Upstox Originals

Festive 2024: How much did India celebrate?

.png)

4 min read | Updated on November 14, 2024, 14:29 IST

SUMMARY

With the Diwali festivities now behind us, one question on everyone’s mind: how did this year’s festive season fare? Diwali is one of India's most significant retail and e-commerce periods. The festival sparks a surge in consumer spending from fashion to electronics, home décor to automobiles. So, which categories truly stole the spotlight this year? In this article, we look at some of the categories that shone the brightest and what it means for the overall consumption trend in India.

The festive e-commerce season recorded a GMV of ₹1.2 lakh crore, reflecting a 12% YoY growth

Par CAIT, traditional channels were expected to register festive sales of ~₹4.25 lakh crore (actuals awaited here).

Here is how the overall festive trend has emerged across various categories:

-

Demand from non-metro consumers: A large portion (60%) of the demand originated from Tier II and Tier III cities as per ClickPost report , indicating the increasing penetration of e-commerce and growing strength of these regions.

-

Increased purchases of luxury brands: Consumers showed a greater inclination towards purchasing premium products during the festive season, as evidenced by Amazon which saw a 30%YoY jump in luxury and large appliances sales while Flipkart saw 17% growth in top brand sales as per media reports.

-

Smartphones emerged as the star performer in e-commerce sales. Online purchases accounted for nearly 65% of all smartphone sales during this period as per media reports. Both Flipkart and Amazon identified smartphones as their top-grossing category, with premium smartphones being the top seller

-

Corporate gifting saw significant growth, with Amazon Business reporting a 134% YoY increase in its corporate gifting store as per media reports. Kitchenware was the most sought-after gifting category.

-

The automotive industry also experienced a strong festive season, with overall auto sales in October surging by 32% year-on-year as per Federation of Automobile Dealers Associations (FADA). The two-wheeler segment spearheaded this growth, propelled by festive offers, new model launches, and improved stock availability.

-

Around ₹20,000 crore worth of gold and ₹2,500 crore worth of silver were sold on the occasion of Dhanteras as per CAIT estimates.

-

Cash-on-delivery (COD) continues to be favoured, particularly in non-metro cities, where it outpaces prepaid transactions by a 3:1 ratio for categories such as cosmetics and fashion as per ClickPost report. Conversely, in metro areas, prepaid transactions have seen an uptick, driven by the allure of digital wallet rewards and cashback offers on high-value purchases.

-

Despite a slowdown in acquiring new customers, there has been an increase in individual e-commerce spending by 5-6%, suggesting a possible shift in consumer behaviour over time as per Redseer report.

Does this mean, all is well?

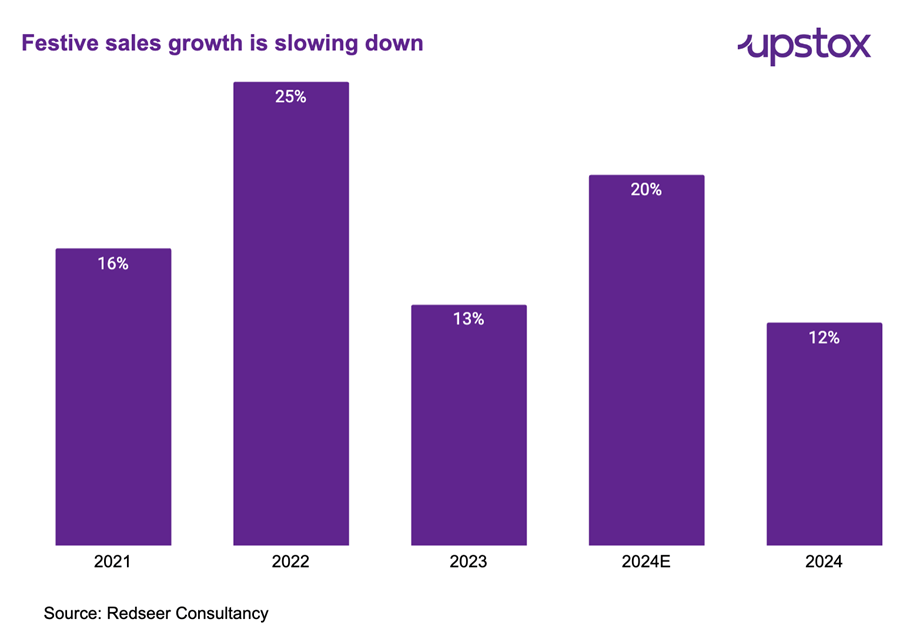

While all these individual trends are very exciting, we also look at the overall trend in festive spending. While e-commerce festive sales have grown in absolute terms, the growth rate has declined. From a ~13% YoY growth in festive 2023, the growth rate has slowed down to 12% YoY which was also below 20% YoY expected festive GMV growth for 2024.

Key insights

-

The festive season data indicates a cyclical economic slowdown, with retail sales showing slower growth compared to last year despite an increase in overall sales.

-

Online platforms, especially in tier-2 and tier-3 cities, are seeing better performance than offline stores, though demand in urban metros and industrial regions is softening.

-

The slowdown is mainly coming from Urban areas as highlighted by Britannia also which said metro areas are responsible for 70% of the slowdown in FMCG.

-

Rural demand remains steady, aided by good agricultural output, yet the overall consumption picture remains mixed.

Conclusion

Overall, the 2024 festive season was successful. The growth of e-commerce, the shift towards premiumisation, the surge in demand from non-metro consumers, and the robust sales figures across various product categories are all encouraging signs for the Indian economy. That said, monitoring what this festive trend does for India’s overall consumption is critical. Was this just a festive bump or does it resent India’s consumption, which has been slowing down.

About The Author

Next Story