Upstox Originals

Beyond the Nifty50: Unique indices for your next investment opportunity

.png)

6 min read | Updated on November 26, 2024, 12:30 IST

SUMMARY

Looking for options to diversify your investment portfolio? Or wondering how to find your next investment opportunity? In this article, we look at some unique indices that offer the opportunity to earn higher risk-adjusted returns and list methods of investing in these indices.

Exploring indices that offer a chance to diversify your investment and earn a better risk-adjusted return compared to peers

Investing in the stock market can be daunting, particularly for those seeking to outperform traditional benchmarks. While widely recognized indices like the Nifty 50 offer stability and exposure to blue-chip companies, there's a growing interest in alternative strategies that might provide higher returns.

In this part 2, we look at 3 other such indices that offer a chance to diversify your investment and earn a better risk-adjusted return compared to peers.

Nifty 500 Multicap Momentum Quality 50 Total Return Index (TRI)

This index selects the top 50 stocks from the Nifty 500 based on both momentum and quality parameters. The index combines the factors of momentum, measured by 6-month and 12-month price returns adjusted for volatility. They are further filtered by quality, which is assessed using ROE, D/E, and 5-year EPS growth consistency.

Nifty 500 Multicap Momentum Quality 50 Index performance versus peers

| Nifty 500 Multicap Momentum Quality 50 Index | Nifty 500 | Nifty 50 | |

|---|---|---|---|

| Return | |||

| 1 Year (Absolute Returns) | 53.7% | 36.3% | 26.8% |

| 5 Years (CAGR) | 28.0% | 19.8% | 15.3% |

| Risk (Standard deviation) | |||

| 1 Year | 20.1% | 14.5% | 13.4% |

| 5 Years | 19.0% | 18.4% | 18.9% |

Source: NSE. Data as of 31st Oct-24

Nifty500 Multicap Momentum Quality 50 has outperformed other major categories of MFs

| Nifty 500 Multicap Momentum Quality 50 TRI | Flexi Cap fund category avg. | Large & midcap fund category avg. | Multicap fund category avg. | |

|---|---|---|---|---|

| 1 Year (Absolute returns) | 53.7% | 42.6% | 46.8% | 47.0% |

| 5 Years (CAGR) | 28.0% | 21.6% | 24.8% | 22.9% |

| Std Deviation | 20.1% | 15.3% | 15.5% | 15.7% |

Source: Value Research, Edelweiss AMC. Data as of 31st Oct-24.

Risks: During the bear phase, high momentum stocks may underperform leading to potential drawdown.

Nifty 50 Equal Weight Index

The Nifty 50 Equal Weight Index allows you to invest equally in each of India's leading 50 companies. Every three months, adjustments are made to ensure each company represents exactly 2% of the portfolio. Additionally, the portfolio undergoes a semi-annual rebalancing to account for any changes in the composition of the Index.

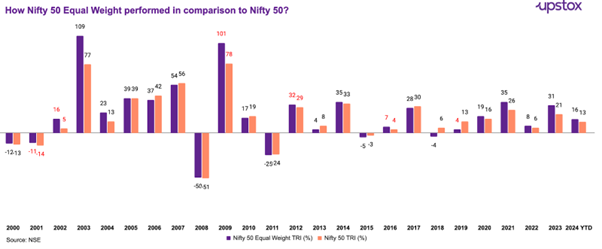

How is it different from NIfty50? This index ensures that investment isn't concentrated by equally distributing weight among all 50 companies, unlike the traditional Nifty 50 where the top 5 stocks have ~40% weight. This index has outperformed the regular Nifty50 in 15 out of 24 years since 2000.

Risks: In a sideways market, this index might underperform the benchmark Nifty 50 considering a scenario where selective stocks only outperform the market.

