Upstox Originals

Deep dive into India’s thriving office market

.png)

5 min read | Updated on January 20, 2025, 16:18 IST

SUMMARY

India’s office market is undergoing a remarkable transformation, shedding its traditional image to emerge as a vibrant ecosystem of tech-enabled, collaborative workspaces. This shift reflects the country’s evolving business landscape, fueled by the rapid growth of sectors such as BFSI (Banking, Financial Services and Insurance), IT services and e-commerce.

India’s office space market is currently valued at ~$42.9 billion

A new spin on square spaces

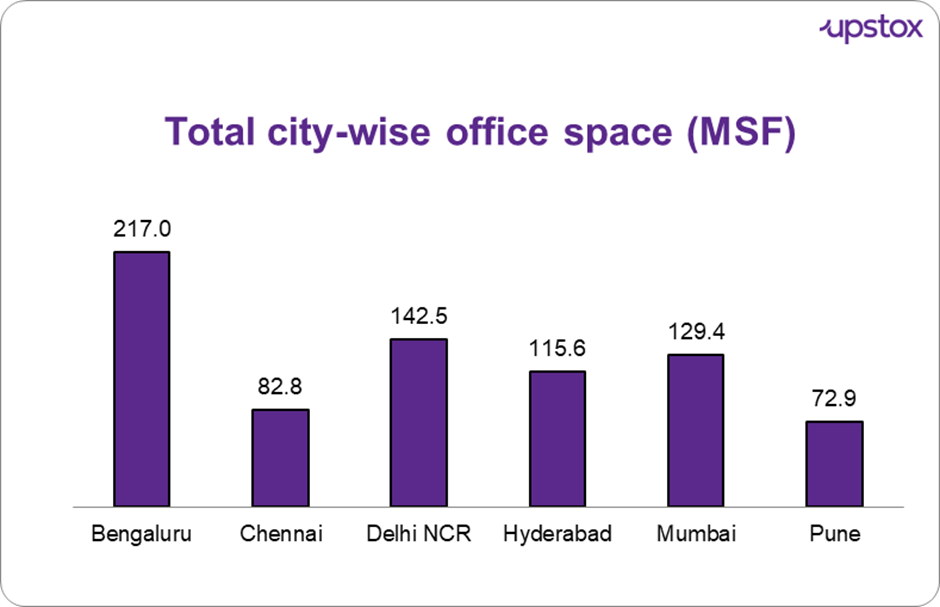

Valued at $42.9 billion in 2025, India’s office space market is expected to grow strongly by 2030, with projected annual growth rates ranging from 20% to near 30%. IT, e-commerce, and BFSI are driving this transformation seeking scalable and tech-enabled workspaces. The prime business hubs? Bengaluru, Mumbai, Delhi, Hyderabad, and Pune.

Source: Colliers; data for select cities as of December 2024

Before we dive in, here are some key terminologies:

- Vacancy rates: Represent the proportion of unoccupied properties or workplaces

- Gross Leasing Volume (GLV): Measures the total area of office space companies commit to using

- Net Absorption: Reflects the net area leased after accounting for vacated spaces.

While vacancy rates reflect demand-supply balance, GLV shows market expansion, and net absorption highlights actual space uptake.

City-wise demand trends

-

In 2024, the technology and BFSI sectors accounted for ~23.0% & ~16.4% of the overall leasing activity, driving office demand in Bengaluru and Pune, as per reports by WoodKraft. While tech firms sought advanced spaces for operations, BFSI focused on secure, client-oriented offices.

-

GCCs (Global Capability Centers) sector increased their share by 32% in 2024, with organisations providers expanding in cities like Bengaluru, Hyderabad, and Pune.

-

Demand for Grade-A (premium, modern commercial spaces in prime locations), eco-friendly office spaces is rising, with companies prioritising LEED and IGBC-certified (Green building certifications) buildings to meet ESG goals, especially in cities like Bengaluru and Hyderabad.

Per CBRE, pan-India leasing space grew by ~16% in 2024. As per reports by Address Advisors, overall leasing activity is expected to grow by 15% in 2025, with cities like Pune, Hyderabad, and Bengaluru driving most of this demand.

