Upstox Originals

A sweet dive into India’s ice cream industry

.png)

8 min read | Updated on December 02, 2024, 13:05 IST

SUMMARY

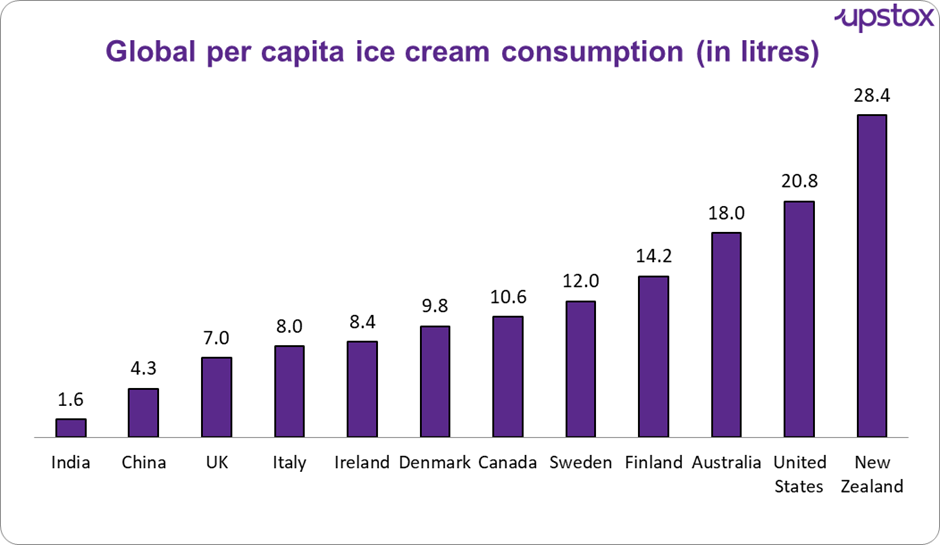

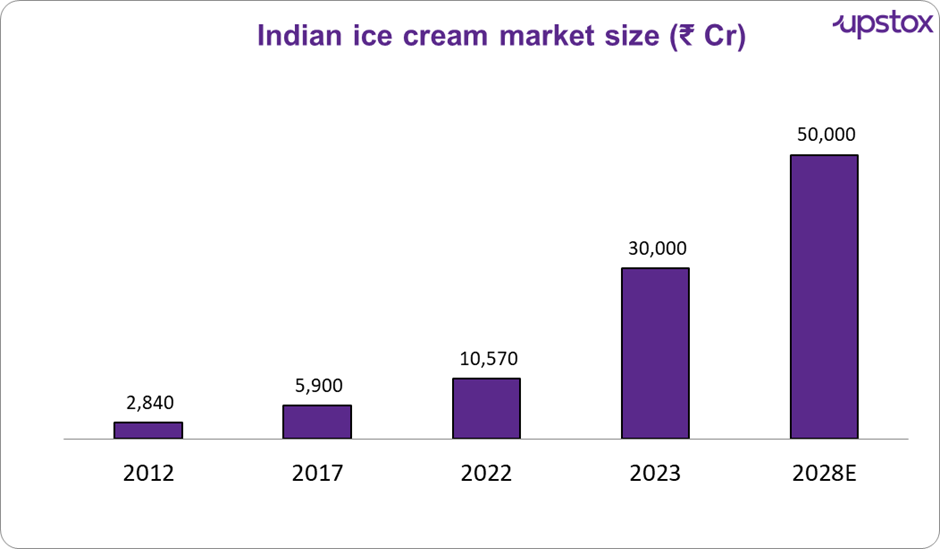

Did you know Indians consume only 1.6 litres of ice cream per capita versus an astounding 28.4 litres in New Zealand? The ice cream industry in India has a long way to go and many experts project that it could reach ₹50,000 crore by 2028. With a booming middle class, rising disposable incomes, and the convenience of quick commerce platforms, organised giants like Amul and artisanal players are thriving in the market.

India's ice cream industry is expected to grow at a rate of 13-15% per year

Ice cream is more than just a summer’s delight. It is the most versatile of foods—a reward for a job well done, a guilty pleasure, an integral part of family celebrations, a pleasure enjoyed at a late-night outing, or just a treat while watching television.

Just like everyone has their favourite flavour of ice cream, they have their own memories and stories related to them as well.

Given this, is it any surprise that India’s ice cream industry is one of the fastest-growing markets? Driven by a surge in quick commerce platforms, increasing disposable incomes and a blend of traditional and modern innovations, the Indian ice cream industry is on a delicious growth path.

In this article, we look at the Indian ice cream landscape and evaluate some key trends in this fast-growing industry.

A scoop of growth

Ice cream binds us together globally. As you can see from the chart below, the love of ice cream is universal!

Just look at the consumption in the USA and New Zealand! And these are countries with climates cooler than India! Yet, their love for ice cream is visible in their per capita consumption.

While you could argue that their population is much lower than ours, even China, with an average per capita consumption of 4.3 litres. India’s per capita consumption is currently at 1.6 litres, so it clearly has a long way to go!