Nifty 500 Multicap 50:25:25 TRI

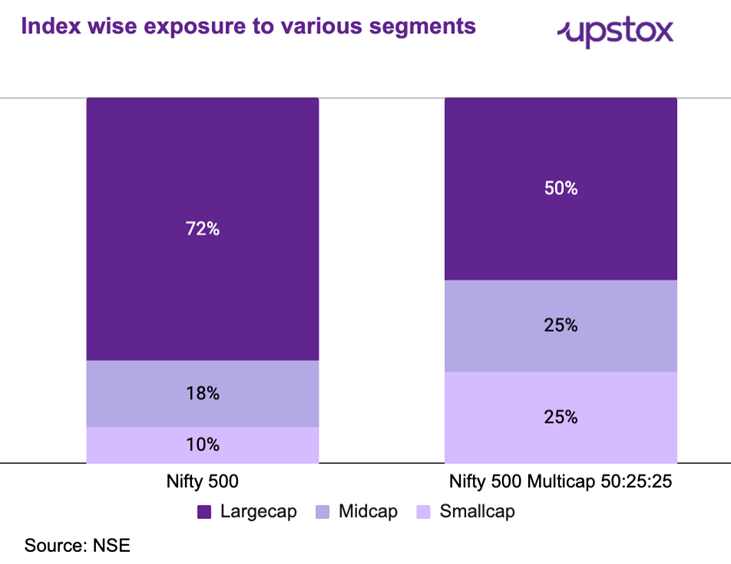

The Nifty500 Multicap 50:25:25 index invests in a portfolio consisting of large, mid, and small-cap companies from the Nifty 500, with fixed allocations of 50%, 25%, and 25% respectively.

This index offers a balanced approach to investing across market capitalisations, aiming to capture growth opportunities across various company sizes. It has outperformed the Nifty 500 TRI over the last 1 and 5 years respectively with equal or lower risk.

| Nifty500 Multicap 50:25:25 Index | Nifty 50 | Nifty 500 | |

|---|---|---|---|

| Return | |||

| 1 Year (Absolute Returns) | 39.7% | 26.8% | 36.3% |

| 5 Years (CAGR) | 23.5% | 15.3% | 19.8% |

| Risk (Standard deviation) | |||

| 1 Year | 15.4% | 13.4% | 14.5% |

| 5 Years | 18.4% | 18.9% | 18.4% |

Source: NSE. Data as of 31st Oct-24.

What makes it unique is the fact it provides a more balanced approach to smallcaps and midcaps with 50% allocation to midcap and smallcap while the Nifty 500 provides only 28% allocation to smallcap and midcap.

Risks: This index, like any equity investment, is subject to market risks. Although it is more diversified than indices focused solely on large-cap stocks, it may still experience volatility due to its exposure to mid and small-cap segments.

Comparative risk and returns performance:

| Index | Nifty 50 Equal Weight Index | Nifty500 Multicap Momentum Quality 50 Index | Nifty500 Multicap 50:25:25 Index |

|---|---|---|---|

| Top 5 stocks | SBI, Wipro, Grasim, HDFC Life, Tech Mahindra | Bajaj Auto, REC, Coal India, Power Fin, Dixon Tech | HDFC Bank, ICICI Bank, Reliance, Infosys, ITC |

| 1 Year (Absolute Returns) | 34.6% | 51.9% | 38.5% |

| 5 Years (CAGR) | 21.5% | 26.7% | 22.3% |

| Standard Deviation | |||

| 1 Year | 13.7% | 20.1% | 39.6% |

| 5 Years | 18.5% | 19.0% | 23.5% |

Source: NSE, AMFI. Data as of 31st Oct-24

How can you invest in these indices?

Below is a non-exhaustive list of funds which offer exposures to these indices

| Index | Nifty 50 Equal Weight Index | Nifty500 Multicap Momentum Quality 50 Index | Nifty500 Multicap 50:25:25 Index |

|---|---|---|---|

| How can you invest?* | Nippon India Nifty 500 Equal Weight Index Fund DSP Nifty 50 Equal Weight Index Fund HDFC NIFTY50 Equal Weight Index Fund UTI NIFTY50 Equal Weight Index Fund Direct | Edelweiss Nifty500 Multicap Momentum Quality 50 Index Fund | HDFC Nifty500 Multicap 50:25:25 Index Fund |

Source: NSE, AMFI

Each index offers a distinct investment approach with its potential benefits and risks. By understanding each index's unique characteristics, investors can make informed decisions aligned with their risk tolerance and financial goals.

Investors should also keep in mind that past performance is not an indicator of future performance. Also, these indexes are new and there are very limited ways to invest in these indexes.

Conclusion

These three unique indices offer distinct approaches to potentially achieving outsized returns. The Nifty500 Multicap Momentum Quality 50 TRI leverages a multi-factor approach, combining momentum and quality, while the Nifty Microcap 250 Index Fund focuses on the potential of under-researched microcap companies. The Nifty500 Multicap 50:25:25 TRI offers a balanced and tax-efficient way to invest across market capitalisations.

Investors should carefully assess their risk tolerance and investment objectives before considering any of these indices. It is crucial to conduct further research, consult with a financial advisor, and compare these indices to other investment options available in the market.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story