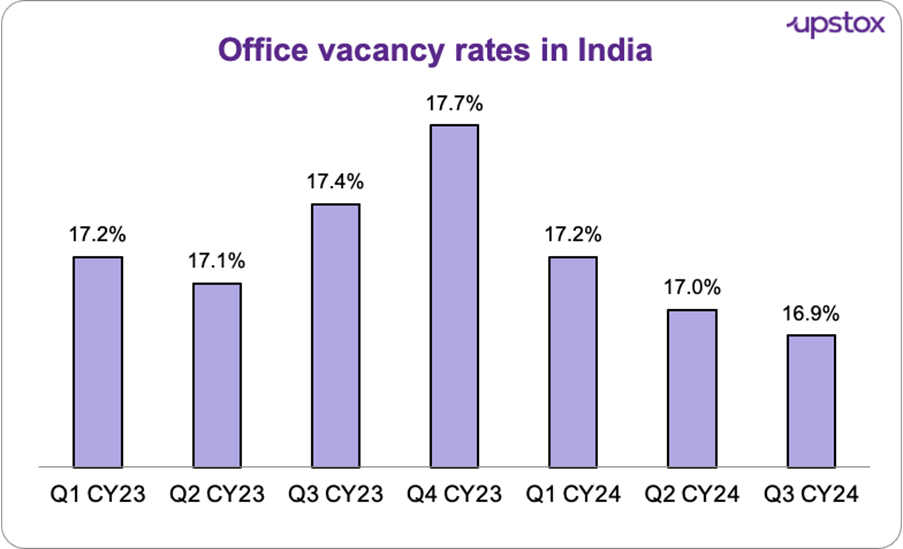

City-wise vacancy trends

Vacancy rates in 2024 stood at 9.8% in Bengaluru, 16.7% in Mumbai, 23.9% in Delhi-NCR, and 24.8% in Hyderabad. Bengaluru added 5 msf of new supply in Q3 FY24, up 57% YoY and nearly double QoQ. 35% of the supply was from North Bengaluru. Facilitated by strong demand, developers are ramping up project completions. In Delhi-NCR, by year-end, 1.1 msf (33.7%) of commercial space—mostly in Gurugram—will enter the market. With Jewar Airport’s 2025 debut, Noida's rentals could see a boost.

Below are the overall vacancy rates in India.

Source: IBEF, CREDAI

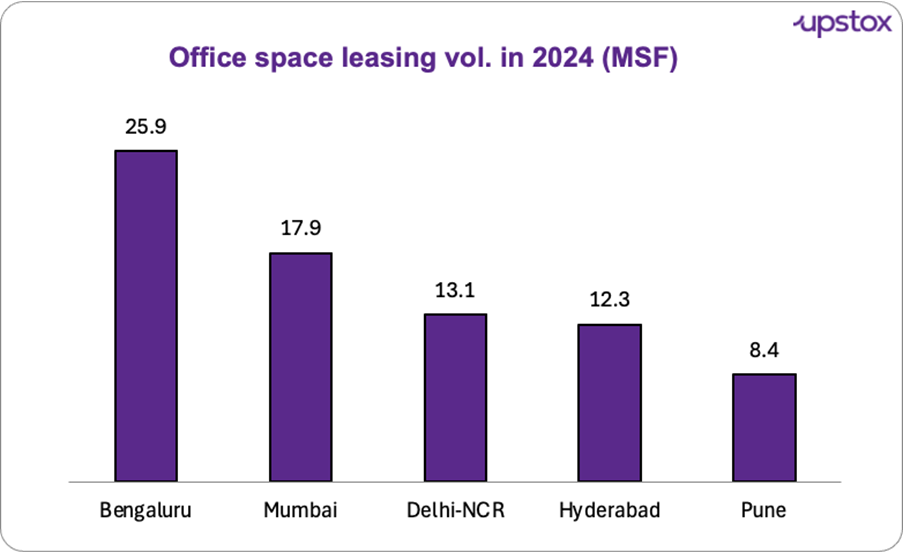

City-wise leasing volumes

Bengaluru, Mumbai, and Hyderabad recorded the highest-ever leasing volumes in 2024. Strong leasing activity and positive net absorption signal healthy demand, lowering vacancies, boosting rents, and spurring new developments. Bengaluru led the charge, accounting for 29% of India’s GLV, followed by Mumbai at 20% and Delhi-NCR at 15%.

Source-Hindustan Times

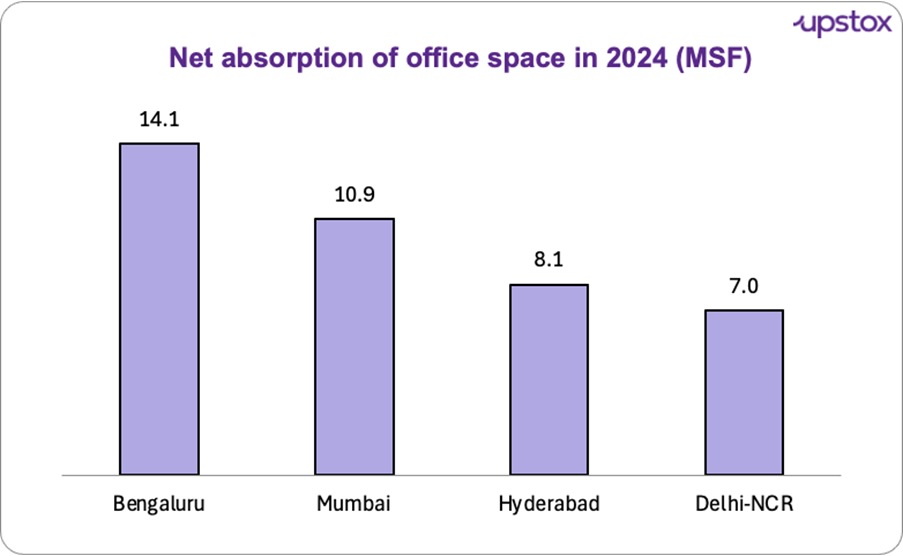

City-wise absorption rates

In 2024, net absorption also reached an all-time high of 50 msf, underscoring the strong demand for occupied office space. This marked a significant increase, surpassing the 2019 peak by 7 msf, highlighting the continued growth and resilience of the office space market.

