Market News

Will NIFTY50 repeat its strong March performance in April?

4 min read | Updated on March 29, 2025, 13:36 IST

SUMMARY

The NIFTY50 index has posted positive returns in April in 9 out of the last 15 years. However, the index shows a weaker performance in April when preceded by a strong March. Let’s dive deeper on how past market behaviors and current economic conditions may shape April's stock performance.

In the last five years, SIP contributions have decreased 4 out of 5 times in April month. | Image: Shutterstock

A study of historical data shows that whenever March experiences a significant uptick, April rarely sees a large surge. Its performance is typically either negative or limited to modest gains. On March 28, 2025, the NIFTY50 closed at 23,519 levels, with a 6.3% return so far this month. So, what can we expect in April 2025?

Historical returns of the NIFTY50 index

| Year | February | March | April | March MoM (%) | April MoM (%) |

|---|---|---|---|---|---|

| 2010 | 4,922 | 5,249 | 5,278 | 6.6% | 0.5% |

| 2011 | 5,333 | 5,833 | 5,750 | 9.4% | -1.4% |

| 2012 | 5,385 | 5,296 | 5,248 | -1.7% | -0.9% |

| 2013 | 5,693 | 5,683 | 5,930 | -0.2% | 4.3% |

| 2014 | 6,277 | 6,704 | 6,696 | 6.8% | -0.1% |

| 2015 | 8,902 | 8,491 | 8,182 | -4.6% | -3.6% |

| 2016 | 6,987 | 7,738 | 7,850 | 10.8% | 1.4% |

| 2017 | 8,880 | 9,174 | 9,304 | 3.3% | 1.4% |

| 2018 | 10,493 | 10,114 | 10,739 | -3.6% | 6.1% |

| 2019 | 10,793 | 11,624 | 11,748 | 7.7% | 1.0% |

| 2020 | 11,202 | 8,598 | 9,860 | -23.2% | 14.6% |

| 2021 | 14,529 | 14,691 | 14,631 | 1.1% | -0.4% |

| 2022 | 16,794 | 17,465 | 17,103 | 4.0% | -2.0% |

| 2023 | 17,304 | 17,360 | 18,065 | 0.3% | 4.0% |

| 2024 | 21,983 | 22,327 | 22,605 | 1.5% | 1.2% |

| 2025 | 22,125 | 23,519* | ? | 6.3% | ? |

What are the charts saying?

