Upstox Originals

Charging ahead: BluSmart’s role in India’s electric mobility ecosystem

.png)

6 min read | Updated on December 15, 2024, 00:01 IST

SUMMARY

Founded in 2019, BluSmart is revolutionising urban transport in India with its 100% electric ride-hailing service. Offering a clean, reliable alternative to traditional cabs, it operates a fleet of 7,000-8,000 EVs across Delhi-NCR, Bengaluru, and even Dubai. It is focussed on sustainability, promises zero ride cancellations, and transparent pricing. Besides that, it is also taking steps to build India’s charging infrastructure to support the growing demand for electric mobility.

BluSmart’s revenue model covers two main areas: electric taxis and charging stations

Founded in 2019 by Anmol Jaggi, Puneet Singh, and Punit Goyal, BluSmart is a 100% electric ride-hailing service with operations in Delhi-NCR, Bengaluru, and Dubai. Unlike the giants Uber and Ola, BluSmart is laser-focused on electric vehicles (EVs).

The company is endeavouring to replace fuel-guzzling taxis with zero-emission vehicles, making every ride a step toward a greener, more reliable future.

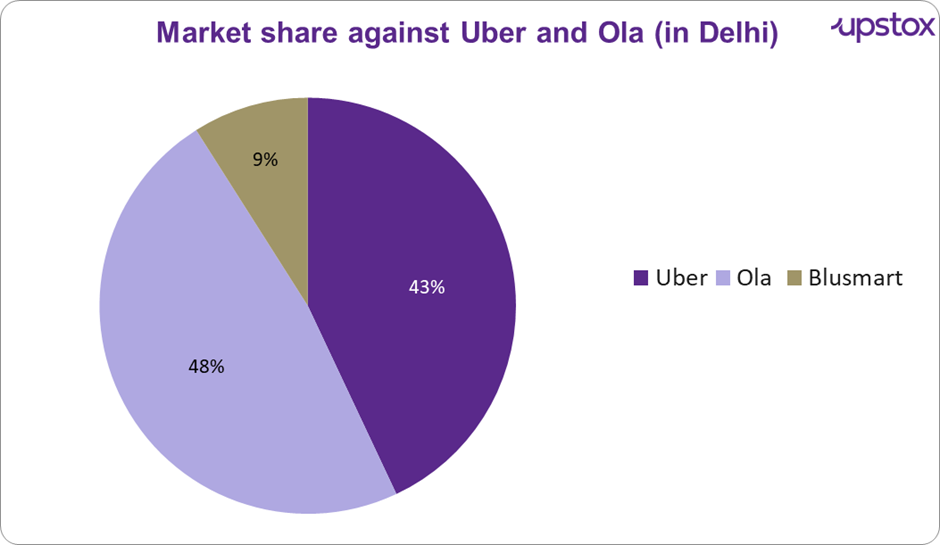

Market share

It currently holds an approximate 9% market share in Delhi's ride-hailing sector.

Source: News articles

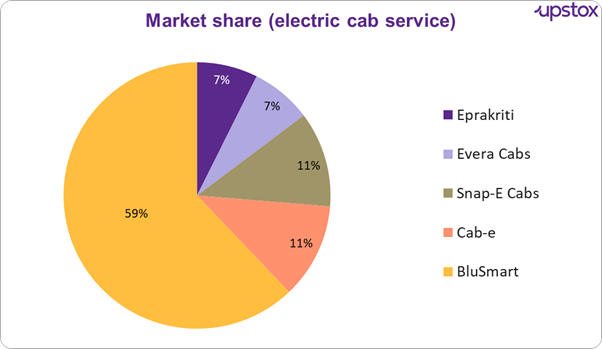

In the larger scheme, when we look at some other pure electric players in the ride-hailing peers, Blusmart’s market share looks more impressive.

Source: tracxn.com; latest available data

BluSmart’s business model

BluSmart operates on a business-to-consumer (B2C) model, offering ride-hailing services directly to customers. BluSmart’s revenue model is pretty straightforward and covers two main areas: electric taxis and charging stations. Their primary income comes from customer rides.

The vehicles are sourced from partners like EESL (Energy Efficiency Services Limited), a government enterprise, and high-net-worth individuals. Their fleet includes a range of popular electric vehicle models:

- Mahindra e-Verito

- Tata e-Tigor

- Tata Xpres-T EV

- Hyundai Kona Electric

- MG ZS Electric

But here’s where it gets interesting— BluSmart also integrates charging stations into its operations, not only to keep its own fleet running smoothly but also to offer charging services to other EV owners.

Unlike other ride-hailing services such as Uber and Ola, BluSmart employs salaried drivers. This ensures a consistent and professional service, as drivers are directly accountable to the company rather than operating as independent contractors.

