Upstox Originals

Chasing the sun: A look at India’s solar aspirations

.png)

9 min read | Updated on September 18, 2024, 12:49 IST

SUMMARY

Did you know India houses the world’s largest solar power plant? India has set ambitious targets for its solar aspirations - targeting ~293 GW by 2030. While India has made great strides towards this target, we still have a long way to go and challenges to overcome. In this article, we chronicle India’s journey so far and look at the solar landscape in the country.

India has set ambitious solar targets

Solar has always been the next big thing in India.

Go back and think of your school/college days, you will remember some science projects that spoke about or showcased solar power. Multiple institutions have created or imported small solar lamps that can help bring relatively inexpensive electricity to villages across India

Given India’s geographical layout, we are well-positioned to take advantage of this non-fossil energy provider.

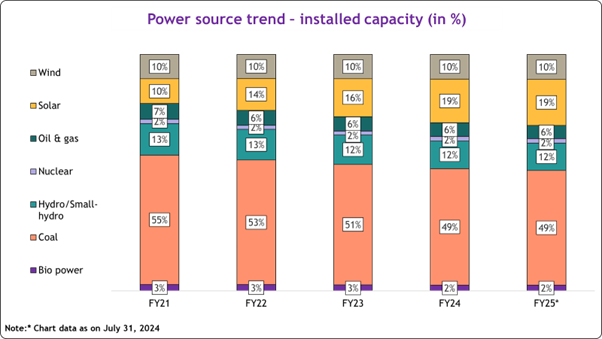

As of July 31, 2024, the energy mix distribution consists of various sources, with coal being the largest contributor, followed by solar, wind, and hydro. From ~10% in FY21, India’s installed capacity for solar power is now around ~19%.

Source: India Climate & Energy Dashboard, Ministry of New and Renewable Energy

India is conscious of its emissions and consequent environmental impact. As such, the government has set an ambitious target of 500 GW of renewable energy by 2030. In the energy mix, solar energy is expected to do a bulk of the heavy lifting and is expected to account for ~60% (293 GW) of the installed capacity.

As a step to achieve that, under the Prime Minister Modi's Pradhanmantri Suryoday Yojana (PSY), the government aims to install rooftop solar in 10 million households.

This leads us to inspect the current landscape - progress made, targets set and the challenges facing this major industry.

Before we start, some keywords to remember Gigawatts (GW) and Megawatts (MW) are units of power used to measure electricity generation and consumption.

- Megawatt (MW): 1 MW equals 1 million watts. It’s typically used to describe the power capacity of smaller facilities, like local power plants or renewable energy projects like wind farms.

- Gigawatt (GW): 1 GW equals 1,000 MW or 1 billion watts. This unit is used for larger-scale projects, such as national grids or large power stations. Both units help quantify energy output or consumption on different scales.

Ambitious milestones set by the government

The Jawaharlal Nehru National Solar Mission was set up in 2010, aiming to generate 20 GW of solar power by 2022. In 2015 this goal was revised to an ambitious 100 GW by 2022, which includes 40 GW from rooftop installations and 60 GW from grid-connected projects.

The mission’s focus is three-pronged - 1) develop solar infrastructure; 2) enhance solar manufacturing and 3) reduce solar power generation costs.

The goal - position India as a leader in renewable energy!

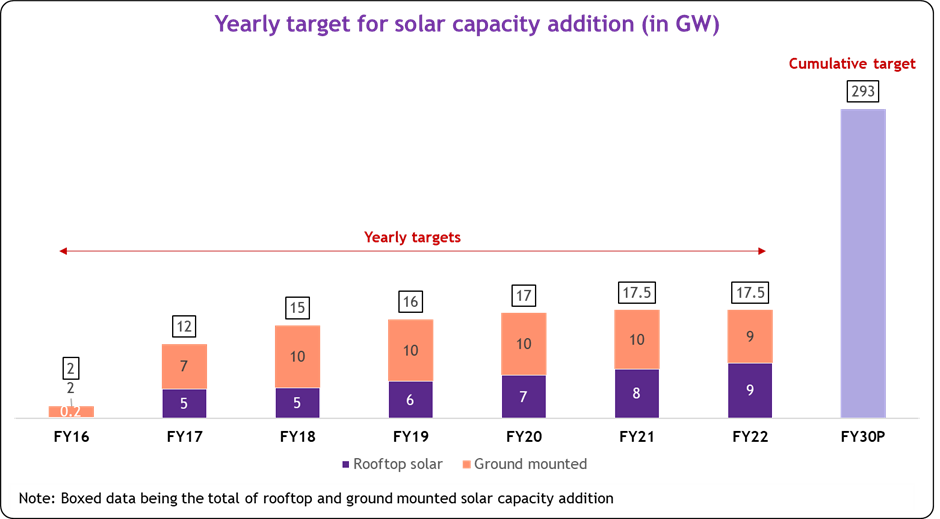

As you might have already guessed from above, with regards to solar infrastructure, the targets are divided into two categories:

