Upstox Originals

Are mutual funds investors giving their investments enough time to grow?

(1) (3).jpg)

6 min read | Updated on July 09, 2024, 19:25 IST

SUMMARY

Data suggests that retail investors are not holding their equity MF investments for long enough. Consequently, they may not be able to realize healthy returns and impact their wealth creation journey.

Investors are not holding on to their MF investments for long enough

Over the years, the second sentence of the above quote has been extensively used—often out of context—in books, magazines, newspapers, websites and now even videos and reels. Continuing with this tradition, I would like to take this opportunity, and use the sentence out of context as well, and with due apologies to Keynes. So, here we go.

The Indian mutual fund investor is turning out to be a firm believer in Keynes’ dictum that “in the long run we are all dead”. Why do I say that? Successful equity investors—from Warren Buffett to the late Rakesh Jhunjhunwala—have made big money by holding on to the equity investments they have made over many many years. But the Indian mutual fund investor doesn’t seem to be buying into that logic, at least not yet.

In the last few years, as the stock market has gone from strength to strength, money has come pouring into equity mutual funds (MFs). These MFs invest a bulk of the money they collect into stocks listed on the Indian stock exchanges.

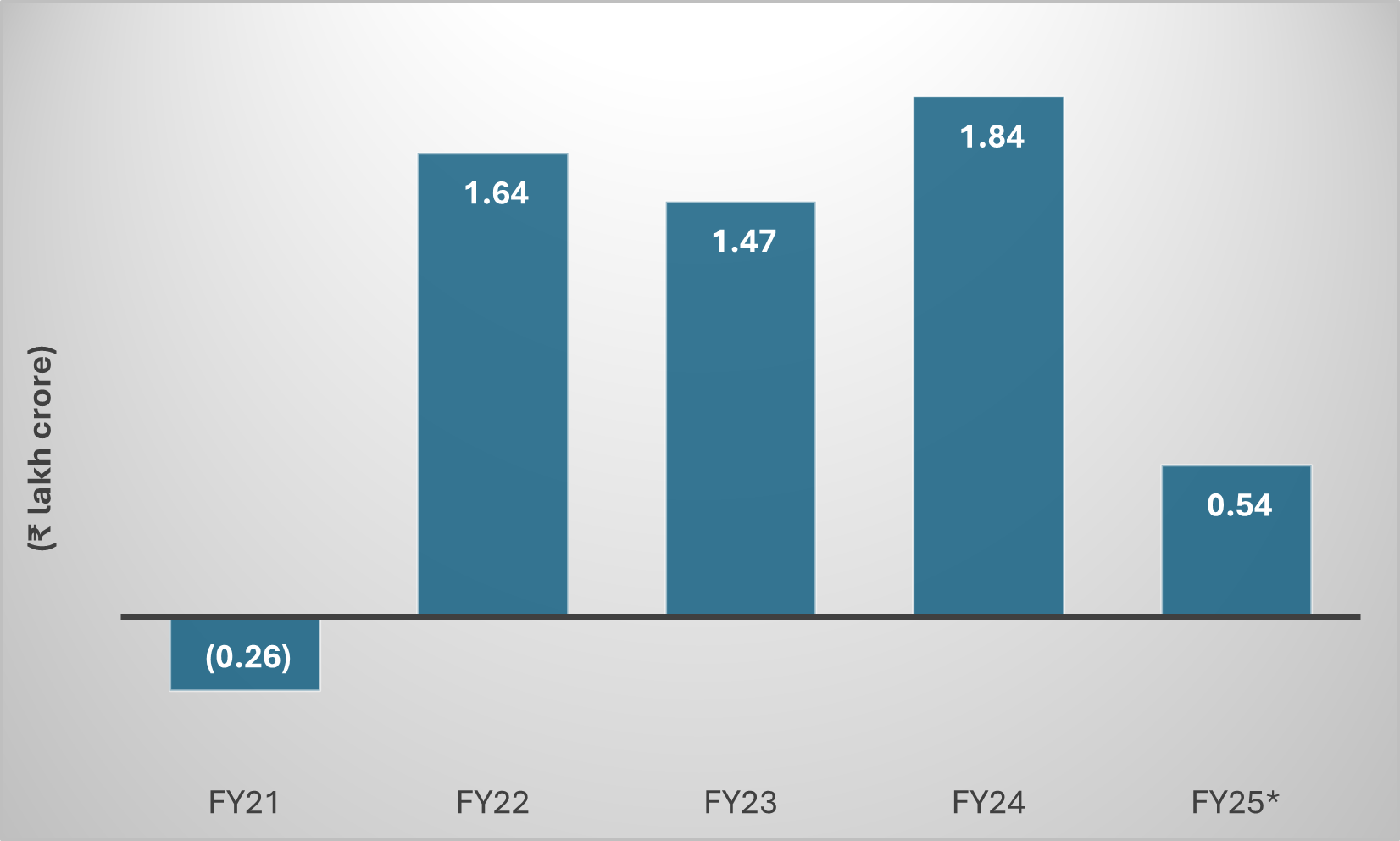

Source: Centre for Monitoring Indian Economy; *FY25 is only for April and May

As can be seen in the above chart, in 2020-21, the net outflow from equity MFs had stood at ₹ 25,966 crore. This was one of the many economic impacts of the spread of the pandemic. Now, investors can buy units of equity MFs. They can also sell them. When the difference between the buying and selling is negative, there is a net outflow from equity MFs. When it’s positive, there is a net inflow.

In 2021-22, 2022-23 and 2023-24, the equity MFs saw net inflows of ₹ 1.64 lakh crore, ₹ 1.47 lakh crore and ₹ 1.84 lakh crore, respectively.

In April and May during this financial year, equity MFs have seen a net inflow of ₹ 53,614 crore.

