Upstox Originals

Decoding 2024 market performance: How does India stack up against its peers?

.png)

4 min read | Updated on December 28, 2024, 23:30 IST

SUMMARY

Mid and small-caps shined the brightest in 2024. They have registered returns of ~25-26% respectively in 2024, the highest among key global peers. This is after their ~11-12% correction from September to October of this year. Relatively large cap returns in 2024 have been modest (~10%), underperforming many of their global peers. In this article, we look at the likely reasons for the same and briefly discuss the outlook for 2025.

India’s NIFTY50 has delivered a ~10% return in the calendar year 2024.

Just like any year, both Indian and global markets have seen shifting trends, geopolitical strains, inflation and growth dynamics, and election results (and there were some surprises this year!). With bated breath, investors across the globe have waited on central banks to start cutting rates—a very will they won’t they situation.

That begs the question - how did the markets react over this year? This prompts us to look at some major markets and how they have fared in 2024.

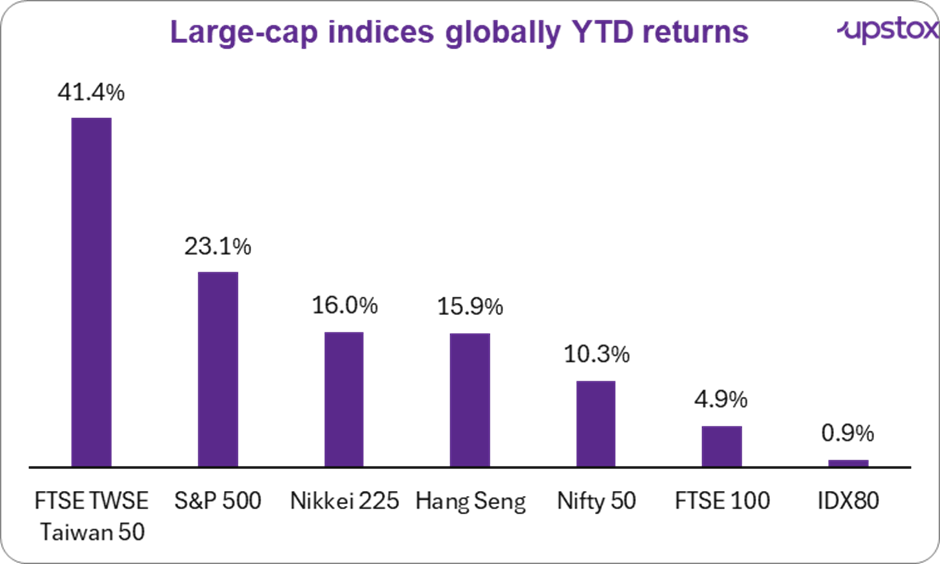

Large-cap

India’s NIFTY50 has delivered a ~10% return in the calendar year 2024. Markets were in a strong bullish trend for most of the year, rising almost 20% till the end of September. Since then they have however corrected about ~9% from their all-time high. While a correction like this is not an unusual thing, the timing (year-end) has painted the full-year returns in a slightly disappointing light.

Indian large-caps have had a relatively modest year even when compared to some of their key global peers. Countries like Taiwan (driven by optimism about its role in AI and its growing e-commerce industry) and the USA (driven by stronger-than-expected economic growth as well as by major tech stocks) have ended the year with a pole position in 2024.

At the other end of the spectrum we have the UK and Indonesia - both saw their performance impacted by inflation and poor results from some key players.