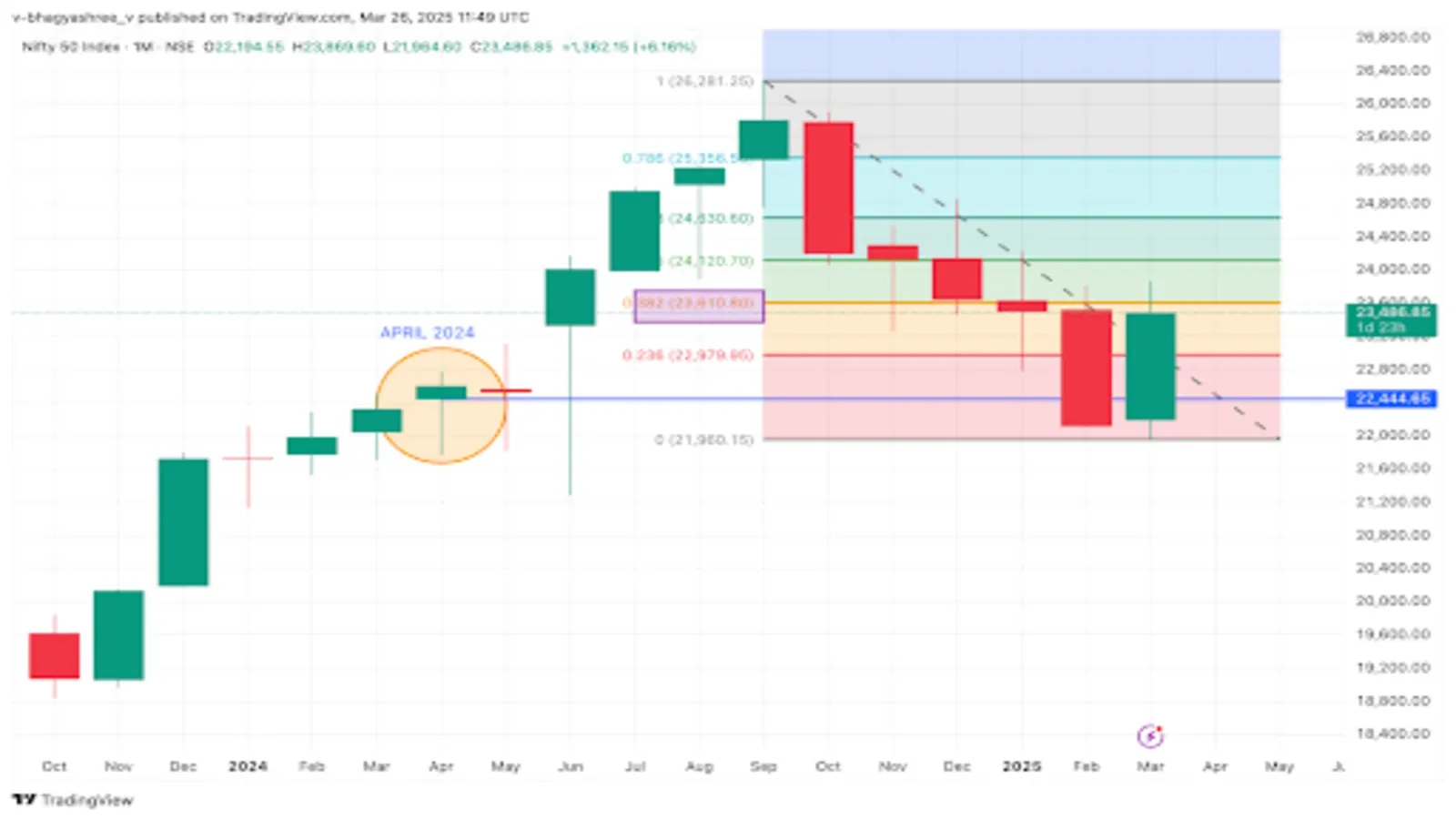

From April to September 2024, the NIFTY50 surged 17%, but then it dropped sharply, giving up all those gains between October 2024 and February 2025. However, in March, the NIFTY50 made a strong recovery and is currently around 23,610 level. This represents a 38.2% recovery from the preceding decline, a Fibonacci retracement level.

NIFTY50 monthly chart: Oct 2023 to March 2025

Transition to the new financial year

In the last five years, SIP contributions have decreased 4 out of 5 times in April on a month-on-month basis. March typically sees a high SIP investments, mostly from salaried employees making last-minute tax-saving investments to take advantage of tax deductions before the financial year ends.

Similarly, net inflows from Foreign Institutional Investors (FIIs) have been negative in 4 out of 5 Aprils over the past five years.

Corporate earnings season

Companies report their Q4 earnings and annual earnings, starting in April each year, and these results influence the stock markets. As per a leading rating agency, India Inc. is expected to see approximately 7-8% year-on-year revenue growth in Q4 FY2025, driven by a revival in rural demand and an increase in government spending.

RBI’s recent actions

RBI’s recent rate cut by 25 bps and the $10 billion dollar-rupee swap is expected to make borrowing cheaper and add liquidity translating into consumer spending.

Trump tariff uncertainties

US President Trump is anticipated to introduce reciprocal tariffs on countries imposing higher tariffs than the US, starting April 2, 2025. India, where the average tariff stands at 12% against the US’ 2.2%, is among those likely to face consequences. To protect its exports, India is considering lowering its tariffs. Such uncertainty may spark volatility in the Indian stock market during April.

The economic calendar

Finally, here are a few upcoming events that could influence the movement of Indian stock markets in April 2025.

| Date | Event | Importance |

|---|---|---|

| April 2 | Manufacturing PMI for March | * |

| April 4 | Services PMI for March | * |

| April 9 | RBI’s Interest Rate Decision | *** |

| April 14 | CPI Inflation for March | *** |

| April 14 | WPI Inflation for March | * |

All said and done, we can expect heightened volatility in the markets this April, as optimism over government initiatives clashes with global uncertainties—particularly Trump’s tariff gambit—leaving investors to ponder whether history will repeat or rewrite itself.

About The Author

Next Story