Upstox Originals

FII selling spree: What does it mean for investors?

.png)

5 min read | Updated on October 29, 2024, 15:05 IST

SUMMARY

More than 88,000 crore! That is how much FIIs have sold in October 2024. Markets have corrected almost 8% from their highs. What does this mean for investors? Are FIIs leaving India, or is this just a portfolio rebalance? In this article, we anlayse these outflows and put them in the context of the larger market activity. We also look at previous such sell-offs and assess their impact on markets

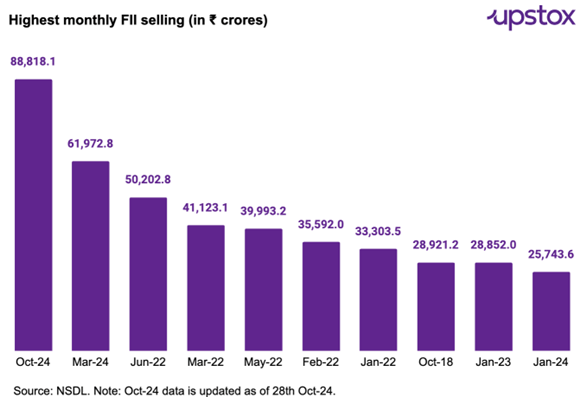

In October 2024, Indian markets have seen the highest FII selling ever

In October 2024, the Indian markets experienced the highest monthly FII selling, surpassing even the levels seen during the pandemic. This led to a market correction, with the broader index dropping by ~8-9% from their all-time highs.

Before we analyze FII selling and its implications let us understand what led to this

Why are FIIs on a selling spree?

Contrary to their buying spree earlier in the year, FIIs have turned sellers. Here are some reasons behind this shift:

-

High valuations, earnings disappointment: As we show in Market mood swings, Indian markets are currently trading at premium valuations. To make matters more serious, so far earnings in Q2FY25 have been below expectations, which has further dampened the sentiment.

-

Chinese stimulus: China's recent economic stimulus has once again made the market an interesting investment prospect. As such, some rebalancing by FIIs is only natural.

-

Global economic shifts: Even post the US FEDs’ rate cut, the yield on US 10-year Treasury bonds has risen, suggesting a recalibration of expectations regarding future rate cuts. This has made bonds more attractive relative to stocks, influencing FIIs to redirect their capital.

Why has the market not crashed?

Thanks to Domestic Institutional Investors (DIIs) who bought stocks worth ₹92,932 crore, thereby cushioning the market against a steeper fall.

Are FIIs really leaving India?

No, they are not!

Some context first

As of today, India's market capitalization hovers ~$5,500 billion. FIIs currently hold roughly 18% of this market cap, translating to approximately $950 to $1,000 billion. In light of this, an outflow of ~$10.4 billion, while substantial in absolute terms, represents just ~0.2% of the total market cap and about ~1% of FII holdings.

FII ownership was ~21.6% in 2016, after which it has been declining. It currently stands at ~18.3% (a decadal low).

The table presents data on significant periods of Foreign Institutional Investor (FII) outflows in the Indian market, showing the financial impact of these outflows on average market capitalization and FII ownership.

| Event | FII outflows ($Bn) | Avg market cap ($Bn) | Outflow as % of avg market cap | FII ownership | FII ownership |

|---|---|---|---|---|---|

| From | To | ||||

| Global financial crisis (Jan 08 - Mar 09) | -15.4 | 1,000.1 | -1.5% | 16.0% | 13.2% |

| US credit rating downgrade (Jul 11 - Oct 11) | -2.7 | 1,315.5 | -0.2% | 15.3% | 15.5% |

| Taper tantrum (Jun 13 - Sep 13) | -3.7 | 1,033.2 | -0.4% | 19.5% | 19.4% |

| Yuan devaluation (Apr 15 - Feb 16) | -7.8 | 1,500.5 | -0.5% | 20.7% | 21.4% |

| Fed hike / Demonetization (Oct 16 - Jan 17) | -5.3 | 1,604.7 | -0.3% | 21.6% | 21.3% |

| NBFC crisis (Apr 18 - Nov 18) | -7.9 | 2,139.2 | -0.4% | 20.6% | 20.3% |

| Slowdown (Jun 19 - Sep 19) | -5.0 | 2,007.9 | -0.2% | 21.1% | 20.8% |

| Onset of COVID-19 (Feb 20 - Apr 20) | -10.6 | 1,669.4 | -0.6% | 21.5% | 19.8% |

| Geo-political worries (Nov 21 - Jul 22) | -34.9 | 3,315.3 | -1.1% | 20.5% | 18.1% |

| Currently ongoing (Sep 24 - Oct 24) | -10.4 | 5,500.6 | -0.2% | 18.3% | NA |

Source: Whiteoak Capital, NSE, Investing.com, NSDL. Data as of 28th Oct-24

Market performance

In this section, we look at the market’s performance during these sell-offs

-

Correction during FII-sell-off: Generally during FII sell-off markets have corrected by ~-10.5% with the severity of correction declining over time. In the current sell-off, markets have declined ~8%-9%

-

Recovery trends: The Nifty 50 has shown strong recoveries after one year from FII-sell-offs with average returns of ~27.4%.

| Event | Nifty 50 returns during FII selloff | Post 1 Year Nifty Returns from FII selloff |

|---|---|---|

| Global financial crisis (Jan 08 - Mar 09) | -50.8% | 73.8% |

| US credit rating downgrade (Jul 11 - Oct 11) | -5.3% | 5.5% |

| Taper tantrum (Jun 13 - Sep 13) | -3.4% | 38.9% |

| Yuan devaluation (Apr 15 - Feb 16) | -18.6% | 27.3% |

| Fed hike / Demonetization (Oct 16 - Jan 17) | -2.0% | 28.8% |

| NBFC crisis (Apr 18 - Nov 18) | 6.3% | 11.0% |

| Slowdown (Jun 19 - Sep 19) | -5.1% | -2.0% |

| Onset of COVID-19 (Feb 20 - Apr 20) | -15.5% | 48.4% |

| Geo-political worries (Nov 21 - Jul 22) | -4.3% | 14.6% |

| Currently ongoing (Sep 24 - Oct 24) | -8-9% | NA |

| Average | -10.5% | 27.4% |

Source: Whiteoak Capital, NSE, Investing.com, NSDL. Data as of 28th Oct-24

Conclusion

FII has been aggressively selling shares as part of a portfolio rebalancing effort. Although the sell-off appears intense in absolute numbers, its impact on the market has been relatively moderate, as reflected by the performance of broader market indices.

With FII holdings at a decadal low and the Indian market showing resilience against this sell-off, historical trends suggest that the market could see double-digit returns within the next year following such FII sell-off.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story