While Bengaluru has the highest net absorption at 28%, its vacancy rates have marginally increased, reflecting accelerated development rather than waning demand. Mumbai, Hyderabad, and Delhi-NCR followed closely, each contributing to this rise in occupied office spaces.

Source-Hindustan Times

Is Chennai leading this market forward?

Source: IBEF, CREDAI

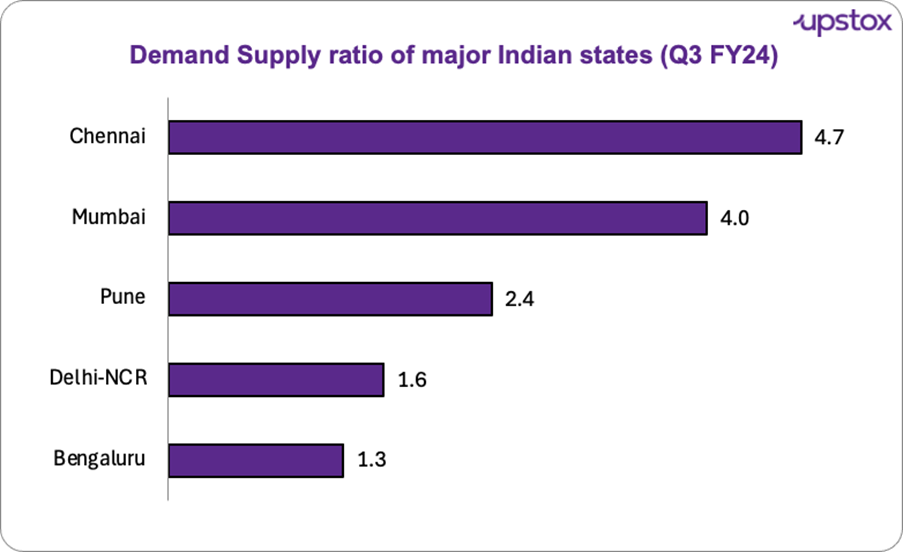

Chennai’s office market has the highest demand-to-supply ratio of around 4.7x, meaning that for every 1 unit of office space available, there is 4.7 times more demand. This reflects high demand and limited supply.

While overall leasing in In Q3 CY2024 was down about 35% YoY in Chenna, we note that large deals continue to remain prevalent. Of the total, 1.8 msf of absorbed office space, 42% of leasing activity came from large deals.

A decade ago, professionals in Chennai often moved elsewhere for career growth, but now, the rise of multinationals, a booming start-up culture, and global companies setting up GCCs have fueled opportunities locally. Companies like Shell, Qualcomm, and Hitachi Energy have committed to Chennai’s office space market.

Co-working & Flexible office spaces

With startups and SMEs seeking flexibility, co-working spaces now contribute 19% of leasing activity, a trend that shows no signs of slowing.

Recent industry data from June, 2024 reveals a 7% increase in co-working space leasing during the initial quarter of 2024, constituting a noteworthy 22% share of the overall office space demand.

This growth is largely due to startups and SMEs that benefit from reduced operational costs and the flexibility of not being tied to long-term leases. Co-working spaces offer cost-effective flexibility with bundled amenities like utilities, internet, and maintenance.

Future outlook

By 2030, India’s Grade-A office market is projected to reach 1.2 billion sq ft (~800 MSF as of now), fueled by the rise of hybrid work, booming tech, and a co-working surge. As businesses seek premium spaces, tier-2 and tier-3 cities are stepping up, offering cost-effective, well-connected hubs.

With government support and investor confidence soaring, India’s commercial real estate is on a path to dynamic, long-term growth.

Hurdles in India's office market

Bengaluru and Delhi-NCR’s Grade-A office developers are navigating a perfect storm—rising costs, delays, and talent shortages slowing project deliveries.

In Bengaluru, hotspots like MG Road and Koramangala see soaring rents as big firms scramble for space, yet geopolitical shifts and wavering foreign investments cast a shadow.

Meanwhile, hybrid work is rewriting the leasing playbook, pushing demand for flexible offices. As developers juggle economic hurdles and evolving workplace needs, the game is all about adaptability.

About The Author

Next Story