- Rooftop solar- panels are installed on the roof of a building. They can save space and they're usually less expensive to set up than ground-mounted panels.

- Ground-mounted solar- panels are installed on the ground using various tools such as pipes, tubing, or poles that are required to hold the panel on the ground.

Milestones versus actuals - How has India fared?

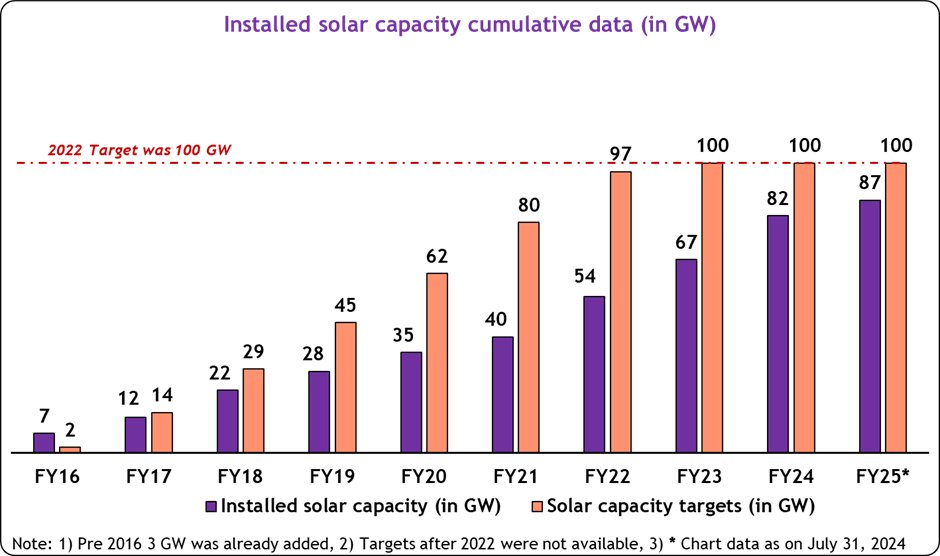

As of July 2024, India has achieved ~87 GW of installed capacity. While still below the 100 GW mark, India has shown remarkable progress and a pace of growth. The chart below provides a clear overview of the rapid expansion in India's installed solar capacity from FY16 to FY25 (till July 2024). Early in the decade, solar capacity saw relatively modest growth, but from 2016 onwards, there was a sharp acceleration.

Source: India Climate & Energy Dashboard, Ministry of New and Renewable Energy

What does this mean for the 2030 target?

As mentioned above, India needs to achieve an installed solar capacity of ~293 GW by 2030. Basis the currently installed capacity of ~87 GW, which implies an annual capacity addition of ~26 GW.

This presents a significant challenge for India, given the average annual addition of only ~14 GW over the past 4 years (FY21-24). The chart below shows the annual solar energy targets.

Source: Ministry of New & Renewable Energy

This begs the question - what are some of the key challenges in these capacity additions? Which hurdles must India overcome to achieve these targets?

Let’s take a look.

-

Import reliance: In the last three years, China has accounted for ~82% of India's total imports of photovoltaic cells. While domestic manufacturing has definitely increased, costs of these locally made cells are still higher than imported ones.

-

Complex approval process: Stricter rules for connecting new solar projects to the power grid have slowed down the approval process to ensure grid stability. Besides that, obtaining permission to connect solar farms to the grid involves a time-consuming and complex procedure, requiring adherence to updated standards.

-

Land availability and acquisition: Finding suitable land for large solar farms is challenging due to environmental and social regulations.

-

High ROI period: Depending upon the project's scope, it is estimated that the payback period can range from 5-12 years. Such a high gestation period also serves as a deterrent.

