Upstox Originals

2024 IPO fever: Blazing returns, but caution is key

.png)

6 min read | Updated on December 13, 2024, 10:32 IST

SUMMARY

2024 has been one of the hottest years for IPOs in India. It has been a stellar year on all three fronts: 1) Number of listings; 2) Funds raised; and 3) Returns since listing (some companies have given as much as 300% or higher returns). It has been one of the most significant years for companies looking to tap the primary market. However, while there are definitely more winners than losers, investors should not forego detailed analysis before investing in these companies.

Stock list

2024 has seen the highest number of IPOs in India

If you made a word cloud and checked one of the most used words of 2024, IPO would surely be one of them!

2024 has seen a torrid pace of public issues as companies look to make hay while the sun is shining (read: strong economy + investor sentiment).

Investors have greeted these issuances with the same gusto, as they have tried to either make quick money via listing day gains or participate in fundamentally strong companies with a solid long-term outlook.

As the year draws to a close, we evaluate the hottest trend in 2024’s financial markets and present some interesting insights.

Market size and volume

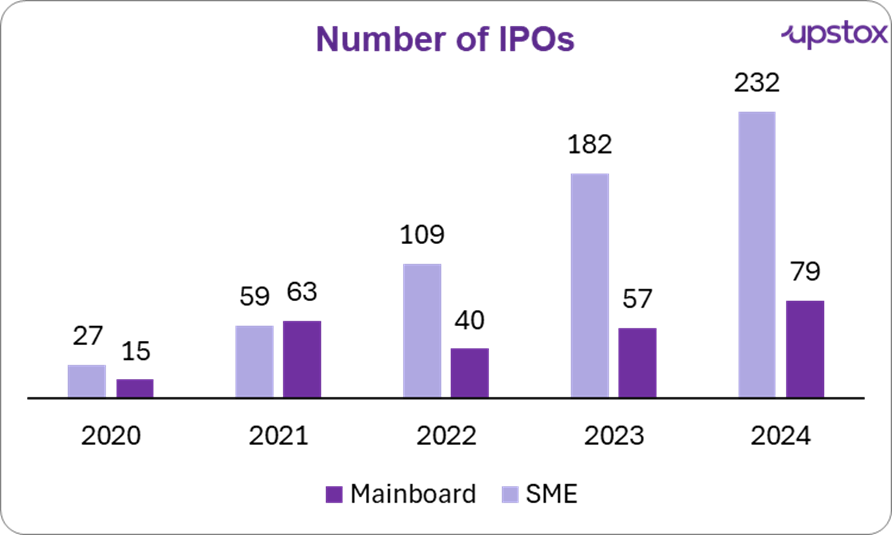

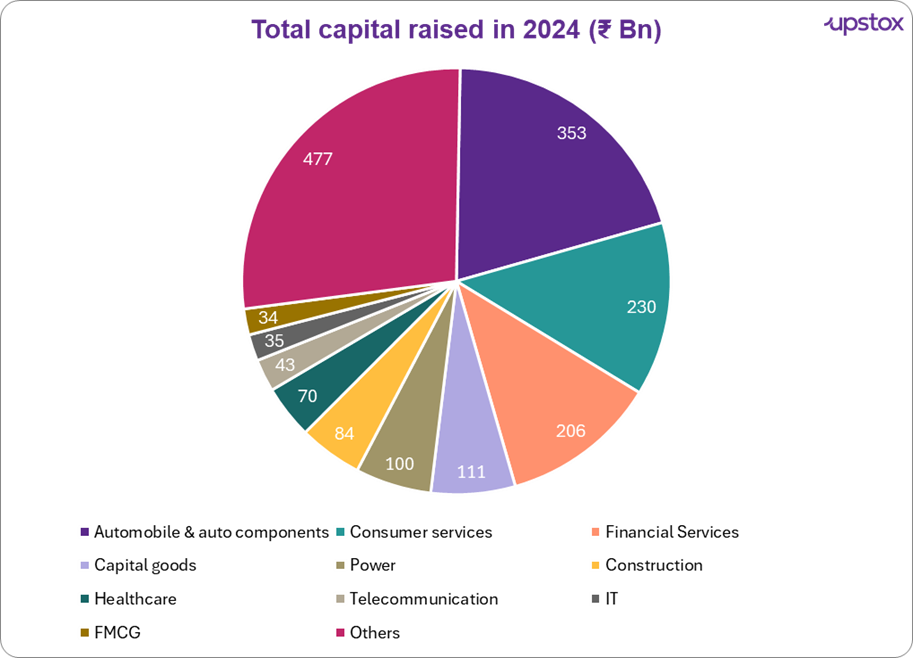

2024 was a groundbreaking period for IPOs, with both the Mainboard and SME segments scaling unprecedented heights. This remarkable growth is reflected in the sheer number of companies entering the market, the record-breaking funds raised, and the exceptional returns delivered by several listings.

