Upstox Originals

Amplifying experiences: The live event industry's soaring growth

.png)

4 min read | Updated on August 23, 2024, 18:57 IST

SUMMARY

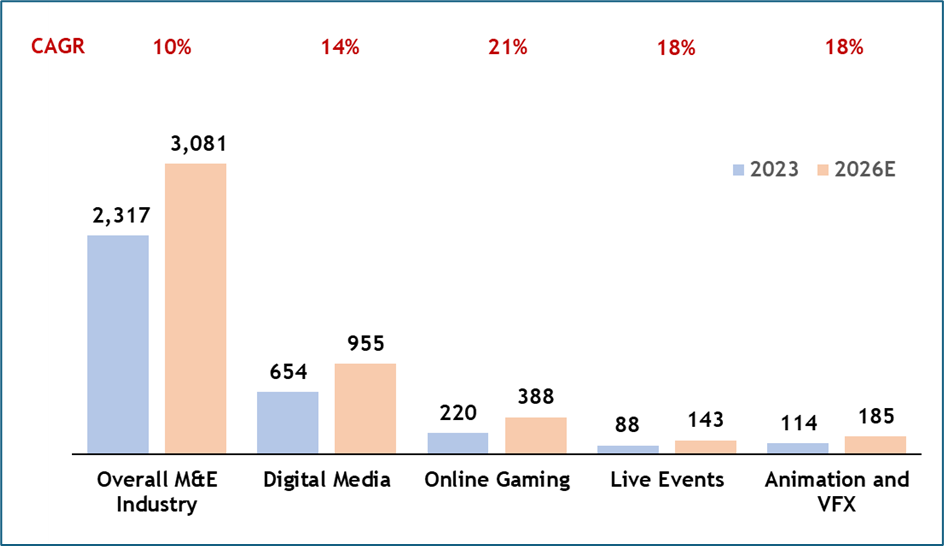

Zomato’s acquisition of Paytm’s entertainment and ticketing business has brought the live events segment into the limelight. A look into this industry reflects - 1) Its resilience - by 2023, it has already overcome the COVID-19 slowdown; 2) strong growth potential - expected to grow at ~18% over the next 3 years, it is one of the fastest growing segments in the overall media industry.

Zomato announced its acquisition of Paytm's entertainment and ticketing business

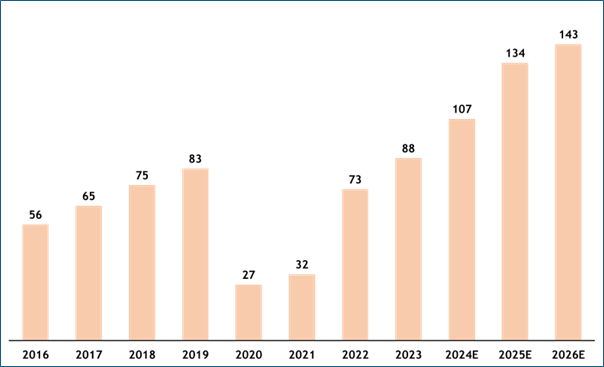

The organized live events segment grew by a staggering 20% in 2023 and reached ₹88 billion, surpassing its pre-COVID levels. The industry is expected to grow to ₹143 billion in the next three years.

Per press reports, in 2023 over 13.5 million people attended music concerts, live comedy, musicals, and other live events, which was more than 2x of that in 2019.

Growth is expected to come from factors like increasing per capita income, ease of ticket purchase, and clear price discovery due to online apps among others. Notable also is the increasing contribution from Tier-II cities such as Surat, Jaipur, Ahmedabad, Vizag, etc.

Domestic live event market size (₹ billion)

Source: Statista

Within the Media & Entertainment (M&E) industry, it is one of the fastest growing segments - expected to grow at 18% from 2023 to 2026, surpassing the overall M&E industry’s 10% growth rate.

M&E market size by segment (2023 to 2026E) (₹ billion)

Source: “M & E Sector Overview” EY and FICCI

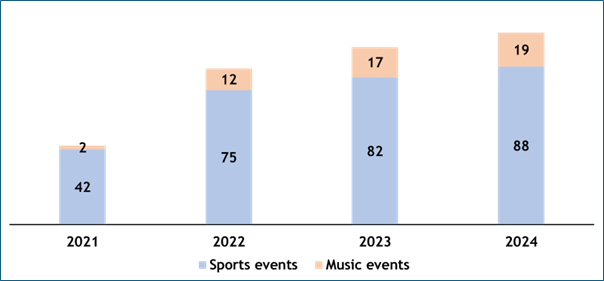

This increase in live events has also translated into a surge in ticket revenues as well. From 2021 to 2024, ticketing revenue from sports events has surged with a CAGR of 28%, while music ticketing revenue has skyrocketed with a staggering CAGR of 112%, reflecting the explosive growth and rising demand in the live events industry.

Ticketing revenues (₹ billion)

Source: Statista

Here are a few key venues from where you can book your ticket*

Source: Press articles; *We have provided FY23 numbers for sake of consistency. For FY24 Paytm Insider’s total revenue (move + event ticketing) was ~ ₹250 crore. On an adjusted EBITDA basis, it generated a profit of ₹29 crore.

Key growth drivers

- Rising per capita incomes are driving the expansion of ticketed events, including music concerts, comedy shows, and sports.

- Government efforts to promote local cultural themes are boosting tourism and event participation.

- Social media has helped amplify the reach and impact of these events.

- The presence of international artists and festivals in India is growing.

- Online ticketing platforms have made event discovery, purchasing, and marketing more accessible.

- Tier-II cities are becoming new markets for live events as infrastructure and income levels improve.

- The development of premium venues is expected to attract more international formats and performers to India.

Zomato enters the ticketing market

In August 2024, Zomato announced its acquisition of Paytm's entertainment and ticketing business for ~₹21 billion, as part of its strategy to expand into the lifestyle sector through its new app, 'District.' Zomato will be able to leverage its existing food delivery infrastructure to cross-sell and increase customer discoverability in entertainment.

This acquisition will help Zomato:

- Integrate dining and ticketing services, including movies and events, enhancing its platform's appeal, and user engagement and creating a seamless user experience

- Diversify its offerings beyond food delivery, leveraging its large customer base to challenge established players like BookMyShow.

- Efficiently utilize the cash and equivalents of ₹12,000 crore

Paytm's decision to focus on its core financial services while divesting its entertainment segment reflects its strategy to streamline operations and strengthen its balance sheet.

For BookMyShow, the entrance of Zomato into the ticketing space introduces a formidable competitor. With Zomato's vast user base and experience in digital transactions, it could pose a significant challenge to BookMyShow's dominance. BookMyShow currently has a greater than 75% market share in move ticketing and greater than 40% market share in online ticketing.

The move signals increasing competition in the online ticketing industry, which could lead to more innovative offerings and better pricing for consumers as the two companies vie for market share.

Conclusion

The live event industry has seen a powerful resurgence post-COVID, with surging ticket revenues and an increasing number of events. Social media has been a game-changer, amplifying the buzz around live events, while advancements in event infrastructure have attracted global artists. These factors combined are driving the industry's rapid growth and optimistic future outlook.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story