Market News

Week ahead: Markets eye Q3 earnings, Trump's inauguration and Bank of Japan policy moves

.png)

6 min read | Updated on January 20, 2025, 07:33 IST

SUMMARY

This week, market trends will be influenced by Q3 earnings, foreign fund outflows, Donald Trump's inauguration and the Bank of Japan's policy decision. Experts suggest that the broader trend of the NIFTY50 could remain range-bound.

Markets are likely to react on major Q3 earnings released over the weekend and Trump's inauguration.

Markets remained range-bound and extended their profit-booking trend for the second consecutive week. The volatility in indices was largely attributed to persistent FII selling, mixed global cues, a weakening rupee, rising dollar and crude oil prices.

On the sectoral front, PSU Banks (+3.4%) and Metals (+3.1%) emerged as the top gainers, while IT (-5.7%) and Consumer Durables (-2.9%) faced the steepest declines.

Meanwhile, the broader markets staged a recovery following the sharp correction in the previous week. The NIFTY Midcap 100 and Smallcap 100 indices posted minor gains, bouncing back after breaching their 21-week EMA in the prior week.

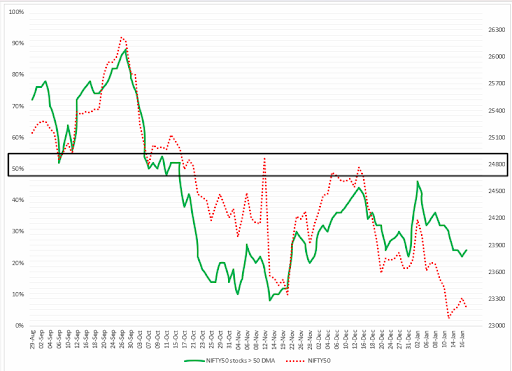

Index breadth

The breadth of the NIFTY50 index remained muted last week with the average 25% of the NIFTY50 stocks trading above its 50-day moving average (DMA) last week. The breadth indicator, which reflects the percentage of NIFTY50 stocks trading above their 50-DMA, continues to show weakness, standing at approximately 24%. This indicates that over 70% of NIFTY50 stocks are trading below their respective 50 DMAs, underscoring bearish sentiment in the market.

As highlighted in our last two week’s analysis, the overall trend is expected to remain under pressure unless the breadth indicator decisively moves above the crucial 50% threshold.

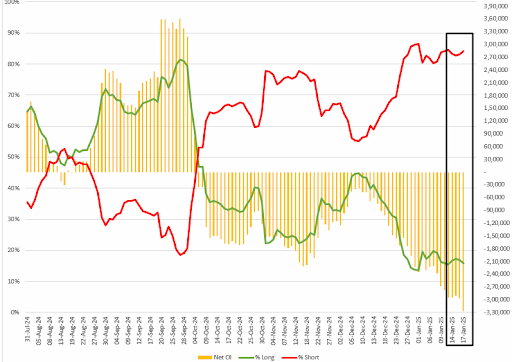

FIIs positioning in the index

Foreign Institutional Investors (FIIs) maintained their bearish outlook in index futures last week, with a substantial 84% of their positions skewed to the short side, resulting in a long-to-short ratio of 16:84. This highlights persistent negative sentiment, as the net open interest in index futures surged over 18% week-on-week to 4 lakh contracts.

By January 17, the long-to-short ratio deteriorated further to 16:84. Traders monitoring this ratio should stay alert for potential short-covering rallies or break below 23,000 which could lead to sharp and sudden market moves.

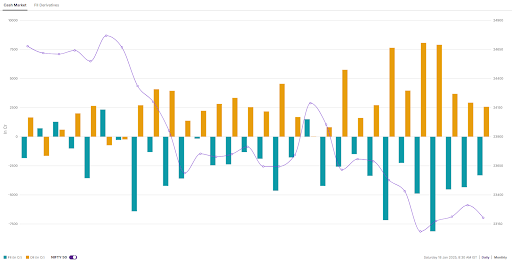

In the cash market, FIIs' activity aligned with their short build-up in index futures. Last week, FIIs sold shares worth ₹25,218 crore, marking a significant increase in the scale of selling compared to the previous week. On the other hand, Domestic Institutional Investors (DIIs) provided strong support to the markets, purchasing shares worth ₹25,151 crore, helping to offset the impact of FII outflows.

NIFTY50 outlook

The NIFTY50 index traded within a tight 400-point range last week, forming a doji candlestick pattern on the weekly chart. A doji is a neutral candlestick pattern that reflects indecision and a pause in market momentum, indicating a balance between buyers and sellers at current levels.

In the sessions ahead, traders should closely watch the 23,400–23,000 range. A decisive breakout or breakdown on a closing basis on the daily chart could offer clear directional cues. Until then, the trend is likely to remain sideways and non-directional within this range.

SENSEX outlook

The Sensex traded within a narrow range last week, forming a classic doji candlestick pattern on the weekly chart. It closed below its 50-week exponential moving average (EMA), signaling caution, while the indecision pattern emerged near the critical support zone of 76,000.

In the sessions ahead, traders should closely track the high and low of the doji candle. From a positional perspective, a decisive close above or below the doji’s range will offer clear directional cues for the long-term trend.

Additionally, key levels to watch for the upcoming expiry are 77,300 on the upside and 76,200 on the downside. Unless the index breaks these levels intraday with a strong momentum candle, the trend is likely to remain sideways.

Additionally, all eyes will be on the Bank of Japan’s highly anticipated monetary policy decision, also scheduled for Friday. The central bank is widely expected to raise interest rates by 25 basis points to 0.5%, signaling a potential shift in its policy stance.

In the coming sessions, traders should keep a close watch on the 23,400–23,000 range. A decisive close above or below this range could offer clearer directional signals for the market.

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

About The Author

Next Story