Fleet size and charging hubs

BluSmart’s fleet has now expanded to 7,000-8,000 EVs. If you’re in Delhi-NCR or Bengaluru, you’ve probably seen their sleek, zero-emission cars on the roads.

They’ve set up 4,400 EV chargers across 36 superhubs, covering 1.5 million square feet in these cities.

Key competitors

Besides Uber and Ola’s ICE offerings, BluSmart also competes against:

-

Uber Green: Uber’s electric ride-hailing service, is rapidly expanding across major Indian cities.

-

Ola: India’s largest ride-hailing platform, making significant investments in electric mobility to transition its fleet towards sustainability.

-

Euler Motors: A commercial EV manufacturer with a focus on logistics and last-mile delivery, indirectly competing in the mobility space.

-

Zypp Electric: A startup providing electric two- and three-wheelers for delivery services and personal transport.

What’s the price tag?

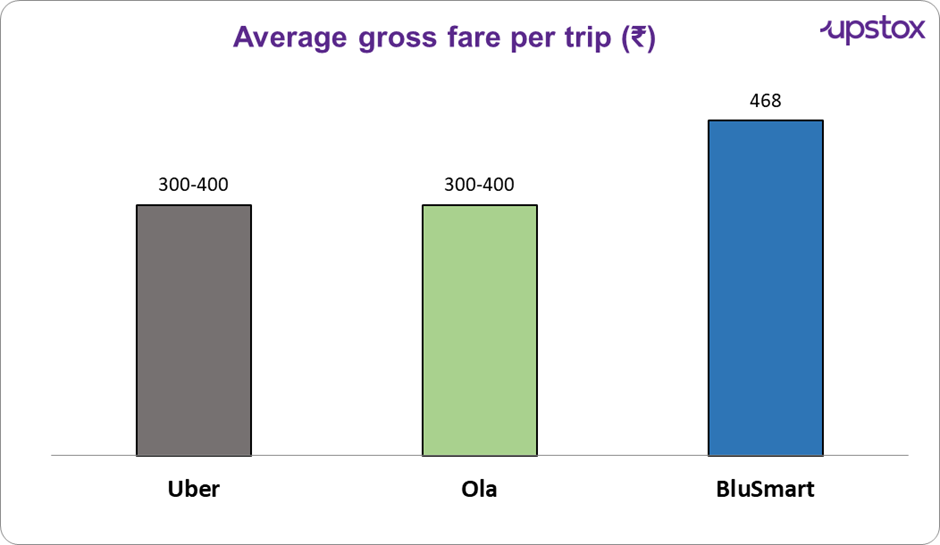

Here’s where things get interesting. A trip from Bangalore airport to Indiranagar Police Station, one of Bangalore's most happening areas with BluSmart premium costs around ₹1,532. Compare that to Ola prime ₹912 or Uber premier ₹1100. Sure, it’s a bit pricier, but you’re paying for more than just a ride.

This is also reflected in the average gross fare per trip for these companies. BluSmart has guided that it is aiming to increase these fares to ₹561 in FY25 (up 20% YoY)

Source: arcweb.com; data as of FY24

So wait, is BluSmart costlier? Yes. But hey, this is what you get by paying the premium

-

Limited surge pricing

-

A promise of no cancellations (although there are some reports lately)

-

A premium experience in some of the latest cars

Looking ahead: expansion and growth

What’s next for BluSmart? Expansion, of course! With Delhi-NCR and Bengaluru already covered, they’re setting their sights on Mumbai by the end of the year. It's a smart move considering that 68% of India’s mobility market is concentrated in these three cities.

Funding and growth trajectory

As of FY25, the company reported a 77% year-on-year growth in Gross Merchandise Value (GMV), reaching ₹275 crore in the first half of FY25.

BluSmart has attracted notable investors, including Swiss impact investor responsAbility and BP Ventures. its recent funding rounds include:

-

Bridge Round: $42 million, led by BP Ventures and responsAbility.

-

Pre-Series B Round: $24 million, with contributions from cricketer MS Dhoni and Green Frontier Capital.

Meet the founders

-

Anmol Singh Jaggi is also the co-founder of the Gensol Group, which operates in 14 countries, and holds a BTech in Energy Studies.

-

Puneet Singh is a seasoned entrepreneur with extensive expertise in renewable energy. He is the co-founder of Gensol Group and serves as a Director at Solarig Gensol Utilities, a JV between Solarig (Spain) and Gensol (India).

-

Punit K Goyal founded PLG Power Limited and PLG Clean Energy Projects. He is an active speaker at CII and IIT events and serves as the Chairman of the Confederation of Indian Industry (CII).

