Upstox Originals

Beyond cash: Will the digital yuan redefine money?

.png)

7 min read | Updated on February 11, 2025, 14:24 IST

SUMMARY

No wallets, no banks - just instant, government-backed digital payments. China’s digital yuan (e-CNY) promises a frictionless financial future, but can it truly replace physical money? With privacy concerns, regulatory hurdles, and competition from tech giants, its path is uncertain. Where does e-CNY fit in the evolving world of digital finance?

The digital yuan accounts for ~2.4% of China's overall money supply

China’s digital yuan (e-CNY) is changing how money works. Launched as a pilot program by the People’s Bank of China (PBoC) in 2020, this government-backed digital currency holds the same value as the physical yuan (1:1, meaning 1 digital yuan = 1 paper yuan). Unlike traditional money, it doesn’t rely on banks or middlemen - giving the central bank full control.

The e-CNY is gradually becoming part of everyday life, from retail stores to public transport in Beijing. It even gained international attention at the 2022 Winter Olympics, where it was one of three accepted payment methods. In 2023, it was used to buy securities on the stock market for the first time, suggesting it might be used more in stock trading in the future.

As its use expands to salaries, shopping, and travel, the digital yuan is steering China toward a fully state-managed digital economy.

Cumulative transaction value of the digital yuan (e-CNY)

| Date | Transaction value |

|---|---|

| December 2021 | ¥87 billion |

| August, 2022 | ¥100 billion |

| June, 2023 | ¥1.8 trillion |

| July, 2024 | ¥7.3 trillion |

Source: figures provided by PBoC on various occasions

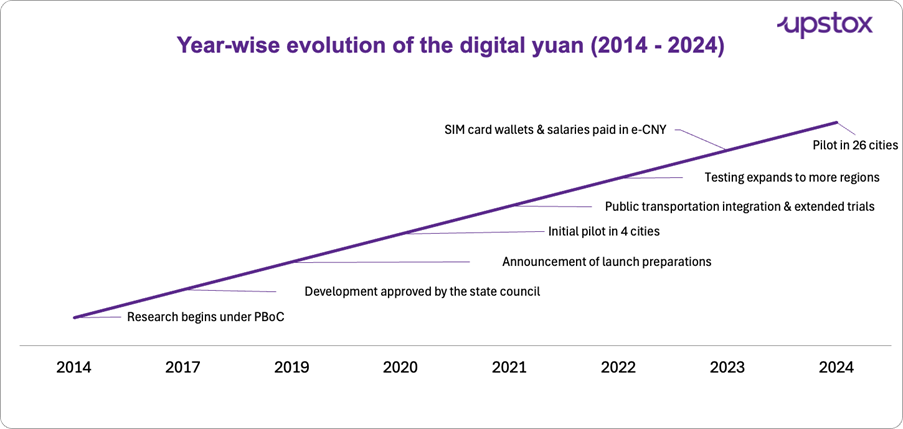

In July 2024, China’s M2 money supply hit ¥303.31 trillion, with the digital yuan making up 2.41% of transactions. It’s steadily gaining ground, shaping the future of China’s financial system. The idea for the digital yuan first emerged in 2014 when the PBoC started researching a cashless future.

By 2017, the government officially supported the project, partnering with tech giants like Alibaba and Tencent. What began as small-scale trials in 2020 has grown, with the e-CNY now being used for wages, transportation, and even international trade - though it remains in a testing phase.

Sources: Forbes, Global Times, CNN, myNews

How it works: The digital currency structure

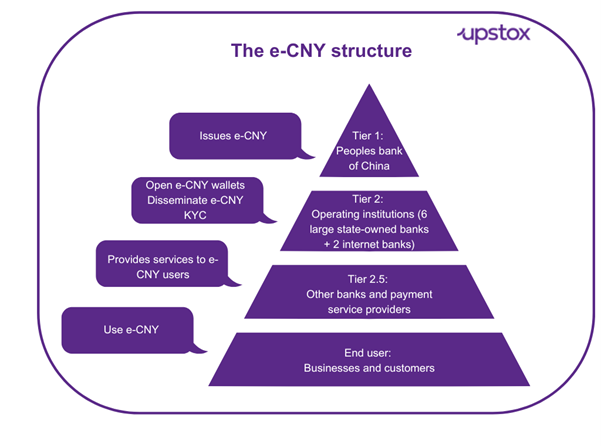

The e-CNY operates on a two-tier system: the PBOC oversees it, while tier 2 banks like WeBank and MYBank provide access. Users set up wallets online or offline and transact through tier 2.5 institutions, which process payments but don’t handle exchanges.

At the ground level, consumers transfer e-CNY seamlessly, and merchants accept payments via tier 2 or 2.5 institutions. The PBOC delegates customer service, KYC compliance, and infrastructure management to tier 2 banks.

Source: Deutsche Bank Research

The banking equation: Potential disruptions and opportunities Unlike traditional digital money, e-CNY is a direct liability of the People's Bank of China (PBOC), not commercial banks—cutting them out of the equation. The PBOC classifies e-CNY as M0, meaning it functions as physical cash in digital form. In monetary terms:

- M0: Physical cash and coins in circulation.

- M1: M0 + demand deposits (money in checking accounts used for transactions).

- M2: M1 + savings accounts, fixed deposits, and other time deposits.

Since e-CNY replaces physical cash (M0) but doesn’t directly impact bank deposits (M1, M2), it might seem harmless. But there’s a catch - deposit disintermediation. If people park money in e-CNY wallets instead of bank accounts, banks lose deposits, making loans costlier.

