Upstox Originals

Exploring green bonds: how can investors finance a sustainable future

.png)

4 min read | Updated on July 09, 2024, 10:15 IST

SUMMARY

Want to earn returns, while contributing towards a “greener” future? This article dives into the world of green bonds, exploring their role in financing a more sustainable future. We break down the key features of green bonds and their growing landscape in India.

Green bond issuance has been on a rise in India

Just like regular bonds, companies and governments issue green bonds, but the borrowed money goes toward specific environmental projects.

So, what makes a bond "green"?

It's all about the purpose. When you buy a green bond, you're essentially lending money for things like renewable energy sources, clean transportation, or projects that reduce pollution.

Why do we need Green Bonds?

These bonds could help meet India's ambitious clean energy and infrastructure development goals. For instance, in Feb 2023 the government committed ₹35,000 crore, over multiple years, towards green tech to achieve its net zero emission target. This spend is only expected to rise.

India’s Sovereign Green Bond (SGrB)

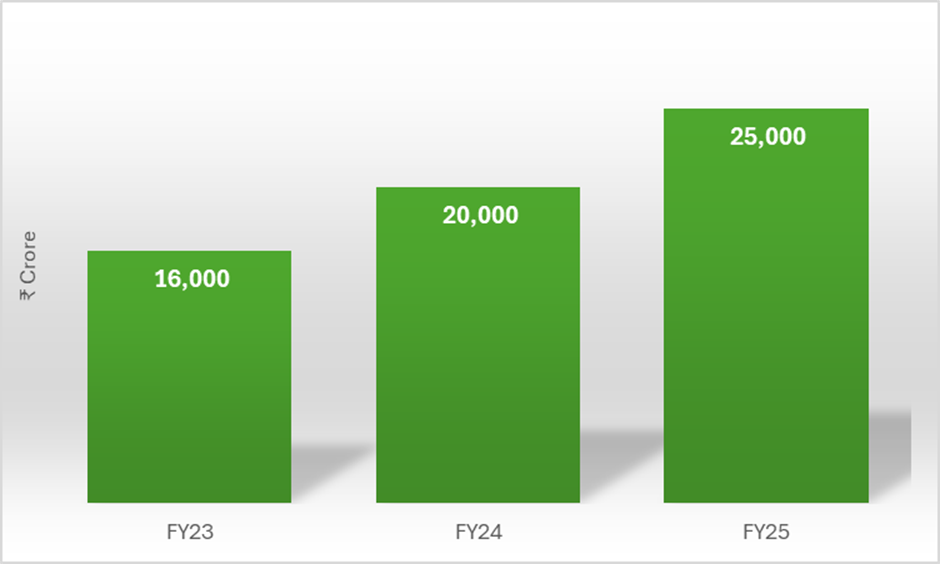

In a bid to mobilize resources for green infrastructure projects, India issued its first SGrB of ₹8,000 crore, a two-tranche deal divided equally between five and ten-year terms, in January 2023. On February 9, each tranche was reopened for an additional ₹8,000 crore, bringing India’s total green bond liabilities to ₹16,000 crore in FY23.

Here are the bond details:

| Type of Bonds | 5-year Sovereign Green Bond | 10-year Sovereign Green Bond | 5-year Sovereign Green Bond | 10-year Sovereign Green Bond |

|---|---|---|---|---|

| Issue Size | ₹4,000 crore | ₹4,000 crore | ₹4,000 crore | ₹4,000 crore |

| Issue Date | 25th January 2023 | 25th January 2023 | 9th February, 2023 | 9th February, 2023 |

| Coupon / Yield | 7.10% / 7.10% | 7.29% / 7.29% | 7.10% / 7.23% | 7.29% / 7.30% |

