Upstox Originals

Affordable housing: Groundwork for building your portfolio

.png)

5 min read | Updated on July 19, 2024, 15:23 IST

SUMMARY

This industry is expected to grow by 20% per annum over the next few years, with multiple growth drivers. Affordable housing is a sector on the rise and will have a spill-over impact on industries from paints to pipes. Explore this industry’s dynamics and opportunities across sectors that will be impacted by this.

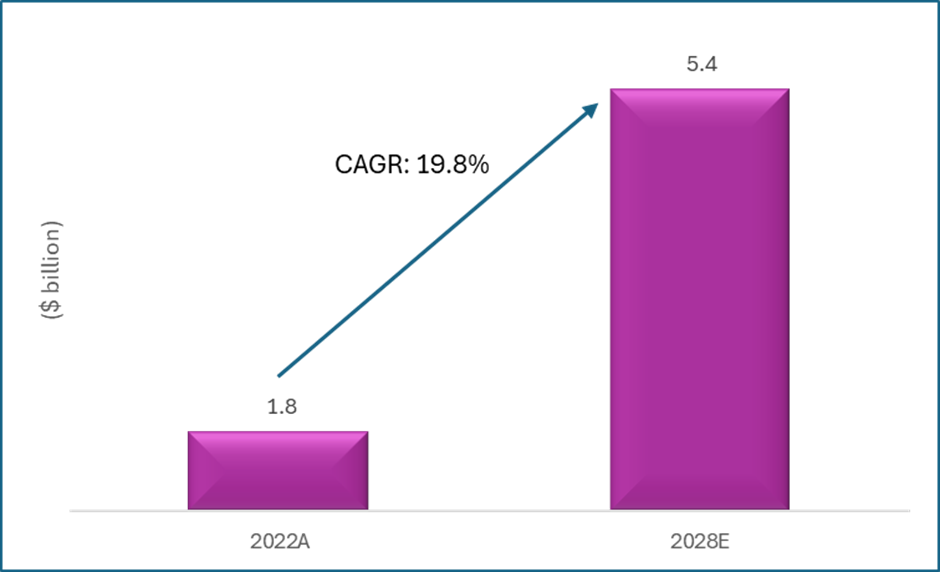

Affordable housing is expected to grow at 20% over next few years

Affordable housing in India is expected to grow at ~20% pa over the next few years, as seen in the chart below, driven by factors including urbanization, government initiatives, nuclearization among other factors.

Source: Press articles

Source: Press articlesWhat is an affordable house?

While its a nuanced definition, simply put - properties with an areas not more than 60 sq.m (in metro cities) and price capped at ₹45 lakh are called affordable houses. Please note, there is a proposal to raise this limit to ₹75 lakh. The scheme is aimed at providing houses for low-middle income segment of the society.

Housing for All: Government push

The government announced its plan to construct 3 crore houses under the Pradhan Mantri Awas Yojana (PMAY). The number of affordable housing units completed by the government have tripled from FY20 to FY24.

Affordable housing units completed by the government so far

Source: PIB

Source: PIBWhat’s Driving Growth?

-

Urbanization- By 2030, 40% of India is projected to live in urban areas from ~36% now. As more rural population comes to urban areas, the demand for low ticket size homes will increase

-

Housing Infrastructure - The government's focus on providing basic amenities such as household toilets, LPG connections, electricity connections, and water connections

-

Rising Income Levels - The improvement in per capita income and better affordability of houses.

-

Nuclearization - The trend of joint family splitting into nuclear families will continue to drive demand for housing as the number of middle-class households is set to double by 2030.

-

Government schemes besides the PMAY: The government has been promoting housing through various schemes and agendas:

-

The government provides interest-cost subsidies ranging from ₹100,000 to ₹267,000 to households obtaining bank loans for housing construction, in addition to subsidies from state governments.

-

The government plans to increase allocations for affordable housing to ₹1 trillion ($12 billion) for 2024-25, a more than 15% hike from the 2023-24 budget.

