Market News

Week ahead: US trade tariffs, auto sales and FII inflows among key market triggers to watch out

.png)

6 min read | Updated on March 31, 2025, 09:30 IST

SUMMARY

Automobile sales, reciprocal tariffs, foreign fund inflows, and the movement of the dollar index will shape the market this week. Experts believe that the trend may remain sideways unless the index breaks the 23,800-23,300 range.

NIFTY50 encountered resistance around its February swing high (23,807) and failed to close above this key level. | Image: Shutterstock

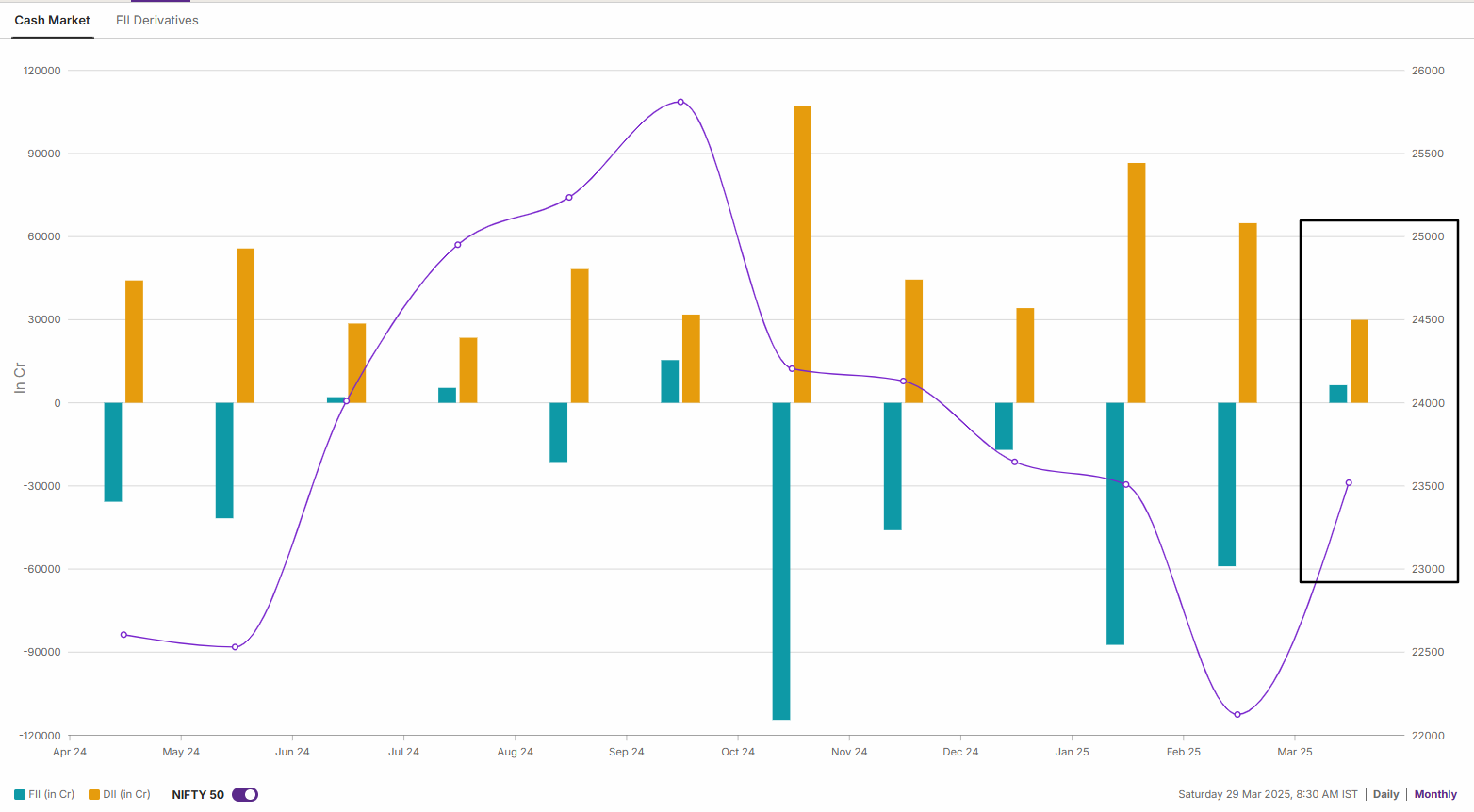

Markets extended its positive streak for the second consecutive week and ended the FY25 (2024-2025) on a positive note. Renewed buying interest of Foreign Institutional Investors (FIIs), strengthening of Indian Rupee and buying in banking and financial services sector lifted the sentiment.

Last week the NIFTY50 index rose 0.7% to end the week at 23,519. However, the broader markets remained under pressure and underperformed their benchmarks. The NIFTY Midcap 100 index was down 0.3% and the Smallcap 100 index was down 0.5%.

In the upcoming holiday-shortened week, the investors will be looking forward and assessing the announcement of reciprocal tariffs. The much-anticipated White House tariff announcement, expected on Wednesday, will be a key market focus mid-week. President Donald Trump will unveil reciprocal tariffs that day, but Wall Street remains uncertain whether this marks the start of negotiations or the final decision.