Source: Trading view, Factsheets; data as of December 18, 2024

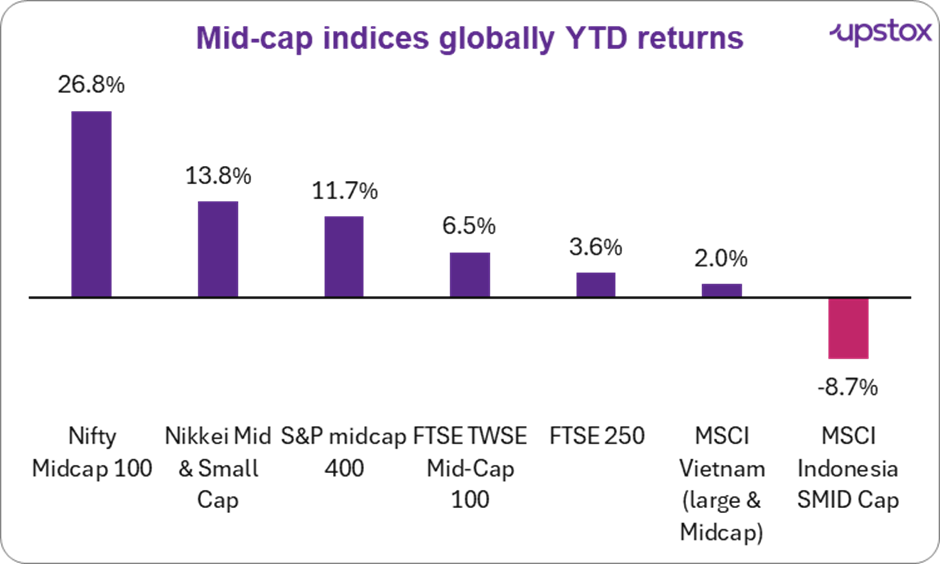

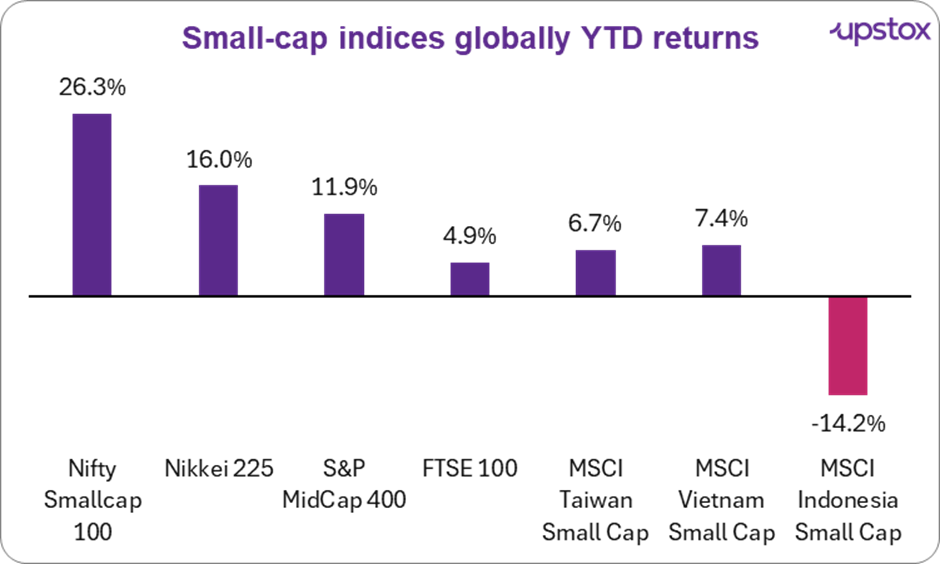

Mid and small-caps

While large-caps had a modest year, mid and small-caps are where India has shined in 2024. Both these indices have demonstrated robust returns (almost 2x of the large-cap returns), outperforming their global peers.

A few potential reasons for the same are:

-

Between FY21-FY24, the mid-cap ROE rebounded almost 800 bps (from FY21 lows) versus a 320 bps outperformance from large-caps.

-

Reported small-cap earnings in the past 2-3 years have compounded at a rate of ~20%, increasing investor confidence.

-

Indian markets have been in a strong risk-on mode, meaning that overall exposure to mid and small-caps has been consistently increasing. Not only FIIs, but even DIIs and retail investors have been increasing their exposure. We highlighted this in Will small and mid-cap steal the spotlight in 2025?

The strength and resilience of both these indices can be seen from the fact that after correcting ~11% and ~12% in September-October 2024, the Nifty Midcap and Smallcap have rebounded by ~5% and ~8% respectively.

Source: Moneycontrol, Yahoo Finance, FTSE Russell factsheet Marketwatch, MSCI, Data as of December 2024

Source: Moneycontrol, Marketwatch, MSCI, Data as of December 2024

What does 2025 have in store?

Our long-time readers know that we do not give any forecasts. That said, most of the analyst expectations for 2025 are optimistic. Growth is expected to pick up, inflation moderate ad FIIs could make comeback. Beyond the obvious (GDP, inflation) here are a few indicators investors should monitor:

-

Trends in government and private spending - critical to monitor, had slowed down in 2024 as it was an election year

-

Overall demand pick up - As highlighted in From fields to fortune, urban demand has been slowing down.

-

Monsoon expectations - As an agrarian economy, monsoons continue to be a key factor that impacts food production and overall rural demand

-

Policy decisions by the incoming USA government - Any potential tariffs or trade wars could hurt overall sentiment, and demand and therefore impact markets adversely.

-

Valuations - In the last few years, investors have largely ignored valuations. How often do you remember an expert that valuations are high? This is a very typical characteristic of a bull market. However, if the cycle turns, stocks and indices that are unable to justify their valuations could see sharper-than-expected corrections.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story