surprise you that for the past 35 trading sessions, FIIs have been net sellers in the local cash markets? Maybe not. What could come as a surprise, for the same time, DIIs have been net buyers for every single session. Not only that, DII purchases have seen a significant increase in the past few months, providing support to markets.

DIIs have been net buyers in the domestic cash market, providing support

It's been a tough couple of months for the markets. From its all-time highs, the Nifty50 has corrected ~11% (as of November 21, 2024).

As one can imagine, multiple factors have impacted the markets - including but not limited to, escalating global tensions, US elections, deprecating rupee, and frothy valuations of domestic markets.

It could be argued that most of these reasons have been true for some time now. For example - market experts have been raising complaints about valuations for over a year now (at least). Similarly, global skirmishes have been going on for more than a couple of years now.

As such, it is honestly difficult to say what broke the camel’s hump - could it be that China’s recent stimulus has changed its global perception or that India’s weak Q2FY25 results have impacted investors.

Source: Moneycontrol; *Data is till November 19, 2024.

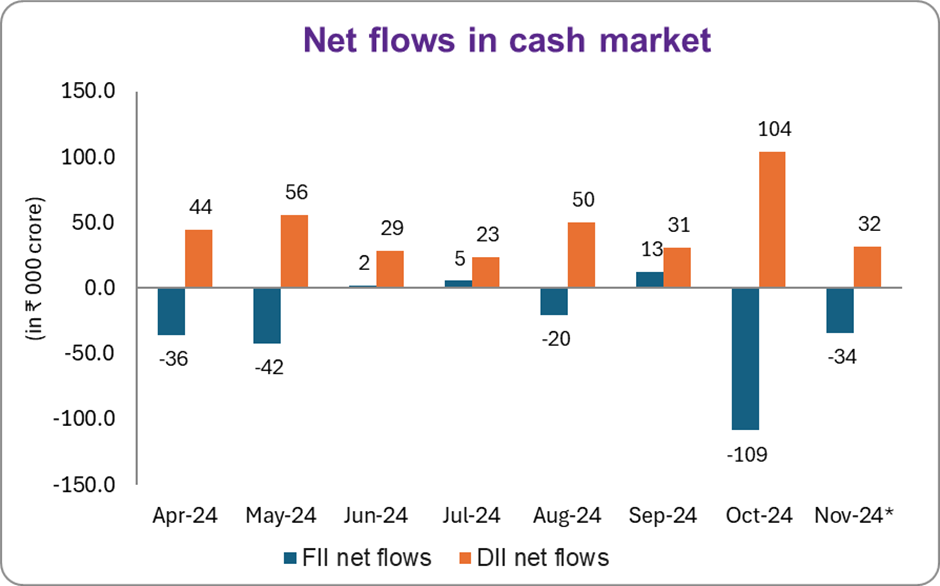

What makes this an even more interesting exercise is the data in the chart below.

Since the beginning of this financial year, DIIs have been net buyers and maintained the momentum. In fact, in October 2024 when markets saw record FII selling, DII purchase was also at record highs. And the pace has not faltered.

In just the first 19 days of November or 12 trading sessions, DII purchase is almost at the same level as their purchase for the full month of September 2024. At this pace, it is set to match if not outpace their August 2024 levels.

Source: Moneycontrol; *Data is till November 19, 2024.

Why this shift? This could be attributed to several factors including:

-

Increased financial literacy: More individuals now understand the importance of saving and investing.

-

Technological advancements: User-friendly digital platforms and tools have made investing accessible to a broader audience.

-

Stable economic growth: A steady economy fosters investor confidence.

-

Favorable political landscape: Political stability creates a conducive environment for financial markets to thrive.

This, I guess also brings to a slightly depressing question - what can shake the faith of the retail investors?

Given the nature of severity of events that the world has witnessed in the past few years, it is difficult to point out what could change DII’s market stance. A few things that come to mind are

-

Any sustained weakening in India’s economic growth. Q2FY25 results have been weak across most sectors. Multiple companies have highlighted a slowdown in consumption. As such, if this trend persists, it could lead to deteriorating domestic confidence

-

Any change in India’s political landscape. If India’s political landscape were to become uncertain, it could impact DII sentiment

-

Worsening global scenario - Yes, global markets have been volatile. But even they have broadly been bullish. Most major markets have not seen any sustained correction. If major global markets were to severely correct, which would impact not only global sentiment, but also trade and business, it could hurt India as well

-

A final, but thankfully more tactical factor could be - profit booking. At some point, DIIs are also likely to book profits, which could further impact markets.

Conclusion

The strengthening of DII in India should not come as a surprise. For most market viewers, DIIs have steadily been increasing their influence on markets. This is a heartening trend that has buoyed domestic markets in tumultuous times. That said, a 10-11% correction in markets is routine and one would hope to see a resurgence in FII activity, to take some load off the local investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story