Upstox Originals

Central banks can bring joy to the Stock Market. Here is how

.png)

4 min read | Updated on September 19, 2024, 11:06 IST

SUMMARY

Global inflation has fallen by ~50%. Global central banks are now considering rate cuts! In India, the situation is a little uncertain. While the RBI is still on a wait-and-watch stance, many market experts are now in favour of a cut. We do not speculate about the future, but here is something interesting we found. Our analysis shows that in the last 4 easing cycles, markets on average returned ~38% absolute returns. Read on to find out more

Markets have responded positively to a rate cut cycle

Basics first

If you read the most recent financial commentary or news, interest rate discussions are all the rage! Investors are waiting with bated breath - to see when the rate cut cycle begins.

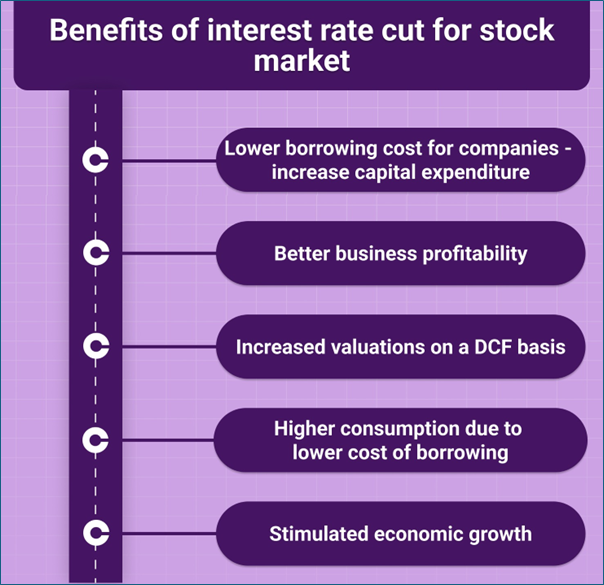

Why is that? A reduction in interest rates typically leads to an increase in the price of various financial assets. Two key explanations for this:

- As interest rates - or cost of funds - reduce, businesses can borrow at cheaper rates. This bolsters profitability

- Lower interest rates increase the present value of discounted cash flows leading to appreciation in the value of the business. See the example below

| Particulars | Scenario 1 | Scenario 2 | Scenario 3 |

|---|---|---|---|

| Annual Cash Flows (₹ crore) | 1.0 | 1.0 | 1.0 |

| Discount Rate (interest Rate) | 6% | 8% | 10% |

| Value of Business (Present Value of cash flows) | 16.7 | 12.5 | 10.0 |

Assumptions - The annual cash flow of the business is considered to be ₹1 crore. Period - 5 years. Note the example is for educational purposes only.

Something similar could happen now too..!

The Indian Monetary Policy Committee has kept rates unchanged since June 2023. Multiple market experts in India are also now in favour of a rate cut, suggesting that it could spur growth.

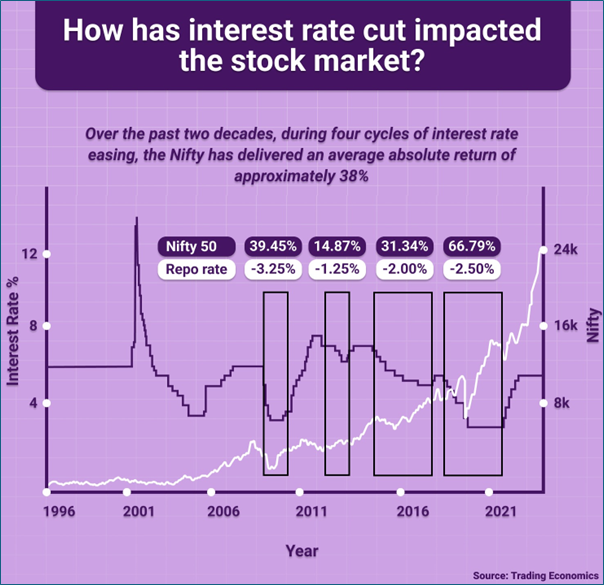

How does the Indian central bank’s interest rates affect the stock market? In the past two decades, India has seen 4 cycles of interest rate easing - continuous and contiguous rate cuts. In all 4 cycles the market has given positive absolute returns with an average return turns out to be ~38%.

| Time frame | Duration (no of days) | Repo Rate Change | Change in Policy Rate (bps) | Nifty absolute returns during the period |

|---|---|---|---|---|

| 11-10-2008 to 13-02-2010 | 490 | 7.5% to 4.75% | -325 | 39.5% |

| 10-03-2012 to 20-09-2013 | 559 | 8.50% to 7.25% | -125 | 14.8% |

| 15-01-2015 to 06-06-2018 | 1,238 | 8.0% to 6.0% | -200 | 31.3% |

| 07-02-2019 to 08-04-2022 | 1,156 | 6.5% to 4.00% | -250 | 66.8% |

| Average | 860.8 | NA | -225 | 38.2% |

Source: News articles, investing.com, press releases, RBI

To be sure, interest rates are just one of the many factors that impact the overall economy and stock markets. Factors like overall economic growth, capital formation, fiscal deficit, political stability, and macro-economic scenario - domestic and global - all of these play a role here.

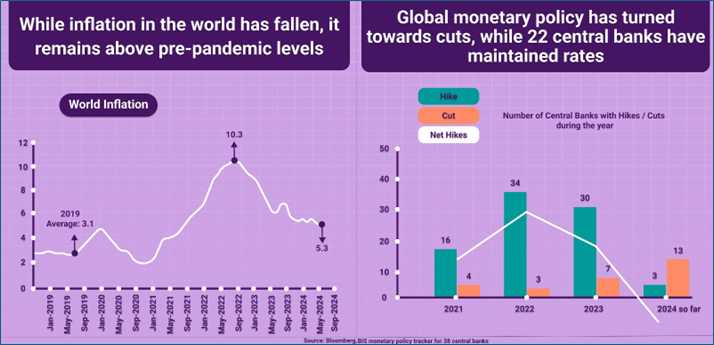

What's happening globally?

Globally central banks have either reduced interest rates or paused interest rate hikes since global inflation has fallen by almost 50% since Sept-23. Recently, the US Central Bank Chairman Jeremy Powell hinted towards a rate cut in Sept-24. In July 2024, he was quoted saying, “We've had three better (inflation) readings, and if you average them, that's a pretty good place." Bloomberg consensus estimates indicate a 0.25% rate cut in Sept-24.

Is there a catch?

Well, yes. Two points to consider.

While many market experts favour a cut, the RBI has still not made its intent clear. In fact in July 2024, Governor Das indicated that he would still like to see some easing in inflation and was quoted as saying, “It is too premature to talk about interest rate cuts.”

Secondly, Indian markets are near all times and valuations are stretched across most asset classes. Besides that, an interest rate cut has been expected for some time now and to a certain extent may also be priced into current market levels. As such, investors should take a more holistic approach before making any investment decisions. As we have highlighted above, interest rates are just one among the many factors that impact markets.

About The Author

Next Story