Sources: Chittorgarh; as of December 11, 2024

A total of ~311 companies went public on the stock exchanges in 2024 (data as of December 11, 2024), collectively raising ~₹1,550 billion, an impressive ~100% increase compared to the ₹780 billion raised in 2023. This marks a new milestone, surpassing the previous record set in 2022, when ~₹1,206.7 billion was raised through equity sales, the highest in 35 years.

Sources: IPO Central; as of December 9, 2024

Mainboard IPOs

In 2024, the IPO market saw a total of 76 listings (as of December 9, 2024). Key points to note:

- 58 IPOs delivered positive listing gains, showcasing strong investor confidence.

- 18 IPOs experienced negative listing day returns.

- Average listing day return stood at an impressive 27.5%, reflecting a favorable market sentiment for new listings.

Top 3 mainboard IPOs

Curiously, the top 3 IPOs that listed at a premium and have also delivered the highest returns since listing were all in the capital goods sector.

These relatively lesser-known companies benefited from favourable policies like 'Make in India,' industry diversification across multiple sectors, investments in advanced technologies, and sensitivity to global economic conditions driving demand for industrial products.

| Listing date | Company | Current price (₹) | Market Cap (₹ Cr) | Issue size (₹ Cr) | Listing gain % | Return since listing % |

|---|---|---|---|---|---|---|

| 16 Jan 2024 | Jyoti CNC Automation | 1,313.9 | 29,881.1 | 1,000.0 | 31.2% | 296.9% |

| 03 Oct 2024 | KRN Heat Exchanger and Refrigeration | 834.0 | 5,183.9 | 341.5 | 117.6% | 279.1% |

| 03 Sep 2024 | Premier Energies | 1329.2 | 59,914.1 | 2,830.4 | 86.6% | 195.4% |

Sources: Trendly; as of December 11, 2024

Overview of their financial performance

Since the listing, these companies have demonstrated robust performance. The table below highlights their key fundamentals. Encouragingly, the top performers have healthy financials, demonstrating robust revenue and PAT growth over the past three years.

Financial performance of top-performing mainboard IPOs

| Company | Sector | 3-year revenue growth (%) | 3-year PAT growth (%) | ROE (%) | EV/EBITDA |

|---|---|---|---|---|---|

| Jyoti CNC Automation | Capital Goods | 36.0 | 58.1 | 20.8 | 68.9 |

| KRN Heat Exchanger and Refrigeration | Capital Goods | 59.6 | 153 | 41.9 | 76.6 |

| Premier Energies | Capital Goods | 64.9 | 119 | 43.7 | 114.0 |

Sources: Screener, NSE; as of December 11, 2024

SMEs IPOs

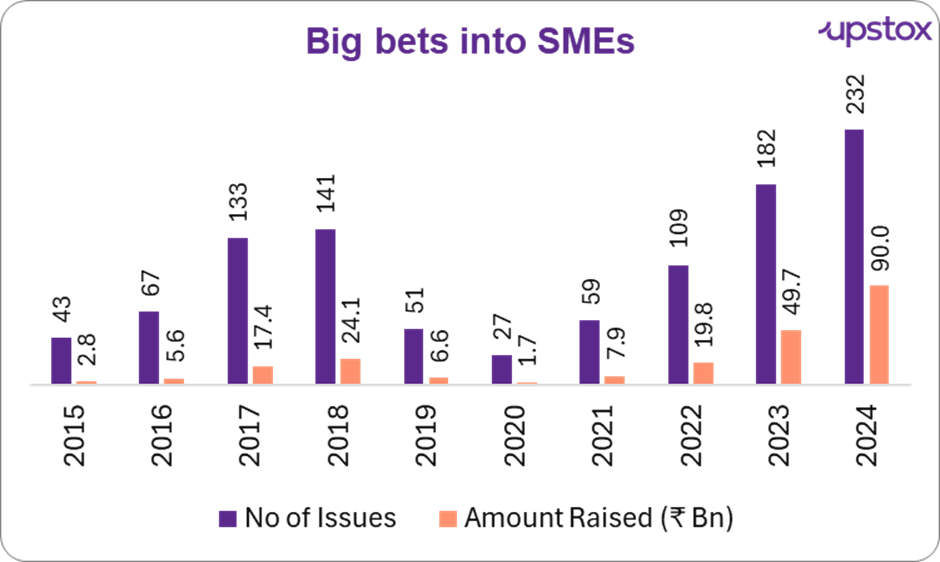

According to data from Chittorgarh, the 232 successful SME IPOs listed as of December 11, 2024, collectively raised approximately ₹90 billion

The table below shows the popularity and performance of SME IPOs have witnessed a remarkable transformation over the years. Back in 2015, the SME IPO market was relatively modest, with only 43 IPOs listed.

