Upstox Originals

Decoding India’s banking liquidity crunch

.png)

8 min read | Updated on March 03, 2025, 19:54 IST

SUMMARY

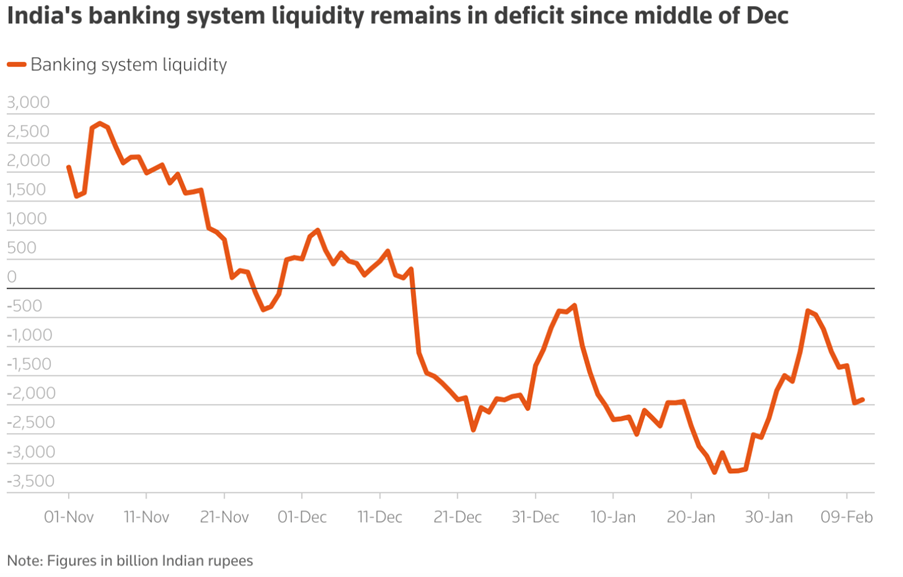

On Jan 23, 2025, the liquidity deficit in Indian banking soared to ~₹3.15 trillion, the worst in 15 years. What does this mean? Are banks running out of money and what’s behind this crunch? From tax outflows to forex moves, multiple forces are draining cash. The RBI's actions have softened the blow, restoring some stability. In this article, we take a deep dive into this phenomenon and its impact on both business and markets.

India's liquidity deficit has eased from ~₹3.15 trillion in Jan 25 to ~₹1.81 trillion in Feb

Recent news has been highlighting how India’s banking system has navigated a period of intense liquidity strain, with cash shortages reaching multi-month highs. In this article, we take a deep dive into the situation and assess its impact on the overall economy and the markets.

Why is this critical?

Liquidity is the lifeblood of the economy. A smooth and calibrated flow of liquidity ensures that banks have enough money to lend - thus boosting credit. It also ensures that interest rates are under control, which is a key factor that helps boost consumption.

Both these factors are critical as they give corporates the confidence to spend on capital expenditure. Thus spurring a virtuous cycle of economic growth.

What is the current situation?

As can be seen from the chart below, Indian banks are facing a liquidity crunch, which has constrained their ability to support growth. On January 23, 2025, the liquidity deficit peaked at ₹3.15 trillion, marking a 15-year high. On a positive note, as of February 27, 2025, the crunch has eased to around ₹1.81 trillion.

Source: Reuters

What is a liquidity deficit?

In banking terms, “liquidity” refers to the availability of cash and cash-equivalents that banks use to lend, invest, and meet obligations. A liquidity deficit - happens when banks don’t have enough free cash to meet short-term needs—like having more bills to pay than money in hand.

Wait, so banks don't have money?

Not really. To fill this deficit or bridge this gap, banks will have to borrow this money from the RBI through various liquidity tools. These measures help banks meet short-term funding needs, but prolonged liquidity stress can increase borrowing costs and impact credit availability in the economy.

What sparked the liquidity crunch?