And that’s a lot of money for just two months. If things continue at the same pace, equity MFs may end up seeing more than ₹3 lakh crore of net inflow during 2024-25. Of course, that’s just a mathematical calculation—or me dragging a few cells on the excel sheet in order to come up with a big round number—and given that, it doesn’t really mean anything much. But such are the times that we live in that nothing seems to work without big round numbers in it. As stock prices have gone up, more and more money has come into equity MFs. And as more money has come into equity MFs, they have bought more stocks using this money, and stock prices have gone up further. So, beyond a point, the market has been going up, because it has been going up. In this kind of market, quick and easy money has been made. But is that enough? Is the idea to make quick and easy money from stocks? Or is the idea to get wealthy by investing in stocks?

Now, the question is, how long do investors hold on to their investment in equity MFs? Data from Association of Mutual Funds in India (AMFI)—the mutual fund lobby—makes for a very interesting reading. What does it say?

-

Retail investors hold on to a little over 41% of their equity investments through MFs for up to two years. So, many retail investors do not give enough time to their equity investments through MFs to experience the power of compounding and in the process become wealthy. And this isn’t a recent phenomenon, even though things have improved slightly on this front. Serious MF investors need to hold on to their investment for a decade or more.

-

In fact, if we look at investors into MFs as a whole, of which retail investors form a bulk, these investors hold on to close to 28% of their equity investments through MFs for up to just one year.

-

Further, these investors hold on to close to 10% of their equity investments through MFs for just up to three months. This tells us that quite a few retail investors out there are using equity MFs to trade stocks, albeit indirectly. Of course, given that the market has just gone in one direction, and that’s up, this strategy might have worked for most, and thrown up some money in the process. But this can’t make you rich, unless the idea is to find meaning in life through trading and get that adrenaline going.

Long-run investing is very boring at the end of the day, even though it’s likely to make you rich. It’s about making a few investing decisions, reviewing them periodically, and largely not doing anything if the situation doesn’t require so. But in the long run we are all dead, so, why not go out there and have some fun, at least that seems to be the story going around currently.

Vivek Kaul is the author of Bad Money.

About The Author

Next Story