Personal Finance News

Top 3 flexi cap funds with highest SIP returns in last 3 years

.png)

3 min read | Updated on September 10, 2024, 08:43 IST

SUMMARY

Systematic Investment Plans (SIPs) have seen a rise in investor participation. The top three Flexi Cap funds with the highest SIP returns over the past three years are JM Flexicap Fund, Bank of India Flexi Cap Fund, and Motilal Oswal Flexi Cap Fund, outperforming their benchmarks and offering strong returns.

Top 3 flexi cap funds with highest SIP returns in last 3 years

Systematic Investment Plans (SIPs) in mutual funds have seen significant growth in India. SIP inflows reached ₹23,332 crore in July 2024, up from ₹15,245 crore in July 2023. The number of SIP folios rose to 9.34 crore from 6.81 crore over the same period. This reflects increasing investor participation.

In this context, we analyse the top three Flexi Cap funds with the highest SIP returns over the past three years: JM Flexicap Fund, Bank of India Flexi Cap Fund, and Motilal Oswal Flexi Cap Fund. These funds are benchmarked against the BSE 500 and NIFTY 500 TRI.

SIP Returns Vs Historical Returns

SIP returns and historical returns measure performance differently. SIP returns account for fluctuations in the market by averaging the purchase price through multiple investments. Historical returns, on the other hand, look at the overall performance of a fund or stock over a specific past period, often a single investment made at the beginning of that period and held until the end.

SIP returns give a clearer view for investors using a systematic investment approach, while historical returns provide a snapshot of past performance over time.

Top 3 Flexi Cap Funds with Highest SIP Returns in 3 Years

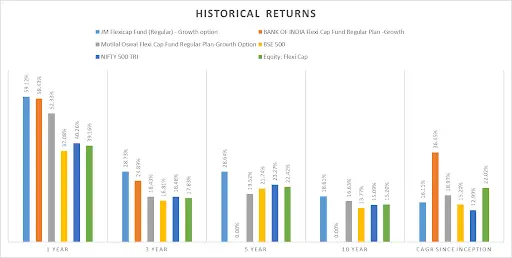

The funds have performed well in past years but the SIP returns of the fund are more impressive. But before we move forward, let's analyse the historical returns of these funds, their benchmark and category average.

Historical Returns

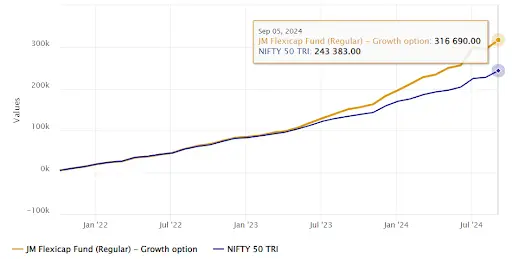

JM Flexi Cap Growth Fund

Launched on September 23, 2008 by JM Mutual Fund, this scheme manages an asset size of ₹3,848.82 crore. The total expense ratio is 1.83%. An investment of ₹1,80,000 with ₹5,000 per month SIP over three years has grown to ₹3,16,690, delivering annual returns of 42.6%.

The minimum investment is ₹1,000, with a top-up option starting at ₹100. For redemptions or switches within 30 days of registration, an exit load of 1% is applicable. As of September 09, 2024, the NAV stands at Rs 108.50. The fund has a compound annual growth rate (CAGR) of 16.11% since inception, compared to the benchmark's (BSE 500 TRI) 15.2%.

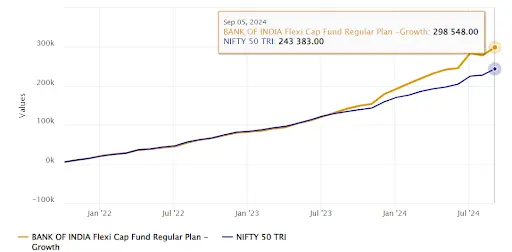

Bank of India Flexi Fund

Introduced on June 05, 2020, by Bank of India Mutual Fund, the scheme's AUM stands at ₹1,700.33 crore with a total expense ratio of 2.04%. An investment of ₹1,80,000 with ₹5,000 per month SIP has grown to ₹2,98,548, reflecting annual returns of 37.76%.

The scheme has an exit load of 1% is applicable if redeemed within three months. The minimum investment is ₹5,000, with additional top-ups starting at ₹1,000. As of September 5, 2024, the NAV is ₹36.85. The fund has delivered a compound annual growth rate (CAGR) of 36.45% since its inception, compared to the benchmark's 15.2%.

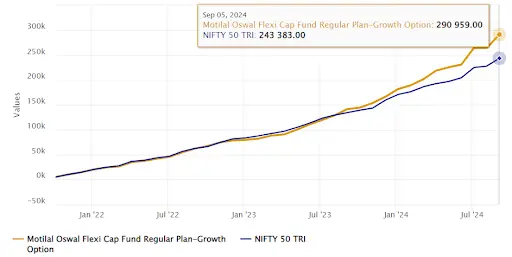

Motilal Oswal Flexi Cap Fund

Launched on April 08, 2014, by Motilal Oswal Mutual Fund, this scheme has assets under management of ₹11,466.13 crore and a total expense ratio of 1.74%. A ₹1,80,000 investment with ₹5,000 per month SIP over three years has reached ₹2,90,959, generating annual returns of 35.68%.

This is an open-ended equity scheme with a minimum investment of ₹500 and a top-up of ₹500. The exit load is 1% for redemptions within 15 days of allotment, with no load after that. The NAV on September 05, 2024, was ₹60.19, and the CAGR since inception is 18.97%, compared to the benchmark's 12.99%.

By signing up you agree to Upstox’s Terms & Conditions

About The Author

Next Story