-

Lack of financing: Given the aforementioned challenges, lenders have stayed away from this sector. The lack of financing solutions and options has is a major deterrent to this industry’s growth. Increased financing options by banks and financial institutions could help small and medium businesses (MSMEs) looking to install rooftop solar panels. The current offering allows MSMEs to access SIDBI's loans for solar installations and energy-efficient upgrades. Loans up to ₹7.5 crore are offered at 7%-8% interest, with no processing fees and 25% margin money.

-

Rooftop solar challenges: Rooftop solar installations face slower growth due to inconsistent government policies on selling back excess electricity and complicated subsidy processes.

-

Workforce shortages: Rooftop solar systems remain expensive, and there is a shortage of skilled workers for installation and maintenance.

Although the list of challenges is extensive, we have reason to remain optimistic. India has demonstrated significant successes, with the Bhadla Solar Power Park being a prominent example. Let’s take a look.

Bhadla Solar Power Park - Case study of a successful solar park

What it is: The Bhadla Solar Power Park, located in Rajasthan, India, is the world's largest solar park, with a generation capacity of 2,245 MW spread across 5,783 hectares.

Who financed it: The project received investment from institutions such as the Asian Development Bank (ADB) and the International Finance Corporation (IFC).

Who all were involved: It involved various solar power developers (SPDs), including Aditya Birla Renewables, Sun Gold Energy, and NTPC Renewable Energy Ltd, among others.

What is the progress: The development of the Bhadla Solar Power Park began in phases. Phase 1 started in 2017 with 65 MW of installed capacity, followed by 680 MW in Phase 2, and 1,000 MW and 500 MW respectively in Phases 3 and 4. The project was fully completed in December 2018.

Effects

Positives:

- Renewable energy: Bhadla Solar Park significantly boosts India's renewable energy capacity, reducing reliance on fossil fuels.

- Global recognition: The park has attracted international attention, positioning India as a leader in renewable energy.

- Job creation: The project has generated jobs in solar energy production and transmission, though these are somewhat limited.

Negatives:

- Land displacement: The project displaced local communities, disrupting traditional agricultural and grazing activities.

- Environmental impact: The clearing of large land areas has affected ecosystems, and reliance on the Indira Gandhi Canal for water raises sustainability concerns. -Limited local benefits: Despite the park's scale, nearby communities have seen little improvement in electricity access or economic opportunities.

Key players

Finally, let’s look at some of the key players in this industry. Please note, this is not an exhaustive list.

List of solar EPC companies

| Name | Market Cap (₹ Cr) | 3Y Sales CAGR (%) | Order Book (₹ Cr)* | OPM Margins (%) | ROE (%) | EV / EBITDA |

|---|---|---|---|---|---|---|

| Sterling and Wilson Renewable Energy | 17,697 | -16 | 8,080 | <0 | -56.7 | 131.4 |

| Waaree Renewables | 14,980 | 307 | 3,200 | 24 | 93.3 | 69.8 |

| KPI Green Energy | 10,980 | 116 | 2,223 | 33 | 29.6 | 28.5 |

| Oriana Power | 4,149 | 125 | 900 | 21 | 169 | 50.5 |

| Gensol Engineering | 3,511 | 147 | 1,448 | 24 | 20 | 15.5 |

| Average | 10,263 | 135.8 | 3,170 | 25.5 | 51.04 | 59.1 |

Source: Screener.in; *Note: Order book as per latest company disclosures, Market Cap as on 16-09-24

List of solar energy production and distribution companies

| Name | Market Cap (₹ Cr) | 3Y Sales CAGR (%) | OPM Margins (%) | EV / EBITDA | ROE (%) |

|---|---|---|---|---|---|

| Adani Green Energy | 3,05,560 | 43 | 79 | 40.8 | 17.1 |

| TATA Power | 1,41,330 | 23 | 17 | 13.1 | 11.3 |

| JSW Energy | 1,34,141 | 18 | 47 | 26.5 | 8.4 |

| SJVN Ltd | 51,186 | 1 | 71 | 29.6 | 5.9 |

| Zodiac Energy | 928 | 30 | 9 | 43.7 | 26 |

| Average | 1,26,629 | 23 | 44.6 | 30.8 | 13.7 |

Source: Screener.in *Note: Market Cap as on 16-09-24

Conclusion

India has covered a huge ground in achieving its solar ambitions. That said, we still need to address challenges that currently persist and are slowing down future installation growth. The success of the Bhadla power park has encouraged further investments. However, for sustainable growth, future projects must better address the social and environmental challenges observed in Bhadla.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story