Upstox Originals

Big ticket IPOs: Unveiling the contrasting fortunes of Tata Technologies and IREDA

.png)

7 min read | Updated on December 03, 2024, 12:11 IST

SUMMARY

In our latest analysis of big-ticket IPOs, we explore the contrasting journeys of Tata Technologies and IREDA. While one of these has failed to trade above its listing price, the other has delivered superb returns. In this article, we discover the factors behind these divergent performances and what they mean for investors.

Stock list

Tracking the market performance of Tata Technologies and IREDA

In our article - From hype to reality, we analysed the performance of a few IPOs listed in 2023. In this article, we look at two relatively bigger IPOs that were also listed in 2023, created some buzz, and were well received.

Our aim is not to conduct a forensic analysis of these companies or pass judgments about their performance, products or execution.

But through these articles, we aim to make two simple points

-

Just because an IPO is over-subscribed, does not necessarily guarantee long-term success.

-

Just because you missed out on an IPO, does not mean you cannot participate in that company’s future growth story.

The surge in listings has created a FOMO for most investors who believe IPO investing to be the holy grail for making returns.

Unfortunately, that is not the case.

As with all investing, we urge and encourage investors to analyse companies basis their fundamentals, valuations, and prospects before making decisions.

With that context, we look at two more companies that were listed in 2023

The table below compares the IPO performance of Tata Technologies and IREDA and contrasts their post-IPO performance trajectories.

| Tata Technologies | IREDA | |

|---|---|---|

| IPO date | 30 November 2023 | 29 November 2023 |

| Issue size (₹ crore) | 3,042.5 | 2,150.2 |

| Subscription | 69.43x | 38.8x |

| Listing day performance | 140.0% | 56.3% |

| Current price* | ₹939 | ₹205 |

| % change from listing day close | -28.5% | 242.5% |

* as of November 26, 2024; Source: Chittorgarh, NSE, news articles.

Tata Technologies

Tata Technologies is a global leader in engineering, digital services, product development, and outsourcing. With a strong presence across Asia Pacific, Europe, and North America, the company collaborates with some of the world’s largest manufacturing enterprises.

Why was the IPO “hot”?

- Majority of brokers India recommended “Subscribe” for the IPO

- The Tata group brand and the rarity of a Tata group IPO after 19 years.

- Deep expertise in automotive industry and IT solutions.

- Focus on EVs and digital capabilities with proprietary accelerators.

- Global client base, including OEMs and new energy vehicle companies.

- Steady revenue growth over the last 3 years, driven by automotive, aerospace, and industrial machinery sectors.

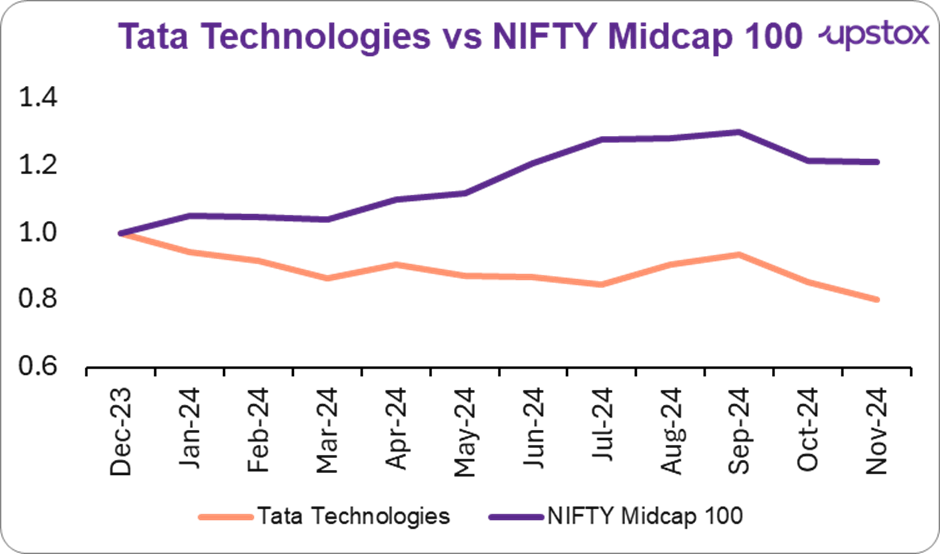

How has the stock performed?

The stock debuted at ₹1,200, an impressive 140% premium over its issue price of ₹500. However, despite the initial boom, the stock has underperformed expectations, delivering a negative return of -28.5% as of November 29, 2024. It has not reached its listing price since and continues to trend downward.

Sources: Investing.com

What went wrong?

-

The stock lost some early momentum due to profit booking. With ¬3.3 crore trades within an hour of listing, many IPO allottees quickly exited to realise profits.

-

The stock experienced a typical 'IPO disease' effect, where the stock price of a newly listed company experiences significant volatility (usually increase) for the initial few weeks, but the stock often underperforms in the medium to long term. Tata Technologies surged 17% on its listing day but then fell nearly 33% from its peak.

-

Smaller deal sizes: Caution from customers led to smaller deal sizes and slower ramp-ups, limiting revenue potential. This was largely due to:

- Decision-making delays driven by the strategic shift between electric vehicles (EVs) and hybrids

- Regulatory concerns regarding Chinese OEMs and European tariffs, making customers hesitant to commit to large, long-term projects.

-

The table below shows the financials for Tata Technologies for the last six quarters. For Q2 FY25, profit after tax has declined by -2.9% QoQ and -1.9% YoY, reflecting challenges in maintaining profitability despite a 2.2% QoQ and 2.1% YoY revenue growth for the same period.