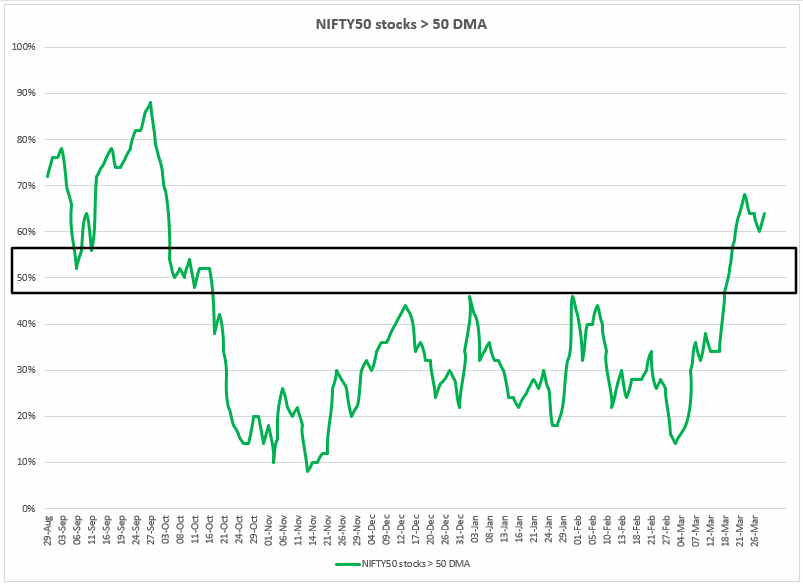

Index breadth

The NIFTY50 index sustained its bullish momentum last week, with market breadth sustaining above 60% since September 2024. This indicator measures the percentage of NIFTY50 stocks trading above their 50-day moving averages (DMA), reflecting the strength of the market and suggesting a broad-based recovery. Meanwhile, as of Friday, 64% of NIFTY 50 stocks were trading above their 50-DMAs.

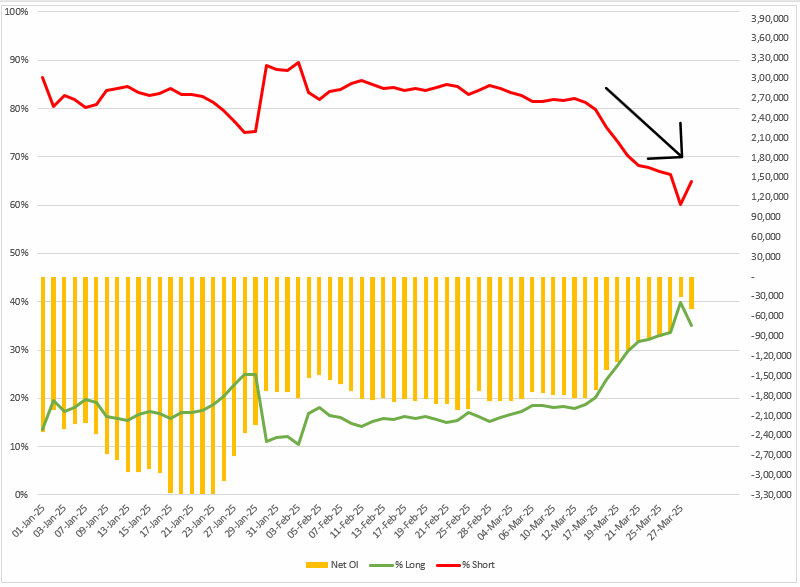

FIIs positioning in the index

Foreign Institutional Investors (FIIs) continued trimming their bearish bets on index futures, fueling the momentum of the short-covering rally. They started the April series with the long-to-short ratio of 35:65 in index futures and a net open interest (OI) of -49,000 contracts.

Meanwhile, the Foreign Institutional Investors (FIIs) turned net buyers in March, ending their five-month selling streak that began in September 2024. They purchased shares worth ₹2,014 crore in the cash market, which helped stabilise the headline index. On the other hand, Domestic Institutional Investors (DIIs) maintained their buying momentum, acquiring shares worth ₹37,585 crore.

NIFTY50 outlook

The NIFTY50 maintained its positive momentum for the second consecutive week, closing above the previous week's high. However, the index encountered resistance around its February swing high (23,807) and failed to close above this key level. It formed a gravestone doji, a bearish reversal candlestick pattern on the weekly chart. The pattern will be confirmed if the close of the subsequent candle will be below the bearish reversal pattern.

In the upcoming shortened week, the key support level for the index is around the 23,300 zone. A daily close below this level would indicate weakness. Conversely, if the index reclaims its February swing high on a closing basis, it could extend its bullish momentum. Until then, the index is likely to remain range-bound within this zone.

SENSEX outlook

The SENSEX also formed a gravestone doji on the weekly chart and witnessed selling pressure from the crucial resistance zone of 78,700 zone. However, the index closed above the previous week’s high, signalling positive breadth in the near-term.

Going ahead, the index may consolidate within the range of 78,700 and 77,000 zones. A breakout of this range on a closing basis will provide further directional clues.

Later in the week, attention will shift to the labour market with the release of the March jobs report on Friday. Experts believe that the U.S. added 1,35,000 jobs in March, down from 1,51,000 in February. This will be the first jobs report to fully reflect DOGE-related layoffs.

On the domestic front, Auto stocks will be in focus as March sales data will be released on 1 April. Street estimates point to weakness in sales across segments, with commercial vehicles, passenger vehicles and two-wheelers all declining on a year-on-year basis, impacted by sluggish demand.

The RBI is likely to lower rates by 25 basis points in April and August, making borrowing cheaper and boosting credit growth. Against this backdrop, shares of Bajaj Finserv, Kotak Mahindra Bank, ICICI Lombard and HDFC Bank were top gainers, advancing in the range of 3% to 8%.

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

About The Author

Next Story