A financial squeeze doesn’t happen overnight - it’s the result of multiple forces pulling cash out of the system. Below are some major factors that have caused the recent crunch:

-

Advance tax outflows: Every quarter, businesses must pay advance taxes based on their estimated income. In December 2024, corporations paid over ₹3 trillion in advance taxes, significantly reducing available liquidity. Since these funds are transferred to the government’s account with the RBI, they temporarily exit the banking system, tightening liquidity conditions.

-

Festive season withdrawals: Festivals bring increased spending, and with it, higher cash withdrawals. Whether for shopping, travel, or large-ticket purchases, the public moves money out of banks, reducing the overall liquidity. This effect is amplified during major festive seasons like Diwali, Christmas, and New Year, where cash demand surges.

-

RBI’s forex market intervention: To stabilise a falling rupee, the RBI intervened in the forex market by selling dollars. Per Nomura estimates, between Oct 2024 and Jan 2025, the RBI has spent as much as $80 billion (sourced from various avenues) to help stabilise the rupee. When the RBI sells dollars, it absorbs rupees from the system, reducing liquidity. This move helps prevent excessive rupee depreciation but also tightens banking liquidity.

-

Slow deposit growth: One of the reasons for the liquidity crunch is sluggish deposit growth, limiting the funds available to banks. For the quarter ended December 2023, banks reported a deposit growth of 9.9% YoY, the lowest since March 2023. What this means is a double whammy - not only are banks seeing a heightened pace of withdrawals, but the pace of deposits (inflows) for banks has also slowed down

-

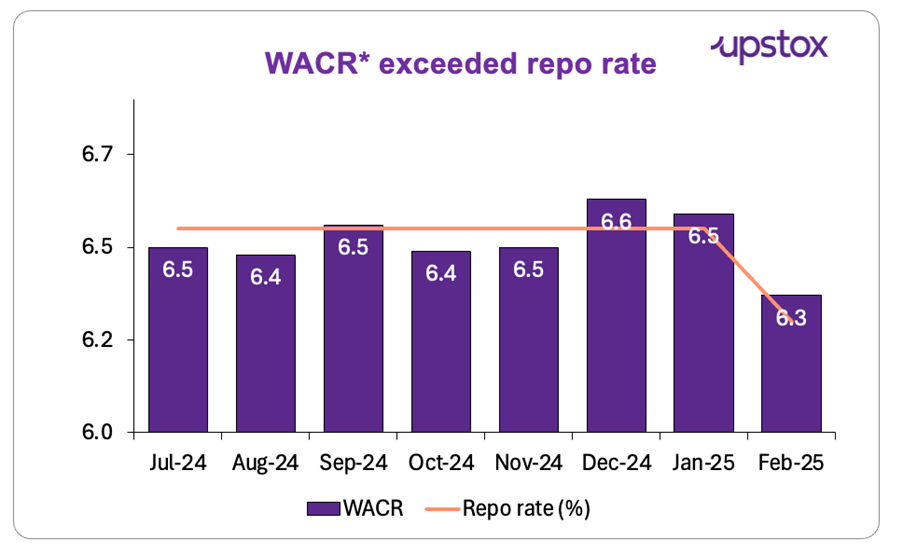

Higher interest rates: One of the most important measures of liquidity stress in the banking system is the Weighted Average Call Rate (WACR) - the interest rate at which banks borrow from each other overnight. Ideally, WACR remains close to the RBI’s repo rate (rate at which RBI loans money to banks). However, when liquidity tightens, banks struggle to secure funds, causing WACR to rise above the repo rate. This signals higher short-term borrowing costs, reduced cash availability, and increased financial strain on the banking sector.

Source: Economic times; *WACR: Weighted Average Call Rate

The consequence of a drying cash flow

The ongoing liquidity strain is tightening financial conditions, making borrowing costlier and slowing down economic momentum. Let’s take a closer look:

-

Rising borrowing costs – Banks are fighting for scarce funds, pushing up short-term interest rates. “There is no liquidity in the system, deposit growth is slow, and stresses are elevated”, warned Axis Bank CEO Amitabh Chaudhry. Higher funding costs make loans more expensive for businesses and individuals alike.

