Market News

Week ahead: FOMC minutes, reciprocal tariffs, FII activity among key market triggers to watch out

.png)

5 min read | Updated on February 16, 2025, 14:20 IST

SUMMARY

Markets face a crucial week with the FOMC minutes set to offer insights on interest rate trends, while Russia-Ukraine peace talks could influence global sentiment. Meanwhile, the NIFTY50 index hovers near the critical 22,700–22,800 support zone, aligned with January lows. A break below could signal further weakness, while reclaiming 23,200–23,250 may trigger a rebound toward 23,600.

NIFTY50 has crucial support around 22,700- 22,800, close below this zone on the daily chart will signal further weakness. | Image: Shutterstock

Markets broke their two-week winning streak amid concerns over Trump's reciprocal tariff policies, mixed corporate earnings, and persistent selling by foreign investors in Indian equities.

The broader markets faced intense selling pressure, with the Midcap 100 index dropping 7.3% and the Smallcap index tumbling 9.4% over the week. Amid the widespread selloff, all major sectoral indices closed in the red. Real Estate (-9.1%) and Consumer Durables (-7.7%) were the hardest hit, leading the weekly declines.

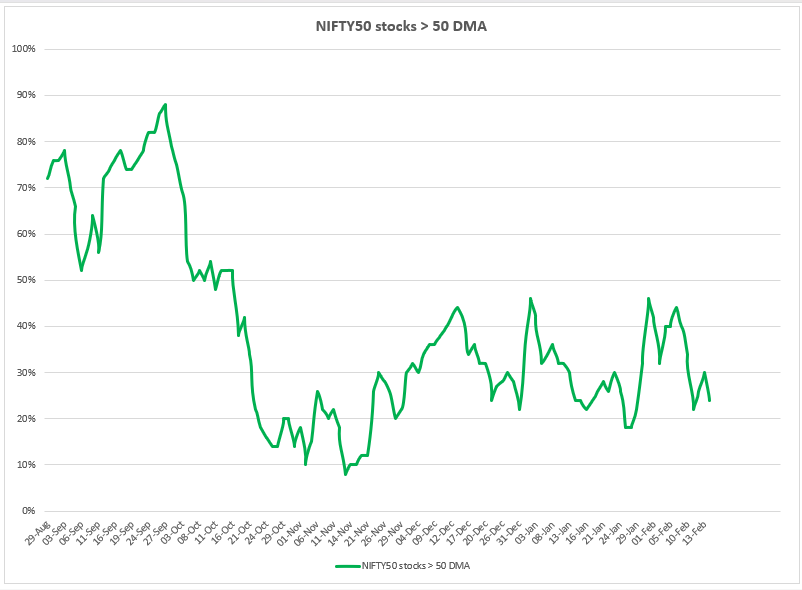

Index breadth

Market breadth continued to weaken last week, with the Breadth Indicator falling to 24% from 40% the previous week and remaining under pressure throughout. The percentage of NIFTY50 stocks trading above their 50-day moving average (DMA) slipped to 24% on February 14th and has now retreated from its recent rebound, reflecting renewed selling pressure.

With market breadth failing to recover and slipping further, the indicator has stayed below the critical 50% mark for over four months. Without a clear improvement, sentiment is likely to remain volatile, limiting any upside potential.

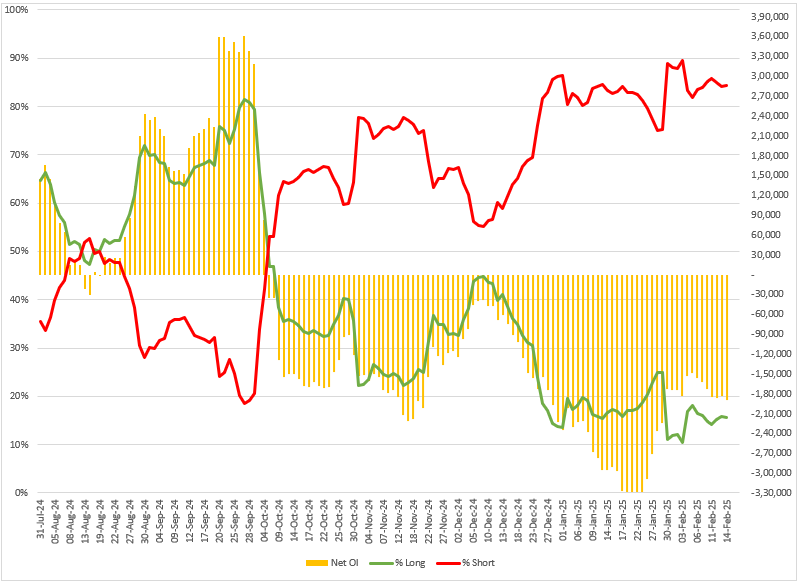

FIIs positioning in the index

Foreign Institutional Investors (FIIs) intensified their bearish stance last week, increasing short positions in index futures. The long-to-short ratio widened to 14:86, driving a 17% rise in net short open interest (OI) over the week.

