Market News

Week ahead: RBI policy, auto sales, US jobs report, Fed Chairman’s speech among key market triggers to watch

.png)

6 min read | Updated on December 02, 2024, 09:28 IST

SUMMARY

This week, market trend will be influenced by monthly auto sales, RBI's monetary policy, foreign fund flows, and global cues. Market participants expect the NIFTY50 index to remain in a consolidation phase.

The NIFTY50 index sustained its rebound from the 50-week exponential moving average (EMA) last week, retracing up to the 20-week EMA.

Markets extended their winning streak for the second week in a row, driven by broad-based buying across sectors and a notable reduction in sell-offs by foreign investors. The NIFTY50 index posted modest gains of nearly 1%, closing the week above the previous week's high at 24,131. Similarly, the SENSEX advanced by 1%, finishing the week at 79,802.

Sectorally, PSU Banks (+4.7%) and Oil & Gas were the strongest performers, while Automobiles (-0.7%) and IT (-0.4%) were the biggest laggards. Meanwhile, the breadth of the broader markets remained positive as the NIFTY Midcap 100 index and Smallcap 100 index advanced over 2% and 5% respectively, outperforming the benchmark indices.

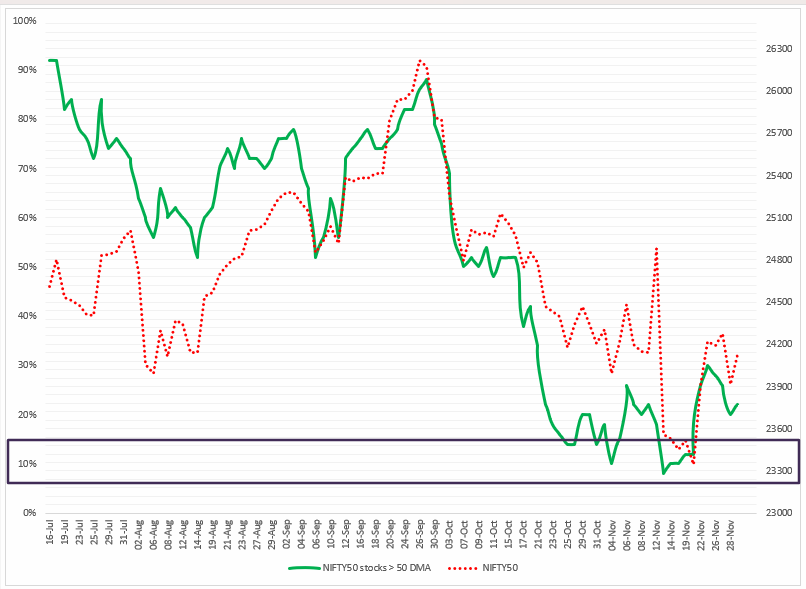

Index breadth

The breadth of the NIFTY50 index showed improvement last week, with an average of 25% of its constituent stocks trading above their respective 50-day moving averages. However, as depicted in the chart below, the breadth of the index has remained weak over the past month (indicated by the green line), consistently hovering below the 20% mark. Notably, last week marked a positive shift, as the breadth sustained levels above 20% throughout the week, except on the day of the monthly expiry of futures and options contracts.