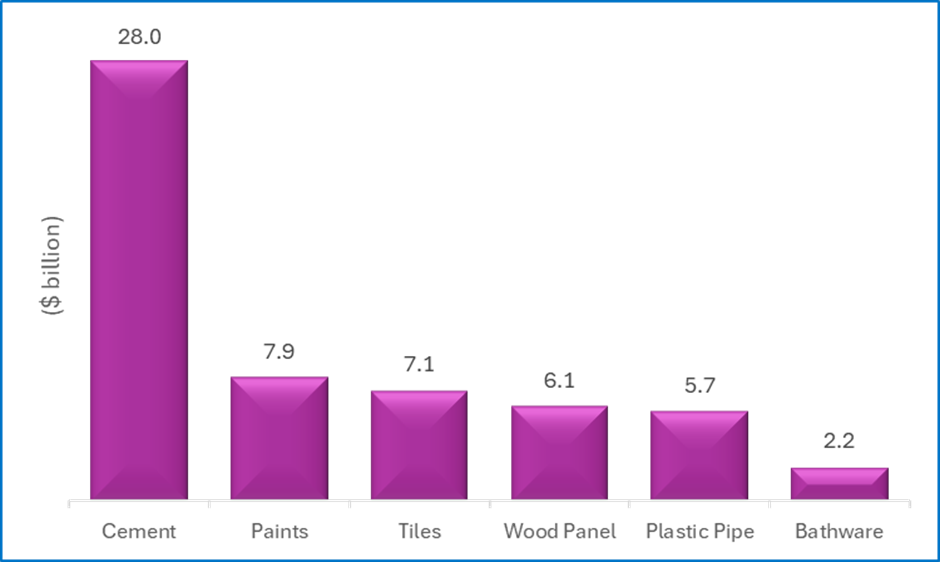

This segment is set to transform numerous sectors, including Building Materials, Paint, Cement, Real Estate, and Housing Finance Companies.

Industry size of impacted sectors in India*

Source : Crisil and Respective sector’s company’s presentation; *latest available data

Source : Crisil and Respective sector’s company’s presentation; *latest available dataKey risks

- Economic slowdowns - Can increase default risks due to job losses and income cuts

- Inventory overflow - inventory overflow of housing units can impact the sector negatively.

- Regulatory risk - Refers to the possibility that the local, state, or federal regulations and policies may impose constraints

- Operational risk - Project may experience problems or failures in the execution or management of the project.

Select companies that could benefit from the growing segment*

| Particulars | Operating Margin % | PE Ratio | ROCE % | Stock Price Returns of last 1 year % |

|---|---|---|---|---|

| Paints | ||||

| Asian Paints | 21.4 | 55.3 | 37.5 | -17.1 |

| Berger Paints | 16.6 | 52.0 | 27.6 | -8.2 |

| Real Estate | ||||

| Lodha | 25.8 | 90.8 | 11.1 | 112.1 |

| Ashiana Housing | 10.2 | 49.6 | 11.8 | 98.5 |

| Max India | -31.0 | NA | -7.9 | 111.5 |

| Suntech | 20.8 | 127.1 | 4.6 | 65.3 |

| Ajmera Realty | 28.7 | 25.1 | 11.7 | 97.2 |

| Cement | ||||

| Ambuja Cement | 19.3 | 50.3 | 14.2 | 65.1 |

| Ultratech Cement | 18.3 | 47.6 | 15.3 | 39.2 |

| Pipe | ||||

| Welspun Corp | 9.0 | 15.4 | 21.6 | 104.1 |

| Astral | 16.3 | 111.0 | 23.7 | 18.2 |

| APL Apollo | 6.58 | 58.0 | 25.3 | 9.8 |

| Housing Finance | ||||

| Aptus | 13.4 | 26.4 | 14.7 | 19.1 |

| Ugro Capital | 5.9 | 20.2 | 12.2 | -2.4 |

| Bajaj Finance | 8.9 | 30.4 | 11.9 | -6.1 |

| Manappuram Finance | 12.2 | 8.8 | 13.8 | 82.5% |

| IIFL Finance | 10.2 | 11.4 | 11.8 | -13.5% |

| Aavas Financiers | 7.9 | 28.6 | 9.91 | 15.1 |

Source: Screener; in case of NBFCs - NIM% have been considered as an EBITDA margin. Data as of 18th July-24.

*Note : This is not an exhaustive list of companies catering to the affordable housing sector. These companies have been selected on the basis of their commentary with respect to the affordable housing sector.

Conclusion

As India continues to urbanize and its population grows, the demand for affordable housing is expected to rise. With the government's unwavering commitment and the potential for substantial returns, the housing finance market is ripe with opportunities for astute investors which also lead to tailwinds in building materials.

By signing up you agree to Upstox’s Terms & Conditions

About The Author