A complement, not a competitor

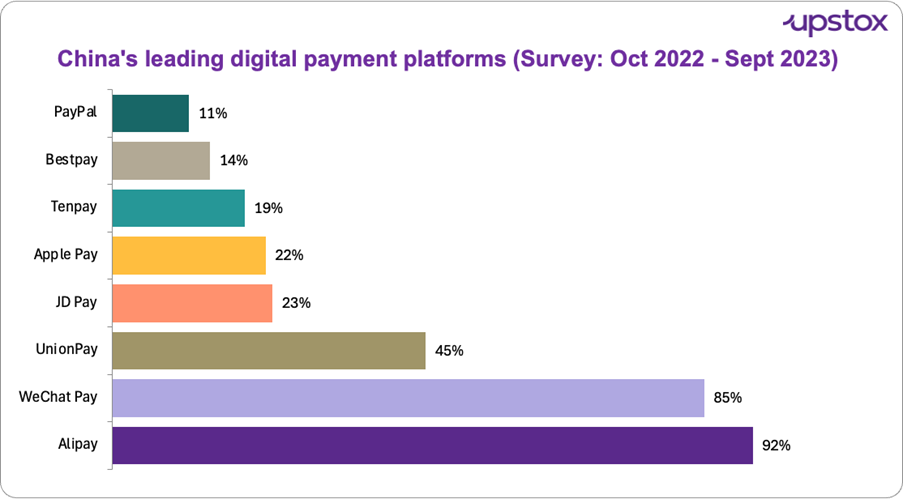

China’s e-CNY expands the nation’s digital payments, complementing Alipay (92%) and WeChat Pay (85%). A 2022–2023 survey of 2,000 users (18–64, Mainland China) confirms nearly 9 in 10 rely on these platforms.

Source: Statista

If existing digital payment platforms and banks already dominate the market, why would people use the digital yuan (e-CNY)? While these private platforms are convenient, e-CNY brings unique advantages that enhance inclusivity and functionality:

- State-backed assurance: Unlike privately managed platforms, e-CNY is issued by the central bank, offering unparalleled trust and stability.

- Universal reach: e-CNY has the potential to work alongside Alipay and WeChat Pay to ensure every merchant, big or small, can accept digital payments.

- Greater financial inclusion: Unlike Alipay or WeChat Pay, which require bank accounts, e-CNY only needs a digital wallet, making it accessible to more people.

The adoption

China’s e-CNY pilot phase is expanding, now covering 26 cities across 17 provinces with increasing real-world applications. Let’s explore some of the use cases:

- Rural adoption: In 2022, the Postal Savings Bank launched an e-CNY wallet demonstration in Ping’an Village, signing up 40% of the population and enabling e-CNY payments in all local shops, highlighting its role in financial inclusion.

- Hardware wallet integration: The PBoC issued 7,000 integrated e-CNY hardware wallet cards, combining employee identification and trade union membership cards with digital yuan functionality for seamless payments and ID verification.

- Wallet registrations: According to Mu Changchun, head of the Digital Currency Research Institute at the PBOC, as of July 2024, 180 million e-CNY personal wallets - one in eight Chinese citizens - have been registered.

To drive adoption, four major e-CNY wallet operating banks - Bank of China, Bank of Communications, China Construction Bank, and ICBC are offering cash rewards and vouchers. These incentives are boosting e-CNY usage, further embedding it into China’s digital economy.

Secure or hackable?

The e-CNY (digital yuan) is fortified with state-backed security, strong encryption, and centralized control by the PBoC, making a direct hack highly unlikely. But that doesn’t make it untouchable. Cyberattacks on wallets, phishing scams, and third-party breaches remain real risks.

Beyond hacking, government surveillance is a bigger concern - every transaction is traceable, raising fears of financial control and restricted spending, despite promises of "controllable anonymity." As adoption grows, so do questions about security, privacy, and state control.

Global CBDC initiatives: A growing trend

China isn’t the only player in the digital currency revolution. The Bahamas led the charge with the Sand Dollar, launching the world’s first digital currency in October 2020, after a successful pilot in 2019. Jamaica jumped in next, unveiling Jam-Dex officially in July 2022, while India kicked off its Digital Rupee pilot in December 2022.

These digital currencies promise faster transactions, greater financial inclusion, and a future with less reliance on physical cash.

e-CNY vs. UPI: Two visions of digital payments

| Aspect | e-CNY (China’s digital yuan) | UPI (Unified payment interface - India) |

|---|---|---|

| Vision | Redefining money by replacing cash with a digital currency | Simplifying payments by linking bank accounts for instant transfers |

| Type | A digital currency issued by the People’s Bank of China (PBOC). Impacts the amount of liquidity in the overall system | A payment infrastructure, not a currency, developed by NPCI. No impact on overall liquidity |

| Control | Fully centralized under PBOC, enabling real-time tracking | A decentralized bank-led system regulated by RBI, fostering competition and innovation |

| Accessibility | Works without a bank account, internet using near-field communication (NFC) technology, benefiting rural and unbanked users. | Requires a bank account, but has expanded financial inclusion in India |

In summary

The digital yuan is reshaping the future of payments, but will it truly take off? While it brings state-backed security and greater financial inclusion, concerns over privacy, surveillance, and financial control remain. It still faces hurdles - habit-driven users, reluctant merchants, and global skepticism.

Can it win over loyal users of Alipay and WeChat Pay? Will it break into the global financial system despite resistance? The answer lies in how China balances innovation, privacy, and incentives. One thing’s for sure - the world is watching as e-CNY shapes the future of digital finance.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story