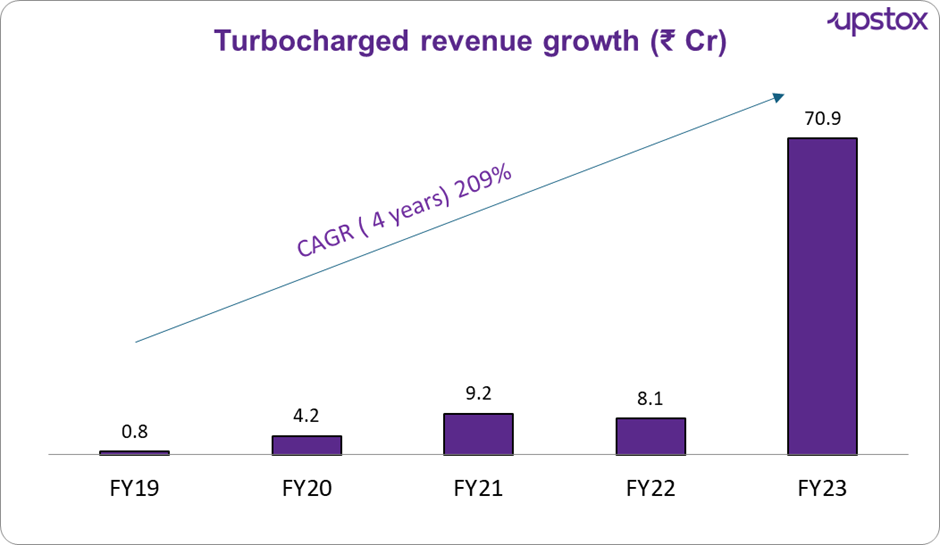

Financials

They also saw their gross revenue increase by 135% from ₹160 crore in FY23 to ₹376 crore in FY24. As can be seen below there has been an increase in their revenue boasting a CAGR of 209% over 4 years.

Source: tracxn.com; latest available data

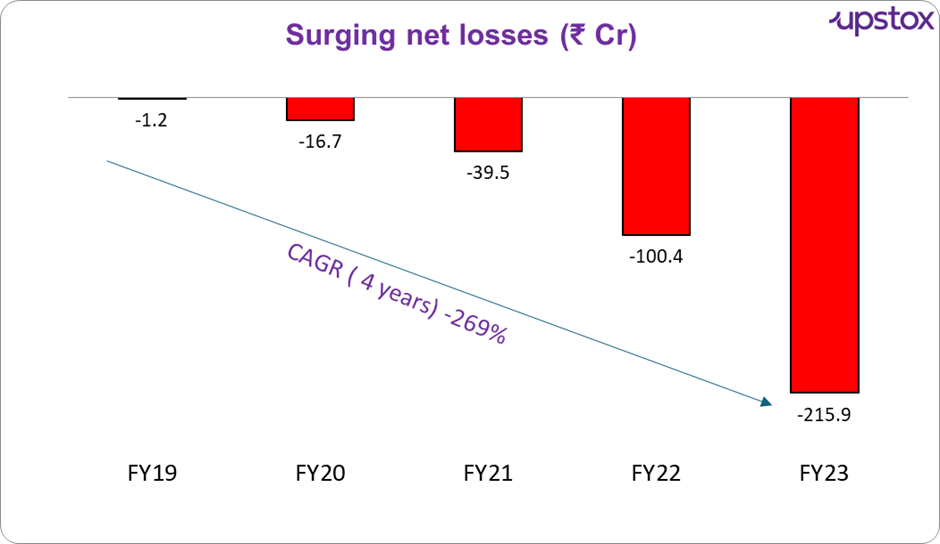

Their losses have been increasing steadily due to significant rises in expenses. However, they continue to push forward with their innovative and expansion plans, which could pay off in the future. They are expecting to turn profitable on an EBITA level by March 2026, as previously mentioned by Punit K Goyal in an interview.

Source: tracxn.com

Challenges facing BluSmart

While BluSmart has made significant progress, it faces several challenges:

-

Scaling the fleet The availability of EV and charging infrastructure limits the company's ability to scale rapidly. Demand often outpaces supply, leading to delayed services during peak hours.

-

High capital requirements Expanding operations, and building charging infrastructure requires significant capital investment.

-

Competition Ola and Uber are intensifying their focus on electric mobility with initiatives like Uber Green, posing a direct challenge to BluSmart. Euler Motors and Zypp Electric are also expanding in the electric logistics and ride-hailing segments, increasing competition.

Conclusion

At its core, BluSmart isn’t just about getting people from point A to point B. It’s about creating a future where mobility is clean, reliable, and accessible. With a focus on sustainability and customer experience, BluSmart is leading the charge—literally—towards a greener India.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story