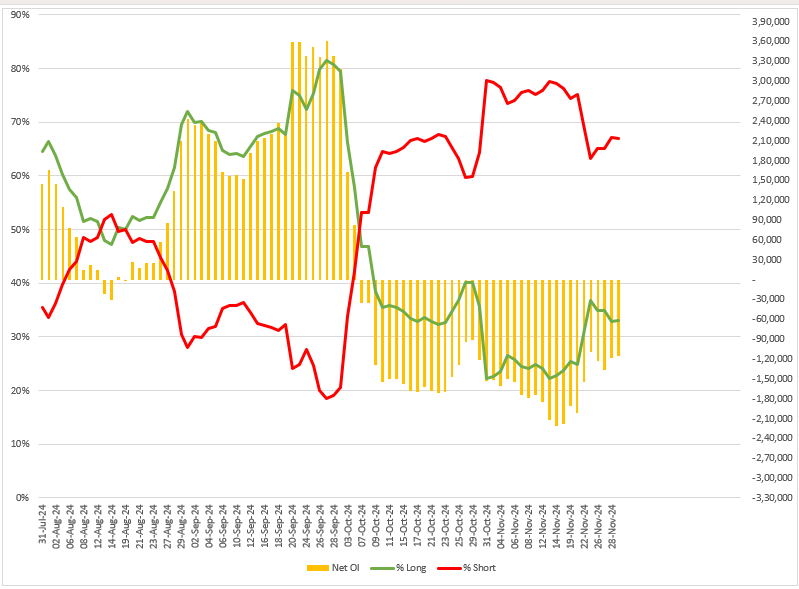

FIIs positioning in the index

Foreign Institutional Investors (FIIs) carried forward their bearish bets in index futures from November, beginning the December expiry with a long-to-short ratio of 33:67, underscoring a continuation of their bearish outlook. Furthermore, the net open interest of FIIs in index futures remained negative throughout November, signaling a consistent build-up of short positions in the segment.

The FIIs have started the December with the long-to-short ratio of 33:67, with net open interest of -1.15 lac contracts, which is indication of weakness. However, traders should closely monitor this ratio closer to the expiry of weekly options contracts and monitor the change in the ratio along with the net open interest to gauge the directional clues.

