Upstox Originals

Why do states walk the tightrope while making their budgets?

5 min read | Updated on July 25, 2024, 15:11 IST

SUMMARY

Each Indian state faces a unique set of financial challenges, making the state budget process no less than a financial Everest to climb. States walk a tightrope, balancing earnings, spending and support from the central government. Here’s why crafting a state budget could be the most unique financial challenge.

Crafting a state budget could be the most unique financial challenge

India's diversity, with its myriad languages, religions, ethnicities, and economic disparities, is a source of immense pride but also presents unique financial challenges at the state level. Punjab faces water scarcity, Kerala struggles with polluted waterways, Mumbai contends with crowded slums, and Rajasthan battles drought. Each state requires distinct financial models to address its unique challenges. Additionally, the central and state governments may be led by different political parties with clashing ideologies, complicating financial planning. Given these complexities, how do Indian states craft their budgets and manage finances while balancing central support and independent planning? Let’s delve into the details.

Money management models

As each state's needs differ, a one-size-fits-all approach is beyond possible. However, a common framework for managing the money exists, which is listed below:

For understanding these basics, let's quickly illustrate the recent Maharashtra state government budget for FY 2024-25; its plans to generate income and allocate its budget across various sectors.

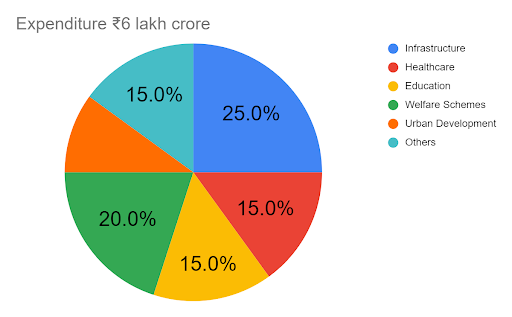

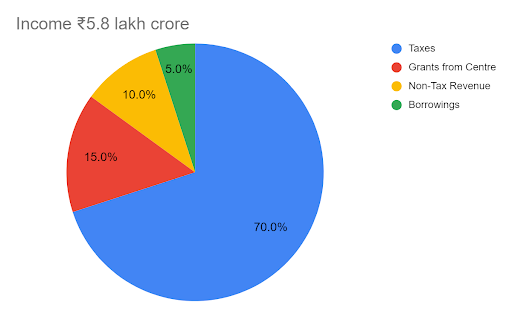

This budget outlines a total expenditure of approximately ₹6 lakh crore, with an income generation of ₹5.8 lakh crore, resulting in a revenue deficit of ₹20,000 crore. As a developed state, Maharashtra allocates 25% of its budget to infrastructure development. In contrast, A similar chart for Uttarakhand, poverty alleviation takes up major pie (which is absent for Maharshtra). This highlights the different financial models adopted by various states based on their unique needs and development priorities.

Dissecting the income expense streams

Each Indian state follows its structured process for financial planning, balancing its income and expenditure. Here's a breakdown of the key aspects.

Indian states incur expenses across various sectors imperative to development and public well-being. Here's a breakdown of the major categories:

The states are partly at their discretion towards generating and allocating their funds in order to promote overall socio economic development.

Thus, each state is partly independent in contributing to its development and simultaneously shoulders the central government’s plan for state development. Managing finances in India's diverse federal system is a complex balancing act. While states hold some power over revenue generation and spending, central government support remains important. Moving forward, fostering a collaborative approach where states have greater fiscal autonomy, coupled with central guidance for national priorities, could be key to India’s holistic development and being the economic powerhouse.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story