-

The stock has basically not been able to live up to lofty investor expectations.

Tata Technologies’ financial performance

| Financial (₹ Cr) | Q1 FY24 | Q2 FY24 | Q3 FY24 | Q4 FY24 | Q1 FY25 | Q2 FY25 |

|---|---|---|---|---|---|---|

| Revenue | 1,258 | 1,269 | 1,289 | 1,301 | 1,269 | 1,296 |

| Operating Profit | 250 | 214 | 237 | 240 | 231 | 236 |

| OPM % | 20% | 17% | 18% | 18% | 18% | 18% |

| PAT | 192 | 160 | 170 | 157 | 162 | 157 |

Source: Screener

IREDA

Indian Renewable Energy Development Agency (IREDA) is a financial institution with over 36 years of experience in funding and supporting renewable energy, energy efficiency, and conservation projects. It offers a range of financial services covering all project stages, from initial planning to post-completion. IREDA also supports activities across the renewable energy value chain, including equipment manufacturing and energy transmission.

Why was the IPO “hot”?

-

Low NPAs through robust credit appraisal, risk-based pricing, and effective monitoring practices.

-

A key player in India's renewable energy initiatives, with 77.8% of its loans dedicated to commissioned renewable energy projects.

-

A 31% market share in renewable energy financing.

How has the stock performed?

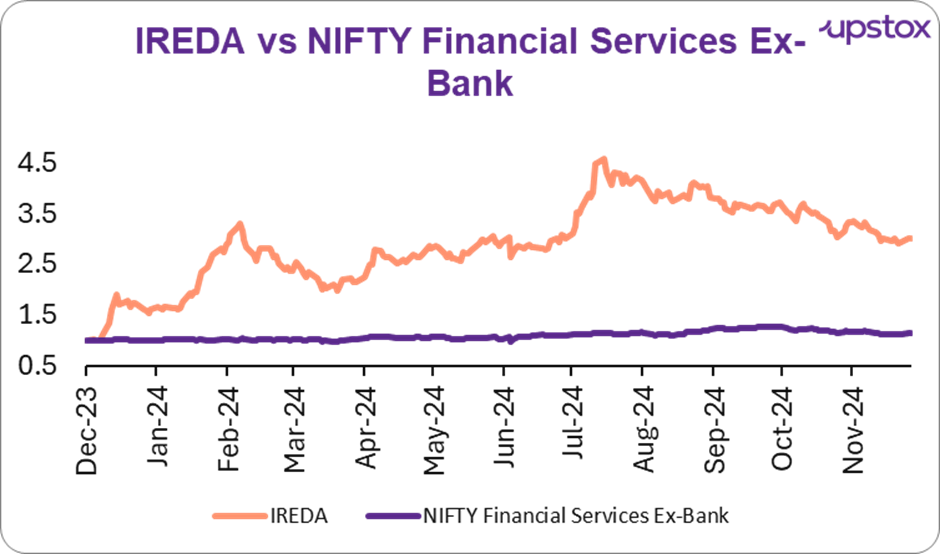

The stock was listed at ₹50, reflecting an impressive 56.3% premium over its issue price of ₹32. Since its listing, it has delivered a 242.5% return to investors as of November 29, 2024 and is consistently being traded above its listing price.

Sources: NSE, Investing.com

What has been driving performance?

-

It was granted Navratna status on April 26, 2024, enabling it to invest up to ₹100 crore or 15% of its net worth in a single project without needing government approval, offering greater financial autonomy and flexibility for growth.

-

It raised ₹1,500 crore through bonds which received an overwhelming response, being oversubscribed 2.7x. The strong investor response and successful bond issuance significantly boosted IREDA's share price.

-

The outlook for India's renewable energy sector is positive, driven by major policy announcements and ambitious targets, including 1) 500 GW of non-fossil fuel-based energy by 2030, 2) 1 Crore households for solar rooftop installation under "PM Surya Ghar: Muft Bijli Yojana" with ₹75,021 crore in funding, and 3) production of 5 MMT of green hydrogen annually by 2030 under the National Green Hydrogen Mission. As the largest pure-play green financing institution of the government, IREDA could benefit from these

-

Financials have shown a promising YoY growth for Q2 FY25, with PAT increasing by 36.2%, loan sanctions increasing by 206% and the loan book showing a remarkable 35.9% increase. It has reported its highest-ever revenue this quarter.

IREDA's financial performance

| Financial (₹ Cr) | Q1 FY24 | Q2 FY24 | Q3 FY24 | Q4 FY24 | Q1 FY25 | Q2 FY25 |

|---|---|---|---|---|---|---|

| Revenue | 1,143 | 1,177 | 1,253 | 1,391 | 1,510 | 1,630 |

| Operating Profit | 348 | 370 | 386 | 498 | 454 | 503 |

| Operating Margin % | 30% | 31% | 31% | 36% | 30% | 31% |

| PAT | 295 | 285 | 336 | 337 | 384 | 388 |

Source: Screener, Company fillings

Conclusion

In conclusion, the divergent paths of Tata Technologies and IREDA serve as a compelling reminder that the success of an IPO is not solely dictated by initial hype or oversubscription. While Tata Technologies’ post-IPO performance underscores the volatility and challenges of sustaining momentum in a competitive landscape, IREDA’s robust returns highlight the power of sectoral strength and strategic alignment with government initiatives.

For investors, these cases emphasise the need to look beyond the surface, carefully analysing fundamentals, market trends, and long-term potential before making investment decisions. A well-informed approach is the cornerstone of navigating the IPO market successfully.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story