Source: worldpopulationreview.com, data as of 2024

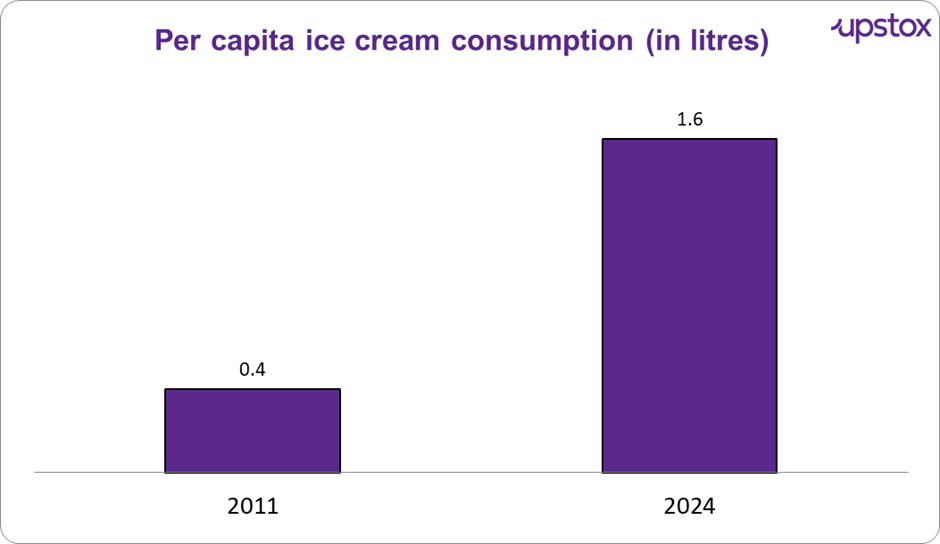

This is, of course, not to say that growth in India is anything less than phenomenal! Over the past decade, India’s ice cream consumption has grown from 400 ml per capita in 2011 to 1.6 litres recently as seen in the chart below.

Source: Hindu Business Line

This surge is fuelled by a growing middle class, increasing disposable incomes, and improved distribution networks through platforms like Swiggy and Zomato.

And there is more to come!

Experts say that this industry is expected to grow at a rate of 13-15% per year in the near future.

Source: Global data

Ice cream hubs of India

Key consumption hubs like Gujarat, Delhi, Mumbai, Bengaluru, and Hyderabad continue to lead the way, but smaller cities are emerging as important markets. Currently, Gujarat, Rajasthan, Maharashtra, and Goa account for one-third of the country’s ice cream consumption.

In humid coastal areas of South India, people tend to prefer light and natural flavours, while in the North, the preference leans towards rich and creamy ice creams, as noted by Gurpreet Singh, MD of Giani's Foods Pvt. Ltd (major ice cream player).

Key players: organised vs. unorganised

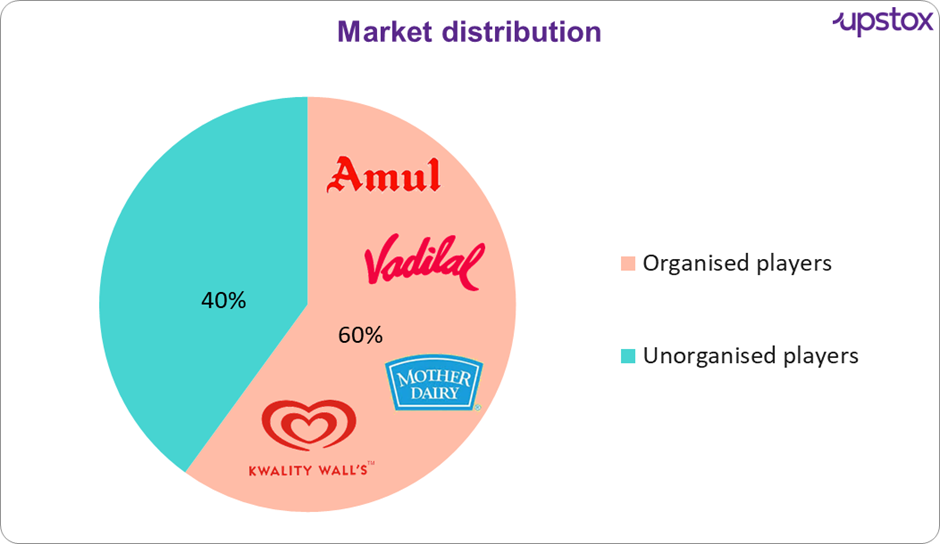

As with most markets in India, the uroganised players have a meaningful share of India’s ice cream market.

Organised players

Dominated by giants like Amul, Mother Dairy, and Kwality Walls, these giants of the industry contribute about 60% to the overall market. These players can reach a wider mass of people with their focus on mass production, nationwide distribution, and consistent quality.

