Upstox Originals

Sky high or grounded? Decoding the valuations of large, mid and smallcap indices

.png)

3 min read | Updated on May 07, 2024, 14:04 IST

SUMMARY

The NIFTY Midcap 150 Index and NIFTY Smallcap 250 Index fell by ~6.4% and ~10.6%, respectively, in just 6-7 trading sessions of early March 2024 on concerns of overvaluation. However, since then, they have scaled new peaks. In this article, we try to analyse if there are pockets of overvaluation in the small and midcap segments of the market or not.

Are the Indian smallcap and midcap indices overvalued?

Over the past three financial years (FY22 to FY24), the NIFTY 100, NIFTY Midcap 150 and NIFTY Smallcap 250 have delivered a total return of ~58%, ~107% and ~118% respectively.

This would lead investors to ask a very pertinent question: are these indices overvalued? What does the historical trend indicate?

To answer that question, we analyse historical P/E trends going back the past three financial years.

But at the outset, here are two disclaimers:

- We have considered the data from April 2021 since the indices’ valuation methodology was changed towards the end of March 2021.

- We have used trailing EPS due to data availability. We caution investors that besides earnings growth, other factors like market sentiments, economic conditions, and investor expectations about future earnings also impact valuations.

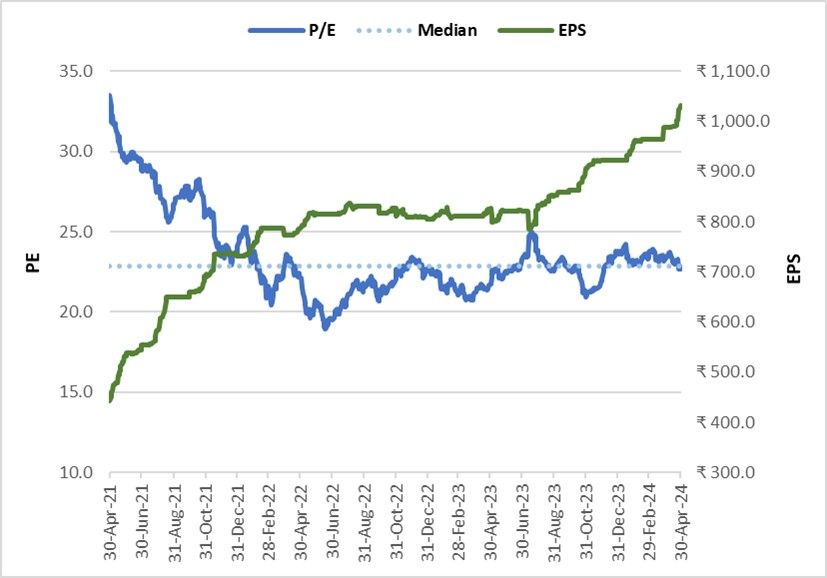

NIFTY 100 index

Despite its 58.4% rise over the last three years, the NIFTY 100 index is still trading around its median PE of the past three years. Earnings have grown by around 123.6% in the same period, implying that performance is backed by the underlying fundamentals.

NIFTY 100 valuations increase (since 2022) supported by rising earnings

Source: www.niftyindices.com

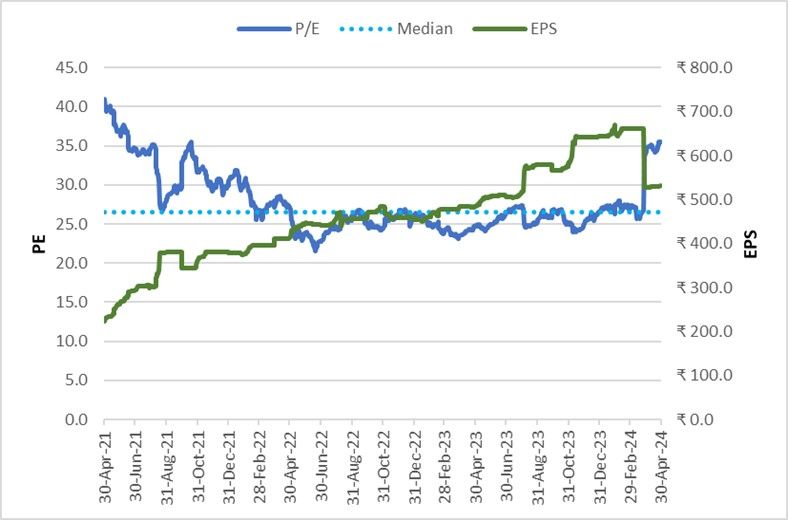

NIFTY Midcap 150 index

The index value itself has grown 107% in the last three years, even though the earnings have grown by around 235.4%. We note that the chart below shows a sudden increase in the P/E ratio on March 28, which is due to the rebalancing in the index. Adjusting for rebalancing, the P/E ratio is at a ~8.0% premium over its median value of 26.5 in the past 3 years. This leads us to believe valuations are slightly overvalued.

Sharp rise in NIFTY Midcap 150 EPS

Source: www.niftyindices.com

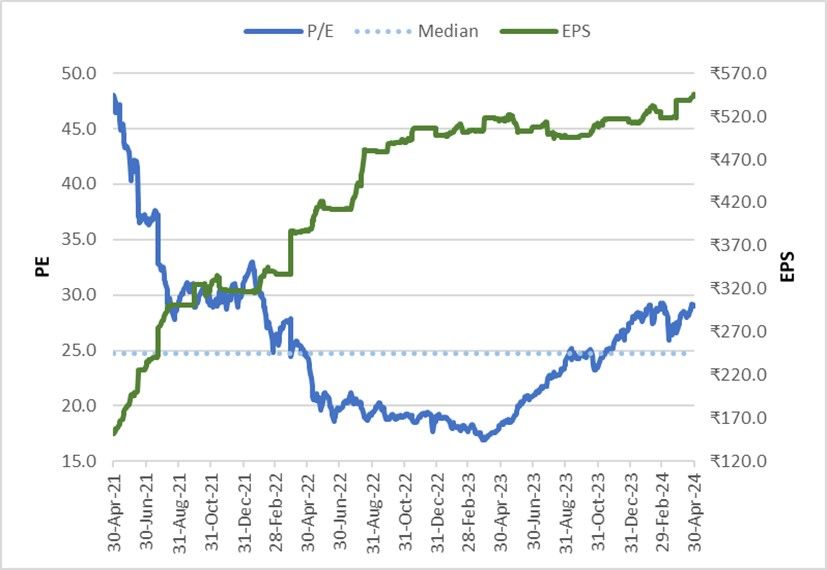

NIFTY Smallcap 250 index

In the last three years, NIFTY Smallcap 250 has risen by 117.8% and is trading at a PE level of 28.9x, which is 17.4% higher than its median PE of 24.6x. In the same period, the earnings have grown by 260.7%

NIFTY Smallcap 250 EPS vs PE

Source: www.niftyindices.com

Conclusion: Our analysis leads us to conclude the following:

NIFTY 100 index: Fairly valued NIFTY 150 Midcap index: Slightly overvalued NIFTY 250 Smallcap index: Overvalued

What should investors do? Despite index-level valuations, investors can potentially find opportunities within the constituents of these indices. Our aim with this article is to point towards those segments, where the probability of finding opportunities is higher.

Besides, these three indices together cover about 500 of the companies within the universe of over 5,000 listed companies. Thus, investing opportunities beyond these 500 companies will also definitely exist, although they could be riskier propositions (given their size). Hence, investors should assess their own risk appetite before making any decisions.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story