-

Profit squeeze for banks – With banks paying more to secure liquidity, their margins are under pressure. This means lower profitability, leading to tighter lending conditions. When cash dries up, spending slows down – With money harder to come by, both businesses and individuals are cutting back on spending. This slowdown in consumption can weaken overall economic momentum.

-

NBFCs on shaky ground – Shadow banks, which rely heavily on borrowing, are now forced to pay higher rates to raise funds. “NBFCs, which fund a large part of tier-2 and tier-3 economies, are struggling to get liquidity”, said Sanjiv Bajaj, Chairman & MD of Bajaj Finserv, in an interview at the World Economic Forum 2025 in Davos. This raises concerns over their ability to continue financing key sectors like housing and MSMEs.

The RBI steps in

From rate cuts to forex interventions, RBI is pulling multiple levers. Here’s how the RBI is fighting back against the liquidity squeeze.

CRR cut: Releasing more funds for lending

The Cash Reserve Ratio (CRR) is the portion of a bank’s deposits that must be kept with the RBI, limiting the amount available for lending. A higher CRR means less money in circulation.

In December 2024, the RBI reduced CRR by 50 basis points from 4.5% to 4.0%, injecting approximately ₹1.2 lakh crore into the system. This gave banks more room to lend, helping businesses and individuals access credit more easily.

Open market operations (OMO): Directly adding liquidity

Another major step was the use of OMO, where the RBI buys government securities from banks. When the RBI purchases these bonds, it provides banks with fresh liquidity, enabling them to extend more credit.

In January and February 2025, the RBI bought ₹60,000 crore worth of government bonds, helping to ease the cash crunch and stabilize short-term interest rates.

56-day VRR: Longer-term liquidity support

The 56-day Variable Rate Repo (VRR) is a longer-term liquidity support measure by the RBI. Normally, banks borrow from the RBI through VRR for 1 to 14 days at a variable interest rate.

However, in February 2025, the RBI introduced a 56-day VRR worth ₹50,000 crore to provide banks with more stability beyond short-term borrowing. This move helped ensure sustained access to funds, reducing financial stress in the banking system.

Rate cuts: Lowering borrowing costs

The Reserve Bank of India (RBI) reduced the repo rate by 25 basis points from 6.50% to 6.25% in its monetary policy review on February 7, 2025. This rate cut aimed to ease liquidity stress by making borrowing cheaper for banks. Lower borrowing costs encourage lending, improve cash flow, and boost credit growth, ultimately supporting economic activity.

USD-INR swap: Managing forex liquidity

To prevent excessive volatility in the currency market, the RBI also turned to foreign exchange interventions. The RBI conducted a dollar-rupee buy/sell swap for $5 billion in January 2025, with the transaction to be reversed on August 4. The RBI received bids worth five times the notified amount at $25.6 billion.

Here’s how it works:

- The RBI buys $5 billion from banks, injecting an equivalent amount of rupees into the system.

- After six months, it sells the $5 billion back, withdrawing the same amount of liquidity.

This move helps manage both rupee stability and liquidity levels, preventing excessive depreciation while ensuring that enough cash remains in circulation. To further manage forex liquidity and prevent excessive currency volatility, RBI conducted a $10 billion buy-sell swap on February 28, 2025, where successful bidders will hand over dollars on March 6, 2025, with redemption scheduled for March 6, 2028.

These swaps help stabilise the rupee, regulate liquidity levels, and ensure smooth financial market operations.

Liquidity lifelines don’t end here - the RBI has more tools in its arsenal, from repo rate cuts and relaxed MSF norms to strategic tweaks in the SDF rate. Even accelerating government spending can inject fresh cash, helping banks breathe easier and keeping the economy in motion.

Impact on markets

Liquidity stress has shaken market confidence, fuelling uncertainty and investor caution. Banking stocks took a hit as tighter financial conditions and higher borrowing costs kept pressure on sentiment.

Final thoughts

Will the liquidity squeeze ease, or are we in for a longer drought? Could we see more open market operations or even rate tweaks? Market watchers are on alert. But here’s the real challenge—how does the RBI inject cash without fuelling inflation? The next few months will reveal whether the central bank can walk this tightrope without tipping the economy off balance.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story