Unorganised players

Regional and artisanal brands like K. Rustom in Mumbai with its ice cream sandwiches, LakeView Milk Bar in Bengaluru with its sundae, PABBA’S with its most-loved “GADBAD” ice cream, and Cheers ice cream parlour from Ahmedabad known for its premium softies which cater to niche markets with unique flavours and localised distribution. These players often emphasise handmade production and traditional recipes, creating a distinct appeal.

Source: thehindubusinessline.com

This brings us to the most exciting part - what’s the new flavour?

Meaning, what are some key trends to watch out for

-

Growth of impulse ice cream category: The "impulse" category (single-serve items like cones, cups, and sticks) has long dominated India's ice cream market. Given the ease of consumption, storage as well as ease of enjoying it, these forms of consumption are expected to lead the market.

-

As observed in many ice cream stores such as Baskin Robbins, Naturals, and Amul, consumers can enjoy a delightful cup or cone of their preferred flavour. Additionally, local kirana stores offer a variety of offerings. These small snack portions are a key driver of this category's growth.

-

Health consciousness: The growing health consciousness among consumers is driving demand for low-calorie, vegan, and lactose-free ice creams from brands like Go Zero, and Noto (profiled below).

-

Premiumisation: Consumers are increasingly willing to pay a premium for exotic flavours like salted caramel, matcha, and rose-pistachio, driving the growth of the premium segment.

-

Innovative marketing: Social media and influencer partnerships have become essential for brands looking to connect with younger audiences. Customisation options and limited-edition flavours also play a significant role in building brand loyalty.

Growth drivers

-

Rising disposable incomes and a young population: A growing middle class with increased spending power is one of the key drivers for bolstering this industry. Besides this, the younger demographic is also fuelling experimentation for bold flavours, leading to further innovation in this industry.

-

Expanding distribution networks: Improved cold storage infrastructure is enabling brands to penetrate deeper into rural markets.

-

The role of quick commerce platforms such as Swiggy, Blinkit, and Zepto has been instrumental in expanding these distribution networks by providing rapid and convenient delivery options.

Key challenges

Despite its growth, the ice cream industry faces several challenges: Rising input costs: Fluctuating prices of milk, sugar, and other raw materials impact profit margins.

Energy-intensive operations: The high energy consumption required for refrigeration and distribution adds to operational costs. Sustainability concerns: There is a growing need for eco-friendly packaging solutions to address environmental concerns

Why is this space in focus?

Hindustan Unilever (HUL) has recently received board approval to demerge its ice cream business into an independent listed entity to optimise its manufacturing and distribution strategies. The ice cream business, contributing around ₹2,000 crore to HUL's total sales, includes popular brands like Magnum, Cornetto, and Kwality Wall's.

This move aims to create a leading ice cream company in India with focused management and greater strategic flexibility. The demerger, which will benefit from Unilever’s portfolio and innovation expertise, is expected to unlock value for HUL shareholders and facilitate smoother transitions for the business and employees.

Vadilal Industries is the only listed player in this space and the following are some key metrics

- Market cap - ₹2,684 crore (as of November 28, 2024)

- P/E: 18.0x (as of November 28, 2024)

- ROE = 31%

- 3-Year Stock Return 2019-2024) = 58%

- 3-Year Profit Growth % (2019-2024) = 34%

Source: Screener

What about unlisted players? let's take a look into some of the key players who are disrupting the ice cream space

Go zero

Go Zero is a Mumbai-based startup that makes zero-sugar, high-protein, and low-calorie ice creams for health-conscious consumers. Recently, the company raised ₹12.3 crore (around $1.5 mn) in its ongoing Pre-Series A funding round, following an earlier $1 mn round in August last year. The funds will be used for marketing, expanding channels, hiring, and launching new products.

Go Zero is rapidly growing, with a presence in over 16 Indian cities and strong performance on quick commerce platforms like Blinkit and Zepto.

NOTO

Founded in 2019, NOTO also focuses on low-calorie ice cream. The brand has seen impressive growth, with revenues rising from ₹8 crore in FY22 to ₹55 crore in FY24.

In March 2023, NOTO raised $2 million in pre-Series A funding to scale operations, enhance manufacturing efficiencies, and expand its geographic reach.

Leveraging platforms like Swiggy and Zomato, NOTO is deepening its market presence and plans to raise a Series A round by the end of 2024 to sustain its growth trajectory

Hocco

Hocco, an Ahmedabad-based ice cream brand launched in October 2022. It has recently raised ₹100 crore at a valuation of ₹600 crore to expand its manufacturing capacity. It currently produces 40,000-50,000 litres per day and aims to triple its output to 1.3 lakh litres daily by next summer.

Focusing primarily on its home market of Gujarat, the brand is leveraging quick commerce platforms to expand into Rajasthan, Maharashtra, and Delhi-NCR. Hocco anticipates doubling its sales in FY26 compared to FY25, driven by increasing demand from digitally savvy consumers seeking instant gratification through rapid delivery services

Conclusion

India’s ice cream market is poised to widen its reach and keep delighting more and more families across regions. With new and established players coming up sugar-free and low-calorie varieties, consumption is likely to keep increasing. So dig in and enjoy a scoopful!

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story