Source: NIFTY Indices, news articles

Please note: detailed data of any 2024 issuance is not available yet

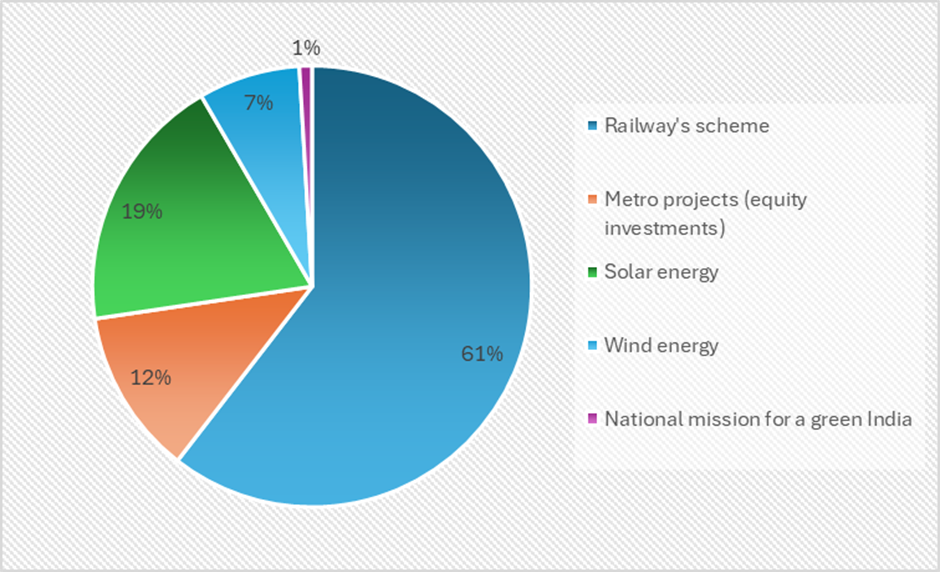

Breakup of utilisation of these funds (FY23)

Source: India Budget

The government significantly ramped up its issuance of sovereign green bonds in FY24, raising ₹20,000 crore, a 25% increase from FY23. These bonds were offered with 5-year, 10-year, and 30-year maturities, carrying interest rates between 7.24% and 7.37%.

Rising issuance of SGrB in India*

Source: The Hindu, press releases; *FY24 and FY25 are estimates

What about individual investors?

5% of total issuance is made available for retail investors. These government-backed bonds are secure and offer attractive returns. You can invest in SGrBs directly through the RBI's retail website or through your brokerage account. Interest rates on sovereign green bonds

How do they stack up versus "non-green" bonds?

Sovereign Green Bonds have a 'greenium,' meaning they have slightly lower interest rates because investors are willing to accept less due to the bonds' environmental benefits. This helps issuers save on interest costs while investors support eco-friendly projects.

For example, the latest 10-year Sovereign Green Bond offers a 7.29% interest rate, compared to 7.38% for a similar non-green bond, showing a greenium of 9 basis points.

Let's explore some of the leading issuers of green bonds in the Indian corporate sector.

| Company | Green bond issued (₹ crore) | Maturity Period (years) | Coupon Rate (%) |

|---|---|---|---|

| JSW Energy | 5,443 | 10 | 4.13 |

| Adani Green | 3,423 | 18 | 6.70 |

| IREDA | 1,500 | 10 | 7.44 |

| Indian Renewable Energy Development Agency Limited | 590 | 10 | 8.47 |

| Mindspace Business Park Reit | 550 | 3 | 8.02 |

| Indore Municipal Corporation | 244 | 9 | 8.25 |

Source: Press release, company website, SEBI

Green bonds are gaining traction in India, but face hurdles that need to be addressed.

- Lack of awareness and understanding: Issuers, investors, and regulators often misunderstand green bonds, their benefits, and the principles behind them.

- Regulatory framework: The current regulatory environment needs improvement to fully support green bonds. Clearer regulations and international alignment would increase investor confidence.

- Shortage of qualified projects: While India has many potential green projects, many lack proper development, financing, or standardization. This makes it difficult for investors to assess their viability.

- Pricing issuances: Green bonds can be expensive to issue due to external evaluations, certifications, and reporting.

Conclusion

Green bonds are experiencing a surge in popularity in India. This is partly due to the government's issuance of SGrBs, which allow global investors to participate in India's climate action goals and contribute to achieving Sustainable Development Goals (SDGs). It provides a new avenue for financing environmentally friendly projects, promoting sustainability initiatives, and potentially attracting investors seeking environmental impact alongside financial returns.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story