Fast forward to 2024, and the SME IPO market has exploded in activity. By this point, 232 IPOs have been listed, reflecting a significant surge in interest.

Sources: Chittorgarh; as of December 11, 2024

Below is a list of SME companies that have delivered the highest returns since listing.

| Listing date | Company name | Current price (₹) | Market Cap (₹ Cr) | Issue Size (₹ Cr) | Listing Gain % | Return since listing % |

|---|---|---|---|---|---|---|

| 04 March 2024 | Owais Metal and Mineral Processing | 1,152.8 | 2,096.2 | 42.7 | 201.7 | 1,225.1 |

| 18 January 2024 | Australian Premium Solar (India) | 541.1 | 1,068.2 | 28.1 | 172.2 | 902.1 |

| 05 April 2024 | TAC Infosec | 915.3 | 979.1 | 30 | 187.3 | 763.4 |

Sources: Trendly; as of December 11, 2024

Financial performance

The table below highlights the financial performance of SME IPOs. Similar to the mainboard counterparts, these companies demonstrate healthy financials.

| Company | Sector | 3-year revenue growth (%) | 3-year PAT growth (%) | ROE (%) | EV/EBITDA |

|---|---|---|---|---|---|

| Owais Metal & Mineral Processing | Metals & Mining | 56.5 | 298.6 | 44.9 | 43.4 |

| Australian Premium Solar (India) | Capital Goods | 26.5 | 50.6 | 19.6 | 41.7 |

| TAC Infosec | IT | 32.6 | 118 | 44.8 | 72.6 |

Sources: Screener, NSE; as of December 11, 2024

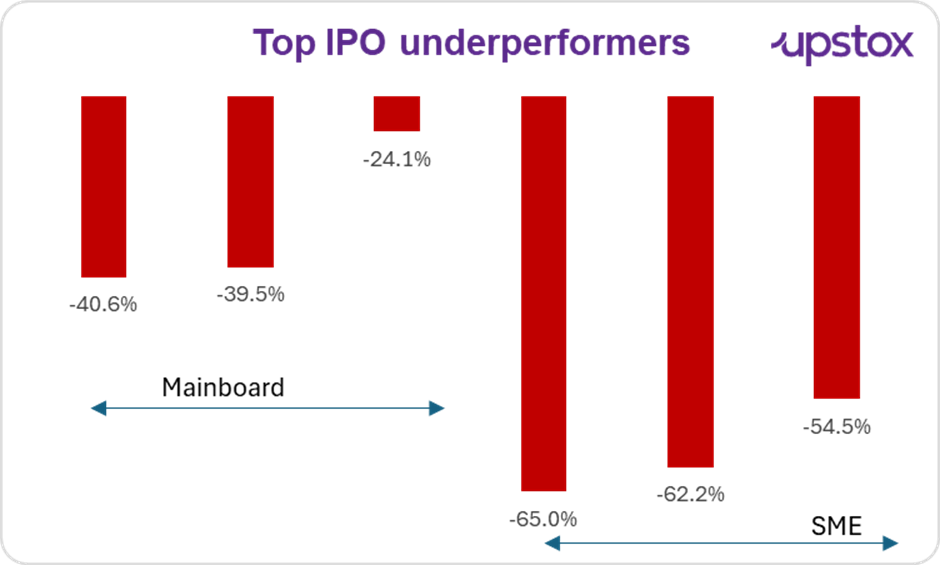

Top IPO underperformers

The chart of the top three mainboard and SME IPOs that have delivered the highest losses to investors since their market debut underscores the inherent risks of IPO investments. While IPOs often seem attractive, offering early access to potentially high-growth companies, it’s essential to remember that every opportunity comes with its own set of challenges.

Sources: Trendly; as of December 11, 2024

Conclusion

The IPO market in 2024 set a benchmark for growth and investor confidence, fueled by sectoral diversity and strong financial performances. These trends underline the robust appetite for equity markets and a favorable environment for public offerings. As the market evolves, it reaffirms its role as a dynamic platform for companies to unlock capital while delivering significant wealth-creation opportunities for investors.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story