Upstox Originals

Coffee chains are brewing across India

.png)

6 min read | Updated on September 30, 2024, 23:31 IST

SUMMARY

Picture this: It's 3 AM, you're burning the midnight oil, and your eyelids are heavier than a sack of coffee beans. What's your savior? A steaming cup of coffee, of course! While tea has traditionally been the go-to drink, coffee shops are popping up everywhere in India. So, as you grab a cup, sit back, and enjoy the buzz, check out this article about coffee chains in India.

Coffee consumption has been increasing in India

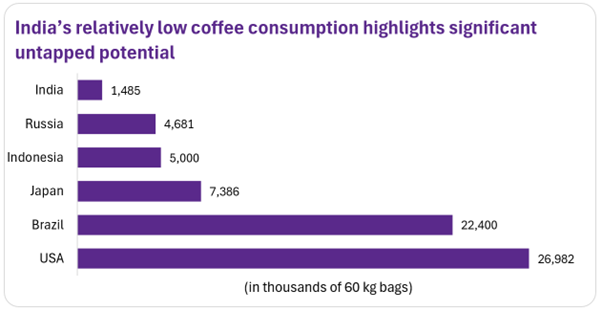

The Indian coffee retail market is valued at $601.5 mn in 2024 and is projected to grow at a CAGR of 8.1% to reach $961.5 mn by 2030. While the average person in India drinks about 30 cups of coffee a year, people in other countries drink around 200 cups! This underpenetrated market has the potential to unfold.

Source: World population review, Coffee consumption as of 2020-21

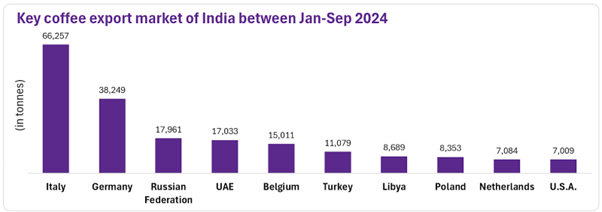

India is the world's seventh largest coffee producer, producing 4,30,320 tons in 2022-23. It's also the sixth largest coffee exporter, with 410,850 tons exported in the same year.

Let’s look at India’s major exporting nations.

Source: Coffee Board of India

Source: Coffee Board of IndiaBut, wait…

Even though India is mostly known for tea, did you know that filter coffee actually started here?

While filter coffees remain a local favourite across the country, the past couple of decades have seen multiple chains open and offer a unique experience. Expectedly these chains are largely prominent in urban India but are slowly and steadily making their way across the entire country.

Moreover, India's economy has been doing well lately, and that means more people have money to spend. This has led to a growing interest in premium products like coffee chains. Young people in India are also becoming more interested in international lifestyles, and that includes drinking fancy coffee.

A few other factors that have led to an increase in coffee consumption are: 1) Increase in sedentary jobs which has caused a spike in hot beverage consumption; 2) Multiple experts have touted health benefits of coffee consumption.

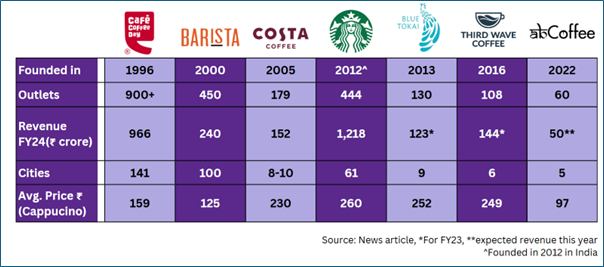

Let’s now look at some of the key players in the market.

Cafe Coffee Day (CCD)

A popular homegrown brand that stands out for its smart marketing strategies and varied café formats.

- Number of stores: Extensive presence with over 900+ varied types of cafes.

- Differentiation: CCD caters to various customer preferences with its CCD Lounge for a premium experience and CCD Square for quick service. Their ever-evolving menu includes international blends, seasonal specials, and region-specific items, keeping the experience fresh and engaging.

The company has faced some serious challenges in the past. Once a first mover, who revolutionized cafe culture in India is now facing stiff competition from emerging startups and shifting needs.

Barista

A well-established name aiming to expand aggressively.

- Expansion plan: Planning to add 60-70 new locations this year, aiming for around 800 in the next 4-5 years.

- Differentiation: Barista blends tradition with modern trends, focusing on a revamped menu, a growing grocery line, and a strong online presence. Their strategy includes expanding into smaller cities and keeping pace with evolving market trends.

Costa Coffee

A global coffee brand with a growing footprint in India.

- Expansion plan: Expanding with 60-70 new stores annually.

- Differentiation: Costa Coffee is experimenting with new locations, including airports and theatres in partnership with PVR INOX. Their strategy involves broadening their reach and offering diverse coffee experiences to attract a wide customer base.

Starbucks

A global coffee giant with a strong international presence, in partnership with Tata Consumer Products is targeting tier 2 and 3 cities.

- Expansion plan: On track to open 1,000 stores by 2028.

- Differentiation: Starbucks excels with its global brand prestige and innovative formats like drive-thrus and 24-hour stores. Their loyalty program enhances customer engagement with exclusive discounts and product innovations.

Blue Tokai

Pioneer in specialty coffee, Blue Tokai is known for its direct trade with farmers and premium bean quality.

- Expansion plan: Expanding to 360 locations in the next 3 years.

- Differentiation: Known for its premium, farm-sourced beans, and online sales. Blue Tokai partners with luxury hotels and restaurants, and even offers ready-to-drink coffee in cans, catering to the high-end market and convenience seekers.

Third Wave Coffee

Coffee shop about quality and authenticity that brews beans in their special way to bring out the best flavours.

- Expansion plan: Goal to open 50 new stores within the next 12 months

- Differentiation: They create a really cool atmosphere where you can learn about coffee and connect with other people. It's a different kind of coffee shop experience that focuses on the craft and the love of coffee.

AbCoffee

A new entrant focused on speed and convenience.

- Expansion plan: Plans to open 150 stores by the end of 2024, with an ambitious goal of 10,000 cafés in a decade.

- Differentiation: AbCoffee revolutionizes the coffee experience with ultra-fast service—coffee in just 1.5 minutes. Their tech-forward approach includes ordering via phone or QR codes, partnerships with Swiggy and Zomato for delivery and focuses on affordability with local bean sourcing.

Coffee shop struggles: A bitter reality

Coffee shops are becoming popular, especially among young people aged 18-35. But running a coffee shop isn't as easy as it looks.

-

High costs: According to Propreturns (one of India's top commercial real estate marketplace), it costs around ₹15-20 lakh to start a small café. And a franchise may cost anywhere between ₹15 lakh and ₹1 crore. Depending on the popularity of the brand and what is being served, one may need a good location, seating space and even a kitchen. And the rent for good spots can be sky-high! As per Magicbricks, rental prices have increased 16% YoY in 13 major cities.

-

Too many competitors: There are many coffee shops in India now, so it’s tough to stand out. Some are big chains like Starbucks, while others are smaller, local places. And don't forget about tea! It’s still a popular drink in India and competes with coffee.

Conclusion

India's coffee culture is on the rise. This growth, however, comes with its own set of challenges—high costs, fierce competition, and the deep-rooted preference for tea. Despite these hurdles, the market's potential is clear. As coffee consumption grows and key players innovate with unique offerings and strategic locations, they're well-positioned to expand their footprint.

Ultimately, the rise of coffee culture in India is not just about expanding the market, but also about redefining how and why people choose coffee in a country where tradition and modernity blend in a rich tapestry of flavours.

About The Author

Next Story