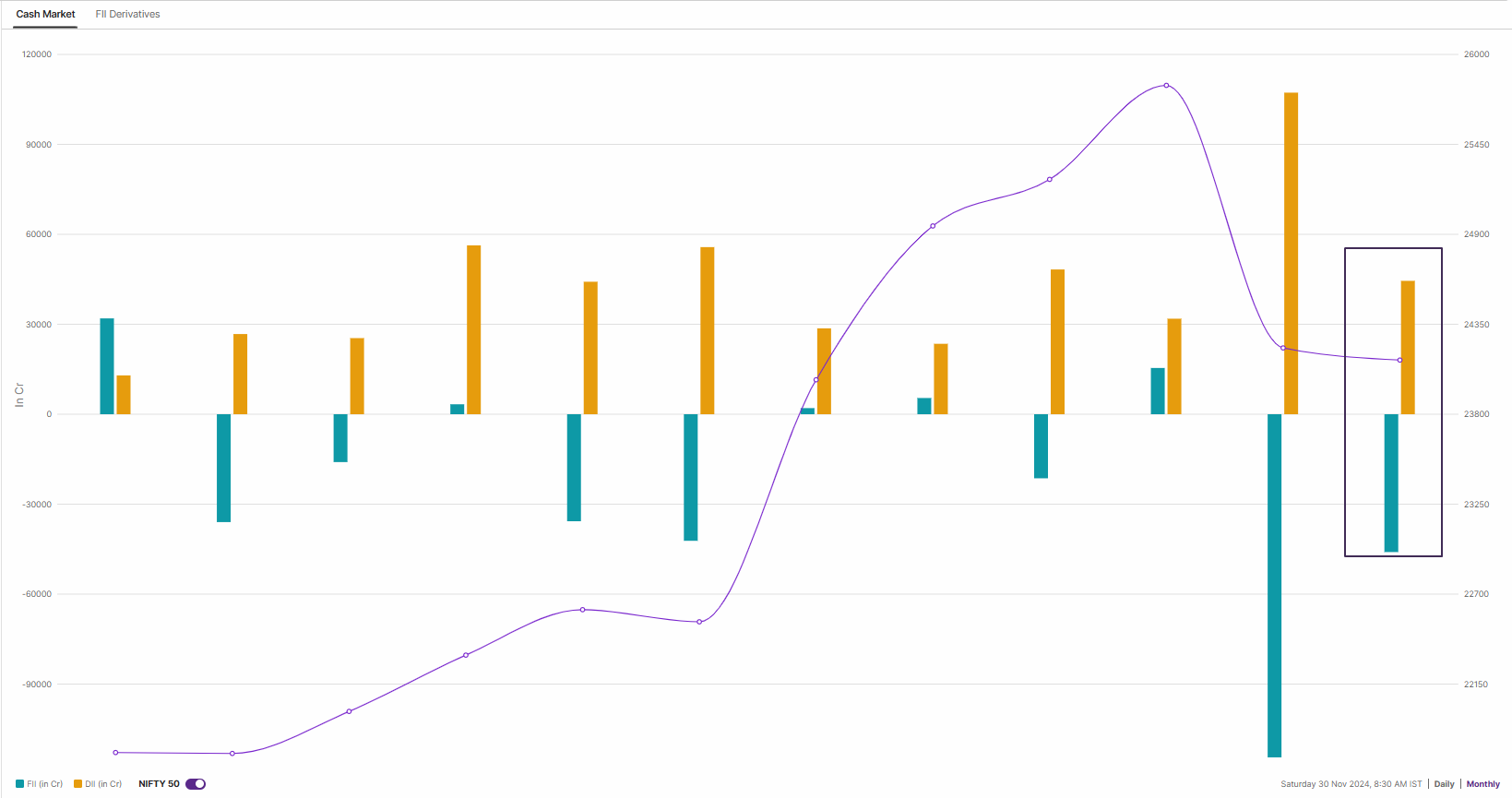

Meanwhile, the cash market activity of the FIIs was in line with the short build-up in the index futures. The FIIs sold shares worth ₹45,974 crore in the month of November, halving the quantum of the sell-off from the previous month. Meanwhile, the Domestic Institutional Investors supported the markets and purchased shares worth ₹44,483 crore.

NIFTY50 outlook

The NIFTY50 index sustained its rebound from the 50-week exponential moving average (EMA) last week, retracing up to the 20-week EMA. As shown in the chart below, the index closed above the high of last week's hammer candlestick pattern, signaling support-based buying. However, the confirmation candle's negative body reflects persistent selling pressure near the immediate resistance zone at 24,350, which coincides with the 20-week EMA.

We believe that the NIFTY50 index is likely to remain range-bound between 24,400 and 23,300, broadly aligning with the 20- and 50-week EMAs. Traders focused on directional moves should closely watch for a decisive close above or below this range, which would offer clearer directional signals.

SENSEX outlook

The SENSEX maintained its bullish momentum and extended gains above its 21-weekly EMA. The index also closed above the previous week’s high, confirming the hammer candlestick pattern on the weekly chart. However, in the case of the SENSEX, while the index marginally crossed the 21-weekly EMA, the body of the candle remained negative, indicating the presence of sellers at higher levels.

In the upcoming week, the trend of the index may remain sideways to bullish with crucial support around 76,600 zone, which aligns with its 50 weekly EMA. However, if the index reclaims the 80,500 mark on a closing basis, it may further extend its gains.

🗓️Key events in focus: In the United States, the Bureau of Labor Statistics is set to release the Job Openings data, followed by the November payrolls report on Friday. The market participants expect an increase of 1,90,000 nonfarm payrolls for November, rebounding from the hurricane-impacted addition of just 12,000 jobs in October. The unemployment rate is anticipated to edge up slightly to 4.2% from the previous 4.

Domestically, attention will focus on the Reserve Bank of India’s three-day monetary policy meeting, scheduled from December 4 to 6. The RBI is set to announce its interest rate decision on December 6 at 10 am. Interest rates have been held steady at 6.5% since February 2023, and market expectations point to a status quo in this final meeting of the year.

📌Spotlight: U.S. Federal Reserve Chair Jerome Powell is scheduled to speak and participate in a conversation at the DealBook Summit 2024 in New York on December 4. This appearance follows his recent remarks emphasising that the Fed is not in a hurry to lower interest rates, citing robust labour market data and inflation that remains above the 2% target.

🛢️Oil: Oil prices ended the week on a negative note, extending their range-bound movement for the third consecutive week. Brent Crude fell 4% to $72 a barrel, remaining within the $70–$76 range over the past three weeks. Similarly, West Texas Intermediate (WTI) declined over 4%, closing at $68 a barrel.

📓✏️Takeaway: In last week's blog, we mentioned that the short-term outlook for both the NIFTY50 and SENSEX remained positive, thanks to the formation of a bullish hammer candlestick pattern on the weekly charts.

Both indices ended the week above the previous week's high, confirming the bullish reversal pattern. However, the body of weekly candles remained red, with NIFTY50 still facing selling pressure near its 21-week exponential moving average.

For the upcoming week, the NIFTY50 is likely to stay range-bound, with immediate resistance at 24,600 and support at 23,300. Unless the index breaks out of this range on a closing basis, the trend may remain sideways. For updates on intraday ranges and any changes to these levels, check out our daily morning trade setup blog, available before the market opens at 8 am.

Disclaimer: Derivatives trading must be done only by traders who fully understand the risks associated with them and strictly apply risk mechanisms like stop-losses. The information is only for consumption by the client, and such material should not be redistributed. We do not recommend any particular stock, securities, or trading strategies. The securities quoted are exemplary and not recommendatory. The stock names mentioned in this article are purely to show how to do analysis. Make your own decision before investing.

About The Author

Next Story