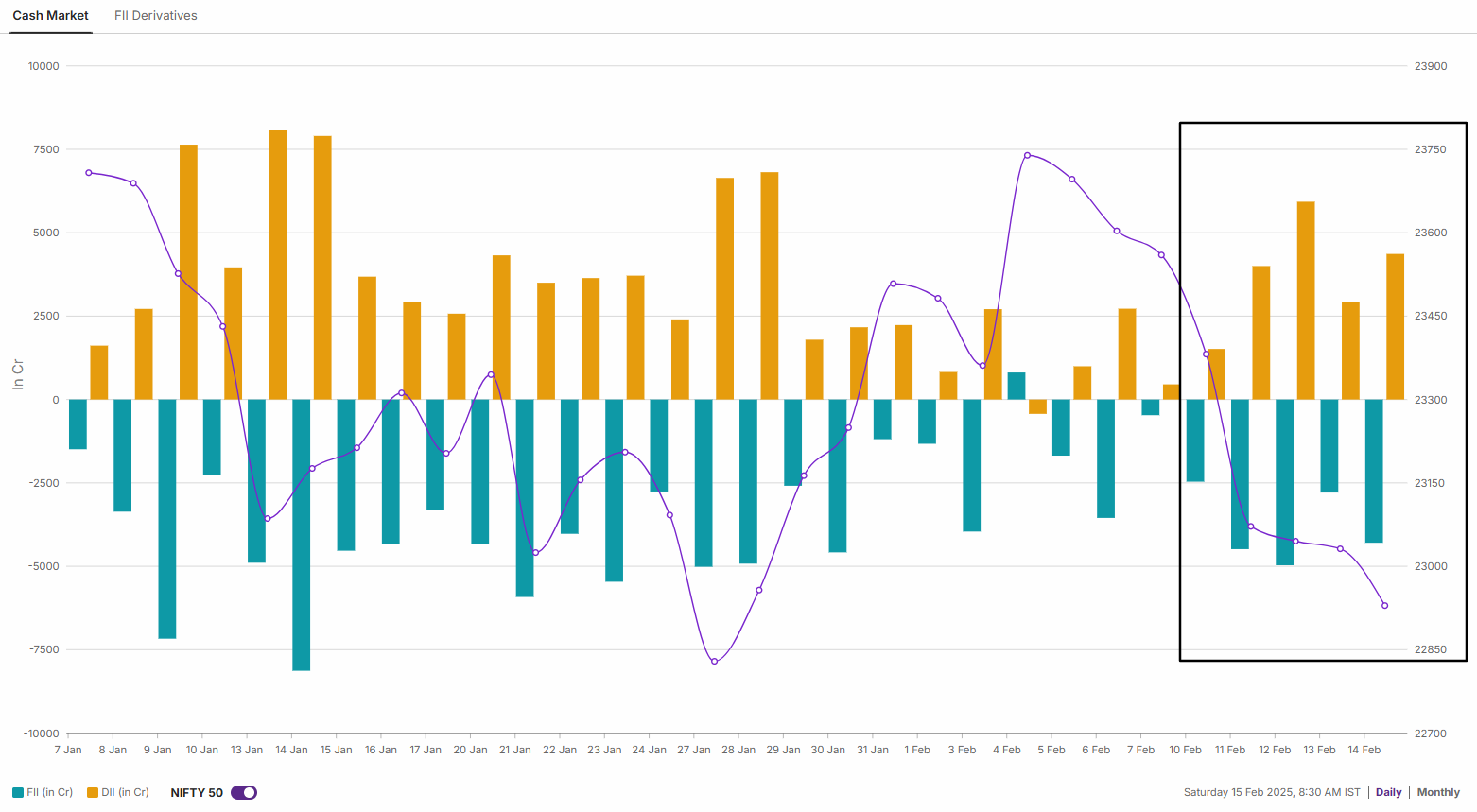

The FIIs' net short position in index futures aligned with their cash market activity, as they offloaded shares worth ₹19,004 crore last week. Meanwhile, Domestic Institutional Investors (DIIs) acted as a counterforce, remaining net buyers and absorbing the selling pressure with purchases totaling ₹18,745 crore.

NIFTY50 outlook

The technical structure of the NIFTY50 index remains weak with the index snapping its two weeks winning momentum. It surrendered its 50-week exponential moving average (EMA) on a closing basis, ending the week below previous week’s low.

For the upcoming week, traders can monitor the crucial support zone of 22,700- 22,800. A close below this zone on the daily chart will signal further weakness. Meanwhile, the resistance for the index remains around the 23,800 zone.

SENSEX outlook

The outlook for the SENSEX also remains weak as it closed below its 50-week EMA. It also ended the week below the previous week's low, forming a bearish candle on the weekly chart.

In the coming week, traders should keep an eye on the key support zone of 75,100. If the breaches this zone on a closing basis on the daily chart could indicate deeper downside potential. On the upside, resistance remains near the 78,700 level.

The pullback followed investor reassessment of geopolitical developments, including President Trump’s Ukraine peace initiative and discussions with Russian President Putin, with Ukraine also set to join the negotiations.

Currently, the index is hovering above the crucial support zone of 22,700–22,800, aligning with its January lows. A decisive break below this level on the daily chart could signal further weakness. On the upside, reclaiming the 23,200–23,250 resistance zone on a closing basis may trigger a rally toward the 23,600 mark.

For intraday range updates and revisions to these levels, visit our daily morning trade setup blog, published at 8 AM before the market opens.

About The Author

Next Story