Upstox Originals

Q3FY25 earnings review: What do the results show about India Inc. and the economy?

5 min read | Updated on February 22, 2025, 17:30 IST

SUMMARY

The recently concluded Q3 earnings season has been weak for India Inc. and the subdued figures have pushed the earnings ratio to its worst level since Q1FY21. Nifty 50 reported 5% YoY PAT growth, driven once again by BFSI, with positive contributions from technology, telecom, healthcare, capital goods, and real estate.

In the October-December quarter of FY25, the PAT year-on-year (YoY) growth settled at 13%, lower than the year-ago period. | Image: Shutterstock

As we wrap up the Q3FY25 earnings season (quarter ended December 2024), a comprehensive analysis reveals that the performance of the most listed Indian companies in the quarter remained muted. The numbers suggest a continued slowdown in corporate revenues and earnings growth, a trend that has persisted consistently for the past four quarters.

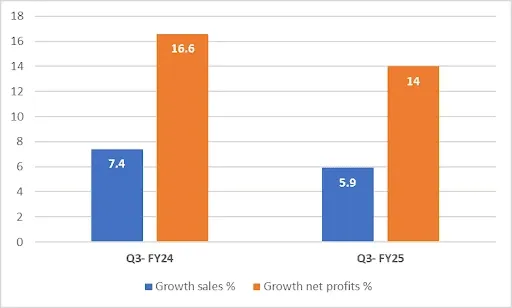

Based on the analysis of around 1,900 companies, India Inc. registered a 14% year-on-year (YoY) growth in its net profit at ₹3.37 lakh crore. While the growth is in double digits, it is slower than 16.6% at ₹2.96 lakh crore in the quarter ended December 2023.

The net sales of corporates also slowed to 5.9% YoY at ₹28.43 lakh crore in the quarter ended December 2024, compared to a rise of 7.4% at ₹26.85 lakh crore in the quarter ended December 2023.

The results of the Q3 earnings season were largely in line with what the D-street expected. Large-cap companies met expectations delivering stable returns with 5% YoY earnings growth. Midcaps outperformed, reporting better-than-expected earnings growth of 26% YoY. And, small caps reported a broad-based decline in earnings of 24% YoY.

What has slowed down the performance?

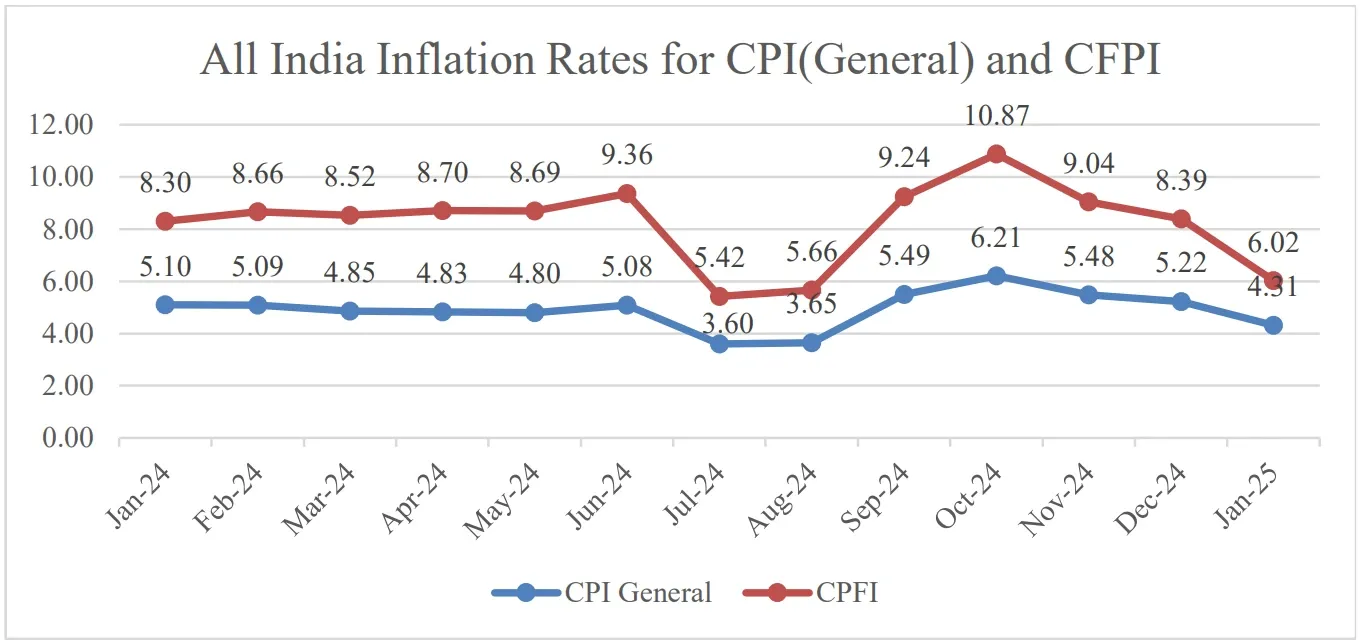

The decline is attributed to several factors. Let’s understand them. Firstly, the decline in profitability in the quarter was attributed to rising input costs, driven by higher inflation. The higher inflation led to slow growth in sales, impacting the earnings of consumer goods companies.

Higher inflation also led to a slowdown in consumption and weak consumer demand, thereby impacting the performance in the quarter ended December 2024. However, the government’s shift from capital expenditure to consumption in its latest budget is expected to stimulate demand. The government’s ₹1 trillion tax relief for middle-class taxpayers can boost consumer spending. The new structure will substantially reduce the taxes on the middle class and leave more money in their hands, boosting household consumption, savings and investment.

Besides, a mix of financial strain and geopolitical uncertainties also weighed down the corporate earnings season heavily. Subdued domestic macros and supply chain disruptions primarily in the Red Sea region, all together put pressure on the earnings and negatively impacted the bottom lines of India Inc.

An in-depth analysis of Q3 results season for FY25

If you look at Nifty50's performance for Q3, it delivered mixed results. While the YoY sales growth in the Dec-24 quarter has slightly improved to 6% from the September low of 5%, it remains below early 2024 levels, suggesting continued demand weakness or sectoral slowdowns.

Likewise, YoY PAT growth in the Dec-24 quarter has settled at 13%, lower than Dec-23 and significantly below the peak of Mar-24. This suggests that despite some recovery in revenue, cost pressures or margin squeezes are limiting profitability improvements.

Compared to the Dec-23 quarter, sales and PAT growth in the Dec-24 quarter declined, suggesting a less favourable business environment.

| Growth (%) | Dec-23 | Mar-24 | Jun-24 | Sep-24 | Dec-24 |

|---|---|---|---|---|---|

| Net Sales (YoY) | 9% | 10% | 10% | 5% | 6% |

| Profit After Tax (YoY) | 15% | 29% | 3% | 13% | 13% |

The earnings downgrade ratio, which compares the number of earnings downgrades to upgrades, stood at 0.3x, the worst since Q1FY21.

Let us find out which sectors performed well in the October-to-December 2024 quarter and which didn’t.

India Inc’s Q3FY25 earnings at a glance: The hits and misses The banking, financial services and insurance (BFSI) sector once again outperformed the rest of India Inc. with double-digit growth in earnings and revenue in Q3FY25. Further, the technology, telecom, healthcare, capital goods and real estate sectors also made positive contributions to the index's earnings performance. Meanwhile, the automobile, cement, consumer and oil & gas sectors witnessed a profit decline.

The BFSI sector’s net profit in the quarter grew 20% (₹1.32 lakh crore) in Q3 FY25, as against a growth of 15.2% (₹1.09 lakh crore). Excluding the BFSI sector, growth in net profits was 10.2% in Q3 FY25 as against 17.5% last year.

In the non-consumer manufacturing segment, crude oil and iron & steel industries dragged down profits. The non-consumer services segment saw higher growth in net profit compared with last year, driven by higher growth in the IT, logistics, and trading industries.

In consumer manufacturing, the auto sector lowered profit growth. If it were excluded, the growth rate would be around ~20.2%.

In terms of sales, there was an improvement in growth for all broad groups, i.e. non-consumer manufacturing, non-consumer services, consumer manufacturing and consumer services, except the BFSI sector, where growth slowed down from 21.7% to 8.9%. The non-consumer manufacturing sector saw a marginal recovery in growth in sales from -0.3% in Q3FY24 to 1.1% in Q3FY25.

Likewise, non-consumer services, consumer services and consumer manufacturing also reported higher sales growth in Q3FY25 compared to Q3FY24.

What lies ahead for India Inc.

With downgrades outpacing upgrades, the road ahead for India Inc. is somewhat uncertain. Having said that, there are indications of an upcoming reversal, driven by measures taken in the Budget 2025 to revive consumer demand, a rise in government spending, a strengthening rural economy and moderation in input cost.

Considering these factors, Q4FY25 results are expected to be relatively stronger than Q3FY25. A positive outlook is also expected, as the impact of increased capital expenditures and tax cuts from the current budget will be reflected in the next financial year. With corporate earnings expected to improve, we can also expect that the earnings